Lending

- Nonconcessional Financing Activity

- Concessional Financing Activity

- Program Design

- Policy Support Instruments

IMF loans are meant to help member countries tackle balance of- payments problems, stabilize their economies, and restore sustainable economic growth. This crisis resolution role is at the core of IMF lending. At the same time, the global financial crisis has highlighted the need for effective global financial safety nets to help countries cope with adverse shocks. A key objective of recent lending reforms has therefore been to complement the traditional crisis resolution role of the IMF with additional tools for crisis prevention. Unlike development banks, the IMF does not lend for specific projects, but to countries that may experience a shortage of foreign exchange, to give them time to rectify economic policies and restore growth without having to resort to actions damaging to their own or other members’ economies. In broad terms, the IMF has two types of lending —loans provided at nonconcessional interest rates and loans provided to poorer countries on concessional terms, for which interest rates are low or in some cases zero.

Nonconsessional Financial Activity

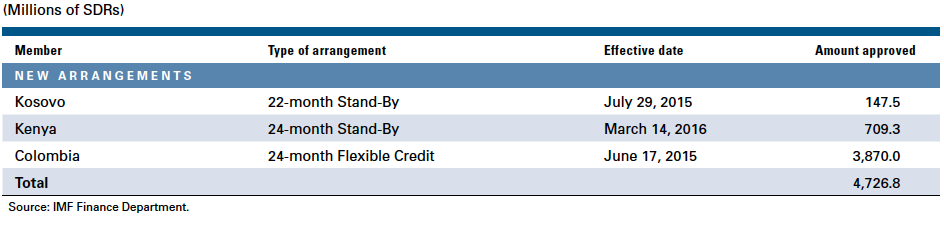

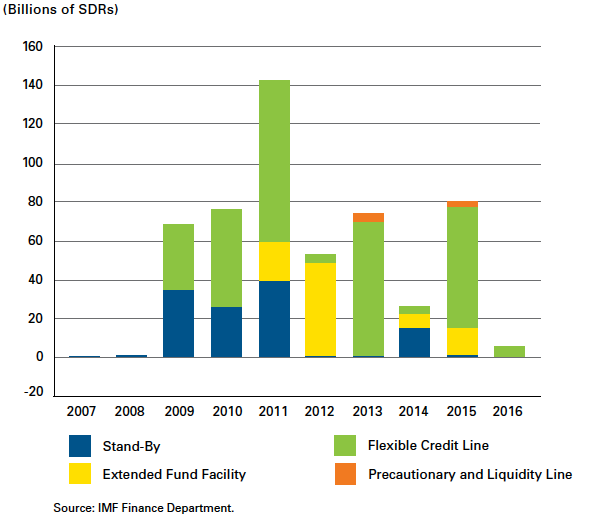

In FY2016, the Executive Board approved three arrangements under the IMF’s nonconcessional financing facilities in the General Resources Account (GRA), for a gross total of SDR 4.73 billion ($6.70 billion not netted for canceled arrangements, and converted to United States dollars at the SDR/$ exchange rate on April 29, 2016 of 0.705552). A precautionary arrangement under the Flexible Credit Line (FCL) for Colombia (SDR 3.87 billion) accounted for 82 percent of these commitments. The FCL approved for Colombia and the precautionary Stand-By Arrangement for Kenya (SDR 0.71 billion) were successors to previous arrangements that were expiring. In addition, the Board also approved a Stand-By Arrangement for the Republic of Kosovo totaling SDR 0.15 billion, and, at the request of the authorities, reduced the FCL for Poland by SDR 2.5 billion. Table 2.1 details the arrangements approved during the year, and Figure 2.5 the arrangements approved over the past 10 years.

Table 2.1

Arrangements approved in the General Resources Account in FY2016

Figure 2.5

Arrangements approved in the General Resources Account during financial years ended April 30, 2007–16

