Outlook for Global Stability: A Bumpy Road Ahead

April 27, 2018

Good afternoon, ladies and gentlemen.

It’s a great pleasure to join you here today. Let me express my thanks to the Governor of the People’s Bank of China for hosting us, and to all of you for joining in this timely and thought-provoking conference.

This morning, we heard an excellent overview of the global economic context, and we explored the characteristics of China’s growing bond market – which is now the world’s second-largest.

In my remarks this afternoon, I’ll discuss the IMF’s most recent assessment of global financial stability, and some of the challenges that we now see for financial stability worldwide.

The IMF’s Global Financial Stability Report, which we published last week, found that, while global growth momentum remains strong, short-term risks have increased recently amid rising trade tensions, while medium-term risks to growth and financial stability remain elevated.

The main challenge for policymakers is to address financial vulnerabilities, without undermining growth. They must also avoid inward-looking policies — particularly on trade — that may damage longer-term prospects for the global economic and financial system.

In describing how we reached these conclusions: I’ll begin by saying a few words about the IMF’s “Growth at Risk” approach — a methodology that we recently adopted for assessing financial stability.

“Growth at Risk” was first introduced in the October 2017 edition of the GFSR.

This approach links current financial and economic conditions to the distribution of future growth outcomes.

Using these distributions, we can identify the set of severely adverse growth outcomes (located in the left tail of the distribution of growth outcomes). These are the worst possible growth outcomes, which may occur with small probability (5 percent). We call this metric “Growth at Risk.” We can then track, over time, how this set of severely adverse outcomes changes as financial conditions tighten or loosen.

The main advantage of the “Growth at Risk” approach is that it allows us to assess whether changes in financial conditions — and the corresponding changes in the constellation of financial vulnerabilities — will be, on balance, macro-critical. Or in other words, whether today’s policies and financial conditions may increase the odds of adverse outcomes for growth and financial stability in the future.

With that background: Let me now focus on our latest global financial stability assessment.

Our main message is:

- Short-term risks to global financial stability have increased over the past six months — as stock-market volatility has risen, and as investors have grown more concerned about geopolitical tensions, especially over trade policy.

- Looking ahead: The odds of a downturn remain elevated, and there’s even a small chance of a global economic contraction over the medium term — that is, over the next three years.

Step by step, let me walk you through our analysis.

Compared to six months ago, global financial conditions have tightened moderately. Yet they remain very accommodative, overall, in both advanced and emerging economies.

This reflects offsetting shifts in market indicators. Expected short rates in some markets (notably in the United States) have edged higher, and equity-market volatility has increased, leading to some tightening in financial conditions. However, investor risk appetite remains strong, as reflected in the prices of risky assets.

Near-term growth prospects continue to look favorable. This is partly because easy financial conditions have dampened — although not eliminated — near-term risks to growth.

-

As you can see here, in the chart on the left: The distribution of one-year-ahead global growth forecasts, conditional on current financial conditions, is shown in orange. In the severely adverse scenario — in the 5th percentile of the distribution — global growth one year from now will be about 3 percent or less.

At the same time: The extended period of easy financial conditions has fueled the buildup of vulnerabilities that may put growth at risk over the medium term.

-

In the left-hand chart: The three-year-ahead distribution of growth outcomes, shown in black, is notably more skewed toward the left. This implies that — in the severely adverse scenario — global growth is more likely to be negative three years from now.

Meanwhile: As shown on the right-hand chart: The “heat map” puts the current forecast of the severely adverse scenario into historical perspective. It shows that, currently, medium-term risks are well above historical norms.

The “Growth at Risk” approach provides a useful framework for examining the potential effects of an escalation of protectionist measures and inward-looking policies.

On this slide: The orange line shows our current one-year-ahead baseline forecast. The black line shows our three-year-ahead forecast.

Trade tensions could affect financial stability through two channels:

-

The first is increased uncertainty in the near term, which would tighten financial conditions and increase downside risks to growth — as shown in the dotted orange line that shows a fatter “left tail.”

-

The second is an impact on global output over the medium term, where the entire distribution of growth outcomes would shift toward the left — as shown in the dotted black line. This would mean that the range of possible growth outcomes — both central and severely adverse — would be less favorable.

With elevated financial vulnerabilities, any shock to the financial system is likely to cause more extensive damage — and is likely to require more significant adjustment.

Indeed: Even though the adjustment to U.S. monetary-policy normalization has been smooth so far, financial markets remain vulnerable to an unexpected policy tightening.

