Banks on the Treadmill

Finance & Development, June 2013, Vol. 50, No. 2

Hiroko Oura and Liliana Schumacher

Stress tests assess banks’ strength by simulating their performance in extreme economic scenarios

A visit to a cardiologist often includes a stress test. Monitoring routine activities is not enough to determine a patient’s health; the doctor makes the patient walk or run on a treadmill or pedal a stationary bike until he or she is out of breath, because some heart problems are easier to diagnose when the heart is working harder and beating faster. The patient may not have any signs or symptoms of disease when at rest, but the heart has to work harder during exercise and therefore requires more blood and oxygen. If the heart indicates that it is not getting enough blood or oxygen, then this can help the doctor identify potential problems.

Something similar occurs when economists conduct stress tests on banks, which are key to the functioning of the economy. The goal of the tests is to find and fix any banks with problems, to reduce the chance of a banking crisis. A banking crisis—when several banks become insolvent or are unable to make payments on time—disrupts the economy by limiting access to long-term loans or liquidity needed for production and distribution of goods and services. This, in turn, affects growth, employment, and—in the end—people’s livelihoods.

To minimize the risk of a disruptive banking crisis, bank vulnerabilities need to be found while there is still time to correct them. But, as in the case of the human heart, vulnerabilities of financial institutions may not be visible by just looking at past performance when the economy is running smoothly and there are no overwhelming problems. To assess banks’ health properly, stress tests perform hypothetical exercises to measure the performance of banks under extreme macroeconomic and financial scenarios—such as a severe recession or a drying up of funding markets.

Stress tests typically evaluate two aspects of a bank’s condition, solvency and liquidity, because problems with either could cause high losses and eventually a banking crisis.

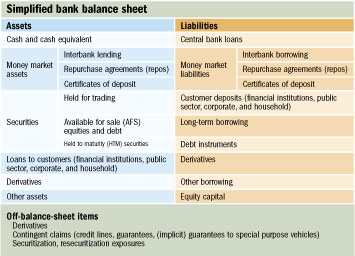

Solvency is measured by the difference between an institution’s assets and its debt. If the value of an institution’s assets exceeds its debt, the institution is solvent—that is, it has positive equity capital (see table). But the ongoing value of both assets and liabilities depends on future cash flows, which, in turn, depend on future economic and financial conditions. For an institution to be solvent, it has to maintain a minimum amount of positive equity capital that can absorb losses in the event of a shock, such as a recession, that causes customers to fall behind on loan repayment. And capital even beyond this minimum might be needed to ensure the continued confidence of the bank’s funding sources (such as depositors or wholesale investors) and access to funding at a reasonable cost.

A solvency stress test assesses whether the firm has sufficient capital to remain solvent in a hypothetically challenging macroeconomic and financial environment. It estimates the bank’s profit, losses, and changes in the value of the bank’s assets under the adverse scenario. Typical risk factors are potential losses from borrowers’ default (credit risk); losses from securities due to changes in market prices, such as interest rates, exchange rates, and equity prices (market risk); and higher funding costs due to lack of investor confidence in the quality of a bank’s assets (liquidity risk).

Solvency is measured by various capital ratios, typically based on regulatory requirements. Individual institutions or the system as a whole is said to pass or fail the test depending on whether the capital ratio remains above a predetermined threshold, called the hurdle rate, during the stress scenario. Hurdle rates are often set at the current minimum regulatory requirement, but they can be set at different values if circumstances warrant. (For example, the hurdle rate might be the minimum capital required for a bank to keep its current credit rating and maintain access to funding; this is called the market-based hurdle rate.)