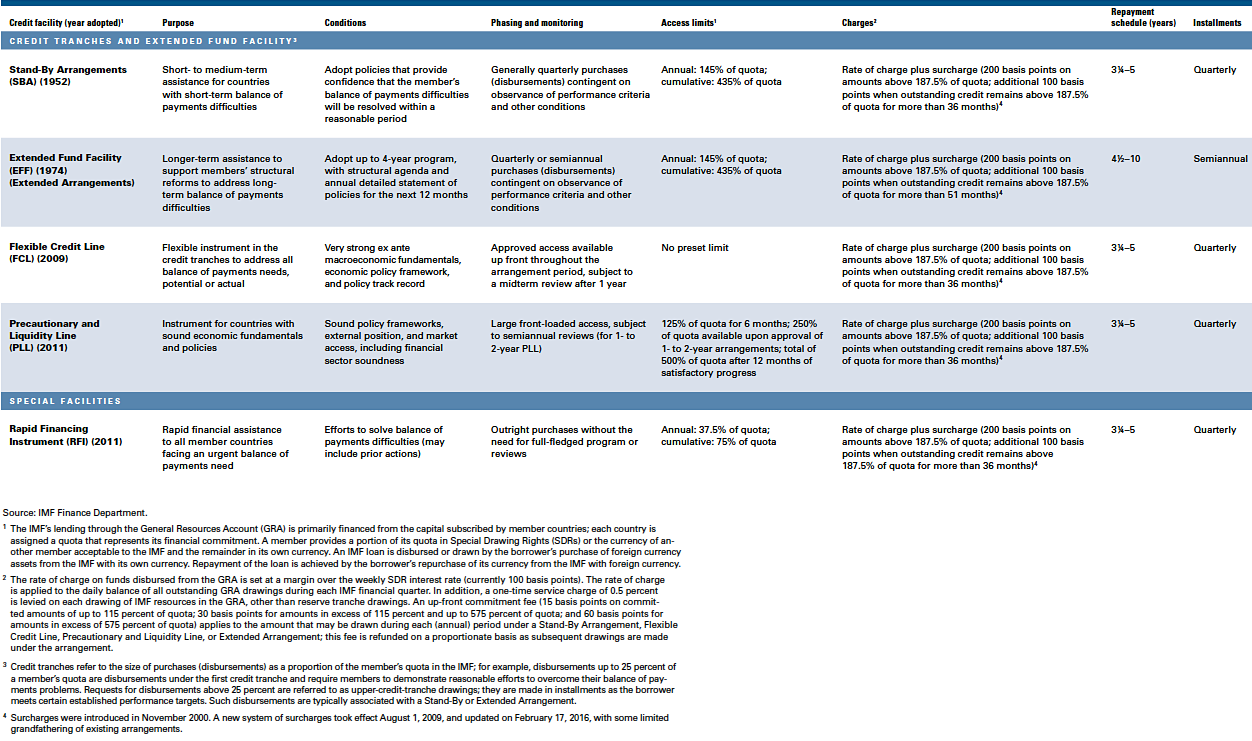

Table 2.2

Financial terms under IMF General Resources Account credit

This table shows major nonconcessional lending facilities. Stand-By Arrangements have long been the core lending instrument of the institution. In the wake of the 2007–09 global financial crisis, the IMF strengthened its lending toolkit. A major aim was to enhance crisis-prevention instruments through the creation of the Flexible Credit Line (FCL) and the Precautionary and Liquidity Line (PLL). In addition, the Rapid Financing Instrument (RFI), which can be used in a wide range of circumstances, was created to replace the IMF’s emergency assistance policy.

