Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Thailand: Roaring Back, Boosted by Trade and Sound Economics

October 15, 2010

- Strong policy response and sound economy boost recovery

- 7½ percent growth forecast for this year

- IMF welcomes gradual policy normalization

After suffering the double blow of a collapse in global trade and domestic political disturbances, Thailand’s economy has staged a remarkable comeback.

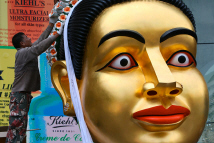

Thai worker decorates a giant figure to promote a store in Bangkok. Stimulus has helped Thailand’s economy to bounce back. (photo: Corbis/EPA/Rungroj Yongrit)

ECONOMIC HEALTH CHECK

The global crisis and the accompanying collapse in world trade had profound consequences for this Southeast Asian county where exports account for more than 60 percent of GDP. Even as the country was rebounding from the crisis, it was then hit by large-scale political protests which took place earlier this year.

However in its annual assessment of the Thai economy the IMF says the country—which has one of the world’s most open economies—has since overcome these events, with the economy roaring ahead.

“We are conservatively estimating that the economy will grow by 7½ percent this year and 4 percent the next,” said the IMF’s mission chief for Thailand, Josh Felman. “Already, GDP has far surpassed its pre-crisis peak, a milestone that advanced countries have yet to reach,” he added.

“This recovery is attributable to the revival in global trade combined with the strong policy response of the Thai authorities. It also helped enormously that the country had a sound economic framework to start with”.

Trade fuels revival

The revival in global trade, which started in early 2009, sparked a surge in the country’s exports even as imports remained depressed. The current account rose from near balance to 7¾ percent of GDP surplus in 2009.

Vigorous export demand has continued into this year and exporters were able to fill these orders, despite the political disturbances because the industrial estates and ports were located far from the protest zone.

The spark from the export recovery has re-ignited domestic demand, which is now carrying the recovery forward, with both investment and consumption now expanding rapidly.

A second factor behind Thailand’s rapid recovery was the policy response of the authorities—one of the most forceful in the region. Years of fiscal prudence and credible monetary management had also provided ample space for decisive action.

Following the crisis, the Central Bank cut its policy rate to a historically low level of 1¼ percent—one of the lowest rates in the region. The government also introduced a series of stimulus packages which injected an estimated stimulus of 3 percent of GDP.

A solid framework

“The most fundamental explanation for Thailand’s rapid recovery, however, lies in its sound economic framework,” said Felman.

The country entered the global crisis from a position of financial strength. It did not have the excesses, such as high consumer debt, which plagued Western countries, while the banking and corporate sector were also strong.

“The strength of the banking, corporate, and public sectors meant they were able to withstand the blow of the global downturn. Once overseas orders came back, they were ready to resume production,” said Felman.

Back to normal

Reviewing the report on Thailand’s economy, the IMF’s Executive Board agreed that the immediate challenge for the country was to normalize its policy stance, while ensuring that the recovery takes hold despite an uncertain global environment.

The Board supported the government’s plan to scale back the fiscal stimulus and the Bank of Thailand’s decision in August to start raising interest rates gradually from their exceptionally low levels. The policy rate has now been increased to 1.75 percent.

With the economy recovering rapidly, the Directors of the Board also noted that the country is now attracting large capital inflows which is complicating policymaking. “They broadly agreed that, in such circumstances, the exchange rate should be allowed to serve as a buffer,” said a press release.

“While the exchange rate has appreciated over the past year, the real effective rate remains close to its long-term average, a competitive level that has allowed exports to gain market share,” said Felman.