Stagnation Risk

Finance & Development, June 2016, Vol. 53, No. 2

Ongoing economic problems make the euro area vulnerable to prolonged slow growth

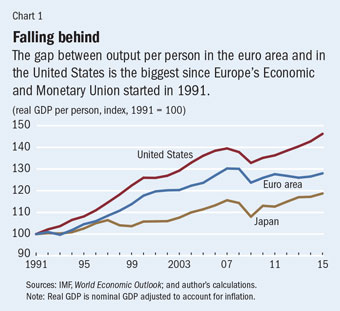

Since the onset of the global financial crisis, real output in the euro area has failed to keep up with the population. As a result, output per person has stalled, and euro area output is now only $40,000 a person, about $16,000 below the U.S. level, after adjustment for price differences. This is the largest gap since 1991, when the Economic and Monetary Union began (see Chart 1).

The euro area is not the only place the crisis has left scars. In advanced economies in general, the growth rate of potential output—the maximum amount of goods and services an economy can turn out at full capacity—is expected to increase only slightly and remain below the precrisis level over the next five years (IMF, 2015).

These subdued medium-term prospects are particularly worrisome for the euro area, given the high level of unemployment and public and private debt in some member countries. Moreover, after several years of anemic growth, there is limited room for policy maneuvering. High unemployment and debt and constrained policymaking leave the euro area vulnerable to shocks that could lead to a prolonged period of low economic growth—often dubbed “stagnation.”

Lower growth for longer

Although potential output cannot be observed, it can be estimated using a production function—an economic model that calculates an economy’s output based on key inputs (labor and capital) and how efficiently they are used. When applied to the euro area, the results suggest that the prospects for larger labor and capital inputs, as well as their more efficient use, remain weak. As a result, the euro area’s growth rate at its full capacity is expected to rise only modestly from 0.7 percent during 2008–14 to about 1.1 percent during 2015–20, which is significantly lower than the 1999–2007 average of 1.9 percent.

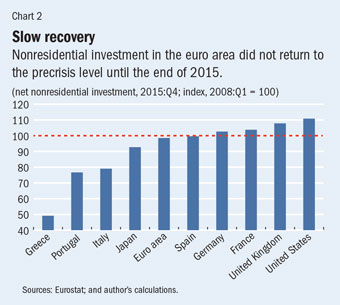

Moreover, the share of older people in the population is growing, while the share of working-age (15–64) people is shrinking. Because the propensity to join the workforce typically begins to erode after age 50, the average labor force participation rate is declining. At the same time, the capital stock is expected to grow slowly. The capital stock expands when new investment outpaces the rate at which that stock wears out (depreciation). This hasn’t been the case in the euro area, where business investment has expanded moderately since 2013, and reached its 2008 level only in 2015 (see Chart 2). In other words, the euro area continues to suffer from too few workers and too little investment.

The area also suffers from weak productivity growth (that is, output per worker hour). Empirical studies find that slow progress in improving the efficient use of labor and capital in the euro area, particularly in the service sector, bears most of the blame for a widening gap in productivity with the United States. Slower efficiency improvements and lower productivity growth in services in turn reflect delayed adoption and diffusion of information and communications technology. Unlike in the United States, where output per service sector employee has surpassed its precrisis peak, growth in the euro area has been gradual, and productivity remains below its precrisis peak in countries such as Germany and Italy.

Moreover, gains in the efficient use of labor and capital in the United States are likely to slow in the future, which will probably affect other advanced economies (IMF, 2015). In addition, adopting and promoting innovation call for flexibility and adaptability. Without swift action to address structural problems in the euro area—such as difficulties in firing workers or cutting wages and a business environment unfriendly to start-ups—diffusion of new technology may be delayed.

Crisis legacies linger

Some problems, such as high unemployment and high public and private debt, predate the crisis. While the return to modest growth should help address these problems to some extent, without decisive policies to improve growth prospects and reinvigorate investment, unemployment and debt will remain a drag on economic growth. High debt could hold back new investment, and high unemployment could arrest human capital development (by delaying investment in education and health, for example).

The euro area unemployment rate remains high, especially for youth and the long-term jobless, raising the risk of skill erosion and entrenched high unemployment. Despite recent improvement, the unemployment rate remains above 10 percent in the euro area and much higher in some countries—for example, nearly 25 percent in Greece. Among those unemployed in the euro area, more than half have been out of a job for more than 12 months—a proportion of the unemployed ranging from a low of about one-quarter in Finland to nearly three-quarters in Greece. High youth unemployment could also give rise to a “lost generation” of workers.

