Capital Buffers

Finance & Development, September 2016, Vol. 53, No. 3

Jihad Dagher, Giovanni Dell’Ariccia, Lev Ratnovski, and Hui Tong

How much capital banks need is an important public policy question

The recent global financial crisis demonstrated how distressed banks can undermine the real economy that produces goods and services. What started as a financial sector problem—real-estate-related losses at banks and other financial intermediaries—quickly turned into an economy-wide problem, at first in the United States, then in other advanced economies.

The large losses banks incurred stirred fear about their soundness and led to the modern version of a bank run: large uninsured depositors and bank creditors running for the exit (Huang and Ratnovski, 2011). Governments had to inject massive amounts of cash and capital into the banking system to ensure that the institutions had the funds needed to meet their obligations and a big enough buffer to keep them solvent.

Policymakers, economists, and regulators have long grappled with what steps could have been taken before 2007 that would have attenuated or even prevented the crisis—which triggered a global recession whose effects are felt even today. One possible measure would have been to require banks to have more capital.

Why banks need capital

A bank’s capital is the difference between the value of its assets and that of its debt liabilities (including deposits). In other words, it is the portion of the bank’s assets that belongs to its shareholders. A bank’s creditors and depositors are better protected from bank distress when the ratio of capital to total assets is high. There are a number of reasons for this. First, because equity holders are the most junior stakeholders in the bank, capital serves as a buffer that can absorb possible bank losses. Second, because equity holders indirectly control a bank’s behavior, the bank is more likely to invest prudently when they have more at stake.

From an aggregate welfare standpoint, an optimal capital level is one that takes into account the cost and benefit of capital not just to banks but to the overall economy. Market forces provide incentives for banks to maintain a positive level of capital. However, because bank shareholders do not internalize the bad effects a bank’s failure might have on bank creditors, depositors, and the overall economy, they tend to want to hold far less capital than is seen as optimal from the society’s point of view (De Nicolò, Favara, and Ratnovski, 2012). Accordingly, bank capital levels have long been subject to regulations that aim to bring them closer to the social optimum.

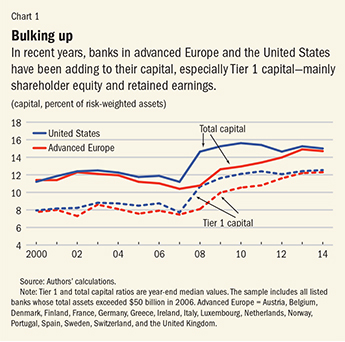

Early bank regulation—so-called Basel I, after the Swiss city where the international group of central bankers and bank supervisors convenes—required banks to have capital ratios of at least 8 percent. Capital ratios are computed by dividing capital—which includes shareholder equity, earnings banks retain rather than pay out to shareholders, and some forms of debt that can absorb losses—by assets that are weighted for risk. Weights are low, meaning less capital is required, for relatively safe assets such as government bonds and high for risky loans. In the early 2000s, bank regulation switched to Basel II, which enabled banks to use advanced customized risk weights for assets, rather than standardized ones, when determining how much capital they needed to hold. Basel II was agreed to several years before the global crisis, but had not yet gone into effect when the crisis spread globally in 2008. The crisis spawned yet another round of capital regulations, Basel III, which required banks to hold substantially more capital than under previous rules—at least 11.5 percent and up to 15.5 percent of risk-weighted assets. As an additional safeguard, Basel III introduced a simple leverage ratio (the relationship between core capital and total assets) and increased the required quality of bank capital (more reliance on equity and less on less tangible assets such as tax credits). Since Basel III was proposed in 2010, banks around the world have increased their Tier 1 capital ratio (the relationship between stockholder equity and retained earnings to total assets) as well as the total capital ratio, which includes other forms of capital, such as subordinated debt (see Chart 1).

How much to hold

The postcrisis increase in required bank capital better equips banking systems to deal with losses. But there is an ongoing debate over the optimal level of capital.

