Measure to Measure

Finance & Development, September 2014, Vol. 51, No. 3

![]() Fighting fires: why the IMF lends

Fighting fires: why the IMF lends

The international monetary system has changed dramatically over the past seven decades, and the IMF has adapted accordingly.

When the delegates of 44 nations gathered 70 years ago for the United Nations Monetary and Financial Conference at Bretton Woods, New Hampshire, their purpose was to design a new international monetary system that would bring order to the interwar economic chaos—the hyperinflations and painful deflations of the 1920s, the collapse of the gold standard, and the Great Depression in the 1930s.

The challenge confronting these monetary and financial experts was to come up with a system that would let countries adjust their external imbalances without resorting to the self-defeating competitive devaluations and restrictive trade policies of the interwar period. The burden of adjustment between countries in surplus and those in deficit had to be equitable, and sufficient global liquidity was needed to foster growth of world trade and incomes. Building on extensive preparatory work (mainly by John Maynard Keynes of the British Treasury and Harry Dexter White of the U.S. Treasury), the delegates accomplished the extraordinary feat of agreeing on the postwar monetary order in just three weeks. In closing the conference, U.S. Treasury Secretary Henry Morgenthau, Jr., remarked that, while the conference proceedings may seem mysterious to the general public, the new order lay at the heart of “bread and butter realities of daily life.” What was achieved at Bretton Woods, he said, was “the initial step through which the nations of the world will be able to help one another in economic development to their mutual advantage and for the enrichment of all.”

The linchpin of the new order—dubbed the Bretton Woods system—was a configuration of fixed but adjustable parities for currencies against the U.S. dollar, whose value would be fixed in terms of gold. The IMF was founded to help manage the system. Its Articles of Agreement, negotiated at the conference (where many countries provided valuable input), inevitably reflected the relative bargaining powers of the main protagonists. The United States, which expected to be the main surplus nation for the foreseeable future, opposed Keynes’s call for an “international clearing union.” This union would have penalized large-surplus and large-deficit countries symmetrically and, since it was based on an artificial unit of account called the “bancor,” could have been used to regulate global liquidity. But the new order at least restrained countries seeking to gain an unfair trade advantage. Devaluation was allowed only in cases of “fundamental disequilibrium,” while countries facing temporary shortfalls in their balance of payments were expected to maintain the parity, with borrowing from the IMF (“purchases” in IMF parlance) available to tide them over.

Down to—and nearly out of—business

The IMF formally debuted in December 1945 with 30 members as countries passed the necessary domestic legislation. The number was up to 40 by the time operations started March 1, 1947, and thereafter membership grew in spurts, starting with the war-torn European countries and former Axis belligerents, then many newly independent developing economies, and finally, in the 1990s, the republics of the former Soviet Union and the countries in central and eastern Europe.

By the mid-1960s, strains began to appear in the Bretton Woods system as persistent U.S. balance of payments deficits turned the postwar dollar shortage into a dollar glut. With the dollar fixed against gold, the main problem from the U.S. perspective was getting surplus countries (at the time, mainly Germany and Japan) to adjust. For the rest of the world, the dilemma was that U.S. deficits were the system’s source of liquidity, but mounting dollars in foreign central bank coffers undermined confidence in the U.S. ability to back those dollars with gold.

The IMF’s solution was the Special Drawing Right (SDR)—an artificial reserve asset (somewhat akin to Keynes’s bancor) that could provide liquidity without the need for corresponding deficits by reserve currency countries. But it proved to be too little, too late. Despite desperate measures to patch the system with central bank swap lines in the 1960s and a last-ditch effort to realign currencies with the Smithsonian Agreement in 1971 after the United States suspended the conversion of dollar reserves to gold, the Bretton Woods system disintegrated. The massive disruption of the late-1973 and 1974 oil price shocks made a return to fixed exchange rates among major currencies impossible. For the IMF, the collapse of Bretton Woods presented an existential crisis. Not surprisingly, there were questions about the relevance of an organization whose raison d’être was management of a system that overnight had ceased to exist. The despondent IMF staff circulated a mock requiem for the institution.

Lending a hand

But the IMF’s role in lending to countries with balance of payments difficulties made it an indispensable part of the international monetary landscape, especially after the oil price shocks. Initial drawings from the IMF (the first was by France in 1947) were “outright purchases,” which means the country drew the money immediately. As early as 1952, however, the notion of precautionary loans—making funds available on stand-by to a country to restore confidence and catalyze private capital flows, potentially obviating the need to actually use IMF money—crystallized in the form of the Stand-By Arrangement. In 1963, recognizing that fluctuations in primary commodity prices were often the major source of balance of payments problems in developing economies, the IMF instituted the Compensatory Financing Facility. And after the first oil shock, in addition to an Oil Facility, in the continuing spirit of helping members correct payment imbalances “without resorting to measures destructive of national or international prosperity,” the IMF introduced the Extended Fund Facility (EFF) in 1974 for countries facing more protracted balance of payments problems.

