Back on the Map

Finance & Development, September 2012, Vol. 49, No. 3

Meral Karasulu and Sergei Dodzin

PDF version

![]() Why Myanmar could be the next economic frontier

Why Myanmar could be the next economic frontier

![]() Aung San Suu Kyi’s Nobel lecture

Aung San Suu Kyi’s Nobel lecture

Myanmar’s reintegration into the global economy promises a better future for its people

In a startling turnaround, Myanmar is emerging from decades of seclusion from the rest of the world. The new government of Thein Sein has initiated historic political and economic reforms that are reintegrating Myanmar into the global community and jump-starting its economic development.

But paving the way for a better future for Myanmar will require firm resolve by its policymakers to sustain the momentum of reform and translate it into concrete gains for the people. And other countries can help Myanmar benefit from their experience through much-needed technical and development assistance.

Inching toward reform

Myanmar has taken a series of steps toward political reconciliation and democratization. Political reforms since March 2011 include the release of political prisoners, relaxation of media censorship, a new labor law that allows for labor unions, and several cease-fire agreements with ethnic minorities. A more visible sign of this political process is the most famous new member of parliament, opposition leader Aung San Suu Kyi, who until late 2011 was under house arrest.

These steps have triggered a positive response from the international community. Following the April by-elections that carried Suu Kyi and her National League for Democracy party to Parliament, the United States, the European Union, Canada, and Australia agreed to suspend most of their economic sanctions against Myanmar, although U.S. markets remain closed to Myanmar’s exports.

Myanmar is rich in natural resources, including natural gas, gems, minerals, and forestry products, and it has a young labor force. Its membership in the Association of Southeast Asian Nations (ASEAN), which Myanmar will chair in 2014, and its proximity to India and China make it a strategic bridge in one of the most dynamic regions in the world.

With the new political openness, hotels in Yangon are already full of foreign businessmen exploring entrepreneurial possibilities. They are immediately recognizable—meeting in lobbies and traveling around the city in their business suits, braving the Myanmar heat. Many large foreign companies, including Coca-Cola, Chevron, and General Electric, have announced plans to invest in Myanmar.

The air is filled with optimism for economic growth and improved living standards, but so far there has been little tangible change on the ground. Daily electricity cuts are routine not only in the commercial center, Yangon, where use of generators is widespread, but also in the new capital Nay Pyi Taw, despite a nearby hydroelectric dam. Roads are poor, financial services are rudimentary, and living standards remain among the lowest in the region. The lack of skills in younger generations points to the erosion of human capital caused by the poor education policies over the past few decades. And sectarian and ethnic conflicts continue to flare up in some regions, underscoring risks to the reform process.

Notwithstanding these challenges, the new government has begun a series of economic reforms. Myanmar’s currency, the kyat, has been officially pegged at an artificially low rate since 1977. This artificial rate, combined with restrictions on international payments and transfers, led to the rapid growth of informal currency markets with several different exchange rates and discouraged trade and investment. The current plan is to reform the exchange rate system to facilitate interaction with the outside world. The central bank replaced the fixed official exchange rate on April 1 with a market-based exchange rate, bringing it closer to the widely used informal market rates. There is still some way to go to unify all informal market rates, primarily by eliminating the remaining restrictions on international payments and transfers. The government is preparing the legal framework and the market infrastructure to accomplish this important step by 2013, in order to welcome the 27th South Asian Games to Myanmar with a modern foreign exchange market.

The new government’s budget was discussed in Parliament in February, a historic first step toward fiscal transparency. The budget aims to double spending on health and education compared with the previous year, with the support of higher gas revenues, which are now recorded at the market exchange rate. But improving human capital will take sustained efforts over many years.

Cognizant of these challenges, the government is drafting a national economic plan to reduce the number of people living below the poverty line from 26 percent (as reported in a recent national survey) to 16 percent by 2015.

A new foreign investment law will allow foreign investors to lease land and set up businesses without local partners. It will also provide tax incentives to encourage technology transfer and job creation through foreign direct investment, which is currently low compared with Myanmar’s neighbors and has strong potential for growth. Three new special economic zones are planned, with high-quality roads, deep-sea ports, electricity, and other infrastructure to attract foreign investment into light manufacturing destined for exports. A land reform will give land titles to farmers to help raise agricultural productivity.

Promising future

The country’s economic prospects have improved as a result of these efforts. The IMF projects real GDP growth to increase to 6¼ percent for fiscal year 2012/13, against an average of about 5 percent in the past five years. Inflation is projected to decline to about 6 percent, much lower than the double-digit inflation experienced in the past decade. This is mainly due to recent appreciation of the kyat in the widely used parallel markets and to less printing of money to finance government expenditures. The new Shwe and Zawtika gas fields, discovered in late 2000s, will significantly increase gas reserves and boost export revenues starting in 2013.

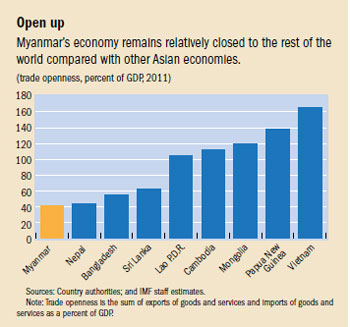

However, Myanmar’s economy still depends largely on agriculture and energy and remains relatively closed to the rest of the world (see chart). Diversifying this economic base is essential to broaden the benefits from global integration and reduce risks to macroeconomic stability. For instance, reliance on exports of natural resources could make the economy more vulnerable to commodity price fluctuations. At the same time, large inflows into the resource sector could lead to sustained currency appreciation, thereby undermining the limited competitiveness of other exports. Part of these risks can be managed with appropriate macroeconomic policies—for example, a fiscal framework that saves windfalls when commodity prices are high and uses these savings during “rainy days” when prices are low could help limit boom and bust cycles.

Sustainable, broad-based growth beyond agriculture and energy requires nurturing the domestic private sector with a better business climate. Less red tape; more consistent and transparent policies to reduce high costs of doing business in Myanmar; and better infrastructure such as electricity, roads, railways, ports, and information technology would help the domestic private sector compete and grow.

The financial system has a large role to play in facilitating this process by improving access to finance for the millions of Myanmar citizens who have never had a bank account. Some steps have been taken since 2010 to liberalize the banking system, but with credit to the economy at 8½ percent of GDP—among the lowest in the region—there is room to expedite banking modernization efforts. It will be essential to further liberalize branch expansions, allow banks to set their own deposit and lending interest rates and offer financial products to fit the needs of a growing economy, and modernize the payment system. These steps should go hand in hand with strengthening supervision and regulation to maintain financial stability. Plans to allow joint ventures with foreign banks are one step in the right direction, and would help to prepare the financial sector for ASEAN financial integration in 2015.

Myanmar has a long way to go to fully integrate with the rest of the world and bring the benefits of this integration to its citizens, but it has begun the journey toward a brighter future.■