On the Rise

Finance & Development, March 2013, Vol. 50, No. 1

High prices and new technology have triggered a sudden surge in oil and gas production in the United States that could shake up global energy markets

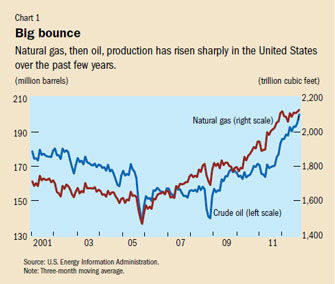

A strong rebound in gas and then oil production in the United States over the past few years has taken markets and policymakers by surprise (see Chart 1). As a result, natural gas prices in the United States are at a 20-year low after adjusting for inflation, while light sweet crude oil from the landlocked production areas in the U.S. Midwest is selling at an unusually large discount from international benchmark prices.

The surge in production is largely the result of the new ability of producers to extract oil and gas from unconventional geological formations—so-called shale rock and tight rock or sand formations. The revolution in production occurred first in natural gas and more recently in oil.

It is already widely accepted that the availability of shale gas resources has fundamentally changed the outlook for natural gas as a source of energy. Prospects for unconventional shale and tight oil production are more uncertain though. Could its development foreshadow a long-term decline in oil prices, as happened during the mid- to late 1970s after the 1973 Middle East war triggered a surge in oil production? Conversely, are there risks that the revolution will not last? Moreover, how will it alter the macroeconomic effects of sharp changes in oil prices (so-called oil shocks) on the U.S. and other economies?

Triggered by high prices

The sudden takeoff in the production of oil and gas from unconventional sources in recent years is another case in which high prices and new technologies combined to turn a previously uneconomical resource into an economically viable one. The jump in oil prices in late 1973, for example, made the development of new oil resources in the Arctic (Alaska) and the North Sea economical and eventually contributed to declines in oil prices that persisted well into the 1980s. More generally, the development of new sources of supply is a normal response to a commodity price boom and has historically been one of the forces behind price declines after a boom. The technology and geology behind the revolution in the United States are the same for both fuels (see box).

The unconventional oil and gas revolution

Oil and gas have long been produced from what are now called “conventional sources”: wells are drilled into the earth’s surface, and pressure that is naturally present in the field—possibly with help from pumps—is used to bring the fuel to the surface.

Other geological structures in the United States—shale rock and tight sand formations—have long been known to contain oil and gas. But the fuels are trapped in these formations and cannot be extracted in the same way as from conventional sources. Instead, producers use a combination of horizontal drilling and hydraulic fracturing, or “fracking,” during which fluids are injected under high pressure to break up the formations and release trapped fossil fuels. Both technologies have been around for more than a half century, but until recently, using them cost more than the price of crude oil and natural gas.

This changed when prices began to rise sharply in recent years. Producers were able to profitably extract oil and gas from these formations. At the same time, improvements in horizontal drilling and fracking technologies reduced the cost of using them.

This shale revolution has been helped by factors specific to the United States. First, the rights to below-ground minerals are private and landowners can lease these rights, which made it easier for small, independent oil and gas companies willing to take the risk—and to push for improvements in the technologies. Second, a competitive natural gas market with access to distribution networks by all producers allowed shale gas producers to market their product. Larger oil and gas companies have long been more skeptical of the new resources and only recently began to invest in the technology.

The future of the unconventional revolution depends heavily on two issues: how much additional oil and gas will be economically extractable and the long-run effect on prices and markets. Whatever happens, the ride could be bumpy in the short run, as markets try to adjust.

Gauging supply potential

Production of crude oil from unconventional sources increased about fivefold in the United States between 2008 and 2012, reaching close to 1 million barrels a day by the end of 2012. On average, shale oil—or light tight oil as it is often called—was about 16 percent of total U.S. production in 2012 and accounted for almost three-fourths of the 1.3 million barrel rise in overall daily oil production in the United States over this period.

So far, much of the increase in oil production has reflected field development in the Bakken Shale, which spans the western states of North Dakota and Montana—although in 2012, production in the Eagle Ford Shale in the state of Texas also started expanding rapidly. Eagle Ford area production is expected to continue to expand, and new field development and extraction should start in other known shale rock formations. Expanding development to other formations is necessary if production is to increase further.

At this point, the ultimate oil extraction potential from shale rock and tight sand formations in the United States is uncertain. In a study commissioned by the U.S. Energy Information Administration (EIA), the total amount of technically recoverable but not yet developed shale and tight sand oil resources in the United States was estimated at 24 billion barrels, less than one year of annual global oil consumption in 2012 (U.S. EIA, 2011). But those estimates are based on 2009 data and such prognostications typically change over time. On the one hand, ultimate recovery usually is a fraction of what is technically recoverable because not all extraction is profitable—if the new supply is big enough to outstrip demand, prices could fall, further reducing the incentive to produce. On the other hand, estimates of the recoverable resources from a newly developed oil formation have often increased over time, as greater knowledge and experience permit better estimates of recovery. More recent estimates say that the amount of technically recoverable unconventional shale and tight oil resources is 33 billion barrels (U.S. EIA, 2012). Moreover, not only is the quality of the estimates a factor, so is the technology, which generally improves over time with the result that the ultimate recovery could be higher than initial estimates.

