Taxing Finance

Finance & Development, September 2012, Vol. 49, No. 3

Geoff Gottlieb, Gregorio Impavido, and Anna Ivanova

Many European policymakers are warming to the idea of broadening taxation of the financial sector

A deep and well-functioning financial sector—which includes banks, investment firms, pension funds, and insurance companies—can offer great advantages to society. Firms have better access to the capital they need for investment. Individuals can better smooth their spending over time—saving in good times to prepare for bad times and retirement. By connecting those with too much savings and those with too little, a strong financial sector can raise long-term growth.

But, as the 2008–09 global economic crisis showed, the financial sector can also impose significant costs on the broader economy. Among other factors, the combination of excessive risk taking, high leverage, and heavy reliance on short-term wholesale finance triggered heavy losses for many important financial institutions in advanced economies. Governments feared that if major institutions went bankrupt, the effect on production and employment would be enormous. To stave off a systemwide financial collapse, governments in North America and Europe spent an average of 3 to 5 percent of GDP to support the financial sector directly. Governments also issued guarantees and other commitments that totaled about 17 percent of GDP on average. Even though the authorities kept the financial system from imploding, the crisis still triggered a global recession that resulted in a cumulative loss of output of about 25 percent of GDP (IMF, 2012).

Many European governments have recently introduced taxes on the financial sector to recover the fiscal cost of the bailouts. But discussions continue in Europe on the role that financial sector taxation could play in safeguarding the financial system. To that end, the European Commission has proposed a coordinated financial transactions tax for all 27 member states.

Taxation of the financial sector can be seen in two ways. First, when applied to risky behavior, taxes can be a corrective tool that reduces the probability of future crises. And second, financial sector taxes can also provide a means of adding to government coffers the resources necessary to cover costs of past and any future crises.

Taxation could supplement regulation of financial institutions because it can be focused on risks to the overall financial system rather than just on individual financial institutions (Keen, 2011). While regulations like minimum capital requirements create buffers that help individual institutions absorb losses, taxation can provide the resources governments need to intervene systemwide. Furthermore, over time, taxation allows for more efficient distribution of losses—by collecting from the current generation to pay for the losses its actions might impose on future generations.

Eliminating distortions

Financial sector taxes could be used to eliminate distortions in the tax system that may have contributed to the recent financial crisis. For example, the fact that a value-added tax (VAT) is not applied to financial services may help explain the disproportionate growth of the financial sector in recent years. Similarly, the ability of financial—as well as nonfinancial—firms to deduct interest payments from their taxes may have encouraged excessive reliance on debt rather than equity financing.

But proponents of financial sector taxation want to do more than reduce existing distortions. They want to design a tax that can make the financial sector bear the social cost of risky behavior. The recent crisis demonstrated that the consequences of a financial sector crisis are not limited to those directly involved in the underlying financial transactions, but can extend to society at large. The underlying rationale for such a tax would be similar to the justifications for taxes on pollution: the polluter is forced to pay for the costs it imposes on society.

There are at least two difficulties in implementing such taxes. First, there is the question of whether the systemic risk posed by the financial sector can be defined and measured. Second, regulators must identify the market activity or characteristic that poses this systemic risk.

Experts have yet to define “systemic risk” in a way that can be of operational use. However, there has been progress in identifying some of the possible sources of systemic risk:

• Size and interconnectedness: An institution that is considered too big to fail or has too many relationships with other financial institutions (too interconnected to fail) benefits from artificially low funding costs because investors presume it will be bailed out by the state if it faces insolvency. This implicit subsidy encourages firms to become large. A tax that would help offset this subsidy—particularly with a progressive rate structure (in which that rate increases as the taxable amount increases)—would reduce the incentive to become systemically important.

• Asymmetric treatment of benefits and costs: Some financial institutions are protected from bearing downside risks because they are too big to fail and/or because they have limited legal liability. Such protection creates incentives for excessive risk taking in all corporate entities, but they are particularly acute in highly leveraged banks. To tackle those issues, higher taxes can be imposed on profits that exceed a certain benchmark. Because some excess returns may be paid out as wages (including bonuses), taxing wages above a certain threshold could serve the same purpose.

• Funding structure: At different times during the recent crisis, banks’ excessive reliance on relatively volatile wholesale funding (raising money through borrowing, often short term, from other banks and financial institutions) and on foreign funding has been blamed for destabilizing the broader financial sector and economy. A tax on such volatile sources of funding could encourage banks to move to more reliable funding sources, like deposits or longer-term local financing.