A liquidity stress test assesses whether an institution can make its payments on time during adverse market conditions by using cash, selling liquid assets, or refinancing its obligations. Adverse market conditions are characterized by the inability to sell liquid assets at a reasonable price and speed (market liquidity problems) or failure to refinance obligations or obtain additional funding (funding liquidity). The ability to quickly pledge assets as collateral is often critical to a bank’s ability to remain liquid in times of stress. Financial intermediaries, particularly banks, have, by the nature of their business, a maturity mismatch in their balance sheet. Most of their liabilities, such as deposits or borrowing from money markets, are much shorter term than the assets, such as loans, that a bank finances with those liabilities. If a large amount of deposits is withdrawn or not renewed suddenly or if a bank finds it impossible to obtain money in wholesale funding markets, the bank might face a liquidity shortage even if it is otherwise solvent. A consumer who has a house worth, say, $200,000 but little cash would be in a similar situation if presented with a big bill that had to be paid promptly.

Liquidity and solvency stress events are often closely related and hard to disentangle. A liquidity shortage, for example, may turn into a solvency problem if assets cannot be sold or can be sold only at a loss—called a fire sale, perhaps reducing the value of assets below that of liabilities. Higher funding costs during a liquidity stress event could translate into solvency stress by raising the cost of liabilities. In turn, market perceptions of solvency problems may create a liquidity shortage because depositors or investors lose confidence or demand higher interest rates from the bank.

A key aspect of stress testing is to assess whether solvency or liquidity problems at one institution could end up causing a systemwide banking crisis. This is determined by assessing which institutions are systemically important (that is, those whose failure or liquidity shortage would cause problems in many other institutions) and by replicating the channels of risk transmission as part of the stress testing exercise. The latter is a particularly complex task on which further research is ongoing and needed.

Looking back

The IMF started to use stress tests as a surveillance tool in 1999. But stress tests were little known among the general public until the global financial crisis, when they were used to restore market confidence. Banks began to use stress tests in the mid-1990s as an internal risk management tool, though it is now a more overarching risk assessment tool.

One of the early adopters was JPMorgan Chase & Co., which used value at risk (VaR) to measure market risk. VaR measured potential daily changes in the value of a portfolio of securities in the event of a rare and negative shock to asset prices that could occur in only 1 percent (or less) of all possible scenarios. These early stress tests covered limited risk factors and exposures and were not well integrated with firms overall risk management and business and capital planning.

Over the past two decades, many country authorities have started using macroprudential stress tests, which analyze systemwide risks in addition to institution-specific risks (which was the sole purpose of VaR). The results are often reported in countries’ Financial Stability Assessment Reports. The IMF has also regularly included macroprudential stress testing as part of its Financial Sector Assessment Programs since they began in 1999.

The global financial crisis drew public attention to stress tests on financial institutions. They had a mixed reception. On the one hand, stress tests were criticized for missing many of the vulnerabilities that led to the crisis. On the other hand, after the onset of the crisis, they were given a new role as crisis management tools to guide bank recapitalization and help restore confidence.

Crisis management stress tests allowed countries to assess whether key financial institutions needed additional capital, possibly from public funds. In particular, the U.S. Supervisory Capital Assessment Program exercise and the exercises organized by the Committee for European Banking Supervisors and by the European Banking Authority in 2010 and 2011 attracted attention because they used stress tests to determine whether banks needed to recapitalize, and the detailed methodology and individual banks’ results were published to restore public confidence in the financial system.

Best practices

Current stress testing practices are not based on a systematic and comprehensive set of principles but have emerged from trial and error and often reflect limitations in human, technical, and data capabilities. To improve the implementation of stress tests, the IMF recently proposed seven “best practice” principles for stress testing (see box) and has provided operational guidance on how to implement them. These guidelines can be used by IMF staff or by financial stability authorities around the world.

Stress testing principles proposed by the IMF

Principle 1 Define appropriately the institutional perimeter for the tests.

Principle 2 Identify all relevant channels of risk propagation.

Principle 3 Include all material risks and buffers.

Principle 4 Make use of the investor’s viewpoint in the design of stress tests.

Principle 5 When communicating stress test results, speak smarter, not louder.

