Power from the People

Finance & Development, March 2015, Vol. 52, No. 1

Florence Jaumotte and Carolina Osorio Buitron

The decline in unionization in recent decades has fed the rise in incomes at the top

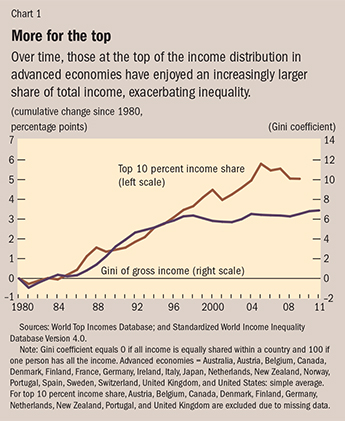

Inequality has risen in many advanced economies since the 1980s, largely because of the concentration of incomes at the top of the distribution. Measures of inequality have increased substantially, but the most striking development is the large and continuous increase in the share of total income garnered by the 10 percent of the population that earns the most—which is only partially captured by the more traditional measure of inequality, the Gini coefficient (see Chart 1).

The Gini is a summary statistic that gauges the average difference in income between any two individuals from the income distribution. It takes the value zero if all income is equally shared within a country and 100 (or 1) if one person has all the income.

While some inequality can increase efficiency by strengthening incentives to work and invest, recent research suggests that higher inequality is associated with lower and less sustainable growth in the medium run (Berg and Ostry, 2011; Berg, Ostry, and Zettelmeyer, 2012), even in advanced economies (OECD, 2014). Moreover, a rising concentration of income at the top of the distribution can reduce a population’s welfare if it allows top earners to manipulate the economic and political system in their favor (Stiglitz, 2012).

Traditional explanations for the rise of inequality in advanced economies are skill-biased technological change and globalization, which have increased the relative demand for skilled workers, benefiting top earners relative to average earners. But technology and globalization foster economic growth, and there is little policymakers can or are willing to do to reverse these trends. Moreover, while high-income countries have been similarly affected by technological change and globalization, inequality in these economies has risen at different speeds and magnitudes.

As a consequence, economic research has recently focused on the effects of institutional changes, with financial deregulation and the decline in top marginal personal income tax rates often cited as important contributors to the rise of inequality. By contrast, the role played by labor market institutions—such as the decline in the share of workers affiliated with trade unions and the fall in the minimum wage relative to the median income—has featured less prominently in recent debates. In a forthcoming paper, we look at this side of the equation.

We examine the causes of the rise in inequality and focus on the relationship between labor market institutions and the distribution of incomes, by analyzing the experience of advanced economies since the early 1980s. The widely held view is that changes in unionization or the minimum wage affect low- and middle-wage workers but are unlikely to have a direct impact on top income earners.

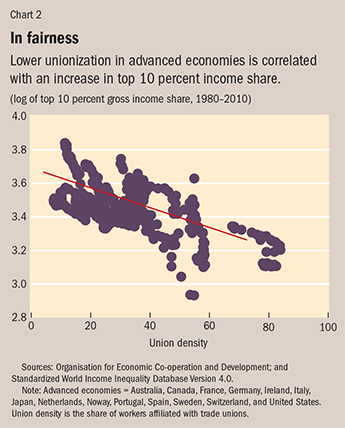

While our findings are consistent with prior views about the effects of the minimum wage, we find strong evidence that lower unionization is associated with an increase in top income shares in advanced economies during the period 1980–2010 (for example, see Chart 2), thus challenging preconceptions about the channels through which union density affects income distribution. This is the most novel aspect of our analysis, which sets the stage for further research on the link between the erosion of unions and the rise of inequality at the top.

Changes at the top

Economic research has highlighted various channels through which unions and the minimum wage can affect the distribution of incomes at the bottom and middle, such as the dispersion of wages, unemployment, and redistribution. In our study, however, we also consider the possibility that weaker unions can lead to higher top income shares, and formulate hypotheses for why this may be the case.

So the main channels through which labor market institutions affect income inequality are the following:

Wage dispersion: Unionization and minimum wages are usually thought to reduce inequality by helping equalize the distribution of wages, and economic research confirms this.

Unemployment: Some economists argue that while stronger unions and a higher minimum wage reduce wage inequality, they may also increase unemployment by maintaining wages above “market-clearing” levels, leading to higher gross income inequality. But the empirical support for this hypothesis is not very strong, at least within the range of institutional arrangements observed in advanced economies (see Betcherman, 2012; Baker and others, 2004; Freeman, 2000; Howell and others, 2007; OECD, 2006). For instance, in an Organisation for Economic Co-operation and Development review of 17 studies, only 3 found a robust association between union density (or bargaining coverage) and higher overall unemployment.

