Whither Economic Growth?

Finance & Development, March 2017, Vol. 54, No. 1

The global optimism at the turn of the century has been replaced by fear of long-term stagnation

It seems like only yesterday that the so-called new economy was ascendant and growth expectations were buoyant. But today there is a widespread fear of a future of secular stagnation, in which very slow growth will be the new normal—especially in advanced economies. While it is clear that the turn-of-the-century optimism was not justified, it is also possible that today’s pessimism is excessive.

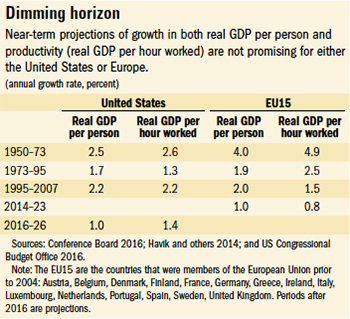

Current mainstream growth projections for the United States and the European Union over the medium term represent a marked slowdown from growth rates in the decades prior to the global financial crisis that began in 2008 (see table). Compared with 1995 to 2007, future US and European growth of real (after-inflation) GDP per person is expected to diminish by half, or worse. In each case, a serious weakening of growth in labor productivity (output per hour worked) is expected. Compared with the golden age of the 1950s and 1960s, the slowdown is even more pronounced, especially for Europe.

Slower growth in Europe and the United States has mixed implications for growth prospects in developing economies. Most obviously, on the negative side, it means less demand for these countries’ exports, so models of development based on export-led growth may need to be rethought. The slowdown may also reduce the availability of new technology across the world. On the other hand, it may imply a lengthy period of low real interest rates and redirection of capital flows away from advanced economies toward emerging markets with more promising investment opportunities. That could mean a continuation of rapid catch-up growth and a faster rise in their share of world GDP.

Inaccurate predictions

It is, of course, not unknown for economists to make inaccurate predictions about future growth or to be slow to appreciate the scope for improved performance of productivity. Alvin Hansen, the founding father of the idea of secular stagnation, is a spectacular example. In his 1938 presidential address to the American Economic Association, he said technological progress was too weak to generate economic growth at a rate that would encourage investment and avert a future of sustained high unemployment. In fact, the halcyon period of US economic growth during the postwar economic boom was on the horizon. Even as Hansen was wringing his hands the economy was experiencing very rapid growth in total factor productivity—the portion of economic growth not explained by increases in capital and labor inputs and that reflects such underlying societal factors as technology and efficiency. Nearly half a century later, in 1987, on the eve of the revolution in information and communication technology, another leading US economist, Robert M. Solow (see “Residual Brilliance” in the March 2011 issue of F&D), lamented that “you can see the computer age everywhere but in the productivity statistics.”

Today’s pessimism, including a revival of Hansen’s secular stagnation thesis (see “Sluggish Future” in this issue of F&D) is based on the recent history of growth performance. For both the United States and Europe, empirical economic analyses show that before the global economic crisis there was a marked decrease in the trend of productivity growth. Productivity growth is crucial to increasing economic output per capita and the overall standard of living. Although there are reasons to think that some of the gains from digital technology are not captured well by GDP and other national income accounts, there is clear agreement among experts that slower growth in the United States is not a statistical artifact but a real phenomenon—more than a temporary symptom of the recent global economic crisis. This is largely because the output that is missing—the gap between today’s GDP and predictions of what it should be based on earlier estimates of trend growth—is at least 20 times greater than most estimates of the consumer welfare gains that conventional national income accounting fails to identify. Still, there is a glimmer of hope. The precedent of the Great Depression years—when total factor productivity growth of 1.9 percent a year underpinned labor productivity growth of 2.5 percent a year between 1929 and 1941—shows that severe banking crises do not necessarily preclude rapid increases in productivity when the national innovation system is strong.

The future of income growth in the United States looks even less promising than that of labor productivity. Whereas growth of real GDP per person in the 40 years before the recent global crisis typically exceeded that of labor productivity, in the future the opposite will likely be the case. This outcome is predicted on the basis of an aging population (which usually presages declining productivity), limited potential for more people in the workforce, and a significant slowing in the rate of improvement of labor quality that arises from increases in educational attainment.

Innovation is the foundation of rapid growth in labor productivity. From the 1920s through the 1960s, well-known inventions such as electricity and the internal combustion engine had a major impact, but the key characteristic of the US economy was that productivity growth based on better technology was widespread, including major changes in office work and retailing as well as the mechanization of factories. In the recent past, information and communication technology made a stellar contribution to productivity growth in a relatively short time span—but it did not match the combined effect of the earlier advances. Indeed, a key message from empirical analyses of US growth performance is that the impact of technological progress on productivity growth has not disappeared but is now much weaker than at its zenith in the mid-20th century. For example, the growth in total factor productivity for the next 10 years projected by the US Congressional Budget Office is about half the rate achieved in the 1930s.

US growth could exceed expectations

This type of empirical analysis, however, is inherently backward looking. It is possible that a forward-looking approach could give a more optimistic view of future US growth prospects. There are at least three reasons to think so. First, in a world where artificial intelligence is progressing rapidly and robots will be able to replace humans in many tasks—including in low-wage service sector jobs that once seemed out of the reach of technological advances—another surge of labor productivity growth may be possible. If, as some estimates claim, about 40 percent of work is amenable to computerization within 20 to 25 years (Frey and Osborne 2013), this could underpin a return to labor productivity growth above 2 percent a year. Second, the rise of China could boost world research and development intensity considerably. Britain switched from its 19th century role as the leading exporter of new technology to 20th century reliance on technology transfer from the rest of the world, especially the United States. A similar transition of roles between China and the United States does not seem beyond the realm of possibility within the next few decades. Third, the information and communication technology revolution—by reducing the cost of accessing knowledge and greatly enhancing the scope for data analysis, which is the cornerstone of scientific advancement—paves the way for discovery of useful new technology. There has, in fact, been significant technological progress in the research and development sector.