Proponents of higher bank capital requirements emphasize the financial stability risks associated with high bank leverage (when banks fund themselves too much through debt and too little through equity) and the exorbitant costs of the crisis that need to be avoided in the future. They argue that requiring more shareholder equity would have little social cost (Admati and Hellwig, 2014). Opponents believe that higher capital standards would increase banks’ funding costs and as a result the cost of bank credit, thus hindering economic activity (IIF, 2010).

We explored how much capital it would have taken to absorb bank losses entirely through bank equity and how much would have been required to avoid public recapitalization of banks (Dagher and others, 2016). The two concepts are different. Government intervention does not hinge on whether a bank fully depletes its capital, and governments often allow regulators to close failing banks, particularly smaller ones.

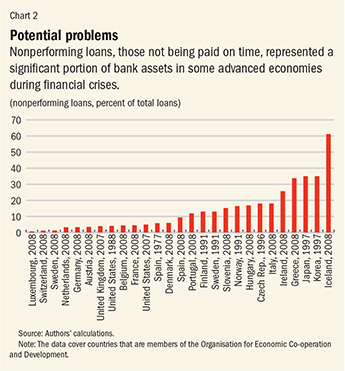

To figure out how much capital banks would have needed to absorb losses in past banking crises, we compiled data on the ratio of nonperforming loans, those that are not being repaid on time, to total loans in 105 banking crises since 1970 (based on data from Laeven and Valencia, 2013). We further used historical data on loan losses, provisions banks made to prepare for losses, and bank risk weights on those loans to determine how much bank capital would have been needed to absorb them.

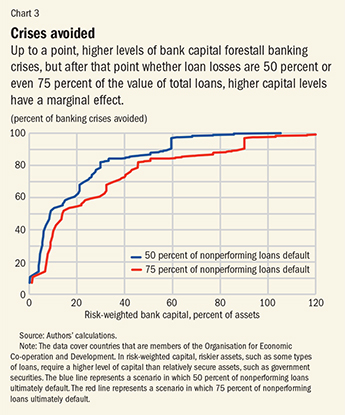

Chart 2 shows nonperforming loans as a percentage of bank assets during banking crises in advanced and emerging market economies that are members of the Organisation for Economic Co-operation and Development (OECD). Chart 3 shows the share of banking crises during which banks could have absorbed all losses through equity for various levels of hypothetical bank risk-weighted capital ratios. The blue line is a benchmark case in which 50 percent of the value of nonperforming loans ends up as loss; on the red line 75 percent turns into losses. What becomes apparent is that the marginal benefit of bank capital is initially high—up to 15 to 23 percent of risk-weighted assets for the blue and red line cases, respectively—but it declines rapidly after that. That is, additional capital is beneficial at first, but becomes almost meaningless above a bank capital ratio of between 15 and 23 percent—largely because extreme crises with substantially higher nonperforming loans are rare. For example, when capital ratios are at 23 percent or so, nearly the same percentage of crises are avoided as when capital is at 30 or even 40 percent.

Avoiding public recapitalization

Policymakers have learned that when it comes to financial crises inaction is not an option. History provides painful examples of the large economic costs of inaction or delay—such as in the United States during the Great Depression of the 1930s or during the Japanese crisis in the 1990s. That is why governments have often injected money into the banking sector during a banking crisis to improve bank capital ratios.

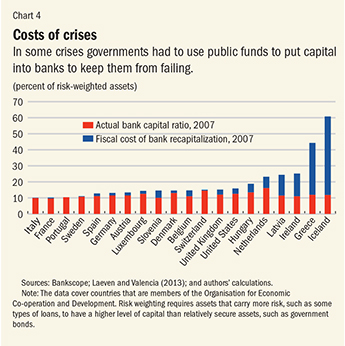

To assess how much capital would have been needed prior to a crisis to avoid having to use public funds to recapitalize banks, we assumed that recapitalization brought banks only to the minimum level of capital needed to restore viability. The level of precrisis bank capital that would have forestalled bank recapitalization is then the sum of the capital in place before the crisis and the postcrisis public capital injection (expressed in percentage points of bank capital ratios).

