|

The IMF and Africa Overview

Africa seeks to lay foundation for growth

Listening and dialogue increasingly define IMF relations with African

countries and civil society. The IMF has been actively seeking out the

opinions of African heads of state, public officials, business and labor

representatives, and civil society and has been translating this advice

into streamlined conditionality and stronger national ownership of reform

programs (see "Conditionality").

|

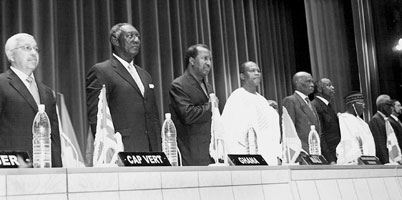

| (From left) Presidents of Cape Verde, Pedro Pires;

Ghana, John Kufuor; Mali, Alpha Omar Konare; ECOWAS executive secretary

Mohamed Chambas; presidents of Senegal, Abdoulaye Wade; Ivory Coast,

Laurent Gbagbo; Nigeria, Olusegun Obasanjo; and Benin, Mathieu Kerekou,

meet for a regional summit of the New Partnership for Africa’s

Development (NEPAD), May 2002. |

For example, the pursuit of national ownership has been central to

the poverty reduction strategy paper (PRSP) process, which has just

undergone a thorough review (see "Poverty reduction").

And the IMF and the World Bank are working hard to make the enhanced

Heavily Indebted Poor Countries Initiative a success—to provide

deeper, broader, and faster debt relief to eligible countries and to

strengthen the links between debt relief, poverty reduction, and social

policies (see "Debt strategy"). There is

also greater recognition that good economic advice cannot be separated

from an understanding of national political processes and the social

dimension of development.

| Strength of global economic recovery

in doubt |

|

At the time of the terrorist attacks

in the United States on September 11, 2001, global

economic growth was sluggish, but the slowdown that

had begun in mid-2000 appeared to be close to bottoming

out. Some major countries—the United States,

Japan, and Germany—were in or near recession,

but some others—China, India, and Russia—continued

to experience robust growth.

The terrorist attacks sparked new

uncertainties, but the immediate economic effects

of the attacks turned out to be moderate. By early

2002, it seemed that a global economic recovery, led

by the United States, was under way. By mid-2002,

however, weaknesses in emerging markets, as well as

in mature equity markets, indicated increased risk

aversion among investors. This sentiment, in turn,

raised questions about the strength of the recovery.

The financial difficulties experienced by some emerging

market economies, particularly in Latin America, meanwhile

pointed to the importance of the IMF’s continuing

work to prevent and resolve crises.

This annual IMF Survey Supplement

describes the institution’s policies and operations

against the background of global economic and financial

developments. It is updated each year to reflect any

changes prompted by world events. The section on the

IMF and Africa (see "The IMF and

Africa Overview" )

represents a new feature of the IMF Survey Supplement.

In future years, the feature will continue to showcase

areas in which the IMF has devoted considerable attention

in the year under review.

|

|

|

Increasingly, the IMF sees that progress in African countries can show

the way forward. Notably, African leaders themselves have designed and

will carry out the New Partnership for Africa’s Development (NEPAD),

a plan to revive the continent and end its marginalization. Under NEPAD,

African countries have committed themselves to encouraging peace, democracy,

and good governance; designing and implementing action plans to develop

the key pro-poor sectors of health care, education, infrastructure,

and agriculture; achieving economic integration at the regional and

global levels by building a strong private sector and fostering a climate

conducive to domestic and foreign investment; and developing more productive

partnerships with Africa’s bilateral and multilateral development

partners.

|

| Kenyan entrepreneurs have launched East Africa’s

first Internet coffee auction. |

The IMF is committed to supporting NEPAD wholeheartedly. Recognizing

that the biggest obstacle encountered by African economies striving

for sustainable growth often is not lack of political will but lack

of capacity, the IMF will set up Africa Regional Technical Assistance

Centers (AFRITACs) in Abidjan and Dar es Salaam as part of its commitment.

Through the AFRITACs, IMF resident experts and short-term specialists

will help West and East African countries build local capacity for economic

and financial management. Working closely with the World Bank, the African

Development Bank, and donors, the IMF will focus on its core expertise—including

macroeconomic policy, tax policy and revenue administration, public

expenditure management, financial sector policies, and macroeconomic

statistics. These AFRITACs, to begin operating later this year, are

the first of five such centers eventually envisaged for the region.

|

| Ghana is promoting high-tech development to reduce

its dependence on mining and agriculture. |

Given its ability to generate income and reduce aid dependency, trade

is an important avenue for self-help, which is the cornerstone of NEPAD

and a major weapon in the international community’s fight against

poverty. Increased and better-coordinated support from rich countries

in the form of more generous aid flows is also a major component of

the poverty-fighting arsenal. The IMF continues to be an advocate for

industrial countries to increase development assistance to poor countries

with strong policies and to open their markets by phasing out trade-distorting

subsidies and other trade barriers.

The IMF also supports stronger implementation of African regional initiatives

as a way to increase access to markets both inside and outside Africa,

improve competitiveness, and promote economic growth. NEPAD identifies

regional cooperation and integration as key conditions that must be

present in order for Africa to develop (see box).

|

| This medical center in Burkina Faso exemplifies

one country’s efforts to develop health care under NEPAD. |

Implementing the “Monterrey Consensus,” which emerged from

the International Conference on Financing for Development held in Monterrey,

Mexico, in March 2002 (see box), is an important

next step in the international community’s efforts to improve living

conditions in Africa. The IMF remains committed to contributing to this

global effort—through its economic policy advice and financial

and technical assistance.

| Supporting regional integration |

|

Eastern and southern Africa

In eastern and southern Africa, regional integration

is being fostered by several subregional arrangements

that have overlapping country membership. Among these

are the Southern African Development Community (SADC),

which is starting to phase in a free trade area set

for 2008; the Common Market for Eastern and Southern

Africa (COMESA), which established a free trade area

between nine of its members in 2000 and plans a customs

union in 2004; the Southern African Customs Union

(SACU); and the East African Community (EAC), which

is planning to implement a free trade area and common

external tariff in 2004. Long-term objectives for

both COMESA and EAC include a common currency and,

for SADC, the formulation of guidelines for the convergence

of macroeconomic policies and the promotion of economic

stability.

The IMF is providing analytical support

and advice to the secretariats of SADC and COMESA

on trade and macroeconomic issues, as well as on financial

sector modernization and reform, macroeconomic statistics,

and the fiscal impact of trade reform. The IMF also

supports the work of the Regional Integration Facilitation

Forum (RIFF), particularly in its efforts to promote

economic reform, coordinate the activities of the

regional integration arrangements, and conduct peer-group

surveillance of macroeconomic and associated policies

in the region.

West Africa

Integration efforts in West Africa are subdivided

into two zones under the umbrella of the 27-year-old

Economic Community of West African States (ECOWAS),

which has 14 members. Its progress toward regional

integration has lagged behind stated aims, however.

In particular, the notional free trade zone is ineffective.

