Collateral Damage

Finance & Development, December 2015, Vol. 52, No. 4

Pablo Druck, Nicolas E. Magud, and Rodrigo Mariscal

A strong dollar is seldom good news for emerging market economies

When the U.S. economy is growing, other economies should benefit from the strong demand for exports from the world’s largest economy—not only directly, but from the rest of the world, which benefits from stronger U.S. demand. But for emerging markets, especially those that are net commodity exporters, a buoyant U.S. economy is often a double-edged sword.

Based on data for 1970–2014 we found that during periods of dollar appreciation—which are about six to eight years long and usually occur when the U.S. economy is growing—real GDP growth in emerging markets slows, even though U.S. growth is driving global demand. By contrast, during periods of a depreciating dollar—which last about nine years—emerging market economies do better.

It may seem counterintuitive when the world’s largest economy is growing and pulling in imports, including from emerging markets, that those economies should suffer. But it appears that the effect of an appreciating dollar in depressing global commodity prices outweighs the buoyant effects of a healthy U.S. economy. That is, as the dollar appreciates, dollar-denominated commodity prices tend to fall, and weaker commodity prices result in falling incomes in emerging market economies, slowing their domestic demand growth. The result is a deceleration in real GDP growth in emerging market economies.

Depressing effect

The depressing effects of a stronger dollar occur even when foreign demand rises for products from emerging market economies whose depreciating currencies make their exports cheaper. In other words, even if net export growth increases, the drop in domestic demand growth is proportionally larger, resulting in slower aggregate domestic production. This is true even when we take into account China’s increasing role in commodity prices, which began in earnest in the late 1990s. Moreover, beyond the effects of a stronger dollar and faster U.S. real GDP growth on emerging markets’ activity, we found that the increase in U.S. interest rates that eventually accompanies a growing U.S. economy, further reduces growth in these economies. These effects are stronger in countries with less flexible exchange rate regimes. Although net commodity exporters are affected the most, countries that rely on importing capital for investment or inputs for domestic production are also affected. That is because most of those imports are priced in dollars. Moreover, borrowing costs rise with interest rate increases, affecting firms that incur debt to finance their investment.

In the past year emerging markets have suffered from a rising dollar and declining commodity prices. The expected persistence of the strong dollar and an anticipated increase in U.S. interest rates will tend to further subdue growth in emerging market economies in the near term.

Why is the protagonist the dollar exchange rate? Part of it is that most international transactions, including those involving commodities, are priced in dollars—the currency that is effectively the global medium of exchange, store of value, and unit of account. And, with the exception perhaps of China (a commodity importer anyway), emerging market economies cannot affect the U.S. multilateral exchange rate much. That means that while developments in the United States affect every emerging market economy, occurrences in those economies have little effect on the United States. Moreover, U.S. macroeconomic policy takes little account of developing economies. That means that the U.S. real exchange rate is likely to be more relevant to an emerging market economy than its terms of trade—that is, the relative price of a country’s exports in terms of its imports. In other words, the dollar is the ultimate driver of emerging market dynamics: the terms of trade are only the vehicle.

Real dollar effects

The effect of the real dollar exchange rate on emerging market economies can be shown in a decade-by-decade look at the effects on South America’s GDP. The story is similar in other regions.

1970s: This was a period of dollar depreciation. U.S. monetary policy was expansionary, with low real (after-inflation) interest rates that hovered around 2 percent. Economic activity in the United States went through two recessions and a period of high inflation and slow growth, often called stagflation. South America’s real GDP growth was strong (averaging over 6 percent), on the back of two oil price surges (in 1973 and 1979) along with higher commodity prices more generally.

1980s: Following high inflation in the United States, the Federal Reserve, the U.S. central bank, tightened monetary policy in the early 1980s. Real interest rates reached 8 percent. As a result, the dollar appreciated and commodity prices dropped. The U.S. economy went into recession but quickly recovered and grew robustly for the rest of the decade. In South America growth was so mediocre that the period became known as Latin America’s lost decade. Moreover, higher U.S. interest rates caused a sharp increase in the cost of international financing, which in many cases resulted in a sovereign debt crisis—in Latin America and some other developing economies.

1990s: After a 1993 recession, there was a sustained period of strong growth in the United States, one of the longest in recent history. U.S. real interest rates were higher than in the 1970s, yet lower than in the 1980s. The dollar progressively strengthened. Commodity prices were mostly weak. Real GDP growth in South America was about 3 percent, not good for emerging market economies and lower than expected given the growth-enhancing structural reforms in the region in the early years of the decade.

