Beyond the Household

Finance & Development, September 2013, Vol. 50, No. 3

Ralph Chami and Connel Fullenkamp

Remittances that migrants send home to their families also have a major impact on the overall economy

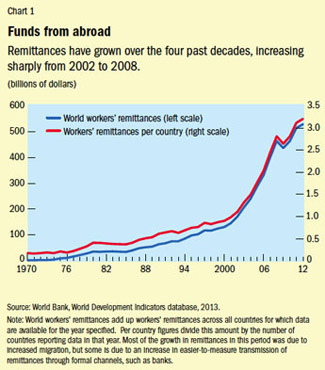

Remittances—private income transfers from migrants to family members in their home country—are good news for the families that receive them. Often sent a few hundred dollars at a time, the remittances increase disposable income and are generally spent on consumption—of food, clothing, medicine, shelter, and electronic equipment. They have been growing for decades (see Chart 1). Remittances help lift huge numbers of people out of poverty by enabling them to consume more than they could otherwise (Abdih, Barajas, and others, 2012). They also tend to help the recipients maintain a higher level of consumption during economic adversity (Chami, Hakura, and Montiel, 2012). Recent studies report that these flows allow households to work less, take on risky projects they would avoid if they did not receive this additional source of income, or invest in the education and health care of the household. In other words, remittances are a boon for households.

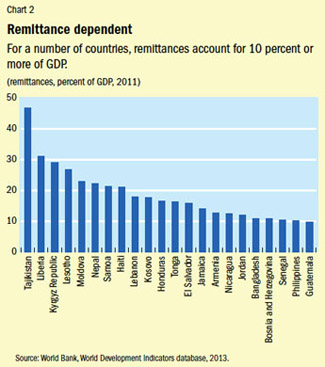

But what is good for an individual household isn’t necessarily good for an entire economy. Whether remittances are also good for the economies that receive them is an important question because remittances are one of the largest sources of financial flows to developing countries. In 2012, workers sent home an estimated $401 billion or more through official channels, and it is likely that billions more were transferred through unofficial ones. These flows are often large relative to the economies that receive them. In 2011, for example, remittances were at least 1 percent of GDP for 108 countries; and 5 percent of GDP or more for 44 countries. For 22 countries, remittances represented 10 percent or more of GDP (see Chart 2). Moreover, remittance flows are typically stable and, from the perspective of the recipient, countercyclical—helping offset a turn of bad luck.

It is not only important to examine whether remittances have a positive or a negative impact on the overall (or macro) economy. Because policymakers and international organizations have come to view these flows as a possible source of funding for economic development, it is also important to examine whether remittances do, indeed, facilitate economic development and, if so, how. For example, have some countries that receive a great deal of remittances been able to develop faster as a result? This article assesses the macroeconomic effects of these flows, highlighting issues in managing their effects and providing policy advice on how to harness their developmental potential. Finding answers is not straightforward, because remittances affect an economy in many different ways. And, ultimately, their net effect depends on how they are used by the recipients.

A source of government revenue

Besides households, there is one other economic actor that benefits from remittances and whose actions are important to the economy—the government. Recently, Abdih, Chami, and others (2012) showed that remittances spent on the consumption of both domestically produced goods and imports increase the tax base, which in turn increases revenues from sales taxes, value-added taxes, and import duties. In other words, remittances can provide much-needed fiscal space—which allowed some countries to increase spending, lower taxes, or both, to fight the effects of the recent global recession.

As we have suggested, the economic impact of remittances depends in part on how governments choose to use them. For example, Chami and others (2008) showed that governments can sustain higher levels of debt when the ratio of remittances to domestic income is high—which reduces country risk. Indeed, the IMF and the World Bank (2009) recently recognized the increased significance of remittances as a stable and countercyclical source of external financing in its assessment of how much debt low-income countries can safely handle. Remittances enable countries to borrow more, which permits them to use that extra borrowing power to fund investments that facilitate economic growth.

On the other hand, Abdih, Barajas, and others (2012) have found evidence that remittances hurt the quality of institutions in recipient countries, precisely because they increase the ability of governments to spend more or tax less. By expanding the tax base, remittances enable a government to appropriate more resources and distribute them to those in power. At the same time, remittances mask the full cost of government actions. Remittances can give rise to a moral hazard problem because they allow government corruption to be less costly for the households that receive those flows. Recipients are less likely to feel the need to hold the authorities accountable, and, in turn, the authorities feel less compelled to justify their actions. This reduces the likelihood that the fiscal space created by remittances will be used for productive social investments. In other words, the interactions that determine the impact of remittances on the overall economy are complex, which is why it is difficult to make generalizations regarding their net effects.

The business cycle

The complex effect of remittances on the economy is also apparent when the business cycle is taken into account. Because remittances increase household consumption, fluctuations in remittance flows can cause changes in output in the short term. But a shock that reduces economic output is also likely to induce workers abroad to send more remittances home, which then has the effect of reducing output volatility (Chami, Hakura, and Montiel, 2012).