Eight ECOWAS members belong to a smaller

regional grouping, the West African Economic and Monetary

Union (WAEMU), within which the CFA franc is the common

currency. WAEMU’s CFA franc is issued by a common

central bank, the Banque Centrale des Etats de l’Afrique

de l’Ouest (BCEAO), and has been pegged to the

French franc since 1948 and at the French franc/euro

conversion rate since 1999. Of all the regional groupings

in Africa, WAEMU is the furthest along the path toward

integration. In addition to successfully maintaining

their 52-year-old currency union, WAEMU members have

implemented macroeconomic convergence criteria and

an effective surveillance mechanism, adopted a customs

union and common external tariff (in early 2000),

harmonized indirect taxation regulations, and initiated

regional structural and sectoral policies.

The IMF has granted significant technical

assistance to WAEMU and its institutions, as well

as analytical support and advice on macroeconomic,

fiscal, and trade policy and on financial sector modernization

and reform. Since 1999, WAEMU has benefited from formal

discussions to supplement the Article IV consultations

with member countries.

The other six ECOWAS members decided

in 2000 to form a second monetary zone (the West African

Monetary Zone—WAMZ) by 2003 and to merge this

zone with WAEMU’s monetary zone by 2004. The

IMF is providing technical assistance to the WAMZ

project, including in statistical/data management

and training for the West African Monetary Institute

(WAMI)––a transitional institution intended

to pave the way for a common central bank. On a policy

level, the IMF believes that the convergence among

WAMZ member economies is not strong enough to adhere

to the declared time frame for achieving a monetary

union.

Central Africa

Integration in Central Africa is concentrated on the

Central African Economic and Monetary Community (CEMAC),

which groups six countries. CEMAC’s common currency,

also the CFA franc, is issued by the Banque des Etats

de l’Afrique Centrale (BEAC). It has been pegged,

like WAEMU’s CFA franc, to the French franc since

1948 and at the French franc/euro conversion rate

since 1999. Despite this notable progress in maintaining

a long-standing currency union, CEMAC’s integration

efforts in other areas are not very advanced. A common

external tariff introduced in 1994 has not been fully

implemented, and progress in harmonizing tax policies

and adopting common sectoral and structural policies

has been slow.

Over the years, the IMF has furnished

technical assistance to CEMAC and its institutions,

as well as analytical support and advice on macroeconomic,

fiscal, and trade policy and on financial sector modernization

and reform. Since 1999, formal regional discussions

have been held to supplement the Article IV consultations

with individual member countries.

|

|

|

Advisory councils launched

Improving Africa's investment climate

Earlier this year, a joint initiative by IMF Managing Director Horst

Köhler and World Bank President James Wolfensohn came to fruition

with the inauguration of Investment Advisory Councils (IACs) in Ghana

and Tanzania. These councils are intended to promote dialogue between

the government and senior executives of local and international companies

on ways to improve the investment climate.

Ghana’s IAC was launched in May 2002 under the chairmanship of

President John Kufuor, who was joined by Köhler and senior Ghanaian

and foreign business executives. At its inaugural meeting, the council

identified a number of priority areas for government action, including

regulatory reforms related to land ownership and mining and labor laws;

safety and security; infrastructure, especially for energy, telecommunications,

and information technology; financial services infrastructure; public

sector sensitivity to the private sector; restoration of competitiveness

to the mining sector; the economy’s dependence on aid and commodity

exports; and the need for a partnership among government, private sector

industries, and labor. The council will convene again in November to

assess progress and update its recommendations.

The Tanzania Investors’ Round Table, chaired by President Benjamin

Mkapa, held its opening meeting in July 2002 in the presence of Wolfensohn.

Preparations for creating the Investment Advisory Council in Senegal

before the end of the year are well under way, and several other African

countries have expressed interest in launching their own IACs.

IMF and World Bank staff plan to attend future IAC meetings as observers

and offer assistance and support where needed. The two institutions’

resident offices stand ready to cooperate with IAC working groups and

provide information. The IMF and the Bank will also consider any technical

assistance requests related to the councils’ work, especially for

follow-up implementation needs and capacity building in their respective

areas of expertise.

| The Monterrey Consensus |

|

The UN International Conference on

Financing for Development marked an important milestone

for the partnership on global development. Held March

18–22, 2002, in Monterrey, Mexico, the conference

brought together more than 50 heads of state, 300

ministers, and representatives of international organizations,

civil society, and businesses to agree on a common

vision of what is required to overcome world poverty.

The conference was widely seen as

a success, and the participants adopted the Monterrey

Consensus, a plan for sustainable development that

defines development priorities and how to achieve

them. Although broad development objectives—such

as halving poverty by 2015 and achieving universal

primary education—had been defined at the Millennium

summit, a UN-sponsored conference held two years ago,

the Monterrey Consensus focuses on how best to finance

the measures taken toward these goals.

The consensus calls for a partnership

between developing and developed countries, based

on a mutually accountable commitment to promoting

growth and reducing poverty. The developing countries

must take the initiative to improve governance, pursue

appropriate policies, strengthen domestic financial

systems, invest in economic and social infrastructure,

and provide a transparent, stable environment for

potential investors. The developed countries, for

their part, must match these efforts by boosting aid;

reducing barriers to free trade; pursuing debt-relief

measures, such as the full implementation of the enhanced

Heavily Indebted Poor Countries Initiative; and helping

developing countries build capacity, in terms of both

institutions and human capital.

The IMF and other international financial

institutions have a coordinating and regulating role

to play in the partnership. They can also encourage

the more efficient use of development aid and provide

the technical assistance that is vital to capacity

building.

The next step is to build support

for the Monterrey Consensus within the countries that

have adopted it, in order to turn its abstract vision

into concrete action. Poverty reduction strategy papers

will serve as important tools in this process (see

"Poverty reduction"), helping

countries articulate nationally owned policies consistent

with reform objectives. But while the Monterrey Consensus

lays the groundwork for future action, details remain

to be worked out. One is the question of how to monitor

progress toward achieving the development goals—or

even how to define progress. In light of these questions,

the dialogue continues.

|

|

|

Debt strategy

Poor countries’ goal is to reduce debt, fight poverty,

and achieve durable growth

The IMF plays a central role, through its policy guidance and financial

support, in helping member countries cope with external debt problems.

The IMF’s ultimate objective is to ensure that debtor countries

achieve sustainable growth and balance of payments viability and establish

normal relations with creditors, including gaining access to international

financial markets. The basic elements of the IMF’s debt strategy

have remained the same, even though the instruments it uses have evolved

over time:

- promote growth-oriented adjustment and structural reform in debtor

countries,

- maintain a favorable global economic environment, and

- ensure adequate financial support from official (bilateral and multilateral)

and private sources.

Paris Club

Debtor countries seeking to reschedule their official bilateral debt

typically approach the Paris Club—an informal group of creditor

governments, mainly those of the Organization for Economic Cooperation

and Development. Under such agreements, debtor countries generally reschedule

their arrears and the current maturities of eligible debt service, with

repayment stretching over many years. To ensure that such relief helps

countries restore balance of payments viability and achieve sustainable

economic growth, the Paris Club links debt relief to the formulation

of an economic program supported by the IMF. In deciding on the coverage

and terms of individual rescheduling agreements, Paris Club creditors

also draw on the IMF’s analysis and assessment of countries’

balance of payments and debt situations.

