Closer to Home

Finance & Development, September 2013, Vol. 50, No. 3

Hideaki Hirata, M. Ayhan Kose, and Christopher Otrok

Despite all the talk of globalization, business cycles seem to be becoming more regional

The inexorable forces of globalization and regionalization have reshaped the world economic landscape over the past quarter century. While international trade flows have been growing at a much faster rate than global output, trade flows within regions of countries have been playing an even more prominent role in world trade. Economic linkages within regions have also become much stronger with the proliferation of regional trade agreements. Moreover, while the volume of global financial flows has reached unprecedented levels since the mid-1980s, overshadowing the increase in global trade over the same period, financial flows within regions have also been on the rise for the past 15 years, especially in Europe and Asia.

These developments appear to have affected the evolution of global and regional business cycles in unexpected ways. For example, despite the presence of strong global trade and financial linkages, there has been significant variation in growth performance across different regions since the 2008–09 financial crisis (Kose and Prasad, 2010). Some regions—such as Asia, Latin America, the Middle East and North Africa, and sub-Saharan Africa—exhibited surprising resilience during the worst of the financial crisis and rapidly returned to growth, whereas others—mainly North America and Europe—experienced deep and prolonged contractions that were followed by sluggish recoveries or double-dip recessions.

This behavior has raised the question of whether regional factors have become more important in driving business cycles in an era of globalization. On the one hand, globalization of trade and finance is expected to translate into stronger linkages across national business cycles and eventually lead to a situation in which business cycles move together simultaneously across the world. On the other hand, if the effects of regional linkages are stronger than those of global linkages and regionwide shocks—that is, unexpected events affecting an entire region—influence activity more than global ones, then one would expect business cycles to be increasingly regional.

Economic theory is unable to provide definitive guidance concerning the impact of increased international trade and financial linkages on the degree of synchronization of global and regional cycles. As a result, we turn to a novel empirical approach that has the potential to provide a comprehensive perspective on the importance of global and regional business cycles (Hirata, Kose, and Otrok, forthcoming).

Specifically, we employed a newly developed methodology to study the roles played by global and regional factors in driving national business cycles. We end up with the surprising conclusion that regional, rather than global, factors play an increasingly prominent role in explaining national business cycles.

Studying regional cycles

The methodology allowed us to consider fluctuations in three major macroeconomic variables for each country: output, consumption, and investment. It is critical to isolate business cycle fluctuations that are accounted for by regional factors (for example, common regional cyclical movements due to regional trade and financial linkages, regional shocks, and regionwide policies) or by global factors (that are worldwide cyclical movements due to global linkages or worldwide shocks). Our methodology separates out the factors driving national business cycles into global, regional, and country-specific factors. The global factor represents fluctuations that are common to all countries and to all three variables in each country. The regional factor captures fluctuations that are common to a particular region of countries. The country-specific factor accounts for the fluctuations that are common across all three variables in a given country.

We used this methodology on a data set that contains 106 countries and covers the period 1960–2010. We divided our sample of countries into seven regions (see table): North America, Europe, Oceania, Asia, Latin America and the Caribbean, Middle East and North Africa, and sub-Saharan Africa. The groupings of countries by region are especially useful in identifying the regional factors, because countries that are geographically close to one another tend to have stronger economic linkages and, therefore, are likely to be affected by similar types of (region-specific) shocks. The relatively long time span of the data enabled us to consider distinct subperiods and to analyze the changes in business cycles that took place during the recent era of globalization (1985–2010) relative to the earlier period.

Sources of business cycles

We first explored the relative importance of different factors for business cycle fluctuations over the period 1960–2010. Rather than showing the results separately for each country, we show the averages for each region or, when we looked at a specific variable, the average across all countries for that variable.

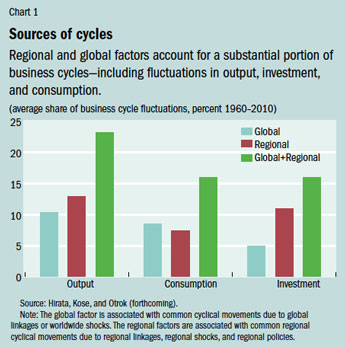

The common factors—the global factor and the respective region-specific factors—account for a significant share of business cycle fluctuations (see Chart 1). Together, on average, they account for about 25 percent of output fluctuations. The global factor, on average, accounts for 10 percent of output growth variation among all countries in the sample, while the regional factor, on average, plays a slightly more important role than the global factor. The global and regional factors also explain roughly 15 percent of the volatility in the growth rates of consumption and investment.

