Crypto assets such as Bitcoin have matured from an obscure asset class with few users to an integral part of the digital asset revolution, raising financial stability concerns.

Crypto assets are no longer on the fringe of the financial system.

The market value of these novel assets rose to nearly $3 trillion in November from $620 billion in 2017, on soaring popularity among retail and institutional investors alike, despite high volatility. This week, the combined market capitalization had retreated to about $2 trillion, still representing an almost four-fold increase since 2017.

Amid greater adoption, the correlation of crypto assets with traditional holdings like stocks has increased significantly, which limits their perceived risk diversification benefits and raises the risk of contagion across financial markets, according to new IMF research.

Bitcoin, stocks move together

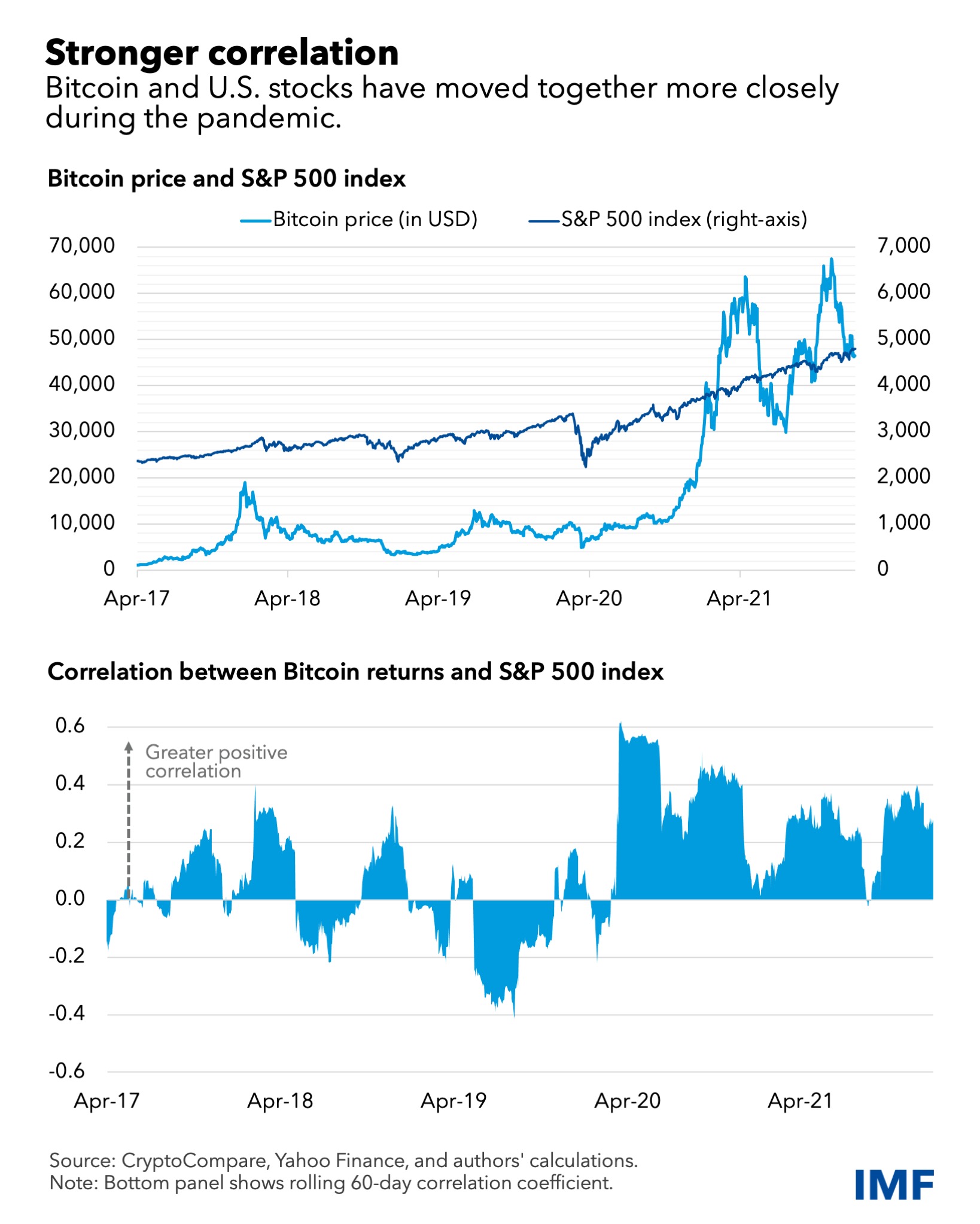

Before the pandemic, crypto assets such as Bitcoin and Ether showed little correlation with major stock indices. They were thought to help diversify risk and act as a hedge against swings in other asset classes. But this changed after the extraordinary central bank crisis responses of early 2020. Crypto prices and US stocks both surged amid easy global financial conditions and greater investor risk appetite.

For instance, returns on Bitcoin did not move in a particular direction with the S&P 500, the benchmark stock index for the United States, in 2017–19. The correlation coefficient of their daily moves was just 0.01, but that measure jumped to 0.36 for 2020–21 as the assets moved more in lockstep, rising together or falling together.

The stronger association between crypto and equities is also apparent in emerging market economies, several of which have led the way in crypto-asset adoption. For example, correlation between returns on the MSCI emerging markets index and Bitcoin was 0.34 in 2020–21, a 17-fold increase from the preceding years.

Stronger correlations suggest that Bitcoin has been acting as a risky asset. Its correlation with stocks has turned higher than that between stocks and other assets such as gold, investment grade bonds, and major currencies, pointing to limited risk diversification benefits in contrast to what was initially perceived.

Crypto’s ripple effects