Over the medium term, the so-called natural rate of unemployment—the rate at which demand for and supply of workers are in equilibrium and employment and wage developments do not create inflation pressure—is projected to remain higher in Italy than during the crisis and decline very slowly in France. While the natural rate is expected to fall in Spain, it is still expected to remain above 15 percent over the next five years. In one scenario, for the euro area as a whole, based on historical relationships between output and unemployment, it could take about four years to reduce the unemployment rate to the average 2001–07 level without a persistent pickup in growth. It would take even longer for countries with higher unemployment and/or lower growth (such as Greece, Italy, Portugal, and Spain). Effective implementation of ongoing structural reforms could reduce that time by raising potential growth and/or making hiring more responsive to growth.

In addition to high public debt, which makes it difficult for countries to use spending and tax policy to stimulate the economy, private sector debt must be further reduced to enable new investment. Nonfinancial corporate debt-to-equity ratios have fallen in most euro area countries as firms have paid down borrowing. However, the debt reduction in many cases was accompanied by a cut in investment, a sharp increase in saving, and higher unemployment. In earlier episodes of significant corporate debt reduction, IMF research found, two-thirds of the increase in debt during credit booms is, on average, subsequently reduced (IMF, 2013). If debt reduction in the euro area follows a similar path, firms have a long way to go in paying off debt, which could significantly delay a recovery in investment. Households in some euro area countries also suffer from high debt. Although household debt-to-GDP ratios have fallen 10 to 20 percentage points in high-debt countries, they remain significantly above their preboom levels, raising the prospect that debt will continue to inhibit consumer spending for some time.

Insuring against shocks

The baseline projection for the euro area continues to foresee subdued growth and inflation over the medium term. This reflects the impact of high unemployment, heavy debt burdens, and weak balance sheets that suppress demand and of long-standing structural weaknesses—such as a rigid labor market and an overprotected product market—that depress potential growth. Moreover, these factors are intertwined: lower potential growth makes it harder to bring down debt, while high unemployment and low investment hurt capital accumulation and reduce potential growth.

Subdued medium-term prospects leave the euro area susceptible to negative shocks—such as another global slowdown—that could push economies into stagnation because they are hamstrung by their inability to respond through macroeconomic policies (such as cutting taxes and/or increasing spending). Moreover, unaddressed problems from the crisis could amplify these shocks. For instance, markets could reassess the sustainability of countries with high debt; subsequent higher borrowing costs would in turn raise the risk of a debt-deflation spiral.

An economic model used to simulate the effect of shocks on the euro area makes several assumptions: with interest rates at zero, monetary policy cannot do much more to stimulate the economy, and high debt limits the use of fiscal policy beyond the operation of automatic stabilizers such as unemployment benefits.

In this scenario, several developments—such as an increase in geopolitical tension, a political crisis within the European Union, or lowered growth expectations—could trigger a sudden drop in investor confidence. Lower equity prices would follow, along with a 25 percent decrease in investment growth (from about 2 percent to 1.5 percent annually) relative to the baseline projection. This would raise public-debt-to-GDP ratios differently across the euro area, depending on a particular economy’s level of debt. Market concerns about debt sustainability would also increase more for indebted countries. Sovereign and corporate interest rates would rise by a full percentage point in Greece, Ireland, Italy, Portugal, and Spain—similar to the increase in the Spanish 10-year sovereign bond yields during late June and July 2012.

These results highlight the vulnerability of the euro area to lower growth. By 2020 the euro area output level would be nearly 2 percent lower than the baseline projection. As a result, it would take three to four more years (relative to the baseline projection) for economic output to reach its full potential. Borrowing costs would increase, especially in Greece, Ireland, Italy, Portugal, and Spain. The unemployment rate and public-debt-to-GDP ratios would also increase. Inflation rates would be lower, pushing the euro area closer to deflation in the near term (see Chart 3).

Reducing vulnerability

Weak medium-term prospects and limited potential to use economic policy to stimulate their economies leave the euro area vulnerable to shocks that could lead to a prolonged period of low growth and low inflation. Insuring against such risks would require a broad and balanced set of policies. Such policies should go beyond the easing of monetary policy that has been the main tool to stimulate euro area economies. Banks, the bulwark of the European financing system, need to be put under stricter supervision and must make faster progress in getting bad loans off their books so that they can lend more. Policymakers must facilitate the restructuring of unhealthy but viable firms to reduce debt and allow them to begin to invest again. Authorities also need to undertake structural reforms to improve productivity and raise potential growth and, when they are able, to increase spending to boost demand, which will promote economic growth. ■

Huidan Lin is an Economist in the IMF’s European Department.

This article is based on the author’s IMF working paper, No. 16/9, “Risks of Stagnation in the Euro Area.”

References:

International Monetary Fund (IMF), 2013, “Indebtedness and Deleveraging in the Euro Area,” Euro Area Policies, 2013 Article IV Consultation—Selected Issues Paper, IMF Country Report 13/232 (Washington).

———, 2015, “Where Are We Headed? Perspectives on Potential Output,” World Economic Outlook, Chapter 3 (Washington, April).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.