Builders and painters wait for work on a roadside in Cape Town: unemployment in South Africa is still among the highest in the world, says the IMF (photo: Nic Bothma/EPA/ Newscom)

South Africa Latest Outlook Shows Urgent Need for Policy Reforms

July 7, 2016

- Low growth amid China slowdown and global financial volatility

- Political wrangling increasing policy uncertainty

- Electricity shortages easing, reforms urgently needed for growth and jobs

South Africa faces significant challenges and needs decisive action to revive growth, the IMF said in its latest annual assessment of the country’s economy.

South Africa has made considerable economic and social progress since its first democratic election in 1994, but many citizens have not sufficiently benefited from the improvements. The report shows income inequality and unemployment remain among the highest in the world, and growth has waned in recent years.

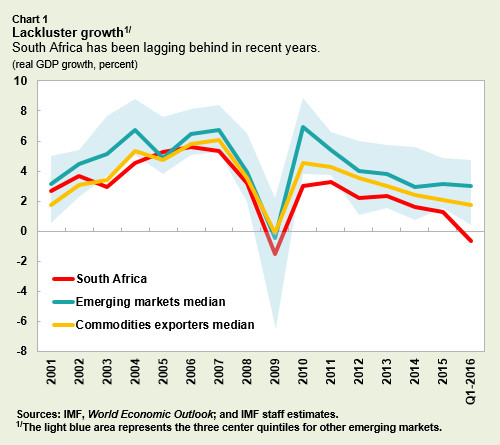

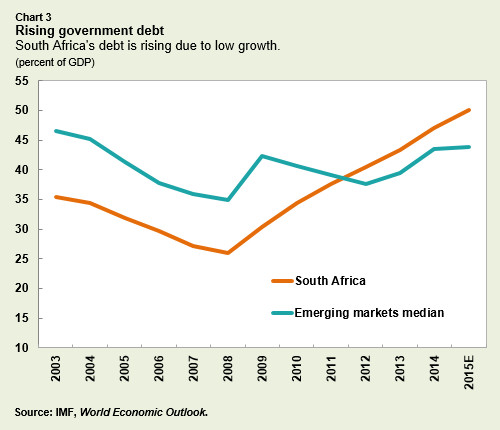

In 2015, South Africa was hit by a number of economic shocks. China’s slowdown and rebalancing, weak commodity prices, and U.S. monetary policy normalization all weighed on growth (Chart 1). On the domestic front, leadership changes at the National Treasury last December and other political developments shook confidence, heightened governance concerns, and increased policy uncertainty. A severe drought in the region also significantly reduced agricultural output.

And while electricity supply has improved, growth continues to be held back by deep-rooted structural problems such as poor education outcomes, and product and labor markets that are out of reach for too many people.

The report shows growth slowed to 1.3 percent in 2015, the lowest since the global financial crisis and below most emerging market economies and commodity producers. The IMF projects 2016 growth at 0.1 percent, which would mean a second year of falling per capita incomes. A muted recovery is expected from 2017, approaching 2-2½ percent in the outer years as shocks dissipate and more power plants are completed; with these projections, unemployment will likely rise over the medium term.

Risks of further deterioration

Downside risks dominate and stem mainly from China, heightened global financial volatility, and domestic politics and policies that may reduce confidence (Chart 2).

Shocks could be amplified by linkages between capital flows, the sovereign, and the financial sector, especially if combined with sovereign credit rating downgrades to speculative grade. The United Kingdom’s recent decision to leave the European Union (EU) has further increased risks, as there are extensive financial linkages between the United Kingdom and South Africa and sizable trade linkages with the EU as a whole.

The report notes, however, that the authorities are making progress in the recent dialogue between government, businesses, and labor, which could catalyze reform implementation and invigorate growth.

Urgent need for more reforms

Besides addressing infrastructure bottlenecks, the report said structural reforms should be a priority in order to boost growth and jobs. Greater competition, labor market policies and industrial relations that work for a greater portion of the population, better quality of government services—especially in education—and improved governance and efficiency in state-owned enterprises would all help increase growth.

Job creation, especially in small- and medium-sized enterprises that are more labor-intensive and hire a relatively high share of low-skilled workers, is the best way to ensure a sustainable reduction in unemployment and inequality. Advancing these reforms will require building trust among stakeholders, ideally via a social bargain.

To generate reform momentum, the report suggests government should implement a focused set of tangible measures with a priority on boosting private sector employment. Clarifying the regulatory environment in the mining sector and reforming state-owned enterprises, for example, would reduce policy uncertainty and increase confidence and trust even in the short term.

Elevated vulnerabilities

Sources of resilience include strong institutions and policy frameworks, the flexible exchange rate regime, strong private corporate balance sheets, a high share of rand-denominated external debt, well-capitalized banks, and the large domestic institutional investor base.

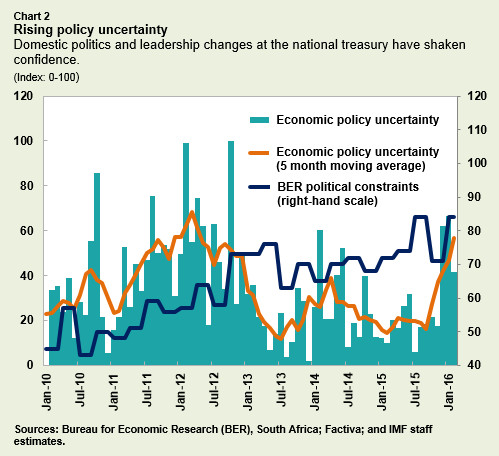

Nevertheless, vulnerabilities remain elevated. The current account deficit, though it has started adjusting, remains among the highest in emerging markets. Rising government debt, due to a large extent to low growth, and financially-weak state-owned enterprises have increased fiscal vulnerabilities, and sovereign downgrades could trigger capital outflows (Chart 3).

Limited macroeconomic policy space

The 2016 budget envisaged significant deficit reduction this year and next to stabilize debt. However, the budget targets could be challenging to achieve if IMF staff’s less-optimistic growth projections materialize. The report suggests that any additional fiscal consolidation needs to be carefully designed to minimize the negative growth impact and protect the poor. State-owned enterprise reforms are also essential to limit fiscal risks, as well as to support growth. Greater private participation and effective regulators could help improve state-owned enterprise performance and free up resources for investment.

Making a strong push on structural reforms is the absolute, urgent priority to put the South African economy on a path to improving living standards and create jobs, the report said.