Shocks to the Purse

Finance & Development, December 2016, Vol. 53, No. 4

Benedict Clements, Xavier Debrun, Brian Olden, and Amanda Sayegh

Governments must understand and manage risks to public spending and debt

A key government task in managing public finances is to forecast how government revenues, expenditures, budget deficits, and public debt will evolve over time. Armed with this knowledge, policymakers can determine whether changes in tax and spending policy are needed to maintain overall economic stability.

Recent experience, however, indicates that public finances frequently evolve in unexpected ways. Adverse events often cause higher budget deficits and larger increases in public debt than anticipated. In other words, public finances are subject to “fiscal risks”—events that may cause fiscal outcomes to deviate from expectations or forecasts. These can arise from unanticipated macroeconomic developments (such as a slowdown in economic activity) or the realization of “contingent liabilities”—obligations that are triggered by an uncertain event. These can be either explicit liabilities that are legal in nature (such as government loan guarantees to farmers when there is a crop failure) or implicit liabilities, public expectation of government responsibility not established in law (for example, to bail out banks after a financial crisis).

A better understanding of fiscal risks and how to manage them is critical if countries wish to avoid large and unexpected increases in public debt that knock fiscal policy off course.

Fiscal risks

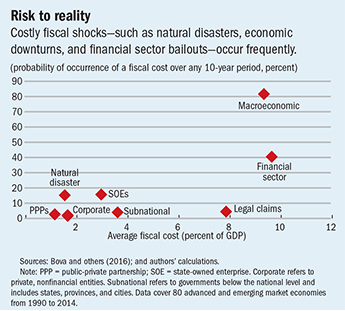

To examine the size and nature of fiscal risks countries have confronted, the IMF undertook a comprehensive survey (2016), looking at fiscal “shocks”—that is, the point at which fiscal risks become reality and affect public finances—to government debt in 80 countries over the past quarter century. The survey confirmed that fiscal shocks are large and frequent, with countries experiencing an adverse shock of 6 percent of GDP once every 12 years on average and a large event—costing more than 9 percent of GDP—every 18 years on average (see chart). Because these figures are only averages, the size and frequency can vary greatly from country to country.

Fiscal shocks have a number of causes. Sharp downturns in economic growth (macroeconomic shocks) and financial sector bailouts have been the most damaging, averaging about 9 percent of GDP per event. But legal claims against the government, bailouts of troubled state-owned enterprises, and claims from subnational governments (such as provinces, states, or cities) have also imposed large fiscal costs—averaging about 8 and 3½ percent of GDP, respectively. While natural disasters, on average, cost about 1½ percent of GDP, these events are more frequent and the impact is much higher for disaster-prone countries. In some cases, fiscal costs have been considerably larger, such as after New Zealand’s Canterbury earthquake in 2010, which cost about 5 percent of GDP, and costs of 4 percent of GDP after the Great East Japan earthquake in 2011. Besides macroeconomic shocks, the majority of fiscal shocks have come from implicit, rather than explicit, contingent liabilities.

Despite the frequency and cost of fiscal risks, they are poorly understood and managed. For example, only about a quarter of the countries surveyed publish balance sheets (which detail assets and liabilities), and in many cases these are incomplete. Slightly fewer than one-third publish quantitative estimates of the impact of changes in key macroeconomic variables—such as the exchange rate or inflation—on public finances, and fewer than one-fifth publish quantified statements of contingent liabilities.

Best practice

Countries should develop a more complete understanding of their fiscal exposures and put in place comprehensive strategies for their management. This involves a four-stage process of identifying the sources of fiscal risks and assessing their potential impact on public finances, assessing whether steps should be taken to reduce fiscal exposure, deciding whether to budget for risks that cannot be mitigated, and determining whether a larger safety margin (in the form of lower public debt) is needed to accommodate some or all of the risks that cannot be budgeted for or mitigated. The higher safety margin can allow countries to absorb most negative shocks to public finances without raising debt to undesirably high levels.

Identifying and quantifying fiscal risks: This involves assigning a number to their magnitude and, where possible, estimating their likelihood. For example, Chile, Colombia, and Peru use simulations to estimate contingent liabilities associated with minimum revenue guarantees to private contractors under public-private partnership arrangements. Sweden estimates price guarantees based on market and options pricing data, as well as simulations. When quantification is too difficult, risks can still be classified into categories (such as probable, possible, and remote) based on judgments about their likelihood.

Mitigating fiscal risks: The diverse array of potential shocks implies that there is no magic bullet to safeguard public finances and that a range of tools is needed. The choice of instrument depends on the nature of risks, the cost-benefit trade-off between mitigating and accommodating them, and institutional capacity. Mitigating measures can include direct controls and limits on fiscal exposures. For example, Iceland limits how much debt subnational governments can accumulate, and Hungary restricts the issuance of new guarantees. Those measures can also involve regulations or incentives to reduce risky behavior (many countries, for example, require banks to hold capital buffers against losses; Sweden charges risk-related fees to beneficiaries of government guarantees). In some cases, risks can be transferred to third parties—for example, by purchasing insurance (which Turkey has done for natural disasters). Governments in countries in which national revenues depend on commodities can also adopt hedging instruments to lock in the selling price ahead of time and protect against price declines. Mexico’s catastrophe bonds are another way to transfer risks of certain natural disasters to investors. If a specified catastrophe occurs, investors forgive the Mexican government’s debt. If the catastrophe does not occur, the government continues to pay out principal and interest, just as for an ordinary bond.