Over the past two decades, rescheduling has helped some distressed

middle-income countries return to financial stability. For low-income

countries, the Paris Club began not only to reschedule, but also to

reduce, their debts in the late 1980s.

New approach needed

Although the terms for Paris Club reschedulings became increasingly

concessional over the years to bring more lasting relief, many poor

countries did not grow as rapidly as had been hoped and their debt remained

high. For these low-income, heavily indebted countries, creditors recognized

the need for a new approach.

Launched in 1996, the original Heavily Indebted Poor Countries (HIPC)

Initiative marked the first time that multilateral, Paris Club, and

other official bilateral and multilateral creditors combined efforts

to reduce the external debt of the world’s most debt-laden poor

countries to “sustainable levels”—that is, levels that

will allow these countries to service their debt through export earnings,

aid, and capital inflows without compromising long-term, poverty-reducing

growth. This exceptional assistance, which entails a reduction in the

net present value (see box) of the public external

debt of the indebted country, aims to free up resources that debtor

countries can use to reduce poverty and invigorate growth.

Assistance under the HIPC Initiative is limited to countries that have

per capita incomes low enough to qualify for World Bank and IMF concessional

lending facilities and face unsustainable debt burdens even after traditional

debt relief (see box). The vast majority of the

eligible countries are in Africa.

Modifying HIPC

Following a review of the HIPC Initiative and extensive public consultations,

a number of modifications were approved in 1999 to provide deeper, broader,

and faster debt relief to eligible countries and to strengthen the links

between debt relief, poverty reduction, and social policies.

| Net present value of debt |

|

The face value of the external debt

stock is not a good measure of a country’s debt

burden if a significant part of the external debt

is contracted on concessional terms with an interest

rate below the prevailing market rate. The net pres-

ent value of debt takes into account the degree of

concessionality. It is defined as the sum of all future

debt-service obligations (interest and principal)

on existing debt, discounted at the market interest

rate. Whenever the interest rate on a loan is lower

than the market rate, the resulting net present value

of debt is smaller than its face value, with the difference

reflecting the grant element.

|

|

|

But the enhanced HIPC Initiative is no panacea.

Debt relief—no matter how generous—is only the first step

to economic recovery for heavily indebted poor countries. These countries

can achieve long-term debt sustainability only if they directly address

the underlying causes that triggered the debt problem in the first place.

To avoid slipping back into a situation where poverty-reducing investments

are sacrificed to mounting external debt repayments, these countries

must use the debt-relief proceeds to create the basis for sustained

growth and poverty reduction.

What has the HIPC Initiative achieved?

By July 2002, 26 countries had reached their decision points under the

enhanced HIPC Initiative, with commitments for over $40 billion of debt

relief (in nominal terms) over time. This initiative, along with other

debt relief, will reduce these countries’ external debts by about

two-thirds, from $62 billion in net present value terms to $22 billion.

Resources are being allocated to education; health care, including HIV/AIDS

prevention and treatment; rural development and water supply; and road

construction. Six countries—Bolivia, Burkina Faso, Mauritania,

Mozambique, Tanzania, and Uganda—have received unconditionally

all debt relief committed under the initiative. Two additional countries,

Côte d’Ivoire and the Democratic Republic of the Congo, have

been considered for HIPC relief on a preliminary basis and are expected

to reach their decision points soon.

Challenges ahead

The first challenge is to bring more heavily indebted poor countries

to their decision points. What makes this challenge particularly difficult

is that many of the countries that have not yet qualified for HIPC relief

are either engaged in, or have recently ended, domestic or cross-border

armed conflict. Their need for debt relief is particularly acute because

they suffer from abject poverty and face major reconstruction tasks.

Many are also struggling with severe governance problems. These countries

require help to develop a track record of good policy performance that

will allow them to move toward their decision points and begin receiving

debt relief. The second challenge is to keep the countries that have

reached their decision points on track to implement sound, poverty-reducing

policies so that they can reach their completion points under the HIPC

Initiative and achieve sustainable growth.

| How the HIPC Initiative works |

|

To qualify for HIPC assistance, a

country must pursue strong economic policies supported

by the IMF and the World Bank. Its efforts are complemented

by concessional aid from all relevant donors and institutions

and traditional debt relief from bilateral creditors,

including the Paris Club.

During this phase, the country’s

external debt situation is analyzed in detail. If

its external debt ratio, after the full use of traditional

debt relief, is above 150 percent for the net present

value of debt to exports (or, for small open economies,

above 250 percent of government revenue), it qualifies

for HIPC relief. At the decision point, the IMF and

the World Bank formally decide on the country’s

eligibility, and the international community commits

to reducing the country’s debt to a sustainable

level.

Once it qualifies for HIPC relief,

the country must continue its good track record with

the support of the international community, satisfactorily

implementing key structural policy reforms, maintaining

macroeconomic stability, and adopting and implementing

a poverty reduction strategy (see "Poverty

reduction"). Paris Club bilateral creditors

reschedule obligations coming due, with a 90 percent

reduction in net present value, and other bilateral

and commercial creditors are expected to do the same.

The IMF and the World Bank and some other multilateral

creditors provide interim relief between the decision

and completion points.

A country reaches its completion point

once it has met the objectives established at the

decision point. It then receives the balance of the

debt relief committed. This means all creditors are

expected to reduce the net present value of their

claims on the country to the agreed sustainable level.

|

|

|

Why not just forgive all the debt?

There have been repeated appeals to the international community to simply

erase all the debt of the world’s poorest countries, but such a

step would not be the most effective or equitable way to support the

fight against poverty with the limited resources available. Today’s

greatest development challenge––reducing world poverty––requires

a comprehensive strategy that includes the efforts of the poorest countries

to help themselves, as well as increased financial assistance from the

international community and improved access to industrial country markets.

Debt relief under the HIPC Initiative is only one element of the international

support for poor countries that removes debt as an obstacle to growth.

For many years to come, these countries will continue to need financial

support on concessional terms to help them implement their growth and

poverty reduction strategies and stand on their own feet.

Total debt cancellation would imperil the funds that multilateral creditors

would have for future lending and would come at the expense of resources

available to other developing countries, some of which are equally poor

but have less external debt. Over 80 percent of the world’s poor

live in countries that are not HIPCs. For the IMF, total debt cancellation

would exhaust the resources that finance the Poverty Reduction and Growth

Facility (PRGF) and the HIPC Initiative, and the IMF would have to stop

providing concessional support to its poorest members.