To examine how global and regional cycles have evolved, we divided our sample into two periods: 1960–84 and 1985–2010. There are roughly equal numbers of observations in each period, but there was a substantial increase in global trade and financial flows in the latter period. In addition, regional linkages became much stronger during the second period—as evidenced by the rapid increase in the number of regional trade agreements (from 5 in 1985 to more than 200 in 2010). The beginning of the second period also coincides with a structural decline in the volatility of business cycles in both advanced and developing economies (the so-called Great Moderation era) that lasted until the financial crisis of 2008–09.

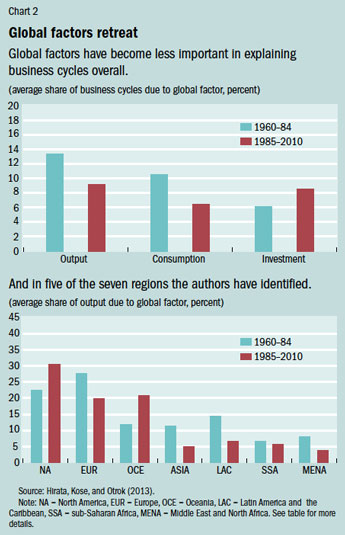

The average contribution of the global factor to output fluctuations declined sizably in the second period—from 13 percent to 9 percent for the full sample of countries. The same pattern held for consumption fluctuations, while the importance of the global factor’s role in explaining fluctuations in investment slightly increased (see Chart 2, top panel). These patterns also held up and were, in fact, stronger in most cases when we evaluated the contributions of different factors in explaining business cycles in different regions (see Chart 2, bottom panel). The global factor appeared to play a smaller role in explaining business cycles in the second period in five out of seven regions.

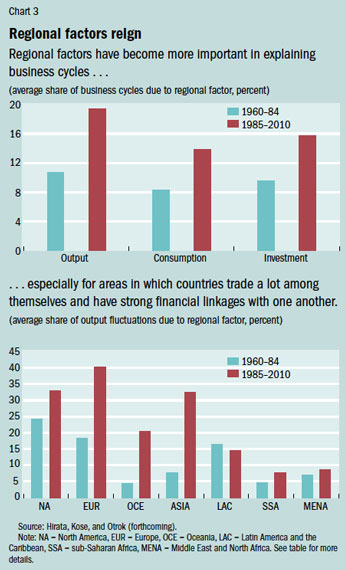

In contrast to the global factor, the regional factor, on average, played an increasingly important role in explaining business cycles over time (see Chart 3, top panel). For example, in the earlier period the regional factor accounted for about 11 percent of output fluctuations and rose to about 19 percent during the second period. This result was more pronounced in North America, Europe, Oceania, and Asia (see Chart 3, bottom panel). In particular, in the second period, the regional factor accounted for roughly one-third of output fluctuations in North America and Asia, 40 percent in Europe, and 20 percent in Oceania. The regional factor also played a more important role in the second period for the sub-Saharan Africa and Middle East and North Africa regions, but the increase in the fluctuation attributed to the regional factor is much smaller.

Have the global and regional factors together become more important? A useful measure of the extent of business cycle synchronization around the world is the combined contributions of the global and region-specific factors to business cycles. The overall importance of these two common factors in explaining output variation increased only slightly. However, even this small change was the consequence of a substantial increase in the relative importance of the regional factor. These findings imply that the level at which business cycles occurred simultaneously has shifted from the global to the regional level.

We conducted a wide range of experiments to check the sensitivity of our results. First, we arrived at very similar conclusions with respect to business cycles in consumption and investment. Second, we analyzed the sensitivity of our results to make sure that they were not driven by episodes of crises (such as the 1997 Asian financial crisis or the 2008–09 global financial crisis) that could temporarily amplify the roles played by different types of factors. We also experimented with alternative break points for the two periods of the sample. In addition, we checked individual country results to ensure that the averages we presented also reflected the sources of business cycle variation at the country level.

The evolution of cycles

To explain the results, we looked at the changes in the roles played by both global and regional factors.

