High inflation can impose serious and lasting costs on the economy and people. But the distributive effects of inflation—the way it transfers money from some individuals to others—are complex.

To respond effectively to the sharpest upsurge in inflation in three decades and to address the damage done to households, policymakers should have a better understanding of how inflation affects various segments of society in different places.

In our April 2023 Fiscal Monitor, we study the effects of (unexpected) inflation on people’s well-being from mid-2021 to mid-2022—a period when food and energy prices rose earlier and faster than other prices. The chapter offers several lessons for policymakers on the impact of inflation on households’ budgets and how fiscal policy can help curb inflation while supporting the vulnerable.

Impact on public finances

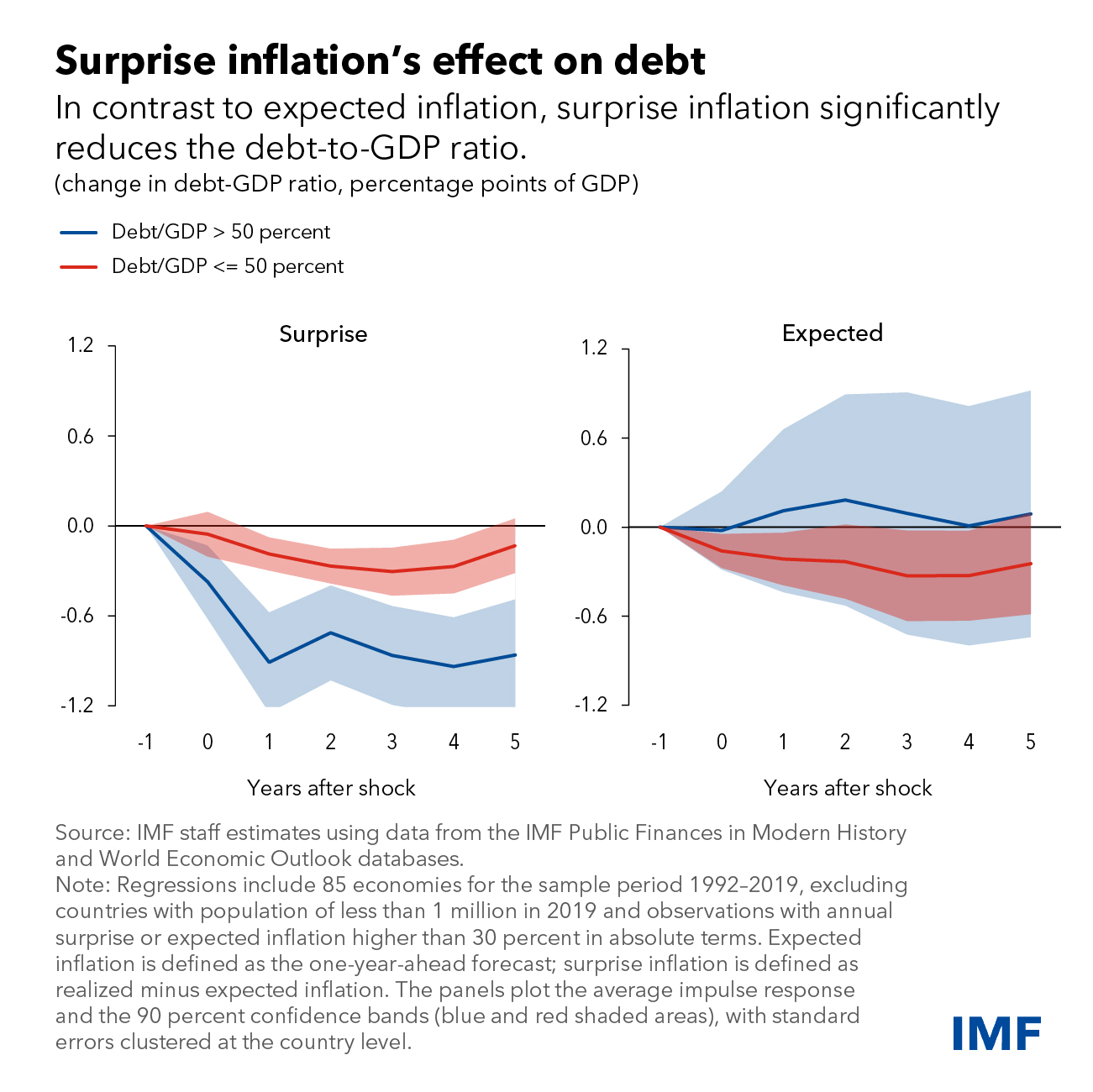

Analyzing how inflation affects public finances, our main finding is that unexpected inflation—such as in the recent episode—erodes the real value of government

debt at the expense of bondholders. For countries with debt exceeding 50

percent of GDP, each percentage point of unexpected (“surprise”) increase

in inflation reduces public debt by 0.6 percentage points of GDP, with the

effect lasting for several years.

As inflation becomes persistent and better anticipated, however, it stops contributing to declining debt ratios.

Likewise, deficit-to-GDP ratios initially decline as spending fails to keep pace with the rise in the monetary value of the economy’s output. But such effects fade even quicker.