Increased crypto-stocks correlation raises the possibility of spillovers of investor sentiment between those asset classes. Indeed, our analysis, which examines the spillovers of prices and volatility between crypto and global equity markets, suggests that spillovers from Bitcoin returns and volatility to stock markets, and vice versa, have risen significantly in 2020–21 compared with 2017–19.

Bitcoin volatility explains about one-sixth of S&P 500 volatility during the pandemic, and about one-tenth of the variation in S&P 500 returns. As such, a sharp decline in Bitcoin prices can increase investor risk aversion and lead to a fall in investment in stock markets. Spillovers in the reverse direction—that is, from the S&P 500 to Bitcoin—are on average of a similar magnitude, suggesting that sentiment in one market is transmitted to the other in a nontrivial way.

Similar behavior is visible with stablecoins, a type of crypto asset that aims to maintain its value relative to a specified asset or a pool of assets. Spillovers from the dominant stablecoin, Tether, to global equity markets also increased during the pandemic, though remain considerably smaller than those of Bitcoin, explaining about 4 percent to 7 percent of the variation in US equity returns and volatility.

Notably, our analysis shows that spillovers between crypto and equity markets tend to increase in episodes of financial market volatility—such as in the March 2020 market turmoil—or during sharp swings in Bitcoin prices, as observed in early 2021.

Systemic concerns

The increased and sizeable co-movement and spillovers between crypto and equity markets indicate a growing interconnectedness between the two asset classes that permits the transmission of shocks that can destabilize financial markets.

Our analysis suggests that crypto assets are no longer on the fringe of the financial system. Given their relatively high volatility and valuations, their increased co-movement could soon pose risks to financial stability especially in countries with widespread crypto adoption. It is thus time to adopt a comprehensive, coordinated global regulatory framework to guide national regulation and supervision and mitigate the financial stability risks stemming from the crypto ecosystem.

Such a framework should encompass regulations tailored to the main uses of crypto assets and establish clear requirements on regulated financial institutions concerning their exposure to and engagement with these assets. Furthermore, to monitor and understand the rapid developments in the crypto ecosystem and the risks they create, data gaps created by the anonymity of such assets and limited global standards must be swiftly filled.