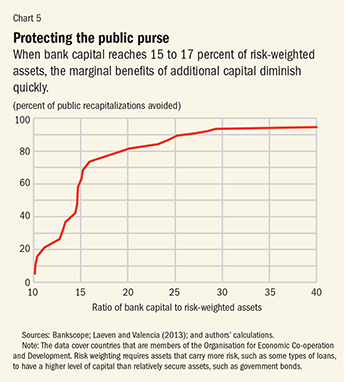

Chart 4 shows bank recapitalization expenditures during banking crises in OECD economies since 2007 as a percentage of risk-weighted assets. Chart 5 depicts the share of banking crises during which bank recapitalizations could have been avoided for each level of hypothetical bank risk-weighted capital ratio. Strikingly consistent with our previous findings, we find that the marginal benefit of bank capital in terms of avoiding public recapitalization declines quickly after a certain level—in this case 15 to 17 percent of risk-weighted bank capital.

Our results suggest that bank capital in the range of 15 to 23 percent of risk-weighted assets would have been sufficient to prevent a large majority of past banking crises—at least for advanced economies. There are, of course, a number of caveats to our analysis. Notably, our results relate to levels of bank capital rather than minimum capital requirements. Banks tend to maintain buffers above minimum capital requirements and draw on those buffers during periods of stress. Moreover, although we focus on bank capital as a means to absorb losses, other instruments (such as debt that can be converted to equity) are also available to absorb bank losses during crises. Finally, we have focused on risk absorption, but more bank capital would also deter banks from taking risks in the first place, because potential losses for equity shareholders would encourage them to pressure management to behave prudently. These factors suggest that the desirable capital requirement level is lower than the range identified in our analysis.

Emerging market and developing economies

Emerging market and developing economies have, on average, suffered greater bank losses than those incurred in advanced economies during past banking crises. This is not surprising because macroeconomic shocks tend to be larger in these economies and credit less diversified, and institutional factors (such as weaker bank regulation and supervision) lead to higher levels of nonperforming loans and loan losses. On one hand, higher bank losses, all else equal, call for more capital to absorb them in these economies. On the other hand, emerging market and developing economies tend to have much smaller banking systems relative to GDP. So when bank losses exceed banks’ ability to absorb them, the direct impact on the economy (and on sovereign spending accounts) might also be smaller. We find that if non-OECD countries had imposed capital ratios in the 15 to 23 percent range, losses exceeding the absorption capacity of capital would have been within 3 percent of GDP in 80 percent of banking crises.

Compared with Basel

Although our ratios are slightly higher than the current Basel standards, they are broadly in line with the wider measure of total loss-absorption capacity for globally systemically important banks set by the multinational Financial Stability Board for institutions that are so big and so intertwined with other major financial entities that their failure would have global consequences. It is up to bank supervisors in individual countries to judge the adequacy of the instruments added to Tier 1 bank capital to make up the total loss-absorption capacity—such as subordinated and convertible debt. If they determine that these additional instruments cannot provide robust loss absorption in crises, they may have to emphasize higher levels of bank capital. ■

Jihad Dagher is an Economist, Giovanni Dell’Ariccia is a Deputy Director, and Lev Ratnovski and Hui Tong are Senior Economists, all in the IMF’s Research Department.

Reference

Admati, Anat, and Martin Hellwig, 2014, The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It (Princeton, New Jersey: Princeton University Press).

Dagher, Jihad, Giovanni Dell’Ariccia, Luc Laeven, Lev Ratnovski, and Hui Tong, 2016, “Benefits and Costs of Bank Capital,” IMF Staff Discussion Note 16/04 (Washington: International Monetary Fund).

De Nicolò, Gianni, Giovanni Favara, and Lev Ratnovski, 2012, “Externalities and Macroprudential Policy,” IMF Staff Discussion Note 12/05 (Washington: International Monetary Fund).

Huang, Rocco, and Lev Ratnovski, 2011, “The Dark Side of Bank Wholesale Funding,” Journal of Financial Intermediation, Vol. 20, No. 2, pp. 248–63.

Institute of International Finance (IIF), 2010, Interim Report on the Cumulative Impact on the Global Economy of Proposed Changes in the Banking Regulatory Framework (Washington).

Laeven, Luc, and Fabián Valencia, 2013, “Systemic Banking Crises Database,” IMF Economic Review, Vol. 61, No. 2, pp. 225–70.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.