Picture This

Lowering the Cost of Sending Money Home

Finance & Development, June 2011, Vol. 48, No. 2

Reducing transaction costs can put more money in the pockets of migrants and their families

INTERNATIONAL remittances to developing countries reached $325 billion in 2010. These transfers, mostly from migrant workers to their home countries, are one of the largest flows of capital to developing countries, often representing as much as 35 percent of gross domestic product in the recipient nation. But it costs a lot to send this money home—often as much as 20 percent of the amount being sent. Reducing remittance costs has therefore recently become part of the development agenda of both the Group of Eight and Group of 20 leading economies. To make pricing more transparent, the World Bank has created a database on the cost of sending and receiving small amounts of money from one country to another. It costs over 47 percent to send $200 from Tanzania to Kenya, the most expensive corridor, but just 4.6 percent to send the same amount from Singapore to Bangladesh, the least expensive one. If the cost of sending remittances could be reduced by 5 percentage points, remittance recipients could receive over $16 billion more each year.

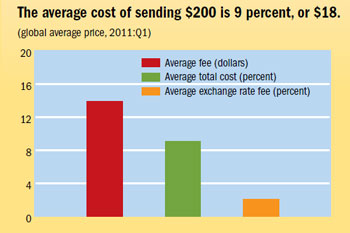

Sticker shock

An important factor in high remittance prices is a lack of transparency in the market. It is difficult for consumers to compare prices because several variables make up remittance prices. The cost of a remittance transaction typically consists of a fee charged by the service provider and a currency-conversion fee for delivery of local currency to the beneficiary in another country. Other factors include exclusivity agreements that limit competition, ill-designed regulation that creates high barriers to entry, and limitations on access to payment systems.

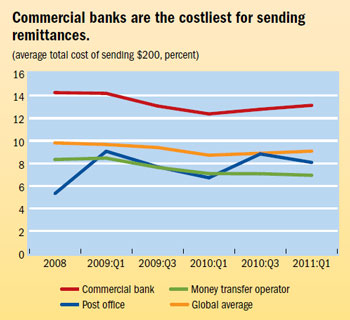

Location, location, location

Remittance costs vary widely between different service providers. Commercial banks, at 13 percent, remain the most expensive option for sending money unless they have dedicated remittance services. At 7 percent, specialized money transfer operators are the cheapest option.

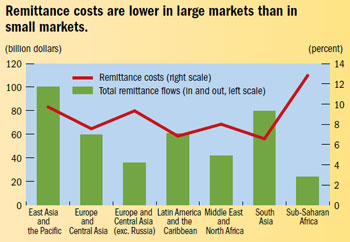

Bigger is better

Remittance costs tend to be lower in large markets than in small markets. The East Asia and Pacific region remains an exception, where the high cost of sending to the Pacific islands drives up the average. However, large markets in the region, such as the Philippines, Indonesia, Thailand, and Vietnam, have remittance costs below 10 percent. Remittances to sub-Saharan Africa cost the most. Sub-Saharan Africa also has the least efficient retail payment systems and regulation that creates high barriers to entry. In addition, high currency volatility over the past six months caused foreign exchange margins to rise, which drove up remittance prices.

Competition matters

Improving competition in the remittance market could significantly reduce fees. The World Bank provides technical assistance in such areas as payment infrastructure, legal framework, and oversight that has helped eliminate inefficiencies in many markets. Government efforts to reform the system must parallel market changes, such as the introduction of new technologies and changes to the operating model of service providers.

Prepared by Kai Schmitz and Isaku Endo of the Payment System Development Group of the World Bank. The data are from the Remittance Prices Worldwide Database, which provides information on 200 remittance corridors, available at

http://remittanceprices.worldbank.org.