Equality and Efficiency

Finance & Development, September 2011, Vol. 48, No. 3

Andrew G. Berg and Jonathan D. Ostry

Is there a trade-off between the two or do they go hand in hand?

IN his influential 1975 book Equality and Efficiency: The Big Tradeoff, Arthur Okun argued that pursuing equality can reduce efficiency (the total output produced with given resources). The late Yale University and Brookings Institution economist said that not only can more equal distribution of incomes reduce incentives to work and invest, but the efforts to redistribute—through such mechanisms as the tax code and minimum wages—can themselves be costly. Okun likened these mechanisms to a “leaky bucket.” Some of the resources transferred from rich to poor “will simply disappear in transit, so the poor will not receive all the money that is taken from the rich”—the result of administrative costs and disincentives to work for both those who pay taxes and those who receive transfers.

Do societies inevitably face an invidious choice between efficient production and equitable wealth and income distribution? Are social justice and social product at war with one another?

In a word, no.

In recent work (Berg, Ostry, and Zettelmeyer, 2011; and Berg and Ostry, 2011), we discovered that when growth is looked at over the long term, the trade-off between efficiency and equality may not exist. In fact equality appears to be an important ingredient in promoting and sustaining growth. The difference between countries that can sustain rapid growth for many years or even decades and the many others that see growth spurts fade quickly may be the level of inequality. Countries may find that improving equality may also improve efficiency, understood as more sustainable long-run growth.

Inequality matters for growth and other macroeconomic outcomes, in all corners of the globe. One need look no further than the role inequality is thought to have played in creating the disaffection that underlies much of the recent unrest in the Middle East. And, taking a historical perspective, the increase in U.S. income inequality in recent decades is strikingly similar to the increase that occurred in the 1920s. In both cases there was a boom in the financial sector, poor people borrowed a lot, and a huge financial crisis ensued (see “Leveraging Inequality,” F&D, December 2010 and “Inequality = Indebted” in this issue of F&D). The recent global economic crisis, with its roots in U.S. financial markets, may have resulted, in part at least, from the increase in inequality. With inequality growing in the United States and other important economies, the relationship between inequality and growth takes on more significance.

How do economies grow?

Most thinking about long-run growth assumes implicitly that development is something akin to climbing a hill, that it entails more or less steady increases in real income, punctuated by business cycle fluctuations. The pattern in Chart 1—which shows the level of real (after-inflation) per capita income in two advanced economies, the United Kingdom and the United States—is consistent with this idea.

The experiences in developing and emerging economies, however, are far more varied (see Chart 2). In some cases, the experience is like climbing a hill. But in others, the experience is more like a roller coaster. Looking at such cases, Pritchett (2000) and other authors have concluded that an understanding of growth must involve looking more closely at the turning points—ignoring the ups and downs of growth over the horizon of the business cycle, and concentrating on why some countries are able to keep growing for long periods whereas others see growth break down after just a few years, followed by stagnation or decay.

A systematic look at this experience suggests that igniting growth is much less difficult than sustaining it (Hausmann, Pritchett, and Rodrik, 2005). Even the poorest of countries have managed to get growth going for several years, only to see it peter out. Where growth laggards differ from their more successful peers is in the degree to which they have been able to sustain growth for long periods of time.

Income distribution and growth sustainability

In our research we looked at the extent to which the duration of a growth episode is related to differences in country characteristics and policies. The quality of economic and political institutions, an outward orientation of an economy, macroeconomic stability, and human capital accumulation have long been recognized as important determinants of economic growth. And we found that they matter for the duration of growth episodes too.

We argue that income distribution may also—and independently—belong in this pantheon of critical determinants of growth duration. At the level of simple correlation, more inequality seems associated with less sustained growth. Chart 3 shows the length of growth spells and the average income distribution during the spell for a sample of countries. We define a growth spell as a period of at least five years that begins with an unusual increase in the growth rate and ends with an unusual drop in growth. The measure of inequality is the Gini coefficient, which varies from zero (all households having the same income) to 100 (all income received by one household).