Poverty reduction

Supporting country-led efforts

In 1999, the replacement of the IMF’s concessional lending facility,

the Enhanced Structural Adjustment Facility (ESAF), with the better-focused

Poverty Reduction and Growth Facility (PRGF) raised expectations about

the IMF’s role in the fight against poverty. Loans under the PRGF—like

ESAF loans—carry very low interest rates, long repayment terms,

and a grace period. The PRGF differs from the ESAF in that it is based

more directly on the premise of a mutually reinforcing relationship

between macroeconomic stability, structural reform, growth, and poverty

reduction. Yet this focus on poverty was not entirely new: since the

late 1980s, IMF advice to its members has increasingly emphasized pro-poor

policies while recognizing that the IMF’s traditional focus on

macroeconomic stabilization—especially on price stability—also

benefits the poor.

Demand for PRGF resources has been high. In recent years, more than

40 countries have had new PRGF arrangements or had ESAF arrangements

transformed to include the new features of the PRGF. Overall in 2001,

the IMF committed new PRGF loan resources of $2.7 billion, a record

high, up from $1 billion in 2000. Last year’s increase partly reflected

approval of a few large new commitments. Current projections indicate

that new commitments in 2002 could reach $2 billion. If high levels

of new commitments continue, consideration will need to be given to

mobilizing new PRGF loan and subsidy resources.

All poor countries seeking assistance under the enhanced HIPC Initiative

or low-cost loans from the IMF or the World Bank are expected to prepare

comprehensive poverty reduction strategies. These strategies—formulated

by a country’s government based on wide-ranging participation,

including by civil society, donors, and international organizations,

and spelled out in a poverty reduction strategy paper (PRSP)—now

provide the basis for all concessional lending by the IMF and the World

Bank.

There is no single blueprint for a country to follow in preparing its

poverty reduction strategy. Rather, each country’s PRSP should

reflect its specific circumstances. But each PRSP should describe the

poor’s main characteristics and specify strategies for the medium

and long terms that would have the highest impact on poverty reduction.

And it should also identify realistic and trackable poverty reduction

goals and set out macroeconomic, structural, and social policies for

reaching them.

Locally produced PRSPs are expected to generate fresh ideas about how

shared growth and poverty reduction goals can be reached and should

help create a sense of ownership and national commitment to those goals.

The IMF and the World Bank participate in the process and, along with

other multilateral and bilateral donors, provide advice and expertise.

But the strategies and policies should emerge from national debates

in which the voices of the poor, especially, are heard.

Taking stock: the PRSP and the PRGF

Although implementation of the PRSP approach and the PRGF is still at

an early stage, it is not too soon to take stock of lessons learned

so far. The IMF and the World Bank together recently reviewed the first

two years’ experience with the PRSP approach, and the IMF reviewed

experience with the PRGF. The reviews drew on internal evaluations and

extensive external consultations, engaging those with firsthand knowledge

of the PRSP process and PRGF-supported programs: participating governments,

international organizations, other aid agencies, and civil society organizations

worldwide. Respondents provided written evaluations and voiced their

opinions at regional forums as well as at the “International Conference

on Poverty Reduction Strategies,” held in Washington, D.C., in

January 2002, organized by the IMF and the World Bank.

Review of the PRSP process

Because only 10 full PRSPs were completed at the time, the review focused

primarily on process and offered a tentative assessment of emerging

content. While countries are completing their full PRSPs more slowly

than originally expected, there is still enough information to begin

defining “good practices.” A second review, planned for 2005,

should provide an opportunity to assess progress more fully, including

the impact on poverty outcomes and indicators.

What were the review’s main findings? The central one is that

there is widespread support for the PRSP approach and broad agreement

that its objectives remain valid. Most donors have indicated their intentions

to align assistance programs with PRSPs, but more needs to be done to

improve practices, especially to reduce the cost for low-income countries

of mobilizing and using aid. It is noteworthy that the PRSP process

has carved out a more prominent place for poverty reduction in policy

debates. Data collection, analysis, and monitoring are becoming more

systematic.

Supporting this, there is a growing sense of country ownership and

more open dialogue within governments themselves and also between governments

and civil society groups—even in countries that lack a well-established

tradition of consultation. Nevertheless, the review saw much room for

improvement, the main challenge being to promote broader and more substantive

participation by domestic stakeholders. The quality of participation

has varied widely from country to country. Discussions have often been

limited to a narrow set of issues related to targeted poverty reduction

programs, effectively excluding civil society organizations from the

broader debate over structural reforms and macroeconomic policies. The

review recommended that development partners increase technical assistance

to bolster civil society’s ability to participate fully and effectively

in the PRSP process. The review also recognized the need to involve

parliamentarians in preparing, approving, and monitoring country strategies.

| IMF expands antipoverty work in the

former Soviet Union |

|

After the breakup of the Soviet Union

just over a decade ago, the seven lowest-income members

of the Commonwealth of Independent States (CIS)—Armenia,

Azerbaijan, Georgia, the Kyrgyz Republic, Moldova,

Tajikistan, and Uzbekistan—were confronted with

the dual challenge of building new states and market

economies. Most of these countries have made significant

progress toward these goals during the past decade.

But the complexity of the transition challenges has

caused living standards to fall sharply and, in some

cases, has made it very difficult to implement market-oriented

reforms effectively.

|

The CIS-7 Initiative is designed

to improve living standards in the former Soviet

Union. At right,

an agricultural market in Moldova, one of the

target countries. |

The IMF—together with the World

Bank, the Asian Development Bank, the European Bank

for Reconstruction and Development, bilateral donors,

and neighboring countries—recently launched the

CIS-7 Initiative intended specifically to help reduce

poverty and promote economic growth in these seven

countries. With nearly 20 million people living in

extreme poverty within their borders, these countries

clearly still have some way to go in overcoming the

economic and social disruptions that have occurred

in tandem with the transition from centrally planned

to market economies.

While each country obviously faces

its own specific adjustment problems, the IMF and

the other international financial institutions sponsoring

the CIS-7 Initiative identified some common development

challenges. In the area of political reforms, government

capacity must be strengthened to resist corruption

and deliver public services more effectively and accountably.

All of these countries need more adequate health and

education services for their people and must take

action to fight the devastating human toll taken by

diseases such as HIV/AIDS, tuberculosis, and malaria.

Improved macroeconomic stability is key for establishing

an environment for local businesses to plan, invest,

and grow, and for helping attract technological know-how

and capital flows from foreign direct investors to

improve productivity and build a dynamic private sector.

Enhanced regional cooperation—for example, in

trade and energy—is indispensable in boosting

the competitiveness of national economies and can

be helpful in resolving regional disputes and dividing

the cost of large infrastructure investments. Finally,

urgent action is needed to reduce debt to sustainable

levels.

The seven countries will be responsible

for making headway in these areas by intensifying

their development and reform efforts. But trade and

development partners and creditors will complement

this work by strongly supporting these countries in

strengthening conditions for growth and poverty reduction.

This assistance to the CIS-7 is expected to include

low-cost loans, debt relief, or debt restructuring

(where needed), as well as greater access to industrial

countries’ markets and promotion of direct investment.

