Three years since the outbreak of the pandemic, fiscal policy has moved a long way toward normalization. Governments have withdrawn exceptional fiscal support, and public debt and deficits are falling from record levels. That’s happening amid high inflation, rising borrowing costs, a weaker growth outlook, and elevated financial risks. Debt sustainability is a cause for concern in many countries.

Our latest Fiscal Monitor discusses how exceptional economic conditions since the pandemic have shaped fiscal outcomes. It calls for consistent policies to bring inflation back to target, address public finance risks while protecting the most vulnerable, and safeguard financial stability.

Navigating volatile times

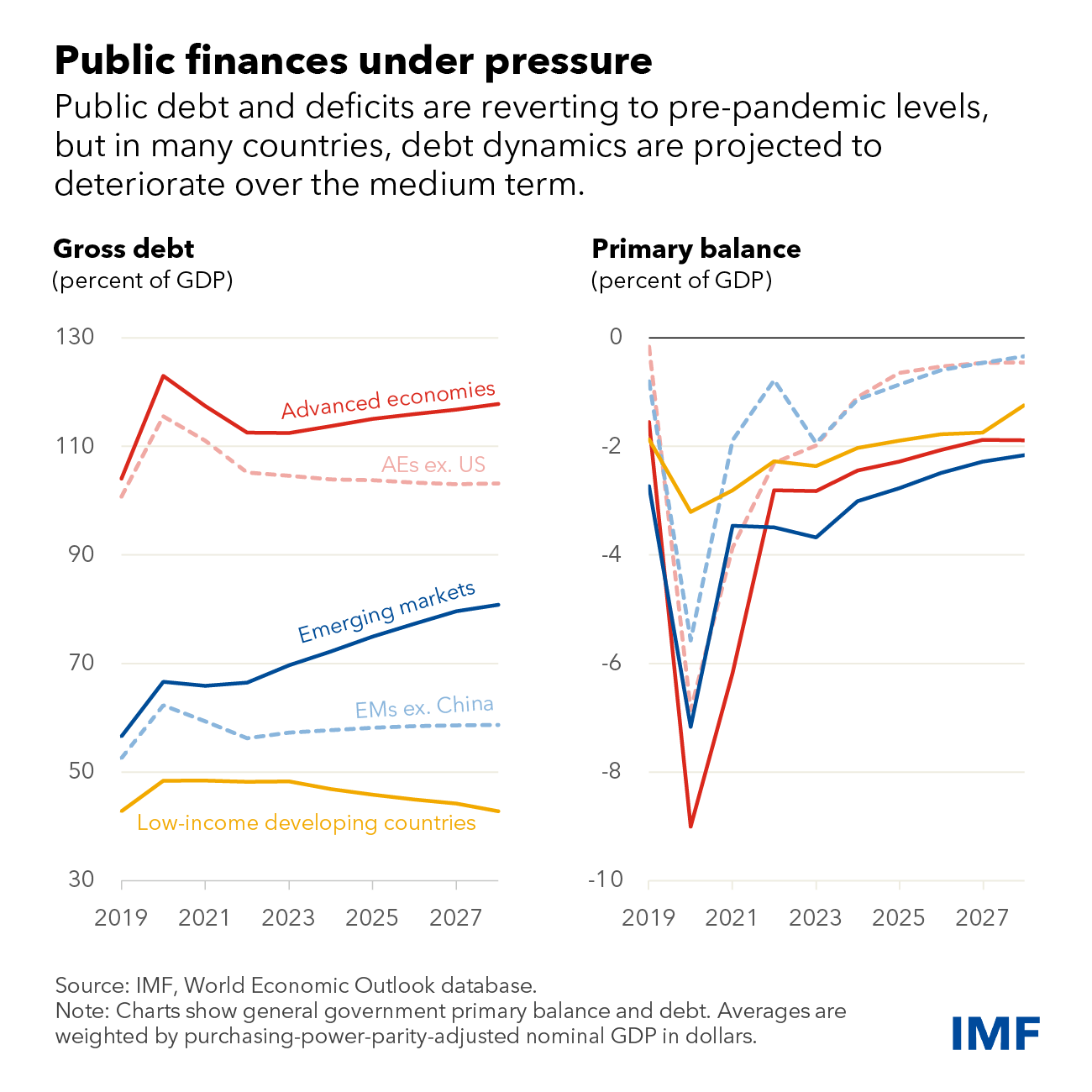

Following 2020’s historic surge in public debt to nearly 100 percent of gross domestic product because of economic contraction and massive government support, fiscal deficits have since declined, as exceptional pandemic-related fiscal measures have come to an end.