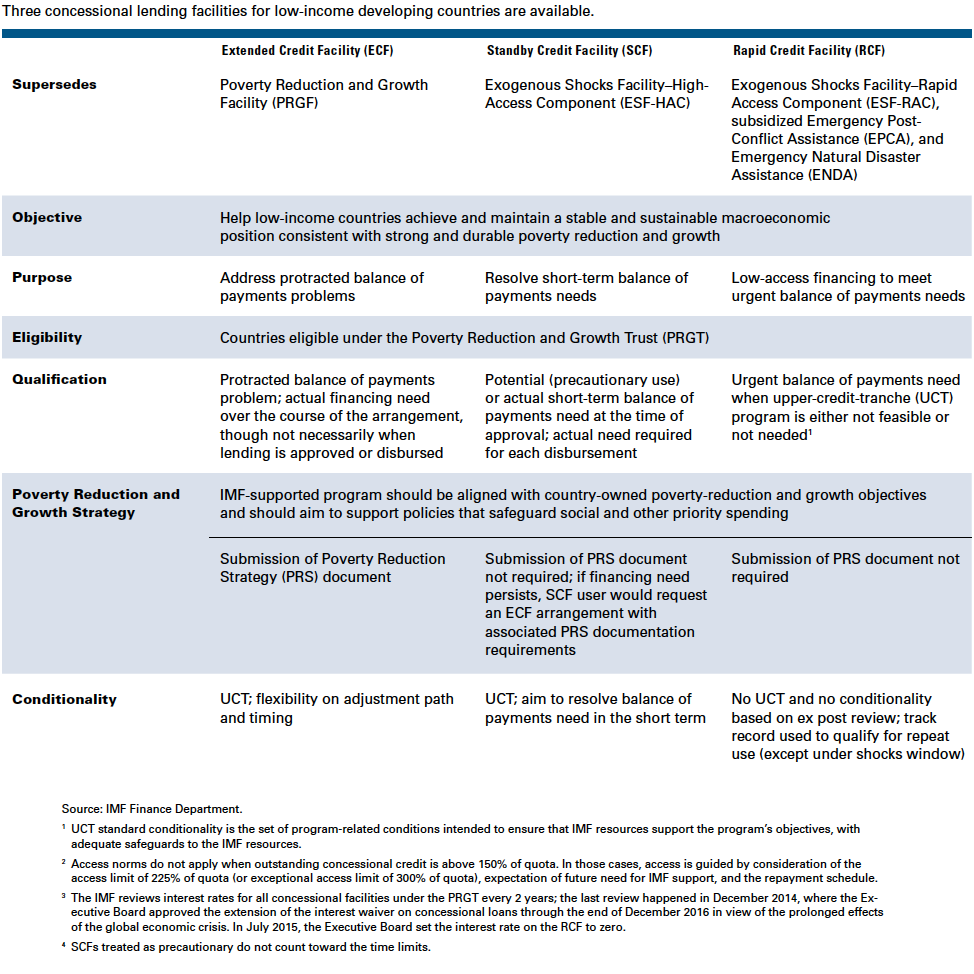

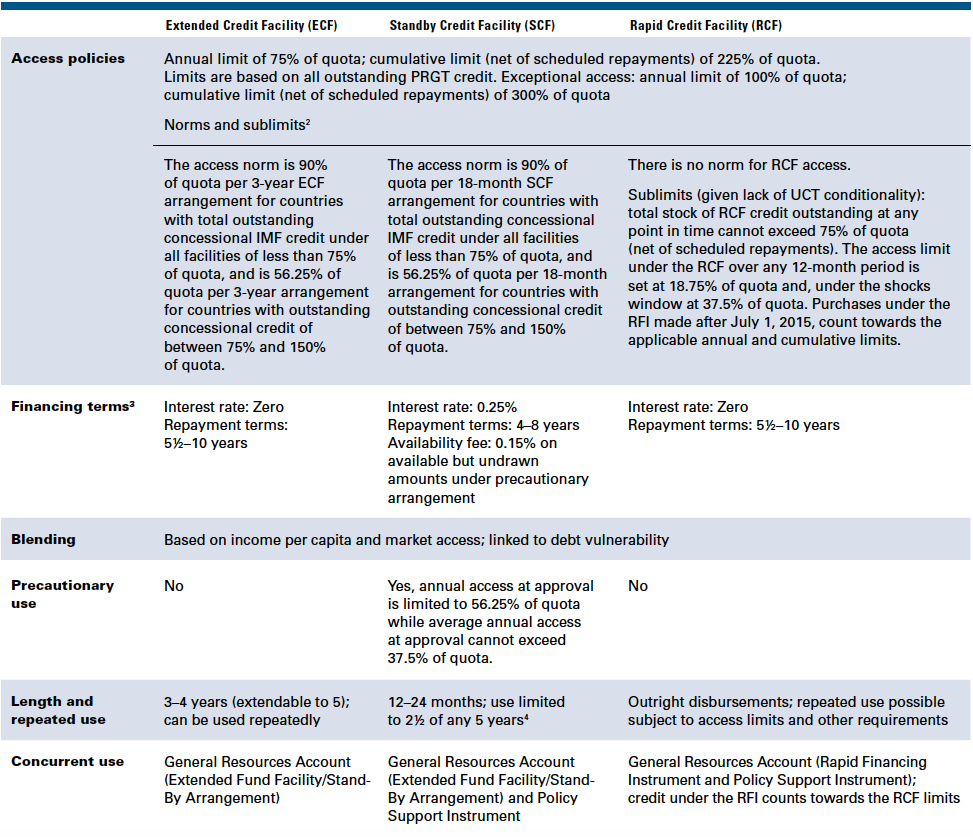

Table 2.3

Concessional lending facilities

By end-April 2016, disbursements under financing arrangements from the GRA, referred to as “purchases,” totaled SDR 4.68 billion ($6.64 billion), with two-thirds of the purchases made by Cyprus, Pakistan, and Ukraine. In addition to these GRA arrangements, on July 29, 2015, the Executive Board approved an SDR 891.3 million (about $1.24 billion) purchase for Iraq under the Rapid Financing Instrument.

