Not Your Father's Service Sector

Finance & Development, June 2014, Vol. 51, No. 2

Prakash Loungani and Saurabh Mishra

Services are gaining newfound respect as the basis of modern global trade

In 1988, General Motors launched an ad campaign with a memorable jingle: “This is not your father’s Oldsmobile. This is the new generation of Olds.” The car’s image had not kept up with its transformation from a staid cruiser to something far more high-tech and stylish. The service sector could use such an ad campaign: it too needs an image makeover to match its transformation over the past decade. The Oldsmobile didn’t make it, but the service sector is here to stay—it already accounts for 60 percent of global employment.

Prejudice against the service sector runs deep. Some regard it as the useless sibling of other sectors of the economy such as agriculture and manufacturing. In The Wealth of Nations, Adam Smith questioned the social value provided by “churchmen, lawyers, physicians, men of letters of all kinds, players, buffoons, musicians, opera-singers, opera-dancers, etc.” To this day, as economist Christina Romer lamented in a New York Times op-ed, there is a “feeling that it is better to produce ‘real things’ than services” (Romer, 2012).

Others have treated services not as socially useless but as somewhat challenged. A famous 1967 paper by U.S. economist William Baumol fostered the view that services is a sector resistant to improvements in productivity. He noted that the provision of services—such as restaurant meals, haircuts, and medical checkups—required face-to-face transactions. These did not lend themselves easily to standardization and trade, the source of growth in productivity and hence income.

This image is no longer a fair representation of the service sector. Service occupations today include a few that even Smith might have considered useful. Trade in services has increased within and across national borders. Many services are now high tech and pay high wages. And increasingly, manufacturing and services, far from being competing siblings, are part of a joint family of value creation. Services are ever more critical to the successful operation of manufacturing, debunking debate over countries’ need to choose between the two sectors.

Tradable and techy

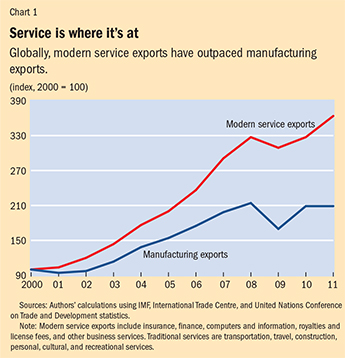

A haircut still means a trip to the local barbershop. But many other services no longer require the provider to be close to the customer. People no longer have to go to the local bank to have access to their money: financial services are global. Many consulting services, such as architectural designs, can be delivered from anywhere. And while most medical care still requires a trip to the doctor, the provision of medical services—including in some cases surgery—from remote locations is increasing. Evidence of this transformation lies in the growing share of the service sector in global exports. Globally, the growth in exports of modern services outpaced manufacturing exports over the past decade (see Chart 1).

The main reason for the increased tradability of services is the revolution in information and communication technologies. Rapidly declining telecommunication costs, increasing Internet adoption around the world, and rapid proliferation of broadband Internet services have made arm’s length delivery of services possible within and across borders. Using telecommunication networks, service products can be transported almost instantly over long distances. The range of service activities that can be digitized and globalized is expanding, from the processing of insurance claims and tax payments to the transcription of medical records to the provision of education via online courses.

Technology and increasing trade have in turn combined to improve productivity in services, albeit not as much as in the manufacturing sector (Summers, 2013). More and more services can now be unbundled: a single service activity can be divided up into tasks done at different geographic locations. Smith famously described how the productivity of a pin factory was boosted if, instead of one worker doing all the tasks involved in making a pin, a number of workers each specialized in particular tasks and then exchanged the fruits of their labor. A similar process of specialization and exchange is under way in many service industries. As with goods, services productivity can rise because of specialization (a finer division of labor) and scale (falling unit costs of production).