Nearly three-quarters of countries tightened both fiscal and monetary policies last year. As a result, in the last two years global debt posted the steepest decline in 70 years and stood at 92 percent of GDP at the end of last year, still about 8 percentage points above pre-pandemic projections. Primary deficits are also falling rapidly and approaching pre-pandemic levels.

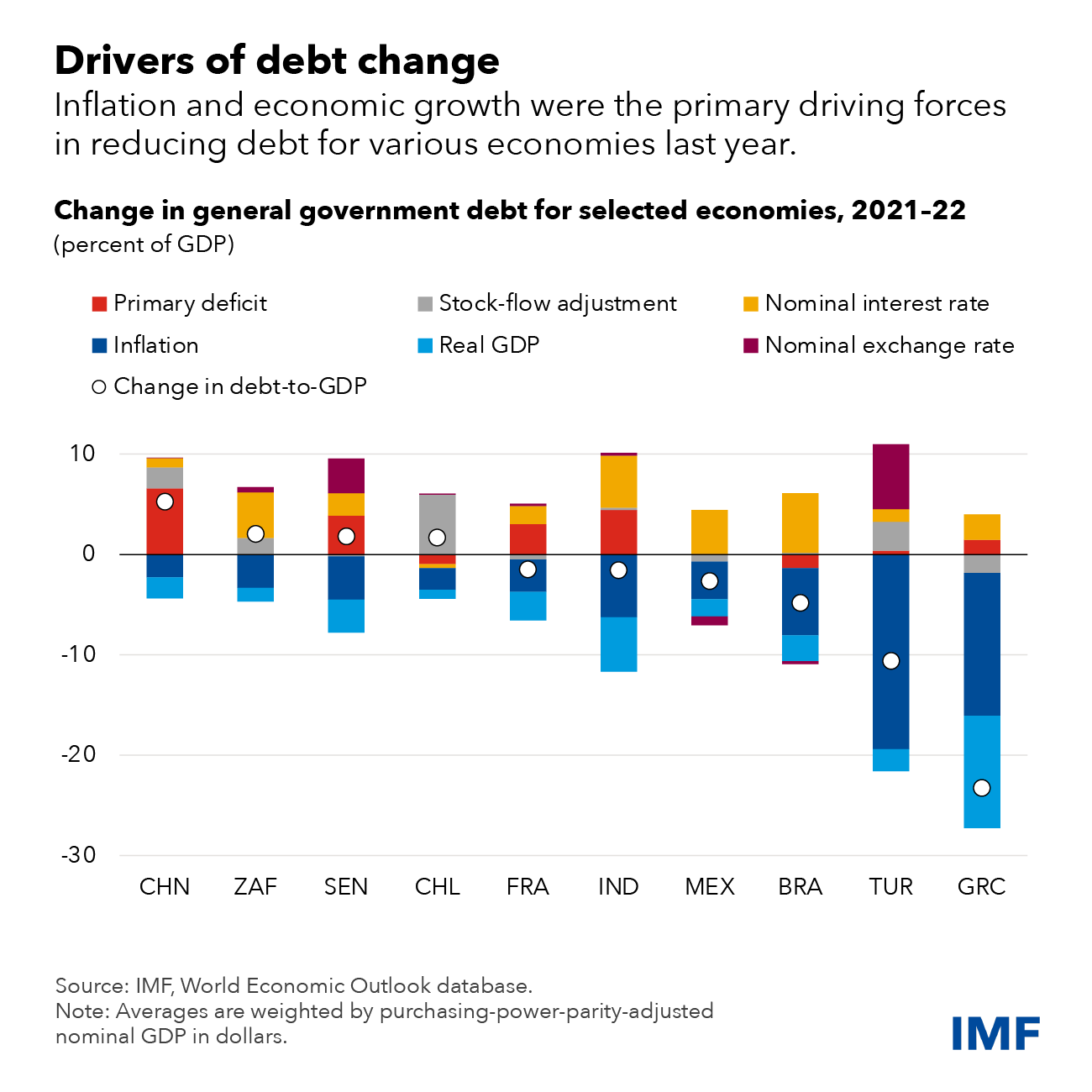

After declining abruptly in 2020, nominal GDP surged over the past two years in many countries, helping public finances. This reflects both a strong economic rebound and the unexpected inflation surge, which fueled higher-than-expected nominal GDP growth and tax revenues.

On average, advanced and emerging market economies (excluding China) experienced debt reductions of about 2 to 3 percent of GDP last year, thanks in large part to inflation surprises. The pace of deficit and debt reductions varied depending on how quickly countries exited the pandemic and how they were affected by subsequent shocks. Countries that confronted a more severe energy or food crisis tightened more gradually, as governments shared the burden to protect households and businesses through both targeted and untargeted measures.

The role of inflation surprises in debt reduction was shaped by individual countries’ debt size and composition. Countries with high initial levels of debt, combined with large inflation surprises and strong growth, experienced significant debt declines. Exchange rate depreciation, primary deficits, and higher borrowing costs played a larger role in shaping debt dynamics in some emerging market economies and low-income countries, limiting the effects of higher inflation on debt ratios.

Tighter budgetary constraints have exacerbated an already difficult balancing act for low-income countries, hampering further the progress toward the UN’s Sustainable Development Goals. Countries have also been hit hard by the cost-of-living crisis and food insecurity, stalling global poverty reduction.

Supporting stability

The near-term outlook is complex. Amid high inflation, tightening financing conditions, and elevated debt, policymakers should prioritize keeping fiscal policy consistent with central bank policies to promote price and financial stability.

Many countries will need a tight fiscal stance to support the ongoing disinflation process—especially if high inflation proves more persistent. Tighter fiscal policy would allow central banks to increase interest rates by less than they otherwise would, which would help contain borrowing costs for governments and keep financial vulnerabilities in check.

