Picture This

Labor’s Losses

Finance & Development, September 2017, Vol. 54, No. 3

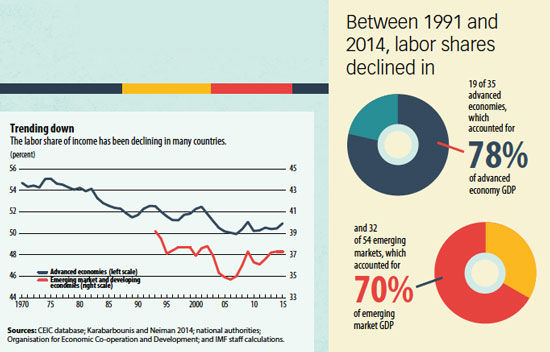

Workers are taking home a smaller slice of the pie

The labor share of income—the fraction of national income paid to workers in wages and benefits—has been declining around the world. At the same time, capital has been accumulating a growing portion of income. Because capital ownership is concentrated among the wealthiest households, an increase in the capital share of income tends to worsen income inequality.

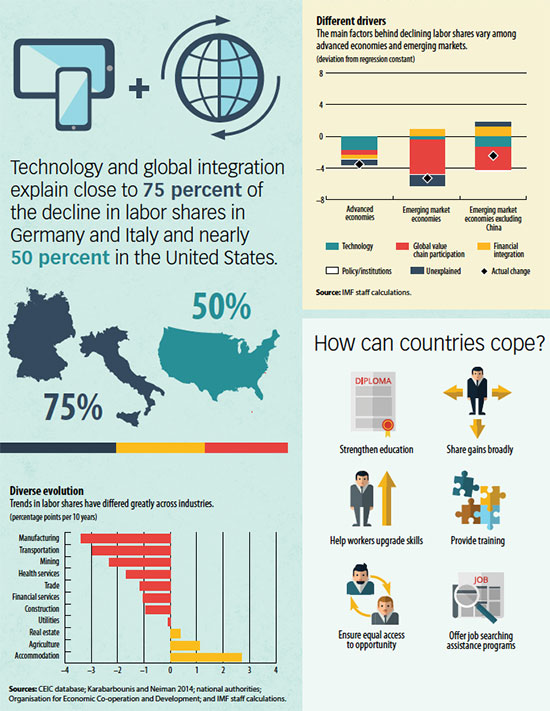

The main factors behind this phenomenon vary across countries. In advanced economies, about half of the decline is attributable to technology as rapid advances in information technology have led to automation of many occupations. In emerging markets, global integration—specifically participation in global value chains—is the key driver. Global integration has lifted millions from poverty by raising productivity, growth, and living standards, and it has also shifted emerging market and developing economies toward more capital-intensive activities. Labor-intensive jobs in advanced economies are frequently offshored to emerging markets, where the same tasks are relatively capital intensive. And this relocation raises capital shares in both sending and receiving economies.

In emerging markets, the decline in labor shares does not necessarily require policy intervention, as the effects of global integration have been largely beneficial. Advanced economies facing disruptions from technological progress, however, should invest in education, skills upgrades, and policies that help match displaced workers with new jobs. Policies that promote development of more advanced skills would also help prepare workers in both advanced economies and emerging markets for the potential disruptions of the future.

MARIA JOVANOVIĆ is on the staff of Finance & Development. Text and charts based on chapter 3 of the IMF’s April 2017 World Economic Outlook.