Out of the Shadows

Finance & Development, June 2012, Vol. 49, No. 2

Anoop Singh, Sonali Jain-Chandra, and Adil Mohommad

Governments are wise to shrink their underground economy by improving institutions to build inclusive growth

THE global surge in public protests against bad governance and lack of inclusive growth is a timely reminder of the importance of developing strong institutions and enlarging the formal economy to encourage economic growth and access to opportunity.

Too often, poorly run institutions and excessive regulation force workers and small businesses into the informal sector—the so-called shadow or underground economy—where legal goods and services are produced but are deliberately concealed from the authorities to avoid taxes, labor standards, or other legal requirements.

Our research confirms that businesses faced with onerous regulation, inconsistent legal enforcement, and corruption have an incentive to hide their activities in the underground economy. We find that institutions are a more important determinant of the size of the underground economy than high tax rates, inflation, or income levels.

As Daron Acemoglu and James Robinson argue in Why Nations Fail, the main difference between rich and poor countries is their man-made political and economic institutions, not their culture or geography. The book’s compelling narrative shows that nations prosper when they put in place inclusive and pro-growth institutions and they fail when their institutions benefit the interests of a narrow elite instead of creating economic benefits and political power that are widely shared.

Pluses and minuses

Large underground economies pose multiple problems for policymaking. Weak institutions and a large informal sector can interact in a vicious cycle to further undermine the quality of institutions that govern and encourage economic activity—the rule of law, absence of corruption, and minimization of unnecessary regulatory burden.

Moreover, large informal economies render official statistics unreliable and incomplete, complicating informed policymaking. And limited participation in the formal economy implies that the benefits of a formal economy—such as property rights protection, access to credit markets, and adequate labor standards—may not be widely accessible. That in turn discourages economic growth and denies economic opportunities to many.

On a more positive note, the informal sector has an important role to play, especially in developing economies, where it may be viewed as the nursery of future economic growth in the formal economy. It serves as an important buffer against economic uncertainty and underdevelopment in the formal sector by providing livelihood to large segments of the population. Indeed, informal economies are much larger in poor and emerging countries than in richer countries.

But firms operating in the informal sector face a variety of constraints that make it difficult for them to do business and grow. These could be infrastructure related, such as access to electricity, land, and water; institutional, which we explore in our research; or related to access to new technologies, financial intermediation, and other benefits associated with participation in the formal economy. For example, unlike in countries with mature property rights systems where capital can be leveraged extensively for productive activity, in poor countries it is often very difficult to establish clear rights to property in the first place, let alone enjoy its benefits, such as the capacity for leveraging one’s savings and protection of formal ownership.

In our research, we explore the relationship between institutional quality and the extent of informality and find, perhaps unsurprisingly, that institutional weaknesses such as excessive regulation and weak rule of law tend to be associated with larger informal economies.

Developing institutions

“Institutions” is a broad term that covers the nexus of rules that govern social interactions. We refer to formal institutions that govern and influence economic activity, focusing more on the rule of law, absence of corruption, and minimization of unnecessary regulatory burden, which effectively serve to encourage and protect economic activity.

The challenges of developing strong institutions and enlarging the formal economy are interlinked. Strengthening institutions requires the ability to enforce rules and protect rights while preserving economic incentives. A state must have ample resources and capacity if it is to improve institutional quality.

But an economy beset by a large informal sector may not have enough resources to implement the improvements in institutional capacity that are needed to reduce the scope of informal activity. If the government tries to raise resources through higher taxation, that may cause the informal economy to grow as firms seek to avoid higher taxes, and erode state capacity even further. That sets off a vicious cycle that may prolong the “bad equilibrium” of weak institutions and limited formal sector development.

How deep?

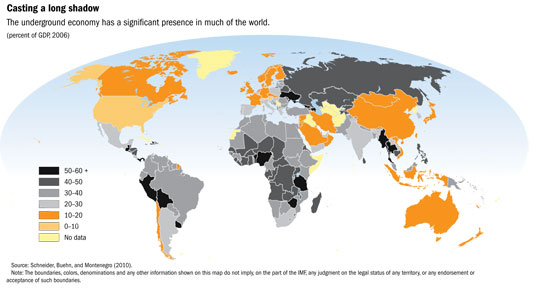

Estimating the size of the informal economy is difficult, given that the very purpose of operating underground is often to avoid detection, and countries may lack the capacity to monitor underground activity. Although there are no direct measures of the size and composition of the underground economy, a number of indirect methods exist, including extrapolating from the excess demand for cash, unaccounted-for consumption of electricity, or labor market trends. These indirect approaches to measuring the size of the shadow economy suggest it is sizable in many countries (see map).

Estimates for 2006 find that the shadow economy in most advanced economies ranges from 14 to 16 percent of GDP, and 32–35 percent of GDP in emerging economies (Schneider, Buehn, and Montenegro, 2010). Underground economies are much larger in Latin America, Central America, and Africa—often more than 40 percent of GDP—while in the Middle East and developing Asia they range between 25 and 35 percent of GDP. Shadow economies remain sizable, but they have shrunk over time.

The extent of informality may also vary by sector within countries, depending on the nature of the activity. For example, the services sector, such as petty/street retail and household services, and subsistence farming may be entirely informal, requiring little capital and/or low skill levels. Labor-intensive manufacturing firms may be highly informal. And activities requiring high levels of skill and capital take place primarily in the formal sector.

