Been There, Done That

Finance & Development, September 2015, Vol. 52, No. 3

Tasking central banks with mandates beyond inflation control recalls bad past experiences in Latin America. Will things be different?

The severity of the global financial crisis upset a number of economic verities, including the nearly universal consensus that the primary responsibility of central banks is controlling inflation.

Several critics have blamed central banks for failing to act to prevent the recent global financial crisis, in part because their narrow mandate gave them limited duties for preserving financial stability. In turn, central bank actions to prevent a protracted recession following the financial crisis have raised questions about whether central banks should be more concerned about growth and employment—not only during crises but under normal circumstances too.

The current environment of low growth with little threat of inflation increases the likelihood that central banks will be charged with additional tasks to enhance economic growth and employment. And potential bubbles give impetus to the notion that central banks have a role to play in preventing another financial crisis. In fact, some central banks have already undertaken so-called macroprudential policies to foster the overall stability of the financial system, not just that of individual financial institutions.

While this discussion is going on in advanced economies, it inevitably will spread to Latin America. Policy debates nowadays are global. Assigning central banks the responsibility for preventing banking crises is likely to gain traction in a region with a history of chronic financial instability, while asking central banks to contribute to economic growth and employment may also be appealing because growth is expected to remain low—as in the rest of the world.

However, assigning Latin American central banks multiple responsibilities is akin to going back to the future. Many central banks in Latin America once had several mandates, including preserving the stability of banks and fostering economic activity and employment—often with unhappy results. History, then, can provide a useful perspective on how to shape future central bank policies in Latin America. After all, as the well-known U.S. novelist William Faulkner once said, “The past is never dead. It’s not even past.”

A varied past

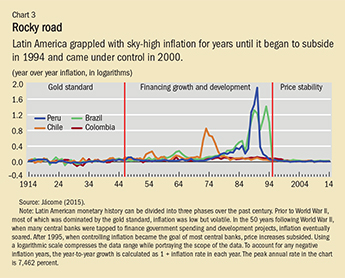

The history of Latin American central banks can be divided into three main periods: the early years that began in the 1920s, the developmental phase that started after World War II, and the golden years since the 1990s (Jácome, 2015). In each of these periods, central banks had alternative mandates and policy frameworks that rendered different inflation trends. The Great Depression in the 1930s and the collapse of the Bretton Woods system in the early 1970s each marked the beginning of a new era of central banking in the region. The global financial crisis and the Great Recession seem to be playing a similar role today.

The first central banks were established in Latin America when the gold standard ruled the international monetary system. They included the Reserve Bank of Peru (1922) and the Bank of the Republic of Colombia (1923). Chile and Mexico established central banks in 1925, followed by Guatemala, Ecuador, and Bolivia in 1926, 1927, and 1929, respectively. Central banks were given three key objectives: maintaining monetary stability, financing the government on a limited basis, and helping preserve bank stability.

Under the gold standard, central banks were committed to preserving the convertibility of currencies at a fixed exchange rate while allowing capital to flow freely in and out of their economies (an open capital account). Central banks could issue banknotes only if they were backed with international reserves—mainly gold and foreign currency convertible into gold.

By the late 1920s, the effects of the Great De?-pression were being felt in Latin America. As the advanced economies fell into recession, the demand for commodities declined. So did export prices for the largely commodity-producing Latin American economies, which in turn fell into depression. The situation was compounded because capital fled the region to take advantage of higher real interest rates in the United States.

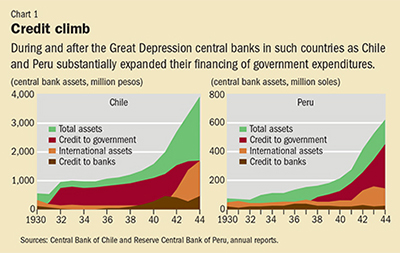

Preserving the gold standard during the Great Depression became impossible and Latin America abandoned it. Central banks no longer had to ensure the convertibility of domestic currencies, but maintained fixed exchange rates with the support of capital controls to limit capital outflows. A transition period of central banking started as monetary policy became expansionary to provide large-scale credit to governments to help restore economic activity. Central bank balance sheets expanded rapidly in such countries as Chile and particularly Peru, where credit to the government increased more than threefold between 1933 and 1938, and rose another 300 percent in 1944 (see Chart 1). In Mexico credit to the government represented close to 45 percent of the Bank of Mexico’s total assets in 1940.

Addicted to central bank financing

While it was initially necessary to expand central bank balance sheets to bring the Latin American economies back from the brink of collapse during the Great Depression, governments became addicted to central bank financing of their spending. Eventually, the monetary expansion entailed in financing government outlays sowed the seeds of high inflation in Latin America.

Latin America endorsed the Bretton Woods system, established in 1945, in which countries committed to maintain a fixed—although adjustable—exchange rate with the support of an enhanced array of capital controls. At the same time, the central banks’ areas of responsibility were drastically changed as governments started to play a decisive role in the formulation of monetary policy. Central bank mandates multiplied. The overarching policy mandates became regulating money and fostering employment in Argentina and promoting the orderly development of the economy in Chile, Colombia, and Peru. The Bank of Mexico was required to formulate monetary, credit, and exchange rate policies with three objectives: promoting the stability of the purchasing power of money, financial system development, and sound economic growth. In practice, central banks turned into development banks—and financed agriculture, industry, and housing, as well as the government deficit. The ultimate result was increasing inflation.