The term premium remains near historical lows, and financial conditions in the United States have eased, even as the Federal Reserve has started lifting the policy rate.

The monetary-policy normalization process has also been accompanied by a weakness in the U.S. dollar — which is not unusual during periods of monetary-policy tightening, so long as overall financial conditions remain relatively easy.

However, this means that a higher-than-expected inflation reading could trigger a faster-than-expected tightening of monetary policy and financial conditions.

I’ll now outline five of the vulnerabilities that may make the road ahead bumpy.

These five factors include:

- stretched asset valuations

- a weakening of credit quality

- vulnerabilities in Emerging Markets and Low-Income Countries

- bank funding mismatches and

- the greater synchronization of house prices.

Let’s consider each of these factors, in turn

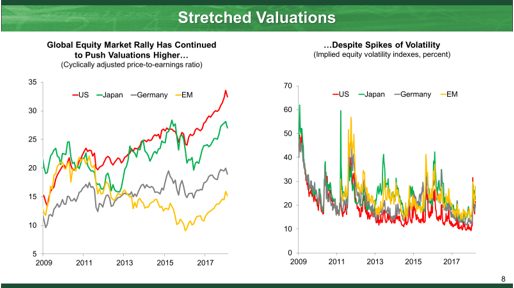

First: Let’s look at stretched asset valuations.

Despite the February sell-off in the equity markets, and despite jitters related to trade tensions, stock-market valuations remain elevated. The cyclically adjusted price-to-earnings ratios — the so-called “CAPE” ratios — have continued to rise in many regions: most notably, in the United States.

However, volatility has returned. The first spike occurred in early February — what we refer to as “the VIX tantrum.” It was largely confined to equity markets. Currently, equity volatility remains closer to historical averages — reflecting higher uncertainty in the markets, due to increased geopolitical and global trade tensions.

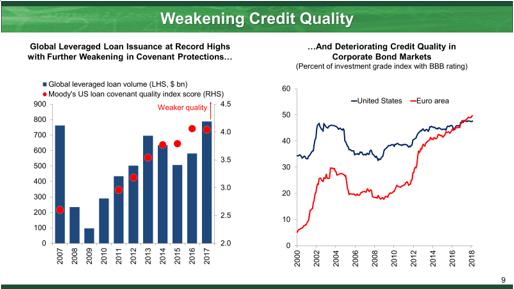

Second: Let’s look at the credit quality of borrowers.

Credit markets in advanced economies are increasingly showing signs of late-stage credit-cycle dynamics.

The global issuance of so-called leveraged loans — made to riskier companies, and to those with already-high debt loads — reached a record $788 billion last year. At the same time, the overall quality of covenants (or investor protections) continued to decline.

There are similar trends in credit quality in corporate bond markets, where lower-rated corporates in the United States and in the Euro area now account for a greater proportion of bonds than they did 10 years ago.

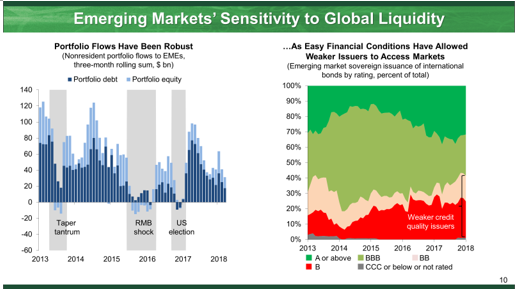

Third: Let’s look at vulnerabilities in Emerging Markets and Low-Income Countries.

Although some Emerging Market economies have improved their fundamentals, many remain vulnerable to a sudden tightening in global financial conditions, and to a reversal in capital flows.

Foreign capital flows have remained robust over the last six to 12 months, allowing weaker Emerging Market sovereign issuers to gain access to the markets.

As a result, non-investment-grade issuance has risen to more than 40 percent of total Emerging Market sovereign issuance over the past year.

Also: In many Low-Income Countries, public debt vulnerabilities have increased.

Easy financial conditions have allowed Low-Income Countries greater access to the markets, and their bond issuance has reached record highs.

At the same time, the creditor composition has become less borrower-friendly.

The share of Paris Club debt has declined from 62 percent to 28 percent between 2007 and 2016 — while the share of external financing provided by commercial and non-Paris-Club creditors has doubled. This could pose challenges for ongoing and prospective debt restructurings, with the potential for unpleasant surprises for private creditors.

Meanwhile: Rising debt burdens have increased debt-sustainability risks among low-income borrowers. Today, 40 percent of Low-Income Countries are at risk of, or are already in, “debt distress,” based on the IMF’s debt-sustainability assessment.