Recent medium- and long-term scenarios for U.S. oil production generally forecast that production from these new sources will increase by another 1½ to 2½ million barrels a day over the next two to three years before stabilizing at 2½ to 3½ million barrels a day. All else equal, this level of production from unconventional sources suggests that total U.S. crude oil production could reach some 8 million barrels a day—and some estimates are even more optimistic.

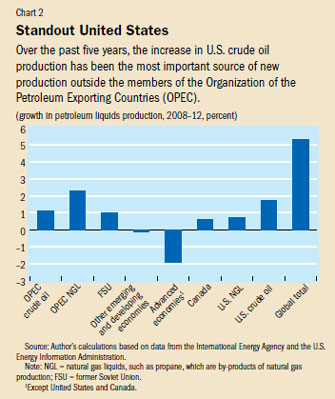

How much the new sources of oil will affect prices depends on the shift in the global supply. Oil markets are sufficiently integrated that prices adjust based on global demand and supply. Over the past five years, the increase in U.S. crude oil production has been the most important source of new production outside the 12 members of the Organization of the Petroleum Exporting Countries (OPEC—see Chart 2). But the increase is still small. In terms of current production, oil extracted from unconventional sources in the United States on average amounted to slightly more than 1 percent of the global total of about 90 million barrels a day in 2012. Had there been no change in oil demand, prices would likely have declined by more. But in the end the increased U.S. oil output roughly matched the global growth in oil consumption. Because there was little production growth elsewhere, increased U.S. oil production in the end contributed to the relative stability of oil prices in 2012.

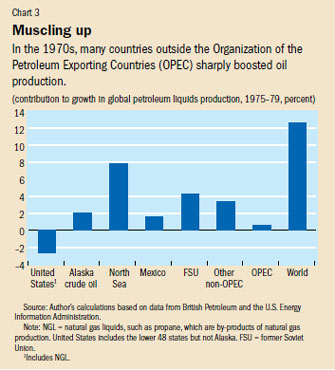

If recent scenarios of further global production growth are accurate, the new sources on their own are unlikely to change the global oil supply picture as fundamentally as supply developments in countries outside OPEC did in the 1970s. Indeed, many non-OPEC producing countries recorded strong cumulative production growth at the time (see Chart 3). That said, unconventional oil production in the United States should facilitate the expansion of the global oil supply in the near term. If the potential for rapid supply expansion elsewhere is also realized, notably in Iraq, oil market conditions could ease over the next few years. In the longer term, shale and tight oil could also be produced elsewhere because there are similar geological formations in other countries (British Petroleum, 2013), but significant exploration and development have not yet started.

Regardless of their impact on global supply and prices, the new resources are significant for the United States as an oil producer. The estimated technically recoverable resources are about 10 times current annual U.S. oil production. Even allowing for lower ultimate recovery, U.S. oil production is set to increase considerably. This is a fundamental change from the outlook not long ago, when U.S. oil production was projected to continue to decline.

More than crude oil

The global oil market implications of the unconventional oil and gas revolution in the United States go beyond the increases in crude oil production. As a result of unconventional oil and gas production, production of natural gas liquids (NGL) such as propane and butane increased about 30 percent during 2008–12. These by-products of natural gas are important, because what matters to end users is not crude oil, but usable petroleum liquids. The combined rise in crude oil and NGL production resulted in an increase in total liquids production from about 6.9 to 8.7 million barrels a day during 2008–12, a 26 percent increase.

Moreover, NGL production is likely to increase further. Current estimates suggest that the shale gas resource basis in the United States is sizable. The EIA-commissioned study also concluded that the technically recoverable amount of undeveloped shale gas resources is 750 trillion cubic feet, about 31 times total U.S. annual gas production. The ultimate recovery surely will be smaller, but largely thanks to shale gas, the estimated proved reserves of natural gas in the United States have risen rapidly in recent years, after declining in the 1970s and 1980s and stagnating in the 1990s.

U.S. natural gas markets are still adjusting to the surprise increase in shale gas production. Over the past few years, prices have fallen to levels not seen in decades, both in dollar terms and relative to other energy sources—mainly coal and crude oil.

So far, oil markets have been unaffected by the new abundance of natural gas in the United States. The main increased usage of gas has occurred in the U.S. power sector, where the share of electricity produced with natural gas has started to rise because many power plants can switch between gas and the now relatively more expensive (and dirtier) coal. But in the longer term, there is potential for other industries to switch to natural gas—even transportation, because natural gas can be used in internal combustion engines, which now rely mainly on refined petroleum products such as gasoline or diesel fuel.