Development agencies plan to better coordinate the

way they administer support under the CIS-7 initiative

while also ensuring that this support is anchored

in country-led poverty reduction programs. International

and regional institutions intend to give added support

through technical assistance and policy advice.

|

|

|

Looking ahead, the focus must shift to implementation of PRSPs and

the need to better understand the links between policies and poverty

outcomes. The review suggested that efforts would have the biggest payoff

in the following four areas:

- Macroeconomic frameworks. Every country’s PRSP is underpinned

by a macroeconomic framework in support of its growth and poverty

reduction objectives. But attention needs to be given to setting more

realistic growth targets that are in line with country circumstances

and constraints, and more care needs to be given to identifying the

sources of pro-poor growth underpinning these targets. Poor countries

must also pay more attention to their heightened vulnerability to

external shocks by identifying in advance potential areas of vulnerability

and appropriate social safety nets or other relevant policy responses.

- Prioritizing policy actions. Trade-offs and better prioritization

of policy actions are needed to make poverty reduction strategies

realistic, especially in the face of tight budget constraints. Uncertainties

about their overall growth strategies, the costs of various actions,

and available financial resources often make it difficult for PRSP

countries to set priorities. Development partners need to provide

more technical and financial assistance to countries building capacities

for setting priorities.

- Poverty and social impact analysis. National capacity constraints

and technical difficulties can hinder countries’ ability to clearly

link policy actions to either a comprehensive diagnosis of poverty

or an analysis of their impact on the poor. Countries, with the assistance

of development partners, should undertake more systematic poverty

and social impact analyses of major policy changes.

- Public expenditure management systems. Countries need to

assess the current state of these systems—which often face problems

such as incomplete coverage, inappropriate classifications, limited

capacity to track spending, and weak auditing—and develop realistic

plans for improving them, seeking technical support as appropriate.

Review of the PRGF

Is the PRGF living up to expectations? To answer this, the IMF carried

out a major review between July 2001 and February 2002 to assess the

extent to which country ownership had been enhanced and PRGF-supported

programs had been based on countries’ poverty reduction strategies.

Since the PRGF is only a few years old and arrangements run three years,

the review was necessarily limited and focused primarily on program

design. An assessment of whether PRGF-supported programs are achieving

their poverty-reduction or growth goals will have to await the later

review scheduled for 2005. Among the major findings of the recent review

were the following:

- The composition of budgeted and actual public spending is becoming

more pro-poor and pro-growth in countries with PRGF-supported programs.

These countries are allocating a larger share of government spending

to education and health care, and PRGF-supported programs are incorporating

measures to improve the efficiency of spending in these areas.

|

Farmers in Cambodia, a

PRGF country, are

experiencing the country’s worst drought in recent history. |

- PRGF-supported programs are characterized by greater fiscal flexibility—whereby

the fiscal framework permits an increase in poverty-reducing spending

when additional resources are available—than the preceding ESAF-supported

programs. PRGF-supported programs target noninterest public spending

that is 2 percentage points of GDP higher, on average, than that targeted

under the preceding ESAF-supported programs. PRGF-supported programs

also show greater flexibility by accommodating more spending when

foreign financing (including grants) is greater than expected, or

by allowing additional domestic financing to compensate for shortfalls

in external financing.

- Almost all PRGF-supported programs emphasize strengthening governance

by improving public expenditure management. Most of these measures

focus on budget control––in particular, keeping spending

within the limits set in the budget. Others are designed to strengthen

auditing procedures or anticorruption strategies.

- Around three-fifths of the country authorities responding to the

survey said that the PRGF provided more opportunity to influence program

design than in the past and that IMF resident representatives and

Washington staff were increasingly engaged in the national dialogue

associated with the PRSP process.

- Conditionality was substantially streamlined in PRGF-supported programs,

in line with an overall streamlining of structural conditionality

in all IMF arrangements. The review found that there were more performance

criteria, prior actions, and structural benchmarks in PRGF arrangements

than there had been for the same countries under the ESAF.

While the review concluded that PRGF-supported programs have had a

promising beginning, it found that there is scope for a more systematic

application of best practices:

- More systematic discussion and analysis of macroeconomic frameworks

and policies are needed—including the sources of growth, alternative

policy choices, and the constraints and trade-offs involved.

- The IMF and the World Bank need to make continued improvements in

differentiating between their roles and coordinating their activities.

IMF documents and joint assessments should more fully report conditions

set by other donors to provide a better picture of total donor conditionality.

- Further efforts are needed on public expenditure issues—including

improving the quality and efficiency of government spending, and strengthening

public expenditure management systems.

- Documentation should clearly set out the PRGF’s role in the

country’s overall poverty reduction strategy as well as the options

considered and the commitments made by government officials.

Beyond the design of PRGF-supported programs, the review pointed to

other improvements that are needed, including

- an increased focus on the sources of growth in PRGF-supported programs;

- more extensive and effective communication with government officials,

development partners, and civil society in countries on the policy

options for PRGF-supported programs;

- PRGF documents that routinely describe the poverty and social impact

analyses being carried out, as well as discussions with country authorities

on the social impact of key reforms;

- further capacity building to develop and assess macroeconomic frameworks,

analyze poverty profiles, and conduct poverty and social impact analyses;

and

- an examination of the structure of the PRGF and its adequacy in

meeting the diverse needs of low-income countries.

| Social dimensions of IMF financing |

|

By pursuing its mandate to promote

international monetary cooperation, the balanced growth

of international trade, and a stable system of exchange

rates, the IMF contributes to sustainable economic

and human development. The IMF recognizes that successful

macroeconomic programs must also include policies

that directly address poverty and social concerns

and that, to support these objectives, IMF-supported

programs must integrate social sector spending that

focuses on improving the education and health status

of the poor.

The reason for attention to social

policy issues is twofold: it reflects the recognition

that “country ownership” is necessary if

the programs are to succeed and that good health and

education contribute to, and benefit from, growth

and poverty reduction.

In pursuing this aspect of its work,

the IMF collaborates extensively with other institutions,

including regional development banks, the United Nations

Development Program, the International Labor Organization,

the World Health Organization, and, especially, the

World Bank. Drawing on their expertise, the IMF advises

countries on how social and sectoral programs aimed

at poverty reduction can be accommodated and financed

within a growth-enhancing macroeconomic framework.

It does so by identifying not only unproductive spending

that should be reduced to make more money available

for basic health care and primary education, but also

key categories of public expenditure that must be

maintained or increased. Through policy discussions

and technical assistance, the IMF also plays a role

in improving the transparency of governments’

decision making and their ability to monitor poverty-reducing

spending and social developments.

Poverty and social impact analysis

The IMF is committed to integrating poverty and social

impact analysis in PRGF-supported programs. The purpose

of this analysis is to assess the implications of

key policy measures on the well-being of different

social groups, especially the vulnerable and the poor.

When such analysis indicates that

a particular measure (for example, currency devaluation)

may adversely affect the poor, such effects would

be addressed through the choice or timing of policies,

the development of countervailing measures, or social

safety nets. Safety nets built into IMF-supported

programs have included subsidies or cash compensation

for particularly vulnerable groups; improved distribution

of essential commodities, such as medicines; temporary

price controls on some essential commodities; severance

pay and retraining for public sector employees who

have lost their jobs; and employment through public

works programs.

