Opening remarks by Krishna Srinivasan, Asia and Pacific Department Director at the Press Conference on the Regional Economic Outlook for Asia and Pacific

April 18, 2024

(As prepared for delivery)

Good morning to everyone here in Washington DC, and good evening to everyone in Asia.

Thank you for joining our Press Briefing for Asia and the Pacific. Please allow me to make a few opening remarks.

Let me start with growth.

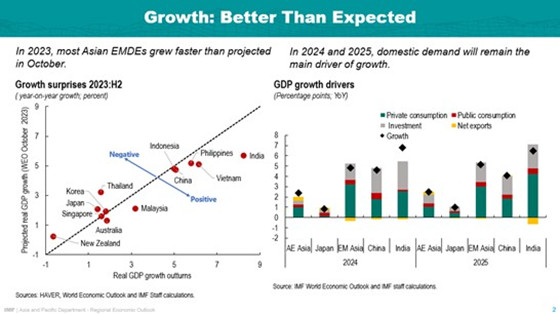

Growth surprised on the upside in the second half of 2023, as robust domestic demand fueled activity especially in emerging Asian economies. Malaysia, the Philippines, Vietnam, and, most notably, India recorded sizeable positive growth surprises.

Growth for the region reached 5.0 percent in 2023—much stronger than the growth of 3.9 percent in 2022—and is 0.4 percentage points higher than what we had projected in the October 2023 Regional Economic Outlook.

The momentum carries over into 2024. We now project the region to grow by 4.5 percent in 2024—an upward revision of 0.3 percentage points relative to October. With this, Asia would contribute about 60 percent of global growth. The region is projected to grow by 4.3 percent in 2025.

Now what will drive growth? The answer depends on the country.

- In China and India, we expect investment to contribute disproportionately to growth—much of it public, especially in India.

- In Emerging Asia outside China and India, robust private consumption will remain the main growth engine.

- In some advanced economies, such as Korea, we expect a positive impulse from exports—driven in part by strong global demand for high-end semiconductors. Domestic demand would strengthen only gradually.

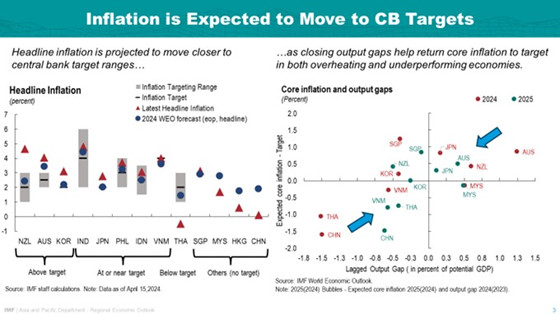

I next turn to inflation, where Asia is ahead of the curve compared to most other regions. Three groups have emerged during the disinflation process.

- In one group of countries—Korea, Australia, New Zealand—inflation is still above target, boosted by persistent price pressures from

- In a second group—most Asian emerging markets and Japan—headline and core inflation are

- Finally, in countries like China and Thailand, inflation is low. This owes to both falling commodity prices and weak demand that puts downward pressure on core prices.

Going forward, we expect that inflation will converge to central bank targets. But this requires a differentiated policy approach: a tighter-for-longer stance in economies where inflation is elevated, and accommodative macro-policies in economies with sizeable slack.

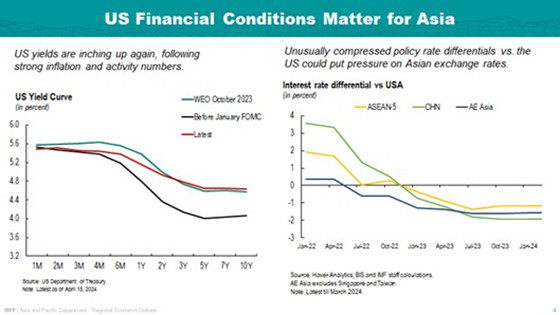

US monetary policy matters for Asia: IMF staff analysis shows that US interest rates have a strong and immediate impact on Asian financial conditions and exchange rates. Expectations about Fed easing have fluctuated in recent months, driven by factors that are unrelated to Asian price stability needs.