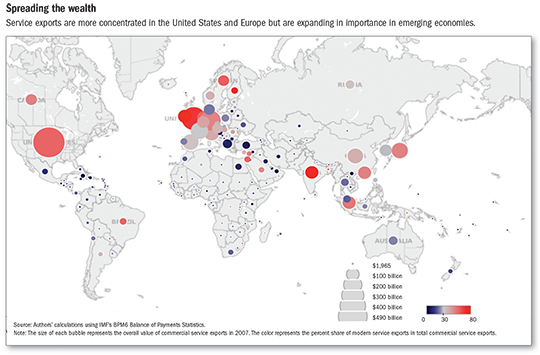

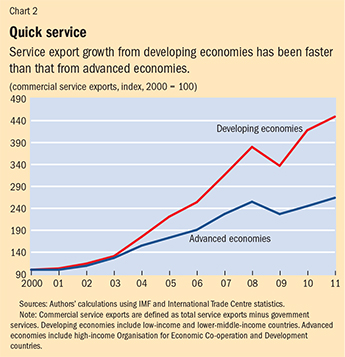

The unbundling of services has opened up niches that can be exploited by developing economies (the term is used in this article to refer to both emerging markets and low-income countries) as well as advanced economies (see map). Though measuring services trade is difficult, it appears that developing economies’ share in world service exports increased from about 14 percent in 1990 to 25 percent in 2011. And even though it is measured from a much lower base, service export growth has exceeded that from advanced economies (see Chart 2).

Recent studies have shown that middle-income countries are starting to export services that have typically been exported by advanced economies. Moreover, this increased service sector sophistication is positively related to developing economy growth, after controlling for other standard determinants of growth. Causality is always difficult to establish, but the results suggest a new channel of growth for developing economies, particularly middle-income economies such as Malaysia (Mishra, Lundstrom, and Anand, 2011; Anand, Mishra, and Spatafora, 2012).

At your service

Traditional economic theories of structural transformation—developed by noted authors such as Nicholas Kaldor, Ragnar Nurkse, and Arthur Lewis—have viewed industrialization as the prime engine of jobs and growth. The push for manufacturing-led growth continues to this day (see, for example, Lin, 2011; and Rodrik, 2011). But the growing interdependence of the manufacturing and service sectors could soon put an end to debate about choosing one sector over the other.

A long-standing truism in California’s Silicon Valley is that “70 percent of hardware is software”—early recognition of the link between sales of computers and software services. It is a phenomenon that now extends beyond the computer industry. Services have become the glue that binds many manufacturing supply chains. The success of many chains depends on an underpinning of services, from research and development at the inception of the product to distribution and repair at completion.

Recognizing this interdependence, companies are shifting from “selling products to selling an integrated combination of products and services that deliver value,” a development that the academic literature refers to as the “servitization of manufacturing” (Baines, Lightfoot, and Smart, 2011). Neither the term nor the practice of manufacturing companies selling services is new. What is new is the magnitude of the practice—and its prevalence in both advanced and emerging market companies—and a change in attitude among managers from viewing services as a necessary evil to seeing them as an essential feature that helps deliver what the customer desires. Companies are more open today to the incorporation of products and services from other vendors if it helps them establish and maintain a relationship with their customers.

Examples abound. An obvious one is FedEx, which through reliable delivery and a tracking system assures companies that products will make it to customers. Less of a household name but just as well known in the business world is Rockwell Automation, which specializes in the maintenance and repair of automation products for virtually every major industry. A more pedestrian example is Zappos, an “online shopping utopia” that has allowed shoe producers to transform shoe shopping from dealing with “salesmen (they are usually men—one doesn’t like to think too closely about why) staggering under stacks of boxes” to a transaction in “the comfort and privacy of customers’ living rooms” (Jacobs, 2009).

Service with a smile

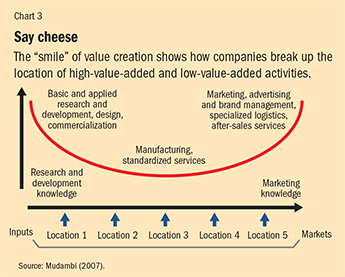

While some companies hold on to one component of the supply chain and outsource all others, many are embracing a vertical integration strategy in which they control multiple parts of the value chain. Activities within a firm’s value chain are generally grouped into three categories: the upstream end comprises design, basic and applied research, and the commercialization of creative endeavors; activities in the middle comprise manufacturing and standardized service delivery; and activities at the downstream end consist of marketing, brand management, and after-sales services.