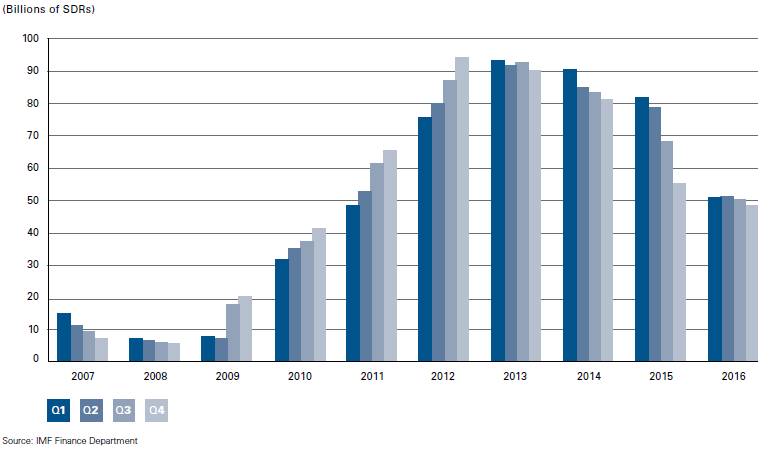

Total repayments, termed “repurchases,” for the financial year amounted to SDR 12.1 billion ($17.2 billion), including advance repurchases, mainly from Portugal for SDR 3.1 billion ($4.2 billion). As a result of sizable repurchases and stalled purchases associated with program delays, the stock of GRA credit outstanding declined to SDR 47.8 billion ($68 billion) from SDR 55.22 billion ($78 billion) a year earlier. Figure 2.6 offers information on nonconcessional financing amounts outstanding over the past 10 years.