Tighter fiscal policies require better targeted safety nets to protect the most vulnerable households, including addressing food insecurity, while containing overall spending growth, as governments are likely to confront social pressures to compensate for past increases in the cost of living.

Risks are high, however, and policymakers will need to be ready to respond quickly. If financial turbulence morphs into a systemic crisis, fiscal policy may need to intervene swiftly to facilitate resolution. If economic activity weakens substantially and unemployment rises, governments should allow automatic stabilizers to work (for example, allow deficits to rise as unemployment benefits increase or tax revenues fall), especially if inflation pressures are under control and fiscal space is available.

Reducing debt vulnerabilities and rebuilding fiscal buffers over time is an overriding priority. Despite the envisaged gradual fiscal tightening in the coming years, we project global public debt will rise, driven by some large advanced and emerging market economies. More generally, concerns with debt vulnerabilities have intensified in many countries. In low-income developing economies, higher borrowing costs are also weighing on public finances, with 39 countries already in or near debt distress.

Countries should step up efforts to develop credible risk-based fiscal frameworks that reduce debt vulnerabilities over time and build up the necessary room to handle future shocks. The enhanced fiscal frameworks can combine strengthened institutions with revamped fiscal rules. Medium-term fiscal plans should include credible policy commitment to achieving debt sustainability—that is, announce specific spending and revenue measures or reforms—while allowing for flexibility to adjust to shocks.

Low-income countries face particularly severe challenges. Revamped efforts to increase revenue are critical to restoring fiscal sustainability, dealing with the cost-of-living crisis, and achieving the Sustainable Development Goals. Despite multiple waves of tax reforms, revenues remain stubbornly insufficient, below levels that enable the state to play its role in sustainable and inclusive development. International cooperation is crucial to helping these countries resolve unsustainable debt burdens in an orderly and timely manner.

— This blog is based on Chapter 1 of the April 2023 Fiscal Monitor: “On the Path to Policy Normalization.”