It may seem counterintuitive that inequality is strongly associated with less sustained growth. After all, some inequality is essential to the effective functioning of a market economy and the incentives needed for investment and growth (Chaudhuri and Ravallion, 2007). But too much inequality might be destructive to growth. Beyond the risk that inequality may amplify the potential for financial crisis, it may also bring political instability, which can discourage investment. Inequality may make it harder for governments to make difficult but necessary choices in the face of shocks, such as raising taxes or cutting public spending to avoid a debt crisis. Or inequality may reflect poor people’s lack of access to financial services, which gives them fewer opportunities to invest in education and entrepreneurial activity.

Against this background, the question is whether a systematic look at the data supports the notion that societies with more equal income distributions have more durable growth.

We study growth spells as medical researchers might examine life expectancy. They study the effects of age, weight, gender, and smoking habits on life expectancy; we look at whether factors such as political institutions, health and education, macroeconomic instability, debt, and trade openness might influence the likelihood that a growth spell will end. The result is a statistical model of growth duration that relates the expected length of a growth episode (or, equivalently, the risk that it will end in a given year) to several of these variables. We compare the risk that the spell will end in a given year with the values of these variables in previous years—at the beginning of the spell or the previous year—to minimize the risk of reverse causality. In the face of the usual difficulties involved in disentangling cause and effect, and the risk that we have been unable to find good measures of important variables, the results we report below should nonetheless be interpreted only as empirical regularities (“stylized facts”).

The analysis suggests that a number of variables found to be important in other contexts also tend to be associated with longer growth spells (see Chart 4). To show the importance of each variable, the chart (which covers 1950 to 2006) reports the increase in the expected duration of a growth spell for a given increase in the variable in question, keeping other factors constant. To compare the effects of the different variables on growth duration, we calculate expected duration when all the variables are at their median values (the value greater than that observed in 50 percent of the observations in the sample). Then we increase each variable, one variable at a time, and look at what happens to expected duration. We want the size of each of these increases to be readily comparable. To achieve this, we increase each variable by an amount such that it moves from the median value to a value greater than that observed in 60 percent of the sample (a 10 percentile increase).

Hazard to sustained growth

Somewhat surprisingly, income inequality stood out for the strength and robustness of its relationship with the duration of growth spells: a 10 percentile decrease in inequality (represented by a change in the Gini coefficient from 40 to 37) increases the expected length of a growth spell by 50 percent. The effect is large, but is the sort of improvement that a number of countries have experienced during growth spells. We estimate that closing, say, half the inequality gap between Latin America and emerging Asia would more than double the expected duration of a growth spell in Latin America.

Remarkably, inequality retains its statistical and economic significance even when we include many potential determinants at the same time, a claim that we cannot make for many of the conventional determinants of good growth performance, such as the quality of institutions and trade openness. Inequality still matters when we allow for regional differences in expected growth duration (such as between emerging Asia and Africa). This all suggests that inequality seems to matter in itself and is not just proxying for other factors. Inequality also preserves its significance more systematically across different samples and definitions of growth spells than the other variables do. Of course, inequality is not the only thing that matters but, from our analysis, it clearly belongs on the list of well-established growth factors such as the quality of political institutions or trade openness.

Do these statistical results find a voice in the political and economic narratives of the actual country growth episodes? It appears to be the case in, for example, Cameroon. Growth averaged 7 percent from 1978 through 1985. Then the economy fell apart and declined by 6 percent a year over the subsequent decade. Oil wealth in the 1970s initially financed large increases in the public sector, particularly in public employee wages, which proved very difficult to cut when oil prices fell. “Although these measures [to cut government spending] were necessary to rescue the country from further economic crisis, they were very unpopular because they least affected the political elite and those in the upper echelon of government, whose privileges remained intact” (Mbaku and Takougang, 2003). Our statistical model of growth duration suggests that the risk that the growth spell would end in 1985 was very high—more than 100 times higher than would be typical for a country enjoying a growth spell. The model attributes this high risk mostly to Cameroon’s unusually high inequality as well as its low inflow of foreign direct investment and high degree of autocracy.