Redistribution: Strong unions can induce policymakers to engage in more redistribution by mobilizing workers to vote for parties that promise to redistribute income or by leading all political parties to do so. Historically, unions have played an important role in the introduction of fundamental social and labor rights. Conversely, the weakening of unions can lead to less redistribution and higher net income inequality (that is, inequality of income after taxes and transfers).

Bargaining power of workers and top income shares: Lower union density can increase top income shares by reducing the bargaining power of workers. Naturally, top income shares are mechanically influenced by what happens in the lower part of the income distribution. If deunionization weakens earnings for middle- and low-income workers, this necessarily increases the income share of corporate managers’ pay and shareholder returns. Intuitively, the weakening of unions reduces the bargaining power of workers relative to capital owners, increasing the share of capital income—which is more concentrated at the top than wages and salaries. Moreover, weaker unions can reduce workers’ influence on corporate decisions that benefit top earners, such as the size and structure of top executive compensation.

To study the role of unionization and the minimum wage in the rise of inequality, we use econometric techniques over a sample including all advanced economies for which data are available and the years 1980 to 2010. We examine the relationship between various inequality measures (top 10 percent income share, Gini of gross income, Gini of net income) and labor market institutions, as well as a number of control variables. These controls include other important determinants of inequality identified by economists, such as technology, globalization (competition from low-cost foreign workers), financial liberalization, and top marginal personal income tax rates, as well as controls for common global trends in these variables. Our results confirm that the decline in unionization is strongly associated with the rise of income shares at the top.

While causality is difficult to establish, the decline in unionization appears to be a key contributor to the rise of top income shares. This finding holds even after accounting for shifts in political power, changes in social norms regarding inequality, sectoral employment shifts (such as deindustrialization and the growing role of the financial sector), and increases in education levels. The relationship between union density and the Gini of gross income is also negative but somewhat weaker. This could be because the Gini underestimates increases in inequality at the top of the income distribution.

We also find that deunionization is associated with less redistribution of income and that reductions in minimum wages increase overall inequality considerably.

On average, the decline in unionization explains about half of the 5 percentage point rise in the top 10 percent income share. Similarly, about half of the increase in the Gini of net income is driven by deunionization.

Future research

Our study focuses on unionization as a measure of the bargaining power of workers. Beyond this simple measure, more research is needed to investigate which aspects of unionization (for example, collective bargaining, arbitration) are most successful and whether some aspects may be more disruptive to productivity and economic growth.

Whether the rise of inequality brought about by the weakening of unions is good or bad for society remains unclear. While the rise in top earners’ income share could reflect a relative increase in their productivity (good inequality), top earners’ compensation may be larger than what is justified by their contribution to the economy’s output, reflecting what economists call rent extraction (bad inequality). Inequality could also hurt society by allowing top earners to manipulate the economic and political system.

In such cases, there would be grounds for governments to take policy action. Such action could include corporate governance reforms that give all stakeholders—workers, managers, and shareholders—a say in executive pay decisions; improved design of performance-related pay contracts, especially in the risk-happy financial sector; and reaffirmation of labor standards that allow willing workers to bargain collectively. ■

Florence Jaumotte is a Senior Economist and Carolina Osorio Buitron is an Economist, both in the IMF’s Research Department.

This article is based on a forthcoming IMF paper by the authors.

References

Baker, Dean, Andrew Glyn, David R. Howell, and John Schmitt, 2004, “Labor Market Institutions and Unemployment: Assessment of the Cross-Country Evidence,” in Fighting Unemployment: The Limits of Free Market Orthodoxy, edited by David R. Howell, pp. 72–118.

Berg, Andrew, and Jonathan Ostry, 2011, “Inequality and Unsustainable Growth: Two Sides of the Same Coin?” IMF Staff Discussion Note 11/08 (Washington: International Monetary Fund).

Berg, Andrew, Jonathan Ostry, and Jeromin Zettelmeyer, 2012, “What Makes Growth Sustained?” Journal of Development Economics, Vol. 98, No. 2, pp. 149–66.

Betcherman, Gordon, 2012, “Labor Market Institutions: A Review of the Literature,” World Bank Policy Research Paper No. 6276 (Washington).

Freeman, Richard B., 2000, “Single Peaked Vs. Diversified Capitalism: The Relation Between Economic Institutions and Outcomes,” NBER Working Paper No. 7556 (Cambridge, Massachusetts: National Bureau of Economic Research).

Howell, David R., Dean Baker, Andrew Glyn, and John Schmitt, 2007, “Are Protective Labor Market Institutions at the Root of Unemployment? A Critical Review of the Evidence,” Capitalism and Society, Vol. 2, No. 1.

Organisation for Economic Co-operation and Development (OECD), 2006, Employment Outlook (Paris).

———, 2014, “Focus on Inequality and Growth,” December 9. Stiglitz, Joseph, 2012, The Price of Inequality: How Today’s Divided Society Endangers Our Future (New York: W.W. Norton).