For those countries that are able

to do so, poverty and social impact analyses ideally

should be undertaken in making policy choices in the

development of poverty reduction strategy papers (PRSPs).

For those countries where national capacity is weak,

the IMF will draw on poverty and social impact analysis

done by the World Bank and other development partners

in the PRSP process.

|

|

|

Financial architecture

Fast-changing world economy drives IMF reforms

Much of what the world now knows about the complexity and dynamism

of global finance was learned—sometimes the hard way—in the

1990s. The decade was a testament to the power of the markets to create

wealth and destroy it. The suddenness, velocity, and scope of crises

in the 1990s were unprecedented, but, in their wake, they yielded two

lessons: crises need to be prevented whenever possible and resolved

quickly when they do erupt.

These dramatic changes in the world economy and the lessons they imparted

are at the heart of the reforms the IMF has advocated and itself absorbed

in recent years. These reforms have emphasized the critical importance

of more information and greater transparency, highlighted the role that

global standards and accepted codes of good practices can play in improving

performance and increasing levels of trust, underscored the need for

expanded cooperation among countries and international organizations,

and called for heightened vigilance over the types of vulnerabilities

that can trigger crises.

More information, please

Markets, as recent crises have demonstrated, don’t like surprises.

A dearth of information or the belated discovery of misinformation fosters

unease, even alarm. The IMF translated this early lesson from the Asian

crisis into action, encouraging countries to provide more information—and

more reliable data—to markets. High on its list of reforms was

a series of statistical initiatives:

Special Data Dissemination Standard (SDDS). Created in 1996,

the SDDS is a voluntary standard whose subscribers—countries with

market access or seeking it—commit to meeting internationally accepted

levels of data coverage, frequency, and timeSpecial Data Dissemination

Standard (SDDS). Created in 1996, the SDDS is a voluntary standard whose

subscribers—countries with market access or seeking it—commit

to meeting internationally accepted levels of data coverage, frequency,

and timeliness. Subscribers also agree to issue calendars on data releases

and follow good practices with regard to data quality and integrity.

Information on subscriber data dissemination practices is posted on

the IMF’s website on the Data Standards Bulletin Board, which is

linked to subscriber websites.

General Data Dissemination System (GDDS). For countries that

do not have market access but are eager to improve the quality of their

national statistical systems, the GDDS offers a “how to” manual.

Voluntary participation allows countries to set their own pace but provides

a detailed framework that promotes the use of widely accepted methodological

principles, the adoption of rigorous compilation practices, and ways

in which the professionalism of national systems can be enhanced. Participating

countries post their detailed plans for improvement on the Data Standards

Bulletin Board, thus permitting both domestic and international observers

to view their progress.

Data Quality Assessment Framework. The success of both the SDDS

and the GDDS, and the growing recognition that good statistics are essential

for effective policymaking, spurred the IMF, in consultation with national

statistical offices, other international agencies, and data users, to

take a further step and evaluate the quality of data as well. This new

framework, developed in 2001, provides the means to assess data integrity,

methodological soundness, accuracy and reliability, serviceability,

and accessibility.

| The openness revolution |

|

Some of the most dramatic changes

over the past decade have taken place in information

exchange. Technological changes have revolutionized

the speed and ease with which information can be shared

and have democratized the production and consumption

of data. What was once arcane and in the province

of the highly specialized is now, via the Internet,

available to everyone with access to a computer.

In an age in which global communications

make the world very small indeed, the availability

of information and commitment to openness matter more

than ever. In the mid-1990s, when the IMF first began

encouraging its members to be more open with their

economic and financial data, its carefully vetted

Annual Report contained virtually the only publicly

available summary of the regular (Article IV) consultations

the IMF conducted with its member countries on the

current state and prospects of their economies.

By 2000, the IMF’s Internet site––www.imf.org––was

serving as the chief vehicle for what amounted to

a sea change in the openness of the IMF and its membership.

The website now posts Public Information Notices summarizing

the IMF Executive Board’s discussions of Article

IV staff reports for many member countries. It has

become a key tool for the authorities and the IMF

to share with the public the goals and means of country

adjustment efforts. Documents outlining the authorities’

intentions are now routinely published, as are more

than half of IMF staff reports on the use of IMF resources.

The IMF has also become much more

transparent about its own policies and operations.

Staff papers outlining the pros and cons of various

policy issues and summaries of Executive Board discussions

of these papers are also now routinely released. On

some key issues of wide public interest, the IMF uses

its website to initiate a dialogue—soliciting

opinions or offering early drafts of papers for comment.

The IMF is also expanding its outreach

to parliamentarians, nongovernmental organizations,

and other interested groups to improve public understanding

of its policies and operations and to broaden and

deepen its dialogue with these groups.

In 2001, the IMF took a formal step

to improve the transparency and effectiveness of its

policies and procedures when it created the Independent

Evaluation Office (see "Independent

evaluation office"). The office, intended

to complement traditional internal evaluations, selects

several major topics for review annually, carries

out these reviews, and posts its findings on the Internet.

|

|

|

Role of standards and codes

Better data, while important in themselves, are an element of a larger

project. Agreement on and implementation of broadly agreed standards

of accepted practices and codes of good behavior provide yardsticks

to measure the quality of policies and performance. They help national

authorities formulate and assess policies and permit market participants

to evaluate how well a country is doing. Widely accepted standards and

codes also have a ripple effect by encouraging greater transparency,

better governance, and improved accountability and policy credibility.

In cooperation with a wide range of international institutions and with

input from numerous national authorities, the IMF has been active in

both developing standards and codes and incorporating them in their

annual review (surveillance) of member country economies.

In 1999–2000, the IMF, with the World Bank, launched a joint program

of voluntary and summary reports in a wide range of areas in which the

two organizations have long-standing expertise. These Reports on the

Observance of Standards and Codes (ROSCs)—about 70 percent of which

are subsequently published—principally examine three broad areas:

transparency, financial regulation and supervision, and corporate governance

(including accounting, auditing, and insolvency). In these areas, the

ROSCs promote the following:

- Transparent governmental policymaking and operations. The

underlying assumption is that better-informed publics are more likely

to hold their governments accountable for their policies and that

investors, armed with better data and a standard against which to

evaluate them, are more likely to invest wisely. Key tools are the

IMF’s statistical initiatives (SDDS and GDDS) and codes of transparency

in monetary, financial, and fiscal policies.

- Stable financial sectors. As a rule of thumb, financial sectors

are as sound and consistent as their regulatory environments are vigilant.

The IMF and the World Bank each year undertake a certain number of

Financial Sector Assessment Programs (FSAPs). These detailed analyses

review and test financial sectors for vulnerabilities, evaluate how

risks are managed, weigh possible technical assistance needs, and

help countries prioritize policy responses. In addition, ROSCs evaluate

banking supervision, securities and insurance regulation, and payments

systems, as well as the transparency of monetary and financial policies.

- Healthy corporate sectors. With the private sector serving

as the engine of growth in most economies, the health of the corporate

sector is a critical concern. The World Bank typically takes the lead

in assessing the quality of corporate governance, the adequacy of

accounting and auditing standards, and the state of insolvency procedures

and creditor rights.

