Doing It Right

Finance & Development, September 2015, Vol. 52, No. 3

Augusto de la Torre, Daniel Lederman, and Samuel Pienknagura

If Latin America is to rely on trade to enhance economic growth, it must find the correct approach

As the recent period of relatively high growth fades into memory, Latin America and the Caribbean is haunted again by the region’s long history of failure to approach the living standards of high-income countries.

Indeed, income per capita in the region (hereafter called Latin America for sake of simplicity) has hovered at about 30 percent of that of the United States for more than a century. It is not surprising, therefore, that the challenge of boosting growth-with social equity-has moved to center stage in the region’s policy discussions. It has led policymakers to pay increasing attention to international trade as a potentially powerful source of growth and, in particular, to the role that regional trade integration can play. For example, an objective of the Pacific Alliance-the 2012 integration agreement between Chile, Colombia, Mexico, and Peru-was “driving further growth, development and competitiveness of the economies of its members.”

In many ways, that push toward regional integration has been influenced by the success story of the east Asia and Pacific region (hereafter east Asia), where there is a close and positive association between rising intraregional trade, growing exports to the rest of the world, and convergence toward the living standards of high-income countries.

But we have found that regional integration by itself is not the crucial ingredient in the east Asian growth potion. Instead it is the way these countries go about it. The link between intraregional trade and growth observed in east Asia reflects two important trade patterns: a high incidence of intra-industry trade, that is, trade flows within narrowly defined sectors or industries, such as electronics and heavy machinery; and a high participation in global value chains, in which trade is associated with multicountry production operations. For example, an auto company may manufacture transmissions in one country, chassis in another, and export these to another country where they are assembled into a vehicle.

We found that once endemic structural factors-such as geography, economic size, and natural resource abundance-are taken into account, Latin America fares relatively well compared with east Asia merely in terms of intraregional trade volume and connectivity among regional trade partners. Where Latin America differs markedly from east Asia is in those key features of trade-intra-industry trade and participation in global value chains. This suggests that policies aimed at simply boosting intraregional trade connections and volumes in Latin America are unlikely to do much to boost growth. Latin American authorities should design policies that favor a more vigorous participation in intra-industry trade and in global value chains.

East Asia’s integration

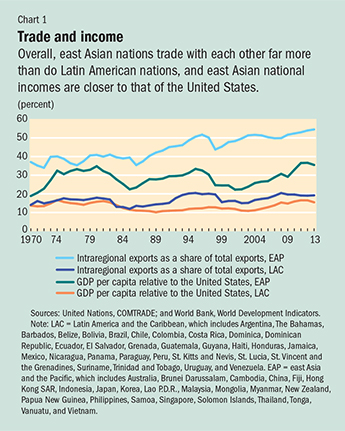

Latin America’s attention to the regional integration experience of east Asia is not surprising. Since the 1970s, the share of intraregional exports within the latter region has increased from about 35 to 55 percent, and total exports have skyrocketed. Alongside these achievements, east Asian living standards moved closer to those in the United States, suggesting that intraregional trade among Asian countries played an important role in their convergence (see Chart 1).

In contrast, intraregional exports in Latin America have stagnated at 20 percent since the 1970s, and the region has experienced relatively low growth in total exports, while economic convergence has remained elusive.

Yet, when trade flow data are broken down, Latin American countries are not as unconnected to their regional partners as the overall numbers seem to indicate.

● In 2013, the average Latin American country had an active export relationship with close to 88 percent of possible regional partners, compared with 83 percent in east Asia.

● Latin American countries are no strangers to formal trade agreements. Between the early 1960s and recently, Latin American countries have experimented with trade agreements of varying nature, depth, and size. Notable examples include MERCOSUR, comprising countries in the southern cone of South America; the Andean Community; CAFTA, which includes Central American and Caribbean countries; and, recently, the Pacific Alliance.

● Regional partners in Latin America have more similar export baskets than do regional partners elsewhere. This means that Latin American countries are naturally biased to trade more with partners outside the region.

● The relatively low intraregional trade within Latin America is partly a result of the region’s geography and economic size. The distance between the median country pair exceeds that of any other region, and the economic size of the median country pair is lower than anywhere else but Africa. When geographic and size impediments to trade are factored in, the region’s measured performance in intraregional trade relative to east Asia’s improves substantially.

Another way to highlight the importance of geography and size on measures of intraregional trade for Latin America is to include exports to the United States, which is relatively close to many countries in Latin America. The share of the region’s exports to the United States was about 40 percent in 2013, which implies that the share of intraregional trade is 60 percent.

The same holds true for the Asia and Pacific region. If both Japan and China are included, the share of intraregional exports in total exports is about 55 percent. But if Japan is excluded, the share is about 40 percent. And if only China is excluded the share drops to about 25 percent.