Figure 2.6

Nonconcessional loans outstanding, FY2007–16

Consessional Financial Activity in FY2016

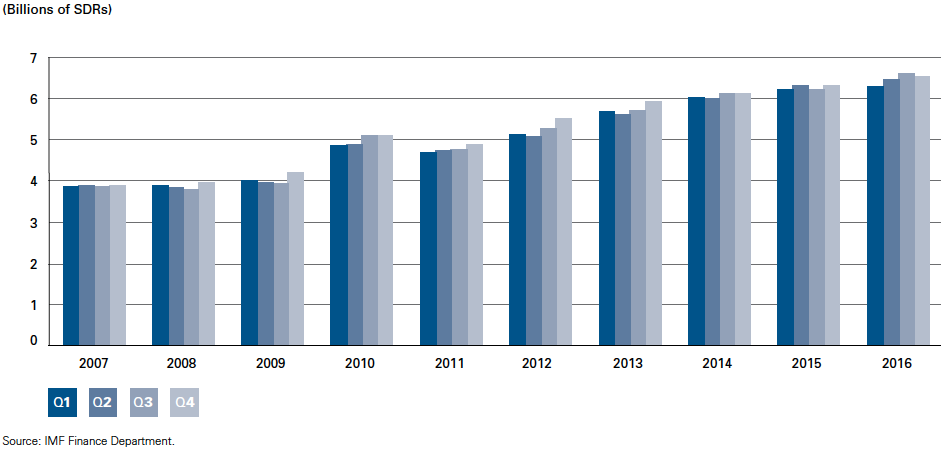

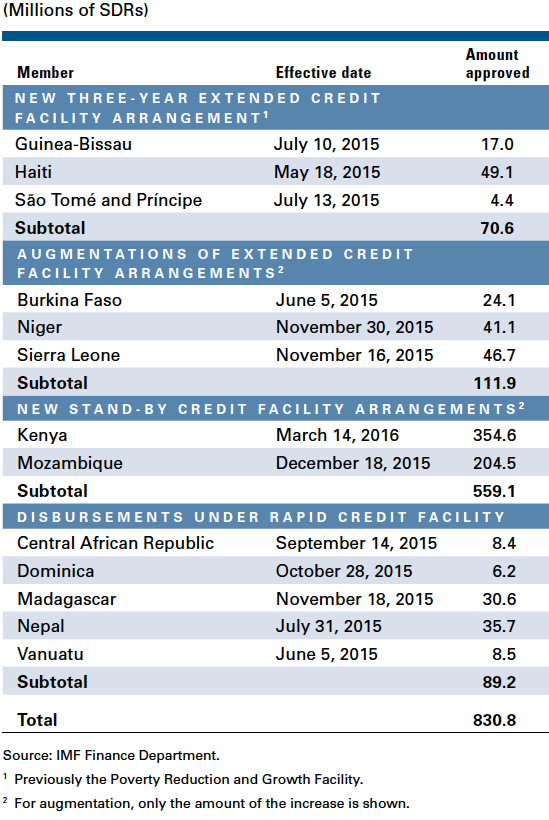

In FY2016, the IMF committed loans amounting to SDR 0.83 billion ($1.2 billion) to its low-income developing member countries under programs supported by the Poverty Reduction and Growth Trust (PRGT). Total concessional loans outstanding to 56 members amounted to SDR 6.5 billion at end-April 2016. Table 2.4 provides detailed information on new arrangements and augmentations of access under the IMF’s concessional financing facilities. Figure 2.7 illustrates amounts outstanding on concessional loans over the past decade.

Figure 2.7

Concessional loans outstanding, FY2007–16

While the Heavily Indebted Poor Countries (HIPC) Initiative has been largely completed with 36 out of 39 eligible countries benefiting, including Chad—the latest beneficiary that received debt relief in April 2015—the IMF can also provide grants for debt relief to eligible countries through the Catastrophe Containment and Relief Trust (CCRT) established in February 2015. The CCRT provides exceptional support to countries confronting major natural disasters, including life-threatening, fast-spreading epidemics with the potential to affect other countries, but also other types of catastrophic disasters such as massive earthquakes. The CCRT is financed with the balance of the Post-Catastrophe Debt Relief Trust, the accounts left over from the financing of the Multilateral Debt Relief Initiative, and contributions from donors. As of end-April 2016, the IMF had provided grants under this trust to cover debt relief of SDR 68 million to the three countries worst hit by the Ebola epidemic (Guinea, SDR 21.42 million; Liberia, SDR 25.84 million; and Sierra Leone, SDR 20.74 million).

In July 2015, the IMF introduced measures to further enhance the financial safety net of low-income countries as part of the international community’s wider effort to support countries in pursuing the post-2015 Sustainable Development Goals. These measures include: (1) a 50 percent increase in access norms and limits to PRGT concessional facilities; (2) rebalancing the funding mix of concessional to nonconcessional financing from 1:1 to 1:2 for better-off countries that receive financial support from the IMF in the form of a blend of concessional and nonconcessional financing, recognizing that these countries typically have significantly greater access to market funding than envisaged when the current facilities were established; and (3) increasing access to fast-disbursing support under the RCF to assist countries in fragile situations, hit by conflict, or affected by natural disasters and increasing the level of concessionality of such support by setting the interest rate on RCF loans permanently at zero percent.

In November 2015, a fundraising round was launched to raise up to SDR 11 billion in new PRGT loan resources, which are needed to support continued concessional lending by the IMF to its poorest and most vulnerable members. The IMF has approached 14 members that are current lenders to the PRGT and an equal number of potential new lenders, including major emerging markets. Expressions of interest received so far, including from three potentially new loan providers, amount to about three-quarters of the target, and responses from five members are pending. Successful completion of the current loan mobilization effort would allow the PRGT to continue to provide loans into the next decade.

Table 2.4

Arrangements approved and augmented under the Poverty Reduction and Growth Trust in FY2016

Program Design

Review of Fund-Supported Programs during the Global Financial Crisis

The IMF Executive Board in December 2015 concluded a review of the design and outcomes of Fund-supported programs undertaken during and following the global financial crisis. The discussion was informed by a staff paper.

The review provided an updated assessment of 32 programs supported from the Fund’s GRA for 27 countries between September 2008 and June 2013. Drawing on lending instruments totaling SDR 420 billion (about $577 billion), the Fund supported euro area countries as they built firewalls against financial contagion, emerging market economies, and small states as they addressed the collapse of trade and financing flows in 2008–09, and the economies of the Middle East and North Africa as they implemented reforms after the 2011 Arab Spring.