Principle 6 Focus on tail risks.

Principle 7 Beware the black swan.

The first three principles highlight the importance of acquiring a good knowledge of the risks, business models, and channels of risk propagation faced by the institution or system under review before beginning the stress tests. They require inclusion in the stress test exercises of all institutions whose failure could significantly harm the economy (so-called systemically important financial institutions) and replication of the potential spillovers and feedback mechanisms that can aggravate an initial shock. Replication is achieved by using economic models that simulate the interaction among different risk factors (such as credit, foreign exchange, or liquidity risks) or among different banks.

Principle 4 underlines the importance of complementing stress test design with features reflecting market requirements as well as the traditional regulatory requirements. This principle acknowledges the increasing market discipline banks face with increasing reliance on wholesale funding sources (that is, lenders other than depositors that are not covered by deposit insurance and that typically lend in large denominations). In the past decade, many international banks started to rely more on uninsured short-term wholesale funding and less on insured deposits.

During the recent crisis, these lenders—concerned about asset values and uncertain about banks’ holdings and valuation practices—triggered liquidity shocks because they were reluctant to lend, which, in turn, caused major bank distress. But the liquidity problem was caused by lender worries about solvency. Delays in recognizing lenders’ concerns along with political difficulties in finding solutions to address them made the crisis longer and deeper.

The operational implication of Principle 4 is that market views should be used to complement stress tests based on regulatory and accounting standards. There are several ways to do this. One is the use of hurdle, or passing, rates based on targeted funding costs. Hurdle rates based on regulatory ratios reflect what regulators consider an adequate solvency ratio, but market assessment of a bank’s solvency may be different. In a world where markets are able to impose discipline on banks by refusing to fund them, markets may demand—and banks have an incentive to target—capital ratios that enable them to attain a certain risk rating or to keep their funding costs under a particular ceiling.

The potential impact of market behavior on financial institutions’ health is also key to understanding Principle 5: smart publication of stress tests. “Smart” means stress tests that are candid assessments of risk and explicit about the coverage and limitations, and results that are announced along with measures that convincingly address any vulnerabilities unveiled by the stress tests—including, but not necessarily limited to, capital injections. In this way, publishing stress test results can alleviate problems of incomplete information during periods of uncertainty and restore market confidence. Even in the case of stress tests undertaken for surveillance purposes during noncrisis periods, communication of their results can raise awareness of risks, promote more realistic risk pricing, and enhance market discipline during good times—which, in turn, should stave off future sudden reversals of investors’ mood.

Principle 6 is technical: it recommends the stress tester use statistical and econometric techniques specifically suited to identifying extreme scenarios, which are typically characterized by many risks materializing at the same time.

No matter how refined the analytical model, how severe the shocks incorporated in stress tests, and how careful a communications strategy, there is always the risk that the “unthinkable” will materialize, as Principle 7 cautions. The stress tester must always keep in mind the risk of a “black swan”—that is, a highly unlikely outcome.

While improvements in stress test design are welcome and encouraged, stress testing is only one of many tools to assess key risks and vulnerabilities in financial institutions or entire systems. Stress tests attempt to identify possible future developments. No matter how much a tester tries, stress tests always have margins of error. Their results will almost always turn out to be optimistic or pessimistic. And there will always be model risk (that the model doesn’t capture key features of the underlying reality), imperfect data access, or underestimation of the severity of the shock.

Because stress test results are outcomes that will not always happen as predicted, they should be used with other tools that can also provide information about potential threats to financial stability. These tools include qualitative and quantitative bank risk analysis, early warning indicators, models of debt sustainability, and informed dialogue with supervisors and market participants. Conclusions about the resilience of an institution or system should draw on all these sources and not just on stress tests.

Just as a stress test in the cardiologist’s office is one of many tools used to assess a patient’s health, stress tests of banks are but one important input to help authorities diagnose and prevent a potential financial crisis. ■