2000s: The decade started with low real interest rates, a depreciating dollar, and strong commodity prices on the back of strong external demand, particularly from China. South America’s growth boomed at about 4? percent—until the 2008–09 global financial crisis.

2010s: The dollar has been appreciating again, especially since mid-2014. Commodity prices have weakened, and are expected to remain subdued into the medium term. If the events of the past four and a half decades are any indication, emerging market economies face a period of low real GDP growth—at least lower than when the dollar was weak and commodity prices high. Economic activity in emerging markets has in fact been decelerating recently. And the dollar, which appreciated about 15 percent between June 2014 and July 2015, again appears to be one of the factors slowing growth in emerging market economies, whose prospects have been revised downward several times by the IMF (2015) and by the market more broadly in recent months.

Softer growth

Based on the experiences of emerging market and developing economies, we have documented some broad generalizations about average occurrences using annual data for 63 of those countries during 1970–2014:

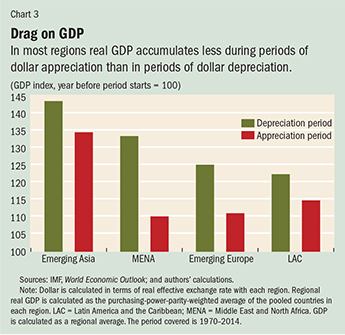

- Periods of dollar appreciation coincide with softer real GDP growth throughout emerging market regions (see Chart 1). During periods of dollar depreciation, emerging market economies fare much better. This is especially true for regions that are net commodity exporters. Specifically, we observed a strong comovement in Latin America (particularly among the net commodity exporters of South America), emerging Europe, and the Middle East and North Africa, and to a lesser extent in emerging Asia.

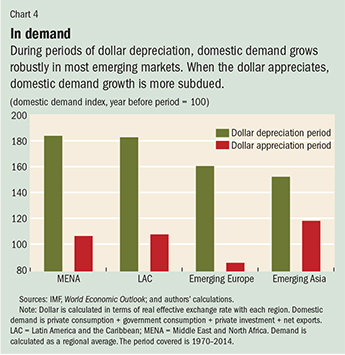

- The stronger the dollar, the weaker is domestic demand in emerging market economies. Domestic demand is a major driver of economic activity, and domestic demand seems to be affected by the purchasing power of the real effective exchange rate (see box), and it is through domestic demand that the U.S. real effective exchange rate is transmitted into economic activity in emerging market and developing economies. The impact on domestic demand appears to be weaker for countries in the Middle East and North Africa and emerging Asia and stronger for Latin America and emerging Europe.

Terms of trade

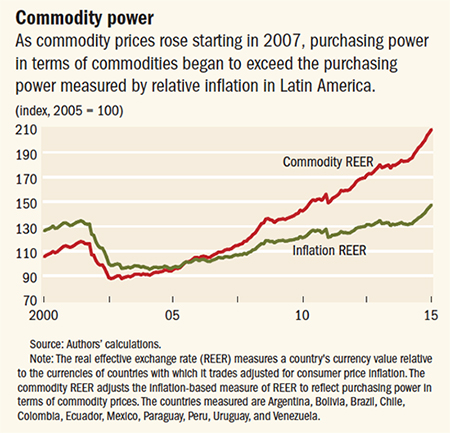

The real effective exchange rate (REER) measures a country’s currency value relative to the currencies of the countries with which it trades, adjusted for inflation. It is a measure of purchasing power.

To determine the REER, a country’s nominal exchange rate with each trading partner is multiplied by the export-share-weighted consumer price index of the trading partners and then divided by the domestic country’s consumer price index.

To construct an index that reflects an economy’s purchasing power, its REER can be adjusted to yield the commodity terms of trade real effective exchange rate. The weighted consumer price indices in the REER are replaced by the trade-weighted commodity terms of trade of each country. The terms of trade measure is a country’s export prices divided by import prices. When commodity prices increase, the commodity REER increases more than the standard REER, and vice versa. The chart shows how the two measures of purchasing power compare in Mexico and South America from 2000 to 2015.

- Periods of higher interest rates in the United States tend to occur alongside a stronger dollar, and vice versa. Higher interest rates increase capital inflows to the United States as investors seek higher yields, leading to an appreciation of the dollar.

- Higher U.S. interest rates appear to be associated with stronger U.S. growth, though not always. Stronger growth eventually generates demand-induced inflation pressure when domestic demand approaches the economy’s ability to produce goods and services efficiently. Rising prices induce the Federal Reserve to tighten monetary policy by raising interest rates, which increases borrowing costs for businesses and individuals. Higher borrowing costs mitigate inflation pressure by slowing credit growth, which tamps down economic activity. However, there have been a few periods during which the relationship between economic activity and interest rates in the United States was not so strong.