The International Monetary and Financial Committee had requested the follow-up review of Fund-supported programs with a view to improving IMF advice and future arrangements. The first such review took place in 2009, with updates in 2010–12.

Executive Directors concurred with the 2015 paper’s conclusion that by boosting confidence and providing resources, alongside other global efforts, Fund-supported programs helped limit the damage from and chart a path through the global financial crisis. Directors noted that Fund financial support helped allow the necessary adjustment to be more gradual. They saw the programs as helping countries gain needed time to address deeper-rooted problems, start unwinding macroeconomic imbalances, and repair balance sheets.

Directors welcomed efforts to learn from program outcomes when designing later programs. They recognized changes in program design that included moving to a slower, albeit still appropriate, pace of fiscal consolidation in some programs; strengthened efforts to achieve internal devaluation; enhanced incentives for debt restructuring to address private debt overhangs; and included sovereign debt restructuring where necessary in some later and successor programs.

Exceptional Access Lending Framework Reforms

The IMF Executive Board in January 2016 approved reforms to the Fund’s exceptional access lending framework to make the policy more calibrated to members’ debt situations, while avoiding unnecessary costs for members, creditors, and the financial system as a whole. The exceptional access framework governs access above the IMF’s normal financing limits, which are based on the size of member countries’ quotas.

The reforms were proposed in an April 2015 staff paper, “The Fund’s Lending Framework and Sovereign Debt—Further Considerations,” and followed a preliminary Board discussion on the topic in 2014. Along with the reform of the IMF’s policy on non-toleration of arrears approved in December 2015, the reform is a component of the four-pronged work program on sovereign debt crisis resolution endorsed by the IMF’s Executive Board in 2013. The reforms are designed to strengthen incentives for collective action when official sector support is required and prevent noncontributing official bilateral creditors from blocking an IMF-supported program.

The reforms include the elimination of the “systemic exemption” introduced in 2010, an increase in flexibility for members where debt is assessed to be sustainable but not with high probability, and a clarification to the criterion related to market access. Where debt is assessed to be sustainable but not with high probability, the reform also gives the IMF appropriate flexibility to make its financing conditional on a broader range of debt operations, including the less disruptive option of a “debt reprofiling”—that is, a short extension of maturities falling due during the program, with normally no reduction in principal or coupons.

Executive Directors favored the removal of the systemic exemption for several reasons:

- To the extent that a member faces significant debt vulnerabilities despite its planned adjustment efforts, the use of the systemic exemption to delay remedial measures risks impairing the member’s prospects for success and undermining safeguards for the Fund’s resources.

- From the perspective of creditors, the replacement of maturing private sector claims with official claims, in particular IMF credit, will effectively result in the subordination of remaining private sector claims in the event of a restructuring.

- The systemic exemption aggravates moral hazard in the international financial system and may exacerbate market uncertainty in periods of sovereign stress.

- It is far from clear that invoking the systemic exemption to defer necessary measures on debt can be relied on to limit contagion, since the source of the problem—namely, market concerns about underlying debt vulnerabilities—is left unaddressed.

The changes to the Fund’s exceptional access framework went into effect immediately and apply to all future completion of reviews under existing arrangements or approval of new IMF arrangements.

Policy Support Instruments

Policy Support Instruments (PSIs) offer low-income countries that do not want—or need—IMF financial assistance a flexible tool that enables them to secure Fund advice and support without a borrowing arrangement. These nonfinancial instruments are a valuable complement to the IMF’s lending facilities under the PRGT. PSIs help countries design effective economic programs that deliver clear signals to donors, creditors, and the general public on the strength of a member’s policies.

In June 2015, the Executive Board approved a three-year Policy PSI for Senegal. The PSI supports implementation of a threeyear program of macroeconomic reforms designed to advance the Plan Sénégal Emergent, the authorities’ strategy to increase growth and reduce poverty while preserving macroeconomic stability and debt sustainability.

The authorities plan to focus on increasing tax revenues by broadening the tax base, as well as on rationalizing current expenditures to create fiscal space for financing infrastructure and social expenditure. Attention will be paid to the quality of expenditure, including investment, and to strengthening public financing, transparency, and economic governance. The authorities intend to accelerate structural reforms to foster a more attractive business environment, thereby promoting development of the private sector.

To date, the Executive Board has approved 18 PSIs for seven members: Cabo Verde, Mozambique, Nigeria, Rwanda, Senegal, Tanzania, and Uganda.