Sovereign strains also spilled into the euro zone banking system as some funding channels closed, and interbank spreads widened. Banks’ access to term funding was sharply curtailed and even short-term markets came under strain as lending tenors were reduced from months and weeks to days. U.S. money market funds dramatically scaled back credit to euro area banks (Figure 2).

This prompted many of those banks to sell U.S. dollar assets. In many markets, the cost of funding now exceeds that during the Lehman crisis. Funding strains are beginning to spill over into the broader economy with tighter conditions

for accessing bank credit for small and mediumsized enterprises and households as banks' ability to fund assets diminishes, leading to rising credit risk (Figure 3).1

The potential impacts of funding strains are already evident. A number of banks have announced significant balance sheet deleveraging plans. These plans include shedding assets in the euro area, the United States, and other developed

markets, as well as in the emerging economies. The execution of some of these plans by affected banks could impact a wide range of economic activities, from trade and project finance, to cross-border arbitrage.

European policymakers have taken significant steps to contain the crisis . . .

EU summit meetings in October and December led to agreements on important steps to stabilize market conditions and restore confidence. The EU will work toward stronger joint economic governance, and growth-enhancing structural

policies will be given greater weight. Banks are to be strengthened with new capital and funding support. The Greek debt overhang is to be addressed through a voluntary debt exchange with private creditors. The European Financial

Stability Facility (EFSF) is to be enhanced to help banks and finance national adjustment programs, and the starting date for the European Stability Mechanism (ESM) is to be brought forward to July 2012.

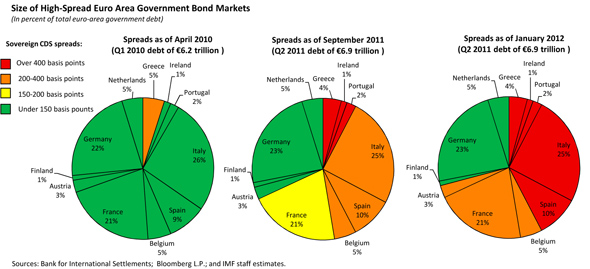

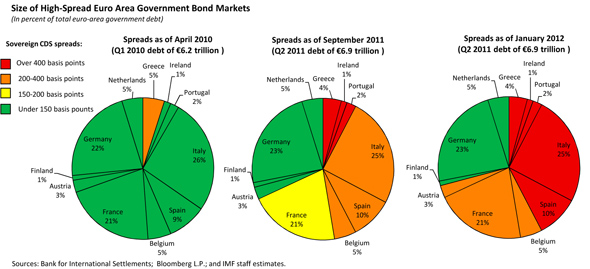

. . . while the outlook for sovereign risk in some larger economies has worsened.

Negative sovereign ratings actions have spread beyond Greece, Ireland, and Portugal further into other euro area countries (Figure 3). This reflects concerns that it will be difficult to reach the political consensus necessary for fiscal consolidation and structural reforms. Market concerns are also rising about the fiscal path in the United States, given little evident progress in breaking the political stalemate over how to carry out needed fiscal consolidation. In the near term, markets have focused on a potential failure to raise the debt ceiling, which the U.S. authorities have estimated will become binding at the beginning of August, absent action. The risk of a temporary default has pushed U.S. short-term CDS spreads above those of some countries rated below the United States’s AAA rating. Even that rating has come under question following S&P’s issuance of a negative outlook in April. In Japan, ratings agencies have downgraded the sovereign outlook on concerns about the government’s ability to achieve deficit reduction.

National governments have recently taken important steps to improve macro-financial stability. Following changes in government, Italy and Spain both announced measures to cut structural budget deficits, improve debt-to-GDP ratios over the medium term, and address longstanding structural rigidities in order to enhance growth prospects.

With private funding markets for euro area banks under severe strain, including due to a lack of eligible collateral to conduct repo operations, the ECB took extraordinary steps to stabilize funding conditions. Measures included cutting reserve requirements, broadening eligible collateral, and offering 3-year longer-term refinancing

operations (LTROs) to mitigate the effects of funding stress on credit provision to the private sector, and provide an alternative to forced fire sales of assets. To alleviate dollar funding strains, the U.S. Federal Reserve and five other central banks reduced the cost of the existing dollar swap lines. While market functioning remains far from

normal, several of these measures – most notably the 3-year LTRO – have had positive effects on market sentiment and funding conditions.