When are countries vulnerable?

More information and more openness can go a long way toward averting

the shocks that ignite serious problems, but as the IMF and other institutions

surveyed the damage done by recent crises, they also asked another question:

how do we know when a country is at risk? The crises of the 1990s were

different, reflecting a larger role for private sector financing, greater

scope for cross-border contagion, and stronger links between external

financing difficulties and distress in domestic financial and corporate

sectors. All of this suggested the value of taking a fresh, hard look

at the sources of vulnerability and the tools available to identify

problems before they become crises.

As a first step, it was clear that the IMF needed to monitor capital

market developments more closely and more continuously. This prompted

the creation of the International Capital Markets Department in 2001

to complement the work of the organization’s traditional regional

(area) and functional departments. As a result, country vulnerability

assessments have been strengthened and now cover a more comprehensive

set of inputs, including the impact of the latest changes in the global

economic and financial environment, early warning systems and indicators,

and ROSC and FSAP findings (when available).

An IMF Executive Board review of vulnerability assessments also pointed

to the need for more data on foreign exchange exposures in financial

and non-financial corporate sectors and more information on country

financing needs. It urged international institutions to convey greater

urgency when they discussed perceived vulnerabilities with national

authorities, and it called for continued work on the formulation of

policy guidelines. In recent years, detailed guidelines have been drawn

up on public debt management (in consultation with the World Bank) and

foreign reserves management (in close collaboration with both member

countries and other international institutions).

Strengthening financial sectors

As the Asian crisis demonstrated, weaknesses in the financial sector

can both amplify crises and cause them. Given the critical role that

resilient financial sectors can play in heading off crises and the fuel

that ailing financial sectors can add to the fire when economies are

under siege, the IMF has been giving added attention to this sector.

It has redirected its FSAP resources to large economies and key emerging

markets that could have a systemic impact on the world economy. And

it has supplemented the FSAPs with newly devised “core” and

“encouraged” Financial Soundness Indicators. These indicators

are meant to guide country surveillance efforts and alert national authorities

to the qualities that characterize healthy financial sectors. The core

indicators focus on crucial elements in the banking system, while those

that are encouraged take a more detailed look at the banking sector

and address aspects of nonbank financial, corporate, household, and

real estate sectors.

Assessing offshore financial centers

Traditionally, global finance was the sum of its national parts, but

the rise in offshore banking centers and a sharp increase in the volume

of funds channeled through these centers have added another dimension—and

level of complexity—to global finance. In response to increasing

calls for more information about offshore banking activities, the IMF

has helped these centers gather data and conduct self-assessments, providing

technical assistance where needed.

Money laundering and financing of terrorism

Money laundering and its now allied concern, the financing of terrorism,

affect both onshore and offshore financial centers. The IMF’s own

work in this area began in the context of financial abuses that threatened

the integrity and stability of the international financial system. The

events of September 11 lent new scope and urgency to the work and hastened

efforts to better coordinate responsibilities among international institutions

to implement the recommendations of the Financial Action Task Force

(FATF) on Money Laundering. The IMF, whose core expertise lies in economic

assessment and in helping member countries build up the quality and

effectiveness of their supervision and regulation of financial institutions,

has focused its efforts on relevant supervisory principles, closer cooperation

with major anti-money-laundering groups; increased technical assistance;

and greater attention to anti-money-laundering issues in its surveillance

and other activities.

|

Specifically, the staffs of the World Bank and the IMF have prepared

a methodology to assess whether adequate controls and procedures are

in place to prevent abuse; the document is currently being piloted as

part of the institutions’ financial sector assessments. Their Boards

will consider whether to add the FATF 40+8 Recommendations to the list

of standards that includes preparation of a ROSC to combat money laundering

and the financing of terrorism, and possible mechanisms for carrying

out such assessments. IMF and World Bank staff are also working closely

with the Financial Action Task Force on Money Laundering to adapt its

recommendations so that they are consistent with the work being done

in the context of the ROSCs.

When to liberalize the capital account

For many of the IMF’s emerging market economies, two important

questions are when and how to liberalize their capital accounts. Access

to capital markets provides the opportunities to finance the investment

that is essential for growth, but the crises of the past decade are

also vivid reminders that the transition can be tricky and the risks

large.

What should countries do to lay the proper groundwork for opening their

capital accounts, and how can they sequence reforms to enhance stability

and minimize volatility?

The IMF, in the course of its annual consultations with member countries,

has helped them gauge their readiness for capital account liberalization

and prioritize financial sector reforms; it has also underscored the

key role played by transparency. Although no foolproof recipe for liberalization

exists yet, experience in many countries suggests that liberalizing

longer-term flows (notably, foreign direct investment) first may be

safer than starting with the more volatile short-term flows.

Resolving crises

Crises will occur no matter how many preventive measures are in place.

The IMF’s goal is to reduce the number and severity of these crises

and help countries deal decisively and effectively with those that do

arise. In April, the IMF’s Managing Director, Horst Köhler,

laid out a four-point work program to strengthen the IMF’s framework

for crisis resolution. It called for increased capacity to assess the

sustainability of a country’s debt, a clear-cut policy on access

to IMF resources in capital account crises, enhanced means to secure

private sector involvement in resolving financial crises, and continued

work on a more orderly and transparent legal framework for sovereign

debt restructuring.

| Public information on IMF finances |

|

In recent years, the IMF has significantly

expanded the volume, quality, and timeliness of information

available on its finances to the public. During financial

year 2002, a new edition of a pamphlet providing detailed

information on the IMF’s financial structure

was published (Financial Organization and Operations

of the IMF, IMF Pamphlet Series, No. 45, 6th ed.,

2001). The IMF also provides background and current

data on its financial activities on its website (http://www.imf.org/external/fin.htm),

including

- current financial position

- IMF liquidity and sources of financing

- SDR valuation and interest rate

- rates of charge on IMF loans and

the interest rate paid to creditors

- country information on

- current lending arrangements

- loan disbursements and credit

outstanding

- loan repayments and projected

obligations

- arrears

- SDR allocations and holdings

- financial statements

|

|

|

Debt sustainability. The ability to distinguish

between types and degrees of debt crises is key to tailoring an appropriate

response. To provide effective assistance, the IMF must be able to differentiate

among cases where restructuring is needed and a substantial write-down

of claims may be in order; where the official sector will need to encourage

creditors to reach voluntary agreements; and where it is appropriate

for the IMF, along with others, to provide financing in support of a

member’s adjustment program and to help restore confidence and

catalyze the resumption of private capital flows.

When is debt sustainable? Hard and fast answers are typically hard

to come by, but the IMF is working to strengthen its analytical tools

to ensure that judgments are well informed. It will be looking in greater

detail at the elements that go into these decisions—and testing

the underlying assumptions about earnings growth, interest rates, and

the primary balance

of spending and income.

Access to IMF resources. For members coping with capital account

crises, there is often a wide gap between their large immediate financing

needs and the IMF resources, as defined by quotas, that would normally

be available to them. A clearer policy on access limits would allow

the IMF to both provide the scale of financing needed in such cases

and reinforce incentives for responsible policies and prudent assessment

of risk.