- When the dollar is in an appreciating cycle, the price of commodities is weaker, which in turn reduces growth in emerging markets.

The dollar cycle

As we have said, an important channel for the negative income effect of a stronger dollar on emerging markets is the depreciation of commodity prices in dollar terms. When commodity exports have lower purchasing power in dollars, a country’s real income is reduced. Domestic demand will fall as will economic output. The opposite happens during periods of a weak dollar.

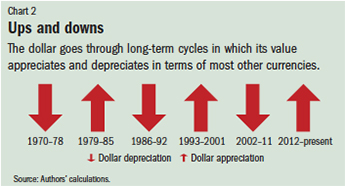

For 1970–2014, we found three appreciation cycles and three depreciation cycles (see Chart 2). Real dollar depreciations were, on average, stronger and lasted longer than real appreciation cycles. The real average appreciation is 3.2 percent a year with an average duration of more than six years (eight years if the ongoing dollar appreciation is not included); the real average annual depreciation is 3.8 percent, with an average duration of close to nine years. Moreover, the cycles are persistent. A period of real appreciation is 83 percent more likely to be followed by another period of appreciation than by depreciation. For real depreciation, the probability of continuation is about 88 percent.

To further substantiate our findings we used event analysis, which seeks to relate over time how GDP in emerging market economies behaves, depending on whether the dollar is in an appreciation or depreciation cycle.

That analysis showed that except for Central America and Mexico real GDP is lower in every region during periods of dollar appreciation. This pattern holds for Latin America as an aggregate, despite the effect of Central America and Mexico, and especially for South America, which is a strong net commodity exporter. It also holds for emerging market economies in the Middle East and North Africa as well as for emerging Europe. To a lesser extent, it is also true for emerging Asia. On average, real GDP in Latin America accumulates about 7 percentage points less during a dollar appreciation cycle than during a dollar depreciation cycle. The differences are even higher in the Middle East and North Africa—about 21 percentage points—and although less dramatic in emerging Asia, comparable to Latin America at 7 percentage points (see Chart 3). The difference is not so marked in Central America and Mexico, however, perhaps because of the strong noncommodity links to the United States, such as trade, tourism, and remittances. The trade link operates through the external demand for goods. Tourism boosts external demand for services. And remittances transfer resources from the United States to Mexico, Central America, and the Caribbean. All help support domestic demand and income in these emerging market and developing economies, offsetting any negative income effect from a stronger dollar. Countries with currencies pegged to the dollar or that use dollars as their domestic currency tend to be further synchronized with the dollar cycle.

With the exception of Central America and Mexico, all regions and subregions experience much stronger real domestic demand growth when the dollar is more depreciated. In many of the regions, domestic demand actually falls or remains flat when the dollar is appreciating. This is a powerful indication of the negative impact of a stronger dollar on the purchasing power of domestic demand. In turn, this suggests that the lower dollar income that results from weaker commodity prices (usually referred to as an income effect) is more important than the increase in economic activity that usually accompanies exports when the domestic currency depreciates. This is commonly referred to as an expenditure-switching effect, because it results in stronger external demand as domestic goods become cheaper in dollars (see Chart 4).

Whither the dollar?

The dollar has been appreciating since at least mid-2014, and based on historical data, there is a more than 80 percent probability that it will continue to appreciate in the short and medium term—in line with the six- to eight-year appreciation cycles we have identified. That means commodity prices in dollars are likely to remain weak, and domestic demand and the reduction in dollar purchasing power mean that real GDP growth in emerging market economies will be slower than when the dollar is falling.

If the Federal Reserve begins to raise interest rates and unwinds the extraordinary expansionary monetary policy it began during the global financial crisis, the dollar is even more likely to remain strong. Capital inflows to emerging market economies are likely to moderate at best (and in a worst-case scenario capital could flee), which could exacerbate the effects of weaker commodity prices. Furthermore, international financing costs would increase. That means, on balance, that the external prospects for these economies are not promising. ■

Pablo Druck and Nicolas Magud are Senior Economists and Rodrigo Mariscal is a Research Assistant, all in the IMF’s Western Hemisphere Department.

This article is based on a 2015 IMF Working Paper, “Collateral Damage: Dollar Strength and Emerging Markets’ Growth,” by Pablo Druck, Nicolas Magud, and Rodrigo Mariscal.

References

International Monetary Fund (IMF), 2015, World Economic Outlook (Washington, April and October).