عربي, Español, Français, 日本語, Português, Русский

The COVID-19 pandemic is accelerating in many countries and uncertainty is unusually high. Decisive government actions are necessary to ensure swift and extensive vaccine rollouts, protect the most vulnerable households and otherwise viable firms, and foster a durable and inclusive recovery.

Most countries will need to do more with less, considering the increasingly tight budget constraints.

Many countries have continued to support people and firms amid the resurgence of infections and renewed restrictions, while calibrating their responses to the evolving economic situation. The January 2021 Fiscal Monitor Update provides an overview of such efforts and outlines what more governments can do to achieve a greener, fairer, and more durable recovery.

Government support has helped people and firms

The global fiscal support reached nearly $14 trillion as of end-December 2020, up by about $2.2 trillion since October 2020. It comprises $7.8 trillion in additional spending or (to a lesser extent) measures to forgo revenues and $6 trillion in guarantees, loans, and equity injections (country details here).

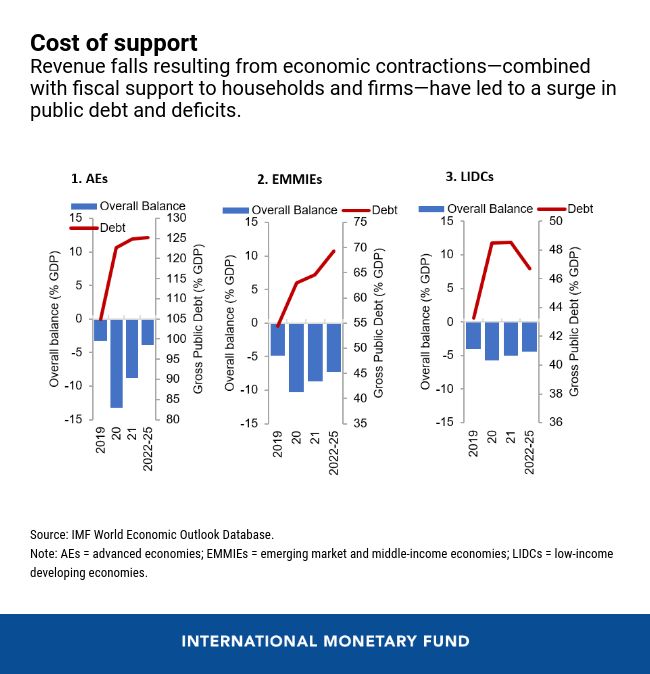