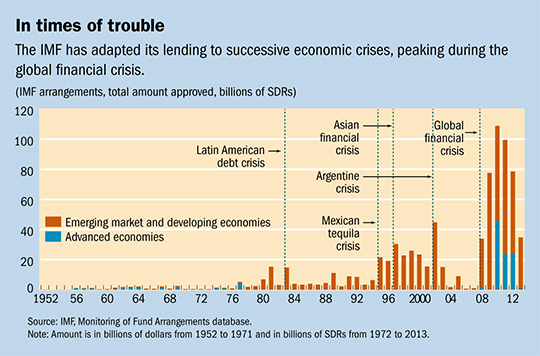

These new lending instruments, especially the EFF, were a vital addition to the lending toolkit during the 1980s developing economy debt crisis, when committed IMF lending rose from SDR 2 billion in 1979 to almost 15 billion in 1983 (see chart). Together with this expansion in its loan portfolio, the IMF had to develop, amend, and adapt its policies on arrears, conditionality, and program design. For low-income countries, the most important innovations were the Structural Adjustment Facility in 1986—precursor to the Enhanced Structural Adjustment Facility in 1987, and the Poverty Reduction and Growth Facility (now Poverty Reduction and Growth Trust) in 1999—and the Heavily Indebted Poor Countries debt relief initiative, both intended to help countries achieve more growth-friendly external adjustment—albeit often with greater structural conditionality in programs.

Just as the debt crisis—and associated IMF lending—was winding down in the late 1980s and questions about the institution’s relevance were reemerging, the IMF managed to return to center stage, this time helping the Soviet Union and central and eastern Europe transform into market economies. Assistance was partly straightforward macroeconomic stabilization, but program design in these countries often required the IMF to provide advice (technical assistance almost doubled between 1990 and 1996) and even impose conditions—for example, regarding pricing policy, privatization, and governance—far removed from its standard mandate.

IMF lending took another quantum leap during the emerging market capital account crises of the 1990s, epitomized by the Asian financial crises in 1997–98 but spanning much of the decade—from Mexico’s December 1994 devaluation to the collapse of Argentina’s currency board in January 2002. Beyond the magnitude of financing involved, these crises posed enormous analytical challenges for the IMF (indeed, for the economics profession at large). The IMF became embroiled in controversy about the appropriate policy response, and it had to develop new tools and incorporate the financial and corporate sectors into its macroeconomic analysis and technical assistance.

Firm, or not so firm, surveillance

Although Bretton Woods had ceased to exist by the early 1970s, the international monetary system still faced many of the same issues confronting the architects of the system. In its final report to the IMF Board of Governors in June 1974, for instance, the Committee of Twenty (a ministerial body established in July 1972 to consider reforms to the international monetary system) listed the “achievement of symmetry in the obligations of all countries, debtors and creditors alike,” and “the better management of global liquidity” among the key goals for the reformed international monetary system.

Again, agreement proved elusive. Instead of a return to a Bretton Woods system (but with more symmetrical adjustment), the amended Articles of Agreement called on the IMF to “oversee the international monetary system in order to ensure its effective operation . . . [and to] exercise firm surveillance over the exchange rate policies of members.” Surveillance was thus to have two components: bilateral, ensuring that individual countries fulfilled their obligations under the (amended) Articles; and multilateral, overseeing the operation of the system. This was the genesis of the IMF’s World Economic Outlook in 1980.

Neither the amended Articles of Agreement, nor the 1977 supporting Surveillance Decision, however, provided much guidance on how surveillance was to be conducted, and the process evolved with experience. By the late 1990s, for example, it was clear that it needed to extend beyond exchange rate issues to periodic health checks on its member countries lest contagion from financial crises threaten the stability of the whole system.

The age-old problem of asymmetric adjustment came to a head with the emergence of large current account imbalances among major economies (dubbed global imbalances) in the early 2000s. These came under the purview of IMF surveillance both because they involved the exchange rate policies of member countries and because they posed a potential risk to the stability of the system. Despite a “multilateral consultation” in 2006 and a 2007 board decision putting teeth into surveillance (subsequently folded into the 2012 Integrated Surveillance Decision), the IMF was largely unsuccessful in persuading the major players to adopt policies that would narrow the imbalances. At the same time, as emerging market countries improved their macroeconomic policies and strengthened their institutions, crises became rarer, and by the mid-2000s, IMF lending fell to its lowest levels in decades. Once again, the IMF seemed headed toward redundancy—this time with the twist that its income, mostly from lending, could not cover the cost of its surveillance and technical assistance.

Full circle

The collapse of U.S. investment bank Lehman Brothers and the ensuing global financial crisis, of course, quelled any doubts about the relevance of the IMF, which was soon injecting liquidity into the global economy through an SDR allocation. It ramped up its lending—first to emerging market countries in Europe and elsewhere, then to several members of the euro area, with longer-term financing (in the form of EFFs) to deal with their more protracted balance of payments problems. Given increased global interdependence and risk of contagion, and building on the idea of the Stand-By Arrangement, the IMF established instruments that were more explicitly precautionary (such as the Flexible Credit Line) to bolster confidence. And responding to the charge that it had missed the crisis it developed a host of analytical tools to better identify, avoid, mitigate, and resolve financial crises and their cross-border spillovers.

Today, the IMF’s loan portfolio and range of surveillance and technical assistance (nearly triple that of 1990)—underpinned by expanding research and analytical work—are larger than ever, and its finances are more sustainable and less dependent on lending. The core challenges of the international monetary system remain much the same as 70 years ago, but how those challenges are manifested, not least with the growth of private capital flows, has changed in ways the founding fathers could scarcely have imagined.

The real accomplishment of the Monetary and Financial Conference was not designing the Bretton Woods system, it was establishing an institution that could, and would, adapt to meet the evolving needs of its members—to benefit the bread and butter realities of daily life. ■