• Trading frequency: Some analysts claim that high-frequency trading of securities by financial institutions contributes to excessive volatility or bubbles in asset prices. Others believe that high-frequency trading is of doubtful social value. These experts favor directly taxing such trading.

Reducing the likelihood of a financial crisis by changing behavior is only one of the goals of financial sector taxation. As noted, governments also want to help cover the costs of future crises. Designing a proper financial sector tax to raise revenues is difficult. Levies could be set to accumulate a buffer equivalent to 2 to 3 percent of GDP—roughly the magnitude of the average country’s direct cost from the most recent crisis—over a period of time. But there is a high degree of uncertainty about the size and cost of future crises. Moreover, some costs may not occur until after the crisis is over. What is critical is that the additional revenue raised by such taxes be used to improve government finances rather than merely to support higher spending.

Tax instruments

At present, four main types of taxes are under consideration:

• A financial stability contribution is a simple levy on a financial institution’s balance sheet (and some off-balance-sheet items) with the goal of ensuring that the industry pays a reasonable share of direct costs associated with resolution of ailing institutions—which might involve their sale, transfer, or liquidation. In addition to raising revenue, the tax also has behavioral effects because it generally includes some combination of a progressive rate structure and a base that exempts equity and deposits. Such an approach implicitly penalizes wholesale debt funding. To change underlying market behavior, such a financial stability contribution would have to be permanent.

• A financial transaction tax (FTT) is levied on the value of specific financial transactions, such as equity trading. It is generally promoted as an instrument to raise revenue while simultaneously reducing financial transactions deemed socially undesirable, such as high-frequency trading. However, like other transactions taxes, an FTT cascades through the supply chain in unpredictable ways, raising the cost of capital for some businesses more than others and potentially encouraging financial disintermediation by reducing the volume of financial transactions (Matheson, 2011).

• A financial activity tax is applied to the sum of an institution’s profits and remuneration. A financial activity tax is essentially the financial sector equivalent of a value-added tax, from which the financial sector is typically exempt. It would reduce the differential tax treatment between the financial sector and other sectors in the economy. A financial activity tax can be further refined to have behavioral effects, such as reducing excessive risk-taking incentives by taxing high returns more heavily.

• A reform of the corporate income tax could help reduce excess leverage in the financial sector. In most countries, the tax system allows companies (including financial sector firms) to deduct from taxable income interest payments to lenders, but not dividend payments to investors. This introduces a tax distortion in favor of debt financing, which compounds the incentives for financial firms to incur excessive risk (Keen and de Mooij, 2012). This distortion can be reduced or eliminated in various ways: a thin capitalization rule would limit interest deductibility below a certain threshold (which could be based on a maximum debt-to-equity ratio), a comprehensive business income tax would not allow for any interest deductibility, and an allowance for corporate equity would provide deductibility for both interest and a notional return on equity.

Design details are key

The ultimate impact of these taxes is heavily influenced by the details of their design. Design guidelines differ depending on the type of tax, but a few broad principles should guide the implementation of most taxes.

The tax should be levied as widely as possible, excluding few, if any, institutions. Everyone benefits from financial stability, and exempting certain institutions could encourage tax arbitrage in which firms change their classification to take advantage of better tax treatment. That would defeat the purpose of the tax. More broadly, taxing only offending institutions could have perverse consequences—such as implicitly revealing those institutions that pose a systemic risk, which could signal to the markets that these institutions will be bailed out.

The appropriate base of any tax depends on its objectives. Taxing a particular component of the balance sheet (say, wholesale funding), of the income statement (profits and remuneration), or a transaction (short-term trading) would be appropriate if the authorities were seeking to correct behavior. As a general matter, however, the overall impact of the various taxes and regulatory requirements on banks should be considered.

The appropriate rate will depend on the type of tax. For a financial stability contribution to have a behavioral impact, the rate must be higher for riskier institutions. For a general financial activity tax, the prevalent VAT rate levied on goods and services should be taken into consideration. But if the goal is a financial activity tax that discourages excessive risk taking, the rate would have to be set relatively high. The rate for an FTT would have to be low to minimize distortions. Even so, the cascading nature of an FTT makes it difficult to avoid a high effective burden.