If there is widespread substitution of natural gas for petroleum products, global oil markets would be affected. The price incentives are there. On an energy-equivalent basis, natural gas prices are a fraction of gasoline or diesel prices in the United States. The price incentives are reinforced by the prospective abundance of natural gas. A switch to greater use of natural gas typically involves investment, which is attractive only if natural gas prices remain relatively lower over the life of a project. Natural gas abundance potentially extends even beyond the United States. A recent study by the U.S. Geological Survey concluded that significant shale gas resources might also be available in other countries, including China and Argentina. But as with unconventional oil production in other countries, it is too early to assess whether the successes in U.S. shale gas production can be replicated elsewhere.

Could short-term market instability derail the unconventional oil revolution? In U.S. natural gas markets, recent price declines have raised the possibility that the shale gas revolution could be self-defeating if prices sink below levels needed to sustain its production. The likely situation is different in U.S. oil markets, which are part of what is in effect a global oil market. That said, integration has so far been hampered by temporary bottlenecks in the internal distribution network, which has not expanded enough to accommodate the sudden extraction of oil from the new sources. The inability to get their oil to the global market has forced producers of shale and tight oil to sell their product at prices above cost, but at steep discounts from international price benchmarks for similar grades of oil. The distribution infrastructure, however, is starting to be upgraded. Assuming that producers can overcome coordination problems and that regulatory barriers will adjust, an improved infrastructure will provide access to the seaborne international oil trade and eventually bring local prices closer to international prices. Another concern is potential environmental damage, which could hold back the expansion. So far, however, there is no conclusive evidence that the new technology leads to groundwater contamination, the main fear about the process.

Unconventional oil and the U.S. economy

The oil and gas sector will remain a significant source of investment and employment in the United States should production expand as expected. Employment in oil and gas extraction and in mining support activities almost doubled over the past decade after declining during the two previous decades. In 2012, some 570,000 employees worked in these two sectors, up from about 300,000 in early 2004. The resurgence in oil and gas will also stimulate the creation of jobs in other sectors.

Because of increased domestic production, net imports of natural gas, crude oil, and petroleum products have declined markedly from a peak of about 12.5 million barrels a day in 2005 to roughly 7.7 million in 2012. Besides higher domestic production, the decline in net imports reflects the impact of high oil prices on consumption. For natural gas, the decline in imports was relatively larger, from a peak of about 3.6 trillion cubic feet to about 1.6 trillion in 2012. In value terms, the decline in the petroleum trade deficit (which includes crude oil and petroleum products) was smaller because of the rise in world oil prices. The deficit peaked at about 2.7 percent of GDP in 2008 and is now below 2 percent. A smaller oil trade deficit should result in a lasting improvement in the overall trade and current account balances if, as expected, oil and gas production remain higher. The higher level of U.S. oil wealth could generate some pressure for an appreciation in the dollar.

The new resource base could also change the effects of oil price shocks on the U.S. economy, although how is still uncertain. It seems clear that the transfer effects of oil shocks will change. If oil prices spike, the wealth transfer from the United States to its foreign suppliers will be smaller than before because a larger share of the wealth from higher prices will accrue to domestic oil producers and U.S. residents. Conversely, though, the United States would benefit less from a price decline because domestic oil producers would take a bigger share of losses from the lower prices. The unconventional oil revolution could affect two other key factors that determine the impact of oil price shocks on economic growth and inflation—household and industrial use (Blanchard and Galí, 2009). Although households are unlikely to reduce oil consumption in the short term, in the longer term, they might substitute gas for oil—which, all else equal, would lessen the effects of oil shocks. In contrast, the share of oil as an intermediate input in production could increase if oil- and gas-intensive industries, such as petrochemical producers, relocated to the United States.

In sum, the unexpected emergence of economically viable unconventional oil and gas resources in the United States and, potentially, elsewhere could have far-reaching effects on global energy markets. Natural gas in particular is likely to become a more important source of primary energy, and its share in total consumption will likely increase substantially. Moreover, the United States is unlikely to become the large net gas importer predicted a few years ago.

The impact of shale or tight oil seems unlikely to be as far reaching. On its own, given continued growth in oil consumption, this new source will ease but not remove the oil supply constraints that have emerged since the mid-2000s, and it is unlikely to exert strong downward pressure on prices. But the shale revolution highlights the reality that price incentives and technological change can trigger important supply responses in the oil and gas sector and that supply constraints can change over time. The full potential of the new resources at the global level is still unknown. Exploration and development outside the United States are only beginning. ■

References

Blanchard, Olivier J., and Jordi Galí, 2009, “The Macroeconomic Effects of Oil Price Shocks: Why Are the 2000s So Different from the 1970s?” in International Dimensions of Monetary Policy, ed. by Jordi Galí and Mark Gertler (Chicago: University of Chicago Press).

British Petroleum, 2013, Energy Outlook 2030 (London).

U.S. Energy Information Administration (U.S. EIA), 2011, Review of Emerging Resources: U.S. Shale Gas and Shale Oil Plays (Washington).

———, 2012, Annual Energy Outlook 2012 (Washington).