About the IMF

The IMF is a global organization that works to achieve sustainable growth and prosperity for all of its 191 member countries. It does so by supporting economic policies that promote financial stability and monetary cooperation, which are essential to increase productivity, job creation, and economic well-being. The IMF is governed by and accountable to its member countries.

The IMF by the numbers

191

The IMF is governed by and accountable to 191 countries that make up its near-global membership.

44

The IMF was founded by 44 member countries that sought to build a framework for economic cooperation.

1944

The IMF was established in 1944 in the aftermath of the Great Depression of the 1930s.

1 trillion

The IMF is able to lend about $1 trillion to its member countries.

What does the IMF do?

The IMF fosters international financial stability by offering:

CAPACITY DEVELOPMENT

Technical assistance and training to help governments to implement sound economic policies.

Learn more

How is the IMF organized?

At the top of its organizational structure is the Board of Governors, consisting of one governor (usually the minister of finance or the governor of the central bank) and one alternate governor from each member country. All powers of the IMF are vested in the Board of Governors. The day-to-day work of the IMF is overseen by its 25-member Executive Board, which represents the entire membership and is supported by IMF staff. The Managing Director is the head of the IMF staff and Chair of the Executive Board and is assisted by four Deputy Managing Directors. The IMF has 18 departments that carry out its country, policy, analytical, and technical work.

Meet the IMF team

The strength of the IMF comes from its talented and diverse employees. The IMF’s global workforce of about 3,100 hails from over 162 countries. Together, they represent a world of cultures, backgrounds, and skills that strive to live core Fund values of excellence, honesty, impartiality, inclusion, integrity, and respect. Learn more about people working at the IMF in the 2020-2021 diversity and inclusion report.

On which issues does the IMF focus?

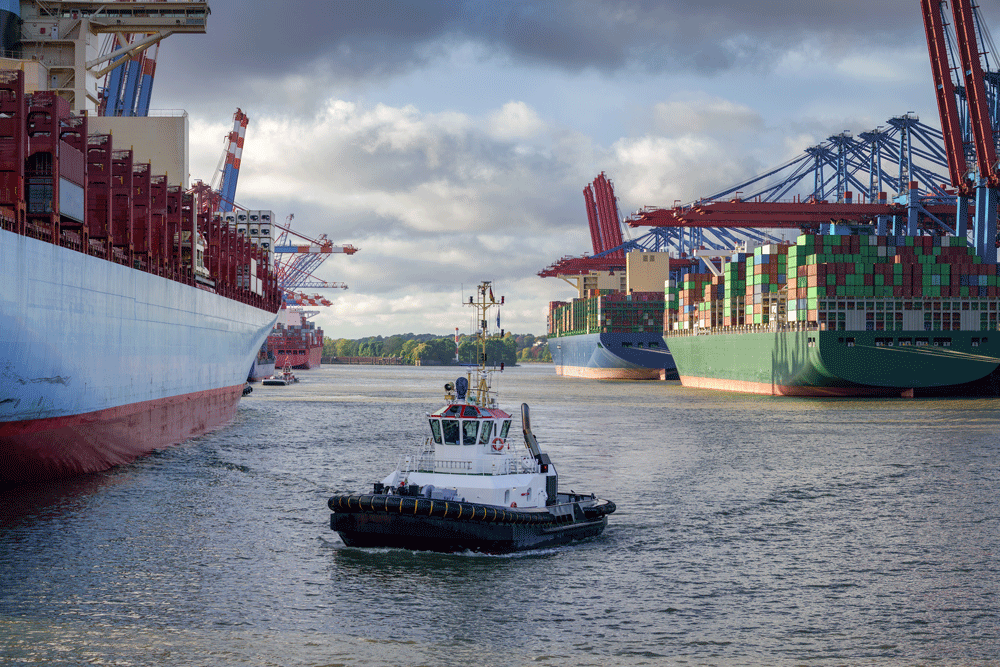

Trade

Open, stable, and transparent trade policies are key for economic growth and resilience and for addressing key global challenges, including climate change, food security, and underdevelopment. Learn more

Fiscal Policy

Fiscal policy is the use of government spending and taxation to influence the economy. The IMF monitors and analyzes global fiscal trends and advises IMF member countries on fiscal issues directly. Learn more

Sovereign Debt

The ability to carry debt varies widely among countries. Debt vulnerabilities have increased especially in low-income countries and some emerging market economies. Learn more

How is the IMF financed?

The IMF's resources mainly come from the money that countries pay as their capital subscription (quotas) when they become members. Each member of the IMF is assigned a quota, based broadly on its relative position in the world economy. Countries can then borrow from this pool when they fall into financial difficulty.

What kind of research does the IMF do?

Economic research is a core activity at the IMF and is dedicated to fostering a deeper understanding of the global economy by analyzing economic trends, challenges, and their implications for both individual countries and the international community. IMF research covers a broad spectrum of macroeconomic and financial issues, including exchange rates, fiscal policy, monetary policy, and global financial stability. Have a look at our publications, which highlight the real-time advice, capacity development, and support the Fund has provided to our members.