The IMF, in a report for the Group of 20 advanced and emerging economies, said that financial sector taxes should ensure that the sector would cover the direct fiscal cost of any future government support, make failures less likely and less damaging, be fairly easy to implement, and address existing tax distortions that may exacerbate financial stability concerns. In this context, the report recommended a financial stability contribution that is linked to a credible and effective resolution mechanism for weak financial institutions. If additional revenue is desired, the financial stability contribution could be supplemented with a financial activity tax levied on the sum of the profits and remuneration of financial institutions (IMF, 2010).

State of play

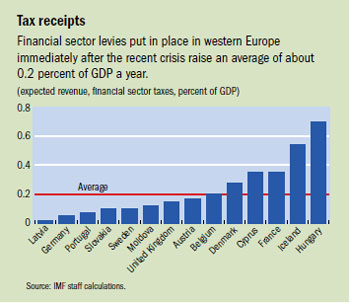

Many countries in Europe introduced financial sector levies immediately after the crisis. Roughly a dozen have taxes similar to financial stability contributions with the primary goal of raising revenue. In about half of the countries, financial stability contributions were meant, at least initially, to be temporary. The rates of the financial stability contributions are relatively low and unlikely to have a substantial behavioral impact. In general, the revenue-raising power of these taxes averages around 0.2 percent of GDP, suggesting that it would take 15 to 25 years to generate resources equivalent to the direct costs of the recent crisis (see chart). It is also unclear whether, or how, tax evasion could affect this over time. To date, the FTT and financial activity tax are far less common in Europe. However, many countries have long had “mini” FTTs—such as a stamp duty on locally registered shares in the United Kingdom—but taxes on stock transactions have been falling into disfavor over the past several decades (Matheson, 2011). In September 2011, the European Commission proposed a coordinated FTT in its 27 member states. The proposed tax, intended to go into effect in 2014, would ensure that the financial sector helps reduce fiscal deficits and government debt accumulation, while seeking to discourage transactions that do not enhance the efficiency of financial markets.

The base of the tax proposed by the European Commission would include all transactions between financial institutions where at least one party to the transaction is located in the European Union (EU). Such a base would cover about 85 percent of all financial sector transactions. House mortgages, bank loans, insurance contracts, and other financial activities carried out by individuals and small businesses would be exempted.

There would be different rates for different types of transactions. For those that involve buying and selling stocks and bonds, for example, the tax rate would be 10 basis points (a basis point is one one-hundredth of a percentage point), while transactions involving derivative contracts would be charged 1 basis point. The effective tax rates would actually be doubled, however, because both parties in the transaction would have to pay the tax. For repurchase (repo) agreements—in which one party raises funds by selling a security and agrees to buy the security back on a specific date—the effective rate would be quadrupled. Each repo agreement involves four taxable transactions. The annual expected revenue from this tax—estimated to be about 0.5 percent of GDP—would be shared between the EU and the member states.

So far, the FTT proposal has not received broad international backing nor have most of the countries in the European Union explicitly supported it. Four EU countries have expressed significant concerns, while nine have expressed support. France unilaterally introduced a temporary FTT on August 1, 2012. The rate is 0.2 percent for French-listed shares, regardless of whether the transaction is executed inside or outside of France. For activities carried out in France only, FTTs at the rate of 0.01 percent will also be levied on high-frequency trading operations and credit default swaps on EU sovereign bonds that are not acquired for hedging purposes.

Although Europe has not reached a consensus on the FTT, the issue is likely to remain on the EU agenda as the continent looks into the future of the monetary union while trying to resolve the problems introduced by the financial and sovereign debt crises. Notably, the European Parliament has decided to endorse a proposal for the introduction of an EU-wide FTT despite opposition by many member states. At its June 2012 summit, the euro area’s four biggest countries committed to introduction of an FTT. ■

Geoff Gottlieb is an Economist and Gregorio Impavido and Anna Ivanova are Senior Economists in the IMF’s European Department.

References

International Monetary Fund (IMF), 2010, “A Fair and Substantial Contribution by the Financial Sector,” Final Report for the G20 (Washington, June).

———, 2012, Fiscal Monitor: Balancing Fiscal Policy Risks (Washington, April).

Keen, Michael, 2011, “Rethinking the Taxation of the Financial Sector,” CESifo Economic Studies, Vol. 57, No. 1, pp. 1–24.

———, and Ruud de Mooij, 2012, “Debt, Taxes, and Banks,” IMF Working Paper 12/48 (Washington: International Monetary Fund).

Matheson, Thornton, 2011, “Taxing Financial Transactions: Issues and Evidence,” IMF Working Paper 11/54 (Washington: International Monetary Fund).