In contrast, for Western Europe the narrative is about catch-up growth rather than the rate of cutting-edge technological progress. From the middle of the 20th century to the recent global crisis, this experience comprised three distinct phases. The first, which ended in the early 1970s, saw rapid catch-up growth, and Europe quickly narrowed the gap with the United States both in income and productivity. During the second phase, from the early 1970s to the mid-1990s, European growth slowed markedly, and catch-up in terms of real GDP per person ground to a halt. That was the result of a decline in work hours and employment despite strong growth in labor productivity and an ever smaller gap with the United States in real GDP per hour worked. However, in the third phase, from the mid-1990s to the crisis, European productivity growth did not keep up with the United States and, rather than catching up, Europe steadily fell behind. The upshot is that in 2007 the income level of the original 15 members of the European Union (the so-called EU15—Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, United Kingdom) was slightly lower relative to that of the United States than it had been in 1973.

Social capability is key

European medium-term growth prospects depend both on how fast productivity grows in the United States and whether catch-up growth can resume after a long hiatus. Economic historians see social capability as a key determinant of success or failure in catch-up growth. Social capability can be thought of as the incentive structures, such as regulation and taxation, that influence the investment and innovation decisions that allow businesses to effectively assimilate the technology developed by leaders (such as the United States) and to eliminate inefficiency. To sustain social capability as development progresses generally entails reforms of institutions and policies, such as capital-market rules and barriers to new entry in markets, which may prove politically challenging. Moreover, social capability varies with the technological epoch—institutional and policy settings that worked perfectly well for the transfer of assembly-line manufacturing technology may fall short when it comes to diffusing information and technology advances in market services.

Rapid growth during the European golden age of the 1950s and 1960s benefited from postwar reconstruction, the movement of labor from agriculture to manufacturing, European economic integration, and patient capitalism, that is, placing a large weight on long-term real returns rather than tomorrow’s share price. Each of these had disappeared, or at least been greatly weakened, by the late 20th century. The postwar political agreements and corporatist structures that underpinned the reconstruction of the European economy implied not only much larger social transfers—which eventually generated substantially higher direct taxes that distorted economic behavior—but also bequeathed a legacy of high regulation for most EU countries.

In the years before the 2008 crisis, when Europe was no longer catching up but falling behind the United States, an American diagnosis of the reasons for this turn of events gained wide currency. Put simply, it said that Europe suffered from too little competition, too much taxation, and too much regulation—which impaired social capability. This was hardly a new turn of events—many European countries had arguably been in this position for some time, which had not prevented (but may have slowed) them from catching up. However, with the arrival of disruptive new information and communication technology—whose productivity gains depended on businesses’ reorganization—employment protection and product market regulation were bigger handicaps. It was not that Europe became more heavily regulated, but that the existing regulation was more costly. In service-oriented economies, even more critical were the forces of creative destruction, which replace less efficient firms and old technology with those that are new and more efficient. These forces were weaker in Europe than in the United States. Much of the remaining productivity gap, especially in southern Europe, stemmed from less efficient allocation of resources—in particular, from a surviving long tail of low-productivity businesses.

Mixed prognosis

The prognosis for growth in the EU15 is mixed. The good news is that productivity is still rising in the United States, even though it has slowed, and that catch-up growth is still possible. When the Organisation for Economic Co-operation and Development (OECD) made long-term potential growth projections in 2014 (using a forward-looking approach that embodied a catch-up growth model rather than extrapolating recent trends), it envisioned potential EU15 labor productivity and real GDP per person growth of 1.6 percent and 1.5 percent a year, respectively, between 2014 and 2030. This is clearly much more bullish than the extrapolation of recent trends by the European Commission.

However, the bad news is that to achieve the outcome projected by the OECD, significant supply-side (structural) reform would be required. It is not difficult to construct a list of reforms that could be expected to deliver the projected result. Both the OECD and the European Commission have undertaken such exercises. Strengthening competition, reforming taxation, and reducing regulation could play a big part—together with full implementation of the European Union’s declared intention to create a single European market in services by eliminating the trade costs associated with different regulations and other barriers to entry for EU suppliers. But the very bad news is that the already difficult politics of such reforms have been further complicated by rising populism and ebbing support for the market economy throughout Europe. The British vote to exit the European Union is a good example.

In summary, the productivity slowdown in the United States is real and predates the crisis, but it is not necessarily permanent. Technological progress is central to future productivity growth but is, as always, unpredictable. With significant supply-side reform, Europe could grow faster than the United States, but this seems unlikely under current circumstances. Indeed, as with information and communication technology, Europe may well struggle to exploit the potential of new technology on the horizon and fall further behind the United States. ■

Reference

Conference Board. 2016. The Conference Board Total Economy Database, May.

Frey, Carl Benedikt, and Michael A. Osborne. 2013. “The Future of Employment: How Susceptible Are Jobs to Computerisation?” Unpublished, Oxford Martin School, Oxford,United Kingdom.

Havik, Karel, Kieran McMorrow, Fabrice Orlandi, Christophe Planas, Rafal Raciborski, Werner Röger, Alessandro Rossi, Anna Thum-Thysen, and Valerie Vandermeulen. 2014. “The Production Function Methodology for Calculating Potential Growth Rates and Output Gaps.” European Economy Economic Papers 535, European Commission, Brussels.

US Congressional Budget Office. 2016. “An Update to the Budget and Economic Outlook, 2016 to 2026.” Washington, DC, August. www.cbo.gov/publication/51908.