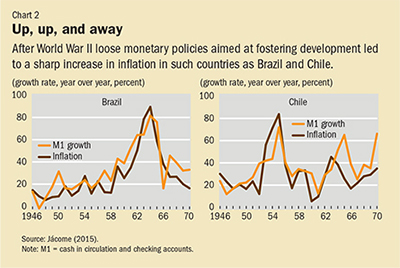

Central bank financing of economic development proved inconsistent with maintaining a fixed exchange rate. Lax monetary policies boosted aggregate demand, but also resulted in current account deficits that eroded international reserves, which led to currency crises and ultimately to a rise in inflation, as illustrated by Brazil and Chile (see Chart 2).

After the Bretton Woods system broke down in the early 1970s and exchange rates became increasingly flexible worldwide, macroeconomic instability worsened in Latin America along with political turbulence. A new transition period for central banking had started as monetary policy simply adjusted to soaring inflation, accommodating rising prices rather than resisting them by restricting the amount of money available. But not long after the Bretton Woods breakdown, a steep rise in oil prices changed things dramatically.

The amount of cash sloshing around in the international financial system rose sharply as oil-exporting countries invested their newfound wealth. Many of these so-called petrodollars found their way to Latin America. These capital inflows provided a large amount of external financing to the region—financing that was largely in the form of dollar-denominated bank loans. But this source of financing did not last long. By the early 1980s, capital inflows turned to outflows because monetary policy tightened (and interest rates rose) in the advanced economies—at a time when most Latin American countries had accumulated sizable budget deficits, current account imbalances, and foreign debt. This situation triggered large devaluations, which made the dollar-denominated liabilities of firms, banks, and the government difficult to repay and pushed inflation through the roof. During this decade monetary policy accommodated the soaring inflation.

A policy turn

The 1990s in Latin America marked a turning point for monetary policy. After more than 50 years of burdening central banks with multiple objectives, governments granted them political and operational independence to permit the institutions to focus primarily—and sometimes exclusively—on containing inflation. One by one, countries accepted that the main contribution of monetary policy to economic growth was to achieve and preserve low and stable inflation because it reduced uncertainty in decision making by consumers and investors.

Chile started the trend in 1989, and in the following decade most Latin American countries approved new laws in which central bank independence was the backbone of reforms to avoid the inflationary bias from political influences on monetary policy. Breaking with the past, government financing—the main historical source of inflation—was restricted and even banned. Countries also introduced, in most cases, exchange rate flexibility to allow the exchange rate to play the role of external shock absorber. In addition, starting in the last half of the 1980s, many countries began reforms to the structures of their economies to make them more market oriented. Those structural changes—such as trade reform, which opened the economies to external competition—also helped reduce inflation.

As inflation declined to single digits in the late 1990s and early 2000s, Brazil, Chile, Colombia, Mexico, and Peru made inflation targeting their policy framework—conducting monetary policy usually by adjusting their short-term interest rates to signal the stance of monetary policy and drive inflation expectations to the preannounced target for inflation. The credibility of the inflation-targeting regimes increased over time as central banks fulfilled their promises. Building credibility reinforced the effectiveness of monetary policy, as market participants kept inflation expectations aligned with central banks’ targets.

Institutional reforms of central banks were instrumental in making the past 15 years the longest period of price stability in Latin America since 1950. This achievement was built on four main pillars: the political and operational independence of central banks, central bank accountability, flexible exchange rates and open capital accounts, and disciplined fiscal policy.

Global financial crisis

Will the Great Recession feed a Latin American debate about a new era of central banking as it has in advanced economies? An expanded mandate for central banks might be well received in Latin America. Being responsible for financial stability may be well regarded as a natural complement to the existing central bank role of lender of last resort to prevent systemic financial crises like those in the past. The additional mandate on financial stability would likely require that Latin American central banks become responsible for macroprudential policy. This is a plausible institutional reform because it would allow countries to benefit from central banks’ expertise in assessing macroeconomic and financial risks and put difficult macroprudential decisions in the hands of a politically independent institution. However, there are also potential costs. In particular, central banks could be considered excessively powerful institutions governed by unelected authorities, which could heighten the so-called democratic deficit argument used in the past against central bank independence. Moreover, the independence of central banks might also come under scrutiny if another financial crisis erupted despite the new mandate. Central bank accountability may also be weakened because the objective of financial stability is difficult to quantify. The challenge for Latin American countries is to design institutions and policy frameworks for preserving financial stability that do not undermine monetary policy credibility (see Jácome and Mancini-Griffoli, 2014).

The case for making central banks in Latin America responsible for economic growth and employment is less clear cut. Central banks cannot consistently influence economic growth and employment, given that their economic activity depends highly on external factors (such as demand for commodities) in the short run and hinges on structural changes to enhance productivity and foster employment in the long run. Therefore, adding growth and employment to central banks’ area of responsibility may put monetary policy effectiveness at risk and would make accountability a cumbersome process, especially if inflation and growth become conflicting objectives.

As an alternative, some Latin American central banks have already assigned more weight to output when they make their policy calculations, without any explicit broadening of their mandate. They aim at smoothing short-term cyclical fluctuations to help employment and protect financial stability.

It took about 80 years for Latin American central banks to achieve low and stable inflation, which improved their countries’ welfare. This was a long and rocky journey in which central banks tried different mandates and policies while many countries experienced long periods of high inflation (see Chart 3). Future developments will not necessarily entail a return to elevated inflation or even hyperinflation, but there is a risk that giving central banks responsibilities they cannot meet effectively may undermine their hard-won political independence and credibility. The result would be to achieve price stability—at the cost of higher interest rates and lower economic growth. ■

Reference

Jácome, Luis I., 2015, “Central Banking in Latin America: From the Gold Standard to the Golden Years,” IMF Working Paper 15/60 (Washington: International Monetary Fund).

———, and Tommaso Mancini-Griffoli, 2014, “A Broader Mandate,” Finance & Development, Vol. 51, No. 2.