However, the increase in remittances is also likely to weaken the incentive to work, which could lead to a more volatile business cycle.

Recipient countries also are affected by economic conditions in the countries that are the sources of remittances. Barajas and others (2012) showed that remittance flows increase the simultaneous occurrence of business cycles in remittance-sending and remittance-receiving countries. This effect is likely to be especially pronounced during economic downturns in the sending countries, which tend to be wealthier than the recipient countries.

So, again, the evidence is mixed. Remittances do stimulate consumption, which for some economies will help reduce the size of the swing between recession and growth by putting a floor under total demand. But for other economies, remittances may increase the severity of business cycles, by inducing workers to stay home when the economy turns down, as well as by linking the business cycles of some developing economies more strongly to the business cycles of remittance-sending countries.

Remittances and growth

Over the past decade, the most studied aspect of remittances has been their impact on economic growth, partly because of the policy importance of this issue and partly because of the many and complex ways remittances might affect economic growth. A useful way to organize the large and diverse body of findings on this question is to use a growth-accounting approach in which the effect of remittances on capital accumulation, labor force growth, and total factor productivity (TFP) growth is studied. TFP is essentially growth that is not accounted for by increases in traditional inputs such as labor and capital and encompasses such things as technology and finance.

Capital accumulation: Worker remittances can affect the rate of capital accumulation in recipient economies in various ways. First, they can directly finance investment. Remittance inflows can also facilitate the financing of investments by improving the creditworthiness of households, effectively augmenting their capacity to borrow. Remittances may also reduce the risk premium that lenders demand, because they reduce output volatility.

But if remittances are perceived to be permanent income, households may spend them rather than save them—significantly reducing the amount of flows directed to investment. And, in fact, the amount of remittances devoted to investment tends to be low. For example, remittance flows into the Middle East and North Africa region fuel the consumption of domestic and foreign goods, with very little going to investment. In addition, many households save part of the remittances by purchasing assets such as real estate, which generally doesn’t increase the capital stock.

Remittances could stimulate increases in so-called human capital by enabling younger members of a household to continue schooling rather than having to work to contribute to household income. For example, evidence from the Philippines and from Mexico suggests that receiving remittances leads to increased school attendance. However, that extra education would likely have little effect on domestic economic growth if it simply makes it possible for the recipients to emigrate.

Labor force growth: Remittances may also influence growth by affecting the rate of growth of labor inputs. One channel through which remittances could affect labor inputs is in labor force participation—the percentage of the population that is working or seeking work. But as has been noted, those effects can be negative. Remittances enable recipients to work less and maintain the same living standard, regardless of how the distant sender intended them to be used (say, to increase household consumption or investment). Anecdotal evidence of this negative labor effort effect is abundant, and academic studies have detected such an effect as well. Thus, remittances appear to serve as a drag on labor supply.

Total factor productivity: Researchers have identified two main ways through which remittances may affect the growth of TFP. First, remittances may enhance the efficiency of investment by improving domestic financial intermediation (channeling funds from savers to borrowers). That is, they may affect the ability of the recipient economy’s formal financial system to allocate capital. For example, remittances may help GDP growth when the financial markets are relatively underdeveloped because remittances loosen the credit constraints imposed on households by a small financial sector. In addition, regardless of the state of the financial sector’s development, remittances are likely to increase the amount of funds flowing through the banking system. This, in turn, may lead to enhanced financial development and thus to higher economic growth through increased economies of scale in financial intermediation.

The business cycle

A second way remittances may affect TFP growth is through the exchange rate. Barajas and others (2011) have shown how remittances can lead to real exchange rate appreciation, which in turn can make exports from remittance-receiving countries less competitive. The industries or companies that produce the exports may be transferring know-how to the rest of the economy or providing opportunities for other local companies to climb up the value chain. This is often the case, for example, with manufacturing. Therefore, if these companies become less competitive owing to exchange rate changes (which are themselves caused by remittances), then these firms must scale back or close, and their beneficial impact on productivity is reduced.

There have been many attempts to estimate the impact of remittances on growth. The earliest such study—by Chami, Fullenkamp, and Jahjah (2005)—found that whereas domestic investment and private capital flows were positively related to growth, the ratio of workers’ remittances to GDP either was not statistically significant or was negatively related to growth. Since then, many studies have been performed, and their main findings vary widely. Some find remittances help growth and others find they hurt growth—and some find no discernible effects. When a positive effect of remittances on growth is found, it tends to be conditional, suggesting that other factors must be present for remittances to enhance economic growth. For example, some studies have found that remittances tend to boost economic growth only when social institutions are better developed.

Perhaps most disappointing is the lack of a remittances-growth success story: a country in which remittances-led growth contributed significantly to its development. Given that in some countries remittances exceeded 10 percent of GDP for long periods of time, one would have hoped to find at least one example of remittances serving as a catalyst for significant economic development. It is worth noting, however, that researchers have also failed to find clear and consistent evidence that other financial flows, such as capital flows and official aid, enhance economic growth and development.