Fourth: Let’s look at the vulnerabilities related to bank U.S.-dollar liquidity mismatches.

Most internationally active non-U.S. banks rely on short-term, or wholesale, sources for about 70 percent of their dollar funding. Those dollar liabilities, moreover, are not always evenly matched with dollar assets, in terms of size or maturity.

While most large banks have strengthened their consolidated capital and liquidity positions since the global financial crisis, the non-U.S. banks face structural U.S.-dollar liquidity mismatches.

If we compare liquidity ratios aggregated across a large number of non-U.S. banks, we see that dollar-liquidity and stable-funding ratios look notably less favorable than the similar ratios at the consolidated level.

Fifth and finally: Let’s look at the greater synchronization of house prices.

As policy tightens in the United States and elsewhere, the possibility of a widespread decline in house prices may pose risks to financial stability

Our analysis — presented in one of the analytical chapters of the GFSR — shows that there has been a steady increase in house-price synchronization across countries.

Although local determinants of house prices are still the most important factor, greater financial integration means that global factors play an increasingly important role for house-price valuations

Furthermore: We found that house-price synchronization tends to increase sharply in the run-up to a crisis. Therefore: Greater synchronicity can signal a downside risk to real economic activity.

To sum up: These vulnerabilities — taken together — may put global financial stability and growth at risk over the medium-term horizon.

So there’s the global perspective on current and projected financial conditions.

Let’s now turn our attention to specific conditions in China.

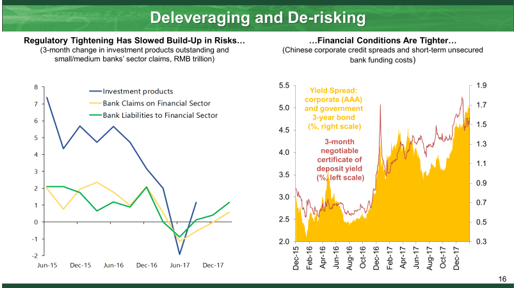

In recent months, China’s policymakers have taken important steps to reduce risks in the financial system — including tightening the regulatory framework.

These efforts have achieved some success in slowing the buildup of bank vulnerabilities.

Yet risks remain elevated, and difficult reform challenges are ahead.

China continues to face a delicate balancing act between protecting near-term economic growth and ensuring the medium-term stability of its financial system.

This chart gives us a stylized view of China’s banks and nonbank financial institutions.

These sectors are tightly linked through their exposure to investment vehicles — which are both large (at about 100 percent of GDP) and opaque.

-

On the asset side: These vehicles — such as wealth-management products and similar private fund structures — are largely invested in illiquid corporate debt. But they also provide leverage to banks and other financial vehicles.

-

On the liability side: These vehicles are largely funded by the issuance of investment products. About half of them are sold to investors as high-yielding alternatives to bank deposits.

This creates significant maturity and liquidity mismatches. To manage those mismatches, investment vehicles borrow from banks and other funds.

Banks are thus exposed to risks in these investment vehicles — as investors, as creditors, as guarantors, as borrowers, and as managers. Small and medium-sized banks and insurers are heavily exposed through on-balance-sheet holdings of these products.

This interconnectedness presents a major vulnerability for China’s financial system. It should continue to be a focal point of efforts to rein in financial-stability risks. The recently announced asset-management rules, and other improvements to the regulatory framework, are important steps toward addressing these risks. But implementation will be challenging.

There has been some progress in curbing the credit expansion and the growth in linkages between banks and non-banks.

Tighter regulations have slowed the growth in investment products — as well as in banks’ intra-financial-sector assets and liabilities.

In addition: The slowdown in leverage has tightened financial conditions in the money markets and the bond markets.

But the key challenge is to tighten regulations without disrupting growth.

When we turn our attention to China’s bond market: Several features stand out.

One factor is: Trading volumes have been falling, particularly for credit and rates bonds (which you can see in the red and purple area in the left chart) — even as the market continues to grow rapidly (as shown by the blue line in left chart).

More broadly: Trading volumes appear highly cyclical, falling sharply in the wake of bond-market and money-market deleveraging campaigns in both June 2013 and late 2016.

As bank-issued, short-term, negotiable certificates of deposit (NCD) trading has risen sharply, there is less and less trading activity for bonds with a residual maturity greater than one year.

This suggests a growing disparity between spot-market liquidity at the front end of the yield curve and further out.