We recommend Asian central banks to focus on domestic inflation, and avoid making their policy decisions overly dependent on anticipated moves by the Federal Reserve. If central banks follow the Fed too closely, they could undermine price stability in their own countries.

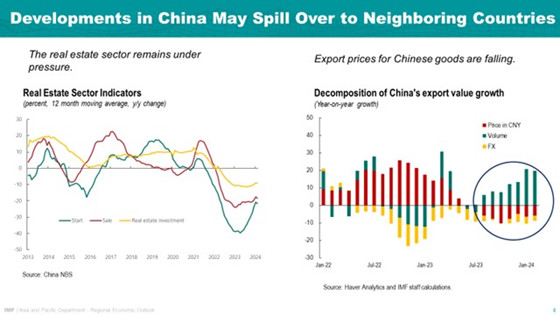

China’s economy is critical for the region. Recent data have been mixed: GDP for the first quarter surprised on the upside, and March readings for the manufacturing and services PMI were quite strong, while the property sector remains subdued. Amid weak domestic demand, inflation turned negative in late 2023 and early 2024 although it has returned to positive territory in February.

A more protracted slowdown in China would be bad news for the region, for several reasons. One channel is shown in the right-hand chart. Chinese export prices fell in the second half of 2023. This not only puts pressure on the profit margins of China’s competitors, but IMF staff analysis shows that their export volumes can also suffer—especially for countries that produce similar goods to China, such as Vietnam or Korea.

But there is also an upside: robust policy support in China can be good news for the region. For this, not only the amount but also the nature of support matters. For example, measures that are aimed at addressing stresses in China’s property sector can go a long way in restoring consumer confidence and boosting domestic demand. By contrast, policies that boost China’s supply capacity would reinforce deflationary pressures and could provoke frictions.

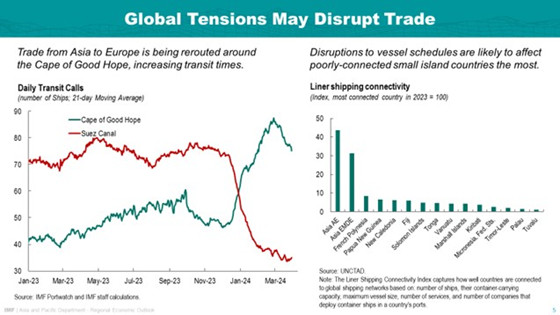

Frictions could also emerge through other channels. For example, global conflict can undermine trade.

As you will be aware, attacks on cargo ships in the Red Sea have forced a re-routing of vessels between Asia and Europe, driving up container prices. Shipping disruptions are particularly detrimental for Pacific Island Countries, which both depend heavily on imports and are poorly connected to global shipping networks.

Such frictions reinforce the impact of trade restrictions that continue to be implemented at a rapid pace, both in Asia and elsewhere. Few regions have benefitted as much from trade integration as Asia—hence geoeconomic fragmentation continues to be a large risk.

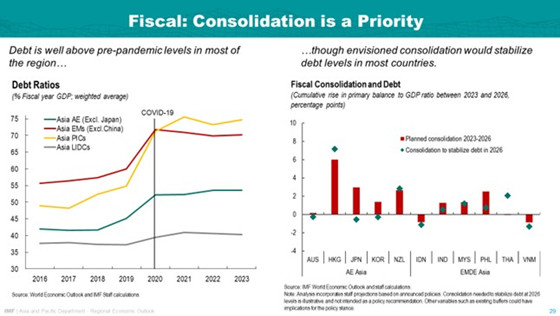

Finally, let me add a word on policies. I have already described the monetary policy challenge. For fiscal policy, we recommend that government focus on consolidation, to curb the rise in public debt and rebuild fiscal buffers.

Our forecasts show that on current fiscal plans, debt ratios would stabilize for most economies, provided governments underpin these plans with concrete policies and follow through on them. But even then, debt would remain significantly higher than before the pandemic.

To reduce debt levels and curtail debt service costs, governments need to collect more revenue and streamline expenditure. Having to pay less on debt would eventually free up budgetary space for spending on development needs, social safety nets, and climate mitigation and adaptation.

Let me close with announcing that our Regional Economic Outlook will be launched on April 30 in Singapore. I look forward to your questions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Huong Lan Vu

Phone: +1 202 623-7100Email: MEDIA@IMF.org