Strengthened tools for involving the private sector. Within

existing legal frameworks, how can the private sector play a more significant

role in resolving financial crises? Alternative financing tools can

help manage crises, but the IMF’s work in this area suggests that

individual circumstances must be examined carefully and the benefits

weighed against possible risks, including unsettled markets and a transfer

of risk from sovereigns to the domestic financial systems. Where a restructuring

of sovereign debt is needed, it is crucial to contain the erosion of

confidence and keep the process orderly.

Sovereign restructurings. These become necessary when countries

run up unsustainable debt burdens. They are infrequent but can be unusually

costly because no legal framework currently exists to handle this process

in a timely, predictable, and orderly manner.

In November 2001, IMF First Deputy Managing Director Anne Krueger renewed

the discussion on what could be done to provide for a speedier and more

orderly way to resolve these problems. Her proposal to create a sovereign

debt restructuring mechanism (see box) has set

off a lively debate about the form the mechanism should take. The IMF

is expected to continue its work on this reform in advance of its 2002

Annual Meetings, where the SDRM proposal is expected to be taken up.

| When countries can’t repay their

debts |

|

Countries, like individuals, may run

up debt and find themselves unable to keep up the

payments on it. To avoid defaulting, they must restructure

their debt. But, unlike bankruptcy provisions in domestic

situations, the global financial system lacks a legal

framework for sovereign debtors and their creditors

to restructure debt in an orderly and timely way.

One major challenge to sovereign debt restructuring

stems from the way international capital markets have

evolved over the past 20 years or so. They have become

more integrated and there has been a shift from syndicated

bank loans to bond issues. As a result, sovereign

borrowers are increasingly able to issue debt in a

range of legal jurisdictions, using a variety of instruments,

to a diverse and diffuse group of creditors. Although

this has expanded the sources of financing available

to emerging market countries, it has also exacerbated

the problems of coordination, collective action, and

equal treatment of creditors when a restructuring

becomes necessary.

IMF proposes a solution

In November 2001, IMF First Deputy Managing Director

Anne Krueger proposed a sovereign debt restructuring

mechanism (SDRM) to facilitate the orderly, predictable,

and rapid restructuring of unsustainable sovereign

debt. Since November, the proposal has undergone various

changes, and the IMF’s decision-making role is

envisaged to be smaller in the latest incarnation.

The resulting twin-track —that is, statutory

and contractual—approach has since received the

endorsement of the international community.

For the mechanism to be effective,

there must be incentives both for debtors to address

their problems promptly and for debtors and creditors

to agree quickly on the restructuring terms. The IMF’s

policies spelling out the availability of its resources

before, during, and after the restructuring process

would help shape these incentives. However, use of

the mechanism would be for the debtor country to decide

and not for the IMF or a country’s creditors

to impose. The debtor country and a majority of its

creditors would have the essential decision-making

authority.

How the mechanism would work

The first track of the SDRM would involve greater

use of collective action clauses in sovereign bond

contracts. The second track would involve creating

a statutory mechanism to empower a qualified majority

of a country’s creditors to negotiate a restructuring

agreement that would then be binding on all of the

country’s creditors. There would also be provisions

to prevent creditors from pursuing litigation against

debtors while a restructuring agreement is being negotiated;

safeguards to protect creditor interests during this

period; and a mechanism that would encourage new financing

by guaranteeing that fresh private lending would not

be restructured. The statutory approach would use

a treaty obligation—probably achieved through

an amendment of the IMF’s Articles of Agreement—that

would provide for legal uniformity in all jurisdictions.

|

IMF First Deputy Managing Director

Anne Krueger first proposed a plan

for restructuring

sovereign debt in November 2001. |

To coordinate a debtor’s varied

creditors, a framework must be created that will aggregate

claims across instruments for voting purposes while

taking account of the seniority and varying economic

interests of the creditors. As part of this framework,

a forum is envisaged for the resolution of disputes

between a sovereign debtor and its creditors as well

as disputes among creditors. The dispute resolution

forum would be small, have a limited role, and be

independent in its membership and operation.

The international community has learned

its lesson from the turmoil that emerging market economies

have experienced in recent years: cooperation helps

the global financial system work more smoothly. To

address the protracted, disorderly, and costly restructuring

process, the IMF will continue to examine the legal,

institutional, and procedural aspects of establishing

the sovereign debt restructuring mechanism.

For a fuller explanation of the proposed

SDRM, see the IMF’s website (www.imf.org).

|

|

|

Effective surveillance and crisis prevention

Helping IMF members reduce vulnerabilities, promote

stability, and foster growth

In today’s global economy, the economic developments and policy

decisions of one country may affect many other countries, and financial

market information can be transmitted around the world instantaneously.

In this environment, there must be some mechanism for monitoring countries’

exchange rate and macroeconomic policies to ensure that the international

monetary system operates effectively. The IMF does this by holding regular

dialogues with its member countries about their economic and financial

policies and by continuously monitoring and assessing economic and financial

developments at the country, regional, and global levels. Through this

function, referred to as “surveillance,” the IMF seeks to

signal dangers on the economic horizon and enable its members to take

corrective policy action.

How surveillance is conducted

|

Country surveillance. As a result of a recent IMF Executive

Board decision, the IMF will generally conduct regular consultations

every year with each of its member countries. (The consultations are

referred to as “Article IV consultations” because they are

required by Article IV of the IMF’s Articles of Agreement.) These

consultations focus on the member’s exchange rate, fiscal, and

monetary policies; its balance of payments and external debt developments;

the influence of its policies on the country’s external accounts;

the international and regional implications of its policies; and the

identification of potential vulnerabilities. As financial markets around

the world become more integrated, IMF surveillance has become increasingly

focused on capital account and financial and banking sector issues.

When relevant from a macroeconomic perspective, policies that affect

a country’s labor market, the environment, and governance are also

covered by surveillance.

Global surveillance. The IMF’s World Economic Outlook report,

prepared twice a year, features comprehensive analyses of prospects

for the world economy, individual countries, and regions and also examines

topical issues. The quarterly Global Financial Stability Report (GFSR)

provides timely coverage of mature and emerging financial markets as

part of the IMF’s stepped-up tracking of financial markets. The

GFSR seeks to deepen policymakers’ understanding of the potential

weaknesses in the global financial system and identify the fault lines

that could lead to crises.

Regional surveillance. To supplement country consultations,

the IMF also examines policies pursued under regional arrangements,

holding regular discussions with the European Union, the West African

Economic and Monetary Union, the Central African Economic and Monetary

Community, and the Eastern Caribbean Currency Union. The IMF has increased

its participation in member countries’ regional initiatives, including

the Southern African Development Community, the Association of South

East Asian Nations, the Manila Framework Group, the Gulf Cooperation

Council, the Common Market for Eastern and Southern Africa, and the

Meetings of Western Hemisphere Finance Ministers.

Improving the effectiveness of surveillance

Provision of information. Timely, reliable, and comprehensive