First, there has been, on average, a decline in the importance of the global factor. This change supports the interpretation that the strong business cycle synchronization observed during the 1970s and early 1980s reflected large common disturbances—the two oil price shocks—and the effects of correlated disturbances in the major advanced economies, notably the disinflationary monetary policy stance of the early 1980s.

Although the latest financial crisis was also a massive global shock, its full impact on the contribution of the global factor has probably yet to be fully realized—we have only three years of observations associated with the crisis. However, when we extended our sample to 2015 using forecast values of the three macroeconomic variables, we ended up with similar conclusions that supported our key findings. We also checked the sensitivity of our findings by considering a sample that ended in 2007. Those results were also in line with our key findings.

Second, there has been, on average, an increase in the importance of regional factors in explaining business cycles in the latter period. This is an intuitively appealing finding because regional linkages have become much more significant in areas in which intraregional trade and financial flows have increased substantially since the mid-1980s: North America, Europe, Oceania, and Asia.

These regions took substantial steps to strengthen intraregional economic linkages during the second period. For example, intraregional trade and financial linkages grew significantly over the past quarter century in North America, where the process of economic integration started in the mid-1980s and culminated with the ratification of the North American Free Trade Agreement (NAFTA) in 1994. During the past decade, intraregional trade flows accounted, on average, for nearly 55 percent of total trade, while intraregional financial assets were about 20 percent of total assets in the North American region.

One of the greatest regional integration projects of history, of course, took place in Europe, with the eventual establishment of the European Union and the creation of the euro area. Intraregional trade flows constituted roughly 75 percent of total trade in Europe during the past decade. Intraregional asset holdings rose from 55 percent to roughly 75 percent of total assets over the same period.

Regional integration in Asia has been driven largely by the Association of South East Asian Nations but has also been complemented by a number of bilateral regional arrangements. The region has seen a rapid increase in intraregional trade and financial flows, especially over the past decade. For instance, the share of intraregional trade flows has been about 55 percent over the past decade.

The nature of trade has also changed in these four regions. One of the major driving forces of the rapid growth in regional trade flows has been the acceleration of trade within industries, which often makes business cycles more synchronized. During the second period, countries in these regions also increased the pace of diversification of their industrial and trade bases. This facilitated an increase in the degree of sectoral similarity across countries within regions, further contributing to the convergence of business cycles.

Regional business cycles can occur because of correlated shocks—such as those associated with the implementation of similar policies, or cross-border spillovers of shocks that originate in a large economy. It is easy to see how these types of shocks and spillovers have been influential in some of the regions that have experienced more pronounced regional cycles. For example, the implementation of similar policies has contributed greatly to the convergence of national cycles in Europe since 1985. Cross-border spillovers originating in the United States and China have probably been important in explaining regional cycles in North America and Asia, respectively.

Regionalization rises

Our results indicate that regional business cycles have increasingly become more pronounced, especially in those regions where intraregional trade and financial linkages have registered rapid growth since the mid-1980s. Surprisingly, the importance of the global factor has declined over time.

These results present a different interpretation of the impact of globalization on the degree of synchronization of business cycles. Most commentators argue that the globalization of trade and finance has led to the globalization of business cycles. We find to the contrary that regional factors have become increasingly more important as the driving forces of business cycles during the recent era of globalization—leading to the emergence of regional business cycles.

The number of regional arrangements with the objective of greater trade and financial integration is likely to increase in the coming years. These arrangements can generate economic benefits, but, as recent developments in Europe have clearly demonstrated, regionwide policies can also have serious consequences for growth and stability at the country level. These developments, along with the emergence of regional business cycles we documented here, call for a better understanding of the design and implications of regional policies. ■

Hideaki Hirata is a Professor of Business Administration at Hosei University and a Visiting Scholar at Harvard University. M. Ayhan Kose is Assistant to the Director in the IMF’s Research Department. Christopher Otrok is the Sam B. Cook Professor of Economics at the University of Missouri and a Research Fellow at the Federal Reserve Bank of St. Louis.

References

Hirata, Hideaki, M. Ayhan Kose, and Christopher Otrok, forthcoming, “Regionalization vs. Globalization,” in Global Interdependence, Decoupling, and Recoupling, ed. by Yin-Wong Cheung and Frank Westermann (Cambridge, Massachusetts: MIT Press—also published as IMF Working Paper 13/19).

Kose, M. Ayhan, and Eswar S. Prasad, 2010, Emerging Markets: Resilience and Growth amid Global Turmoil (Washington: Brookings Institution Press).