Taxing times

There is considerable debate on how an increase in taxation affects underground economic activity.

On the one hand, more burdensome tax regimes (including high tax rates and administration) may entice firms to move underground to evade taxes and boost profits. Estimates show that if the tax burden as perceived by firms becomes more onerous, the size of the shadow economy rises by 11.7 percentage points (Johnson, Kaufmann, and Zoido-Lobaton, 1998).

In contrast, higher taxes may also be associated with a smaller underground economy, as the former may lead to stronger revenues and better public goods provision, including a more robust legal environment, thereby encouraging firms to operate in the official sector.

An alternative view is that political, economic, and social institutions are the main drivers of underground economic activity. Indeed, regulatory burden, more corruption, and a weaker legal environment are all correlated with a larger unofficial economy. Regulatory burden includes costs related to complying with license restrictions and leads to increased costs for firms, which may encourage a move to the shadow economy. A 1 percentage point increase in the regulation burden (as measured by the Heritage Foundation index) is associated with a 12 percent increase in the size of the underground economy (Friedman and others, 2000).

Cumbersome labor market restrictions often lead to an increase in the amount of informal employment and thereby feed the underground economy. The International Labor Organization estimates that more than 70 percent of workers in developing countries are outside the official economy, even though the underground economy makes up a much lower share, at about 35 percent of GDP.

Overly stringent labor market regulations have the unintended consequence of encouraging informal labor arrangements because they raise the cost of hiring for firms. Restrictions on hiring and firing intended to protect workers have instead discouraged firms from hiring in the formal labor market, because compliance tends to be expensive and cumbersome. Instead, firms hire informal workers, pay them under the table and avoid providing health insurance and other benefits.

Another drawback of operating in the informal sector is the lack of access that firms and individuals have to the formal financial sector. In many developing countries, less than half the population has an account with a financial institution, and in some countries fewer than one in five households do. This lack of access to finance traps firms in low-productivity operations and perpetuates inequality as they rely on their own, often limited, resources to start businesses.

Quantifying the theory

Our research based on data for nearly 100 countries finds that:

• Better institutions are associated with a significantly smaller shadow economy. If overall institutional quality improves by 1 standard deviation, the shadow economy shrinks by almost 11 percentage points. Furthermore, a similar improvement in the rule of law is associated with an 8 percentage point reduction in the share of the shadow economy.

• Institutions are the most important determinant of the size of the underground economy. Once we control for institutions, other factors, such as tax rates, inflation, and per capita income are no longer statistically significant. It is not higher taxes themselves that increase the shadow economy but rather weak institutions and rule of law. Businesses have an incentive to go underground not to avoid high taxes but to avoid regulations and the administrative burden they impose.

• Countries with more corruption tend to have larger underground economies. A relatively small increase in corruption leads to a much larger increase in the size of the shadow economy.

Taking action

The underground economy is a significant part of many countries’ economies and represents a vital growth opportunity, especially for developing countries. Due to the variety of problems facing informal economic activity, persistent large informal sectors can lead to low productivity and low growth in the sectors in which they prevail, necessitating policies to remedy the problem. Maximizing inclusive growth requires an understanding of the incentives motivating underground activity, to bring as many people as possible into the formal economy. The literature offers some ideas on how the informal sector can be unshackled, and integrated into the formal sector. For example, governments that wish to shrink the shadow economy could focus on strengthening the rule of law, creating access to the formal economy, and strictly enforcing only the minimum necessary regulations.

A key enabling condition for private sector activity to flourish is a well-functioning property rights system. Firms in the formal economy that enjoy these rights and protections can leverage assets into working capital and grow their businesses. De Soto (2000) argues that recognizing the assets of the informal sector as property might help convert these assets into capital that can be used for investment. In general, institutional reform should include measures to ease regulatory burdens where possible and strengthen the rule of law to effectively enforce the minimum necessary set of regulations. Country-specific and sector-specific circumstances will of course guide the precise path and desirable sequencing of policy measures, which will vary considerably.

Given this central role of institutions in discouraging the growth of underground economies and catalyzing long-term economic growth, institutional development must take center stage. In addition to developing a strong legal and judicial framework as the basis for good institutions, it is also important to give priority to the establishment and strengthening of economic institutions, which in turn have a powerful impact on macroeconomic stability, access to and security of property rights, and free trade. ■

Anoop Singh is the Director of the IMF’s Asia and Pacific Department. Sonali Jain-Chandra is a Senior Economist, and Adil Mohommad is an Economist, also in that department.

References

Acemoglu, Daron, and James A. Robinson, 2012, Why Nations Fail: Origins of Power, Prosperity, and Poverty (New York: Crown Publishing).

De Soto, Hernando, 2000, The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else (New York: Basic Books).

Friedman, E, S. Johnson, D. Kaufmann, and P. Zoido-Lobaton, 2000, “Dodging the Grabbing Hand: the Determinants of Unofficial Activity in 69 Countries,” Journal of Public Economics, Vol. 76, pp. 459–93.

Johnson, S., D. Kaufmann, and P. Zoido-Lobaton, 1998, “Regulatory Discretion and the Unofficial Economy,” American Economic Review, Vol. 88 (May), pp. 387–92.

Schneider, F, A. Buehn, and C. Montenegro, 2010, “New Estimates for the Shadow Economies All Over the World,” International Economic Journal, Vol. 24, No. 4, pp. 443–61.