Whither remittances?

The mixed evidence regarding the macroeconomic impact of remittances reflects a number of underlying truths about their role in an economy. First, they are unequivocally good for recipient households because they alleviate poverty and provide insurance against economic adversity. Second, there are many different paths through which remittances affect an economy. Third, none of these paths is necessarily active at any given time—that is, many economic and social conditions determine whether any given path is active or significant. And, finally, many of these paths have opposing or conflicting economic effects.

These realities shape the challenge faced by policymakers who wish to maximize the development potential of remittances. To make the most of remittances, governments will have to strengthen or facilitate the channels through which remittances benefit the overall economy while limiting or weakening others. This task is challenging not only because economists still do not fully understand all the ways that remittances affect the economy, but also because this task may put policymakers in conflict with households, which are used to utilizing remittances in particular ways. Nonetheless, there are several promising approaches for policy.

Each country wishing to make better use of remittances must study how the recipients actually use them. This is essential to ensuring that policymakers understand the specific obstacles that prevent remittances from being used to facilitate development, and the kinds of development-friendly activities (such as education, business formation, or investment) remittance recipients would be most likely to engage in. Obstacles to using remittances for development and opportunities for such use are likely to vary with the particular economic, social, and legal environment of each country.

Policymakers must take advantage of the fiscal space created by remittance flows by investing more in social institutions and public infrastructure. For example, the increased tax revenues that remittances generate can finance initiatives to increase the professionalism of civil servants and improve the enforcement of rules and regulations. Likewise, the government can take advantage of its increased borrowing capacity to finance improvements in infrastructure. One potential use would be to upgrade a country’s financial system at all levels, including improvements in the payment system, availability of banking services, and financial literacy.

Policymakers must design programs that are responsive to the needs of individual households and that give recipients the proper incentives to use remittances productively. Promoting the acceptance of remittance income as collateral for private loans used to finance productive investments is one way to direct remittance income into growth-enhancing investments. In addition, governments could subsidize education or business loans for which remittances are pledged as collateral. Policymakers will have to work closely with remittance recipients—and senders—to make these efforts work.

Increasing globalization and demographic changes, such as the aging of developed-economy workforces, mean that remittances are likely to increase in size and importance in the future. It is clear that remittances improve the welfare of households that receive them and, as such, should be encouraged. But, to be more helpful to recipient economies, governments must design policies that promote remittances and increase their benefits while limiting or offsetting any counterproductive side effects. Getting the most value possible out of remittances will require significant, thoughtful effort from national governments and the assistance of international organizations. For example, a review of governance and institutional quality is routinely undertaken as a part of the IMF’s annual consultations. The incentive effects of remittance flows suggest that such reviews are of particular importance in remittance-receiving economies. Efforts like these enable countries to tailor their development strategies to the role that remittances actually play, which in turn increases the chance that they can be utilized to enhance development and growth. ■

Ralph Chami is a Division Chief in the IMF’s Middle East and Central Asia Department, and Connel Fullenkamp is a Professor of Economics at Duke University.

References

Abdih, Yasser, Adolfo Barajas, Ralph Chami, and Christian Ebeke, 2012, “Remittances Channel and Fiscal Impact in the Middle East, North Africa, and Central Asia,” IMF Working Paper 12/104 (Washington: International Monetary Fund).

Abdih, Yasser, Ralph Chami, Jihad Dagher, and Peter Montiel, 2012, “Remittances and Institutions: Are Remittances a Curse?” World Development, Vol. 40, pp. 657–66.

Barajas, Adolfo, Ralph Chami, Christian Ebeke, and Sampawende Tapsoba, 2012, “Workers’ Remittances: An Overlooked Channel of International Business Cycle Transmission?” IMF Working Paper 12/251 (Washington: International Monetary Fund).

Barajas, Adolfo, Ralph Chami, Dalia Hakura, and Peter Montiel, 2011, “;Workers’ Remittances and the Equilibrium Real Exchange Rate: Theory and Evidence,” Economia, Vol. 11, pp. 45–94.

Chami, Ralph, Adolfo Barajas, Thomas Cosimano, Connel Fullenkamp, Michael Gapen, and Peter Montiel, 2008, Macroeconomic Consequences of Remittances, IMF Occasional Paper 259 (Washington: International Monetary Fund).

Chami, Ralph, Connel Fullenkamp, and Samir Jahjah, 2005, “Are Immigrant Remittance Flows a Source of Capital for Development?” IMF Staff Papers, Vol. 25 (Washington: International Monetary Fund).

Chami, Ralph, Dalia S. Hakura, and Peter J. Montiel, 2012, “Do Worker Remittances Reduce Output Volatility in Developing Countries?” Journal of Globalization and Development, Vol. 3, pp. 1–25.

International Monetary Fund, and World Bank, 2009, A Review of Some Aspects of the Low-Income Country Debt Sustainability Framework (Washington).