Taking an even closer look: Bond-market trading activity appears to be closely linked to leverage cycles.

Using data from the interbank market: Spot trading volumes are closely correlated with repo volumes — particularly for riskier bonds (see the blue dots, in the chart on the left).

While this could reflect market-making activities, it may be driven more by leveraged carry-trade activity:

- Most repo transactions are pledged, not outright — precluding the use of repos for rehypothecation.

- The correlation is stronger for bonds other than rates bonds, which (except for NCDs) are less liquid — the opposite of what you’d expect to see from market-making activity.

- Repo volumes are many multiples of spot volumes.

If a large share of spot volumes is related to leveraged carry trades, it means that genuine market trading activity — and the price-discovery function of the bond market — is even less than it appears.

The imbalance between repo and spot bond-market trading activity could be a source of financial stability risk.

As interbank spot turnover has fallen, repo volumes have continued to rise (as you can see on the right-hand chart) — reaching a multiple that is well higher than in the United States and many other countries.

If safe bonds cannot be easily sold for cash in stressed markets — but can only be financed through repos — the liquidity of safe bonds is dependent on the balance-sheet capacity and appetite for counterparty risk of others in the financial system.

In other words: It is more difficult for the system to collectively deleverage and reduce counterparty risk in times of stress.

In instances of widespread deleveraging pressure in China, deleveraging-related selling would also, probably, quickly overwhelm spot markets.

That factor may explain why yield-curve flattening or inversion occurs fairly frequently — because only the front end of the yield curve is liquid during episodes of deleveraging.

Asset-management reforms, that help remove implicit guarantees, may help reduce distortions in the bond market.

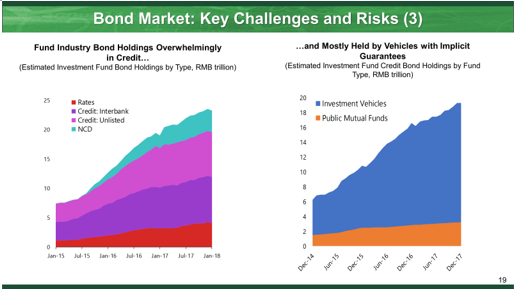

Investment funds have become a critical part of the bond-market investor base. But they have largely invested in credit bonds and short-term bank funding instruments, and they remain less important participants in rates-bonds markets

This large allocation to higher-yielding bonds may be linked to several factors: The fund industry is largely composed of investment vehicles that benefit from implicit guarantees from sponsors — and they are structured as fixed-yield products that do not face mark-to-market pressures.

If reforms can fully unwind implicit guarantees for investment vehicles and increase the use of mark-to-market (NAV) pricing, it may cause important shifts in investor behavior.

Without guaranteed fixed yields, investors in investment vehicles would become more risk-sensitive — and they would gradually shift allocations toward safer assets.

This would help promote market deepening. But it could lead to shrinking net demand for riskier corporate bonds in the short term — weighing on credit growth.

China’s authorities have already taken a number of actions to strengthen the policy framework, including:

- Introducing asset-management reforms, strengthening liquidity buffers, and cracking down on nonbank regulatory arbitrage — including through the use of the macroprudential policy assessment (MPA) tool;

- strengthening central coordination and policymaking by increasing the powers of the PBOC and by unifying the banking and insurance regulators.

- Recently, the authorities announced improved financial-system data collection.

For securities markets and the asset-management sector, some of the key recommendations in the Fund’s most recent FSAP include:

- Strengthening the legal framework and data disclosure for Wealth Management Products and other investment vehicles;

- Prohibiting promises of “expected yields” and other similar debt-like features of Wealth Management Products; and

- Addressing regulatory arbitrage between banking, insurance, and securities businesses — through enhanced functional supervision.

New asset-management rules set to take effect this year are a promising blueprint to address key distortions in the financial market — including by targeting implicit guarantees. The gradual phase-in is important, allowing time to address data gaps and strengthen buffers.

We believe that effective implementation will be critical. Reforms should be carefully calibrated and properly sequenced, and credit growth should be allowed to decelerate — as this is necessary for financial stability and sustainable growth over the medium term.

Ladies and gentlemen, we are pleased to recognize the strong steps that China’s authorities have already taken, and to underscore the IMF’s commitment to continuing to work with you toward reforms that promote greater stability.

It has been a pleasure to address you today, and now I’ll welcome any questions you may have.

Thank you very much.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Media Relations

Phone: +1 202 623-7100Email: MEDIA@IMF.org