Impact on households

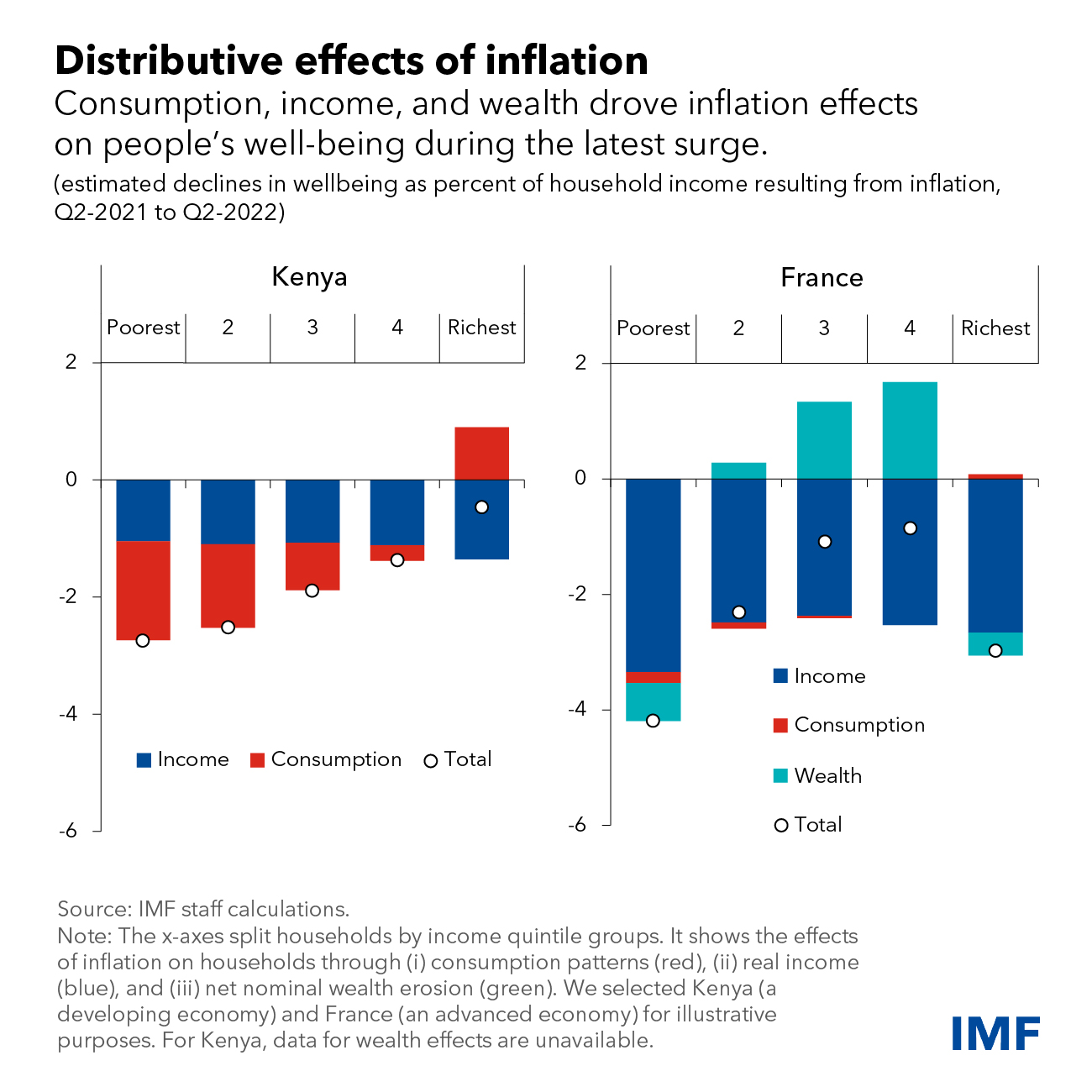

Based on public surveys of thousands of households in six economies

(Colombia, Finland, France, Kenya, Mexico, and Senegal), we find that

inflation from mid-2021 to mid-2022 impacted people through three main

channels: their consumption patterns; their income from wages, pensions, or

transfers; and their assets and liabilities. The below chart displays the

estimated effects of these channels to a developing economy (Kenya) and to

an advanced economy (France), prior to any new government intervention in support of households.

Although the impact varies across countries (and across income groups), the surveys reveal that:

- The faster rise in food prices compared to other prices hurt poor

families disproportionately because food represents a higher share of their

total consumption. This effect was most pronounced in low-income countries.

- Inflation eroded real incomes in commodity-importing countries, as wages

across all income groups did not keep pace with prices.

- As inflation eroded the monetary value of assets and liabilities,

families with negative net worth benefitted at the expense of creditors,

particularly in countries with developed financial and credit markets.

- Redistributive wealth effects of inflation were also influenced by the age of the head of household: young families, which tend to be net borrowers, experienced gains through the wealth channels, whereas old households saw their wealth eroded.

Curbing inflation while protecting the vulnerable

Fiscal policy can support monetary policy in dealing with inflation because it also affects aggregate demand. Our statistical evidence suggests that fiscal policy’s impact on inflation has changed over the decades. For advanced economies we find that, since 1985, reducing public expenditure by 1 percentage point of GDP lowers inflation by half a percentage point.

In addition, fiscal policy can also help protect the vulnerable.

The economic model used in the chapter incorporates inequality in incomes, consumption, and asset holdings. It shows that when central banks act alone—without the support of fiscal policy—they need to hike interest rates substantially to fight inflation. Fiscal tightening makes it possible to increase interest rates by less to contain inflation.

But to safeguard the poor—who benefit more from public services—tax hikes or cuts in lower-priority spending must be combined with larger transfers. This strategy results, by design, in no drop in consumption for the poor, but also in a lower decline in overall consumption.

— This blog is based on Chapter 2 of the April 2023 Fiscal Monitor: “Inflation and Disinflation: What Role for Fiscal Policy?”