Deterring growth

As we said, any trade-related factors behind Latin America’s low growth do not seem to be related merely to connectivity and trade volumes with regional partners. Rather, the type of trade the countries conduct (or fail to conduct) with one another and with global partners may better explain the region’s predicament. Moreover, the same factors that underpin the region’s relatively low trade volumes may also shape how its international commerce is structured. That is, it is plausible that differences in distance and size among Latin American trading partners compared with those in east Asia explain differences in their trade structure.

Economists have shown that intra-industry trade and participation in global value chains can enhance the progrowth effects of trade by exerting competitive pressures on domestic producers and facilitating learning and the access to foreign technologies and know-how that foster innovation and productivity gains.

Trade openness can by itself deliver productivity gains, regardless of how a country’s trade is structured. International trade shifts resources to sectors in which the local economy has a comparative advantage and also raises competitive pressures, pushing out unproductive local firms and encouraging the reallocation of capital and labor from those firms to more productive ones.

What makes intra-industry trade and insertion into global value chains different from broad trade openness, however, is their potential to generate greater learning and technological spillovers that enhance productivity. In the case of intra-industry trade, foreign competition pushes local producers, especially exporters, to upgrade the quality of their products or to produce different varieties of the product. But these improvements are not independent of technology—it is likely that upgrades by local exporters build on the foreign technologies to which they are exposed through trade.

Exposure to foreign technologies and know-how is the main channel through which a country’s growth and productivity are enhanced by participating in global value chains. Value chains are characterized not only by tight links between firms at different stages of the production process; their success also hinges on the quality of the products delivered by firms involved in the process and the efficiency with which these products are delivered across different stages of production. These traits facilitate quality enhancements and knowledge diffusion across firms inside the chain and can benefit other local firms that interact with firms in the value chain.

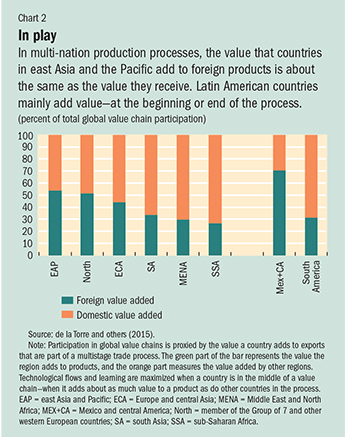

However, participation in value chains does not guarantee knowledge flows and exposure to foreign technologies. The learning potential and knowledge flows appear to be greatest in countries that join at intermediate stages of production, where interaction with suppliers and buyers is highest.

It is in intra-industry trade and participation in global value chains that economies in Latin America lag. Despite the region’s good connections to regional and more distant trading partners, its degree of intra-industry trade, captured by an index ranging from zero to 1, was only about 0.25 in 2011 (de la Torre and others, 2015). This contrasts with 0.35 among east Asian and Pacific countries. Furthermore, although for the past two and a half decades Latin American countries have increased their participation in global value chains much faster than countries from other regions, they still are well behind east Asian countries. In east Asia nearly 50 percent of exports were part of value chains in 2011; in Latin America it was close to 40 percent.

There are also important differences between Latin American countries and Asian countries in the way they participate in these production chains. Firms in Latin America normally are either in the early stages of production through the supply of raw materials (mainly South America) or in the final stages of production as assembly lines (Central America and Mexico). East Asian firms tend to participate in the intermediate stages of production—receiving inputs from abroad, transforming them, and shipping them to more advanced stages of production. They then maximize the potential for learning and knowledge transfers (see Chart 2).

Changing emphasis

When Latin American policymakers focus on regional integration, they must emphasize development of intra-industry trade and integration into global production networks.

Governments could try to induce such changes in trade patterns directly by, say, providing incentives to specific sectors. But, as a recent report by the Inter-American Development Bank (2014) argues, these types of interventions are only effective if policymakers know more than private sector firms. Instead, broad-based policies-such as those that improve the contractual environment for firms, encourage labor market flexibility, and enhance the quality of education and infrastructure-will attract new investment, raise skills, and lower trade costs. This can foster more dynamic and competitive firms that could in turn actively participate in global production networks. ■

Augusto de la Torre is Chief Economist, Daniel Lederman is Lead Economist and Deputy Chief Economist, and Samuel Pienknagura is Research Economist, all in the Office of the Chief Economist for Latin America and the Caribbean at the World Bank.

References

de la Torre, Augusto, Tatiana Didier, Alain Ize, Daniel Lederman, and Sergio L. Schmukler, 2015, Latin America and the Rising South: Changing World, Changing Priorities (Washington: World Bank).

Inter-American Development Bank (IDB), 2014. Rethinking Productive Development: Sound Policies and Institutions for Economic Transformation, Development in the Americas Report (Washington).