Budget provisions: Policymakers should incorporate in the budget expected costs of highly probable risks (for example, in the United States for credit guarantees and in Australia for student loan defaults); create a budget contingency for risks that are moderate and possible (for example, in the Philippines for natural calamities); and consider setting aside financial assets to meet the costs if larger risks materialize (for example, Chile’s stabilization fund, which accumulates money when copper revenues are high).

Accommodate residual risks: Some risks may be too large to cover, too costly to mitigate, or simply not precisely known. For example, some remote events (such as natural disasters that occur every hundred years) may be too costly to insure, or markets may not be liquid or deep enough for countries with large commodity exposures to hedge fully against all risk of a downturn in price. Governments should take these risks into account in setting long-term targets for government debt to allow a margin of safety while remaining within the debt levels defined by their fiscal rules. To get a sense of how big a margin is needed, it is useful to examine what potential swings in macroeconomic and fiscal variables could imply for the path of public debt. Because these variables cannot be predicted with certainty, countries might consider a probabilistic approach to predicting the path of public debt as a part of fiscal risk management (see box).

Forecasting in uncertain times

Most fiscal forecasts begin with a baseline scenario that uses specific macroeconomic assumptions—for example, for economic growth. If macroeconomic developments differ from those assumptions, public finances will be affected. To get a good sense of the possible outcomes, it is useful to construct fan charts, which show different probabilities for the path of the debt-to-GDP ratio from an initial starting point. The basis for the probable paths are econometric estimates of the relationship between different macroeconomic variables and how past fiscal policy has reacted to those changes. In general, countries that have experienced greater swings in macroeconomic and fiscal variables will have a wider range of potential outcomes and more uncertainty.

This information can be useful for countries in managing fiscal risks. In the chart, for example, in a country with a fiscal rule that limits its debt to 60 percent of GDP, the initial debt-to-GDP ratio is about 40 percent. In the baseline forecast, the debt-to-GDP ratio is assumed to be about the same over the next six years. Based on this projection it would seem a foregone conclusion that this country would be able to stay beneath that 60 percent ceiling. But given the past variability of the overall economic environment and its effect on fiscal outcomes, there is a 15 percent chance that the debt-to-GDP ratio will exceed the ceiling in six years. Policymakers could use this information to decide whether they need to lower their current 40 percent debt-to-GDP ratio to ensure that the country has enough of a safety margin to stay under the ceiling, taking into account the priorities of the government and how willing policymakers are to risk exceeding their debt ceiling.

Countries also must develop more sophisticated and integrated approaches to analyzing fiscal risks. Governments should build on conventional risk analysis tools, which tend to focus on the impact of plausible and discrete shocks, and periodically subject public finances to a fiscal stress test similar to those used to gauge the health of the banking system. These tests would enable authorities to assess the consequences of various types of shocks to key macroeconomic variables—such as interest rates, exchange rates, and housing prices. The authorities would have to take into account the interaction of the shocks and realization of related contingent liabilities on government liquidity, sustainability, and solvency. For example, fiscal stress tests could involve scenarios similar to what happened during the global financial crisis, when public finances were hit by the combined effects of a housing and financial crisis and a sharp economic slowdown. In a constellation of such shocks, spending for the social safety net can increase dramatically while national income, and thus tax revenues, fall sharply.

In designing strategies for managing fiscal risks, governments should also take into account the costs of mitigating them. This analysis must be informed by data on the probability of these risks, their macroeconomic consequences, and society’s preferences. Some countries may prefer spending programs with a near-term benefit for the population (such as public investment), rather than provisioning funds to help address the consequences of possible natural disasters. And in some cases, eliminating all risks may be undesirable. Ending all risks to the financial system, for example, might require deposit insurance and capital requirements that would unduly stifle lending and economic growth.

Priorities differ

Efforts to strengthen fiscal risk analysis and management should take into account differences in countries’ abilities to handle sophisticated monitoring and quantitative analysis of their fiscal risks.

For example, countries with limited capacity in this area should aim first to develop basic financial balance sheets, establish rules of thumb for public finance sensitivity to key macroeconomic variables, and better understand and disclose major contingent liabilities. Countries with higher capacity could focus on disclosing the size and probability of their contingent liabilities and on periodic stress tests to estimate their exposure to extreme events.

Fiscal risk mitigation strategies should also be tailored to capacity. Low-capacity countries should focus on limiting their exposure to guarantees, public-private partnerships, and other explicit contingent liabilities through direct controls and caps. Countries with higher capacity could make more effective use of regulations, incentives, and risk transfer instruments and recognize and provide for any remaining exposure to risk in their budgets and fiscal plans. ■

Benedict Clements is a Division Chief in the IMF’s African Department, Xavier Debrun is a Division Chief in the IMF’s Research Department, Brian Olden is a Deputy Division Chief and Amanda Sayegh is a Technical Assistance Advisor, both in the IMF’s Fiscal Affairs Department.

References

Bova, Elva, Marta Ruiz-Arranz, Frederik Toscani, and H. Elif Ture, 2016, “The Fiscal Costs of Contingent Liabilities: A New Dataset,” IMF Working Paper 16/14 (Washington: International Monetary Fund).

International Monetary Fund (IMF), 2016, “Analyzing and Managing Fiscal Risks—Best Practices,” IMF Policy Paper (Washington).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.