Food and Fuel Crisis

Regional Economic Outlook

Mideast Faces Lower Growth Prospects, Needs Bold Policies

FINANCE & DEVELOPMENT

Extracting Resource Revenue

Finance & Development, September 2013, Vol. 50, No. 3

Philip Daniel, Sanjeev Gupta, Todd Mattina, and Alex Segura-Ubiergo

For countries with abundant oil, gas, and mineral deposits, formulating tax and spending policies can be tricky

For countries with abundant oil, gas, and mineral deposits, formulating tax and spending policies can be tricky

Being well endowed with resources may be beneficial for a developing country, but an abundance of resources can make it difficult for policymakers to design and implement spending and tax policies.

Read March issue of F&D

PODCASTS

Food Prices Impact

In Search of Sweet Liquid Gold

In Search of Sweet Liquid Gold

By Jacqueline Deslauriers

Managing Oil Wealth in Africa

Managing Oil Wealth in Africa

By Sharmini Coorey

Riding Out Food and Fuel Price Volatility

Riding Out Food and Fuel Price Volatility

By Samya Beidas–Strom

New Rules for Everyday Foodies

New Rules for Everyday Foodies

By Tyler Cowen

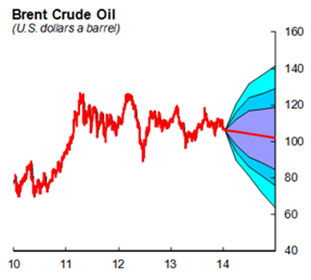

COMMODITY PRICES

Commodity Price Outlook & Risks

Futures markets show most commodity prices remaining flat or declining over the next 12 months, with the exception of gasoline, natural gas, and some food products. Oil prices are expected to decline due to an expected rise in non-OPEC supplies, and possible recovery from outages in OPEC nations. Copper and gold futures prices are flat but soybean and soybean meal prices are expected to fall on the prospect of a large South American crop in 2014.

Futures markets show most commodity prices remaining flat or declining over the next 12 months, with the exception of gasoline, natural gas, and some food products. Oil prices are expected to decline due to an expected rise in non-OPEC supplies, and possible recovery from outages in OPEC nations. Copper and gold futures prices are flat but soybean and soybean meal prices are expected to fall on the prospect of a large South American crop in 2014.

More

IMF Primary Commodity Prices

The Commodities Research Department provides information on primary commodity market developments. it's presented annually, quarterly, monthly, and weekly.

Archives: 'Shocked' countries remain at risk

The July 2008 study, focused on two priorities: getting inflation under control, and putting in place social safety net programs which target the poorest:

Video

Conference on Understanding International Commodity Price Fluctuations