Management guru Ram Mudambi has drawn attention to the fact that many “firms combine the comparative advantages of geographic locations with their own resources and competencies to maximize their competitive advantage” (Mudambi, 2008). A common pattern is the “smile” of value creation in which companies break up the location of high value–added and low value–added activities (see Chart 3). An early and prominent—though also controversial—example is the geographic location of Nike’s value chain; the parent company in the U.S. state Oregon concentrates on design and marketing while closely coordinating production through an offshore network of low-cost suppliers. An ad campaign could not save Oldsmobile, but General Motors has kept its Pontiac LeMans alive by placing design and marketing in advanced economies and assembly in emerging market economies.

The good news is that locating high value–added operations in advanced economies and relegating low value–added activities to developing economies is starting to change (Mudambi, 2007, 2008). Firms—particularly those in mature emerging market economies—are beginning to catch up when it comes to some high value–added activities. And advanced market firms are stripping out the more standardized portions of their high value–added activities and relocating them to emerging market economies. Witness mushrooming business consulting and knowledge-processing offices and the boom in e-commerce and online retailers in emerging markets across the Middle East, Brazil, China, India, and Singapore.

Happy together?

To reap the benefits of these trends, even developing economies where manufacturing still looms large must develop state-of-the-art services. Such services are needed for manufacturing firms to connect to global value chains and develop competitiveness in more skill-intensive activities along the value chain. Some countries may be able to use their comparative advantage in labor costs to become exporters of some intermediate or final service products. In others, services may pose lower barriers to entry than capital-intensive industries or offer an easier route to employment for women than other available options. Countries such as Malaysia could take advantage of the globalization of services to escape a potential middle-income trap (Flaaen, Ghani, and Mishra, 2013).

The good news is that the spread of the service sector—and of service exports—in developing economies has outstripped the oft-cited example of information technology growth in India. Think of the mobile revolution that has transformed financial services in many countries in Africa, the Nigerian film industry, game design in Cambodia, accounting services in Sri Lanka, and human resources–processing firms in Abu Dhabi.

Narratives of structural transformation often pit manufacturing versus services and advanced versus developing economies. While such forces of conflict surely exist, the story may be changing: the transformation of the service sector offers hope, at least in some cases, of amicable coexistence. ■

Prakash Loungani is an Advisor and Saurabh Mishra is a Research Officer, both in the IMF’s Research Department.

References

Anand, Rahul, Saurabh Mishra, and Nikola Spatafora, 2012, “Structural Transformation and the Sophistication of Production,” IMF Working Paper 12/159 (Washington: International Monetary Fund).

Baines, Tim, Howard Lightfoot, and Palie Smart, 2011, “Servitization within Manufacturing: Exploring the Provision of Advanced Services and Their Impact on Vertical Integration,” Journal of Manufacturing Technology Management, Vol. 22, No. 7, pp. 947–54.

Baumol, William, 1967, “Macroeconomics of Unbalanced Growth: The Anatomy of Urban Crisis,” The American Economic Review, Vol. 57, No. 3, pp. 415–26.

Flaaen, Aaron, Ejaz Ghani, and Saurabh Mishra, 2013, “How to Avoid Middle-Income Traps? Evidence from Malaysia,” World Bank Policy Research Paper 6427 (Washington).

Jacobs, Alexandra, 2009, “Happy Feet: Inside the Online Shoe Utopia,” The New Yorker, September 14.

Lin, Justin, 2011, “New Structural Economics: A Framework for Rethinking Development,” World Bank Research Observer, Vol. 26, No. 2, pp. 193–221.

Mishra, Saurabh, Susanna Lundstrom, and Rahul Anand, 2011, “Service Export Sophistication and Economic Growth,” World Bank Policy Research Working Paper 5606 (Washington).

Mudambi, Ram, 2007, “Offshoring: Economic Geography and the Multinational Firm,” Journal of International Business Studies, Vol. 38, pp. 206–10.

———, 2008, “Location, Control and Innovation in Knowledge-Intensive Industries,” Journal of Economic Geography, Vol. 8, No. 5, pp. 699–725.

Rodrik, Dani, 2011, “The Manufacturing Imperative,” Project Syndicate, August 10.

Romer, Christina, 2012, “Do Manufacturers Need Special Treatment?” The New York Times, February 4.

Summers, Lawrence, 2013, “Economic Possibilities for Our Children,” NBER Reporter, No. 4.