. . . but stability risks remain elevated as sovereign financing will be challenging and backstops are not yet adequate . . .

Restoring sovereign access to funding at sustainable yields is a key challenge as many remain vulnerable to shifts in market sentiment. However, regaining market confidence is likely to take time, during which domestic reform may

need to be supplemented by short-term external support for primary or secondary markets, if available support from private markets is insufficient. While the 3-year LTRO did much to alleviate bank funding concerns, thus far it has

had less of an impact on peripheral sovereign yields, which, while declining at the short end of the yield curve, were little changed at the long end.

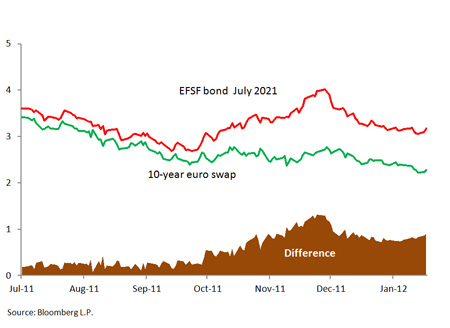

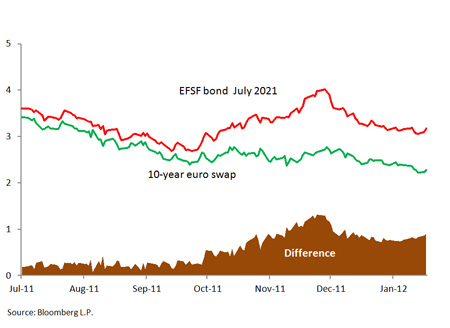

The EFSF can now operate in primary and secondary public debt markets, but its capacity remains limited. Taking into account resources already committed to program financing, it only has about €300 billion available to deploy. While some proposals to leverage the EFSF have merit, even with a plausible amount of leverage the total amount of firepower available would still likely not be sufficient to contain rising sovereign spreads under stress scenarios. Moreover, the recent widening in EFSF spreads (Figure 4) and S&P’s decision to downgrade the facility’s AAA

rating in mid-January suggest that even the current funding model for the facility may be under pressure.

. . . and deleveraging by banks may ignite an adverse feedback loop to euro area economies . . .

Pressures on European banks have recently escalated, reflecting the increase in sovereign stress and the closure of many private funding channels. To insulate banks from such negative shocks, global steps toward a safer financial

system are essential. In this regard, the European Banking Authority (EBA) has initiated a process calling for banks to reach higher capital ratios.2

It judged €85 billion in additional capital to be necessary (excluding €30 billion already programmed for Greece) to reach a 9 percent core Tier 1 ratio and provide an adequate sovereign capital buffer (Figure 5).

There remains the potential for an adverse feedback loop between credit markets and the real economy in the euro area and beyond, as outlined in the downside scenario described in the January 2012 World Economic Outlook

Update. The ECB’s recent actions likely forestalled an imminent crisis as substantial debt maturities need to be rolled over this year by euro area banks, with large amounts due in the first quarter. But even with this funding and a subsequent LTRO to be conducted in February, deleveraging could still be substantial.

While some deleveraging may be unavoidable, the way it is done makes a difference—there is "good" and "bad" deleveraging. Some types of balance sheet deleveraging do not necessarily represent a reduction in credit to the real

economy. For example, some banks (especially in Germany, Ireland, and the United Kingdom) are seeking to reduce balance sheets by shedding some assets that remain on balance sheets as a legacy of the original leg of the credit crisis. In other cases, banks may sell non-core businesses (e.g., asset management arms, insurance business, or overseas operations) or even loan portfolios. In cases where this results in a transfer of assets to strong hands, it would not reduce credit to the economy, although asset sales can cause declines in asset prices whose adverse

impact goes far beyond the sellers, further pressuring capital. However, provision of credit to the real economy is most affected when banks decide to let credit lines and loans run off and curtail new loan originations.