Cameroon is typical. We have examined six historical cases, including Colombia, Guatemala, and Nigeria. These cases, and our broader statistical analysis of a large number of growth episodes, suggest that inequality is an underlying feature that makes it more likely that a number of factors—external shocks, external debt, ethnic fractionalization—come together to bring a growth spell to an end.

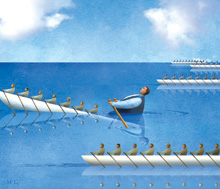

Raising the tide

One reasonably firm conclusion is that it would be a big mistake to separate analyses of growth and income distribution. To borrow a marine analogy: a rising tide lifts all boats, and our analysis indicates that helping raise the smallest boats may help keep the tide rising for all craft, big and small.

The immediate role for policy, however, is less clear. More inequality may shorten the duration of growth, but poorly designed efforts to reduce inequality could be counterproductive. If these efforts distort incentives and undermine growth, they can do more harm than good for the poor. For example, the initial reforms that ignited growth in China involved giving stronger incentives to farmers. This increased the income of the poor and reduced overall inequality as it gave a tremendous spur to growth. However, it probably led to some increased inequality among farmers, and efforts to resist this component of inequality would likely have been counterproductive (Chaudhuri and Ravallion, 2007).

Still, there may be some win-win policies, such as better-targeted subsidies, better access to education for the poor that improves equality of economic opportunity, and active labor market measures that promote employment.

When there are short-run trade-offs between the effects of policies on growth and income distribution, the evidence we have does not in itself say what to do. But our analysis should tilt the balance toward the long-run benefits—including for growth—of reducing inequality. Over longer horizons, reduced inequality and sustained growth may be two sides of the same coin.

The analysis calls to mind the developing country debt crises of the 1980s and the resulting “lost decade” of slow growth and painful adjustment. That experience brought home the fact that sustainable economic reform is possible only when its benefits are widely shared. In the face of the current global economic turmoil and the need for difficult economic adjustment and reform in many countries, it would be better if these lessons were remembered rather than relearned.■

Andrew Berg is an Assistant Director and Jonathan D. Ostry is Deputy Director in the IMF’s Research Department.

References

Berg, Andrew, and Jonathan D. Ostry, 2011, “Inequality and Unsustainable Growth: Two Sides of the Same Coin?” IMF Staff Discussion Note 11/08 (Washington: International Monetary Fund).

———, and Jeromin Zettelmeyer, 2011, “What Makes Growth Sustained?” forthcoming in Journal of Development Economics.

Chaudhuri, Shubham, and Martin Ravallion, 2007, “Partially Awakened Giants: Uneven Growth in China and India,” in Dancing with Giants: China, India and the Global Economy, ed. by L. Alan Winters and Shahid Yusuf (Washington: World Bank).

Hausmann, Ricardo, Lant Pritchett, and Dani Rodrik, 2005, “Growth Accelerations,” Journal of Economic Growth, Vol. 10, No. 4, pp. 303–29.

Mbaku, John M., and Joseph Takougang, eds., 2003, The Leadership Challenge in Africa: Cameroon under Paul Biya (Trenton, New Jersey: Africa World Press).

Okun, Arthur, 1975, Equality and Efficiency: The Big Tradeoff (Washington: Brookings Institution Press).

Polity IV Project, www.systemicpeace.org/polity/polity4.htm

Pritchett, Lant, 2000, “Understanding Patterns of Economic Growth: Searching for Hills among Plateaus, Mountains, and Plains,” World Bank Economic Review, Vol. 14, No. 2, pp. 221–50.