. . . that could exacerbate financial stability risks in the United States . . .

The U.S. economy is susceptible to a range of shocks from the euro area, reflecting the close financial and trade integration extending across the Atlantic. Potential spillovers could include direct exposures of U.S. banks to euro area banks or the sale of U.S. assets by European banks. For example, the CMBS and ABS markets have been under pressure in recent months, weighed down by the volume of European asset sales. Funding strains more generally could rise, transmitting pressure to the U.S. banking system. An important demonstration of this is the persistent

widening of interbank spreads in dollar markets since mid-2011, in parallel with the widening of euro interbank spreads.

Some domestic risks also remain. While U.S. sovereign financing conditions have generally benefited from a flight to safety away from the euro area, such a situation cannot be counted on to persist indefinitely. It is thus necessary to resolve the political impasse over the fiscal situation in the United States, as noted in the January 2012 WEO Update. While the U.S. banking system has regained a good measure of health since the crisis and ongoing Federal

Reserve stress tests should continue to enhance transparency, legacy problems in the mortgage sector remain, weighing on consumption, and pushing some of the burden of sustaining demand onto the public sector. More broadly, banks will

struggle to maintain historical returns on equity, particularly in a new, tighter regulatory environment.

. . . threaten emerging Europe and spill over to emerging markets more broadly.

Emerging Europe would be heavily affected by deleveraging on the order of that assumed in the downside scenario described in the January 2012 WEO Update, reflecting the large presence of euro area banks in those economies. The deep recession in emerging Europe in 2009 was largely the result of the sudden stop in capital

flows from western European banks, which abruptly ended the credit boom.

Emerging markets beyond central and eastern Europe could face spillovers from the European debt crisis through several channels. Overall macroeconomic prospects for emerging markets have already deteriorated, and are subject to downside risks stemming from Europe, as discussed in the January 2012 WEO Update.

While emerging markets outside of Europe have been quite resilient to shocks and developments in major economies in the past year, recent indicators have weakened significantly and the general business climate has deteriorated.

First, credit channels could become impaired as pressures on European banks result in a pullback of cross-border lending, notably trade finance activities, and a loss of parent bank support for local lending. For example, euro area banks provide roughly 30 percent of trade and project finance in the Asian region, even though their

balance sheets account for only about 5 percent of bank assets. The impact depends on the extent to which local banks can step in and fill the financing gap: even though some banks may have the balance sheet capacity to do so, there are

significant operational challenges in some areas of trade finance. New entrants will also have to raise substantial dollar funding in stressed market conditions. Constraints on long-term funding could severely limit banks’ capacity in such areas as shipping and aviation trade finance, as well as project and infrastructure finance.

Second, local asset markets (foreign exchange, fixed income, and equity markets) could come under renewed strains through outflows, deteriorating liquidity, and a repricing that could have a knock-on impact on local financing conditions. Emerging markets that are heavily reliant on external portfolio flows could be especially susceptible.

How resilient are emerging markets in the face of these challenges? Many emerging markets have built up considerable capital and liquidity buffers to counter adverse shocks, and local markets generally held up well under the strains of the Lehman crisis. Since then, some have built up further (albeit limited) headroom to conduct

countercyclical economic policies, although the situation varies across regions and countries.

Emerging Europe is particularly vulnerable, in view of the concentration of European bank lending and the dependence on Europe as an export market. In that region, buffers are generally weak relative to other emerging market

regions, and other longstanding vulnerabilities in the financial system, including maturity and currency mismatches in some economies, could strain balance sheets.

Additional policy actions are needed for a comprehensive plan.

Faced with the above risks, policymakers in all major economies need to focus on a number of interlocking challenges. European policymakers need to promptly put in place a comprehensive package that restores confidence. In addition to pursuit of appropriate macroeconomic and financial policies, European policymakers need to implement vigorously the policy measures agreed at the October and December summits.

Furthermore, there is a need to: provide a sufficiently high firewall that avoids a destabilizing spiral of high funding costs for sovereigns and banks; manage the process of balance sheet adjustment in the banking system

to prevent a disorderly deleveraging and, instead, promote an adequate flow of credit to the private sector; and take additional measures that may be necessary to bolster confidence in the global financial system, for both emerging and

advanced economies. Achievement of this policy agenda will require prompt and thorough implementation of recent initiatives, and the adoption of new policies to promote and enhance financial stability.

In particular:

- The "firewall" needs to be sufficiently large and convincingly built. Sovereigns that are solvent but facing financing strains may require an extended period of successful policy implementation before investors return. During the intervening period, it is crucial to secure affordable funding from external sources. The EFSF was meant for this purpose in the euro area. However, given its size and structure, the EFSF has a limited ability to undertake this role. To establish confidence, it would be highly desirable to increase the size and flexibility of the EFSF/ESM at the earliest possible opportunity. Until this larger firewall is wellestablished, provision by the ECB of

substantial and sustained liquidity support to stabilize government debt and bank funding markets remains essential.

- A "macroprudential gatekeeper" is needed to assure deleveraging plans are consistent with sustaining the flow of credit to support economic activity and to avoid a downward spiral in asset prices. Within the EU, such a

role could be coordinated among the EBA, European Systemic Risk Board (ESRB), the national bank supervisors, and the banks themselves. Countries should aim to monitor and limit deleveraging of their banks not only in home markets but also abroad, where such efforts would normally take place in cooperation with host country regulators. A potential precedent for such a gatekeeping function is the current Vienna Initiative, which aims to coordinate national efforts to avoid adverse cross-border effects on emerging Europe associated with deleveraging on the part of euro area banks.

- A credible increase in banks’ capital buffers along the lines recommended by the EBA remains necessary to restore market confidence. As envisaged in the EBA guidelines this should be done as far as possible by increasing capital rather than reducing credit. Steps are already being taken to require banks to meet a certain level of nominal capital (as was the case under the Troubled Asset Relief Program in the United States and the Fund for Orderly Bank Restructuring in Spain) rather than a ratio, which provides incentives to shrink assets. Banks should be encouraged to raise capital from private sources. However, given some recent challenges for banks in doing so,

public funding should be made available as a backstop to such efforts, but should be subject to strict conditionality. Some bank capital could be raised via pari passu injections with the government or via contingent capital instruments.

In addition, there needs to be a pan-euro-area facility with the capacity to take direct stakes in banks. To

complement the ECB’s LTRO, bank guarantee schemes should be established at the euro area level to help reopen private funding markets. Finally, a weak tail of banks with low capital, poor profitability, and vulnerability to funding shocks still exists, acting as a drag on recovery. Some of these will need to be restructured and recapitalized, or resolved.

- Adjustment remains essential, but the nearterm impact on growth should be taken into account. As recognized by policymakers, in most of the advanced economies it is essential to make a credible commitment to

fiscal consolidation over the medium term, in order to remove the long-term tail risk of sharp increases in sovereign spreads. However, the rhythm of fiscal adjustment also needs to take into account the impact on current economic conditions. As outlined in the January 2012 Fiscal Monitor Update, automatic stabilizers should be allowed to

operate in the event that growth slows more than expected and in the United States, expiring policies designed to support demand need to be renewed. Monetary policy should also be sufficiently accommodative and, when needed, structural policies should be aimed at promoting growth, notably by restoring the competitiveness of the private

sector.

- Policymakers in emerging markets should stand ready to counter funding and credit strains, and to deploy countercyclical policies where headroom is available. Emerging markets in many cases have built ample cushions of reserves that could be used to counter external liquidity shocks. An adequate and flexible combination of macroeconomic and financial policy measures can help limit the impact of external shocks, but care should be taken to

avoid generating financial distortions.

1—

See Euro Area Bank Lending Survey, ECB at http://www.ecb.int/stats/money/surveys/lend/html/index.en.html.

2—The EBA issued a recommendation on December 8, 2011 noting "Banks should first use private sources of funding to strengthen their capital position to meet the required target, including retained earnings, reduced bonus payments, new issuances of common equity and suitably strong contingent capital, and other liability management measures. National supervisory authorities may, following consultation with the EBA, agree to the partial achievement of the target by the sales of selected assets that do not lead to a reduced flow of lending to the EU’s real economy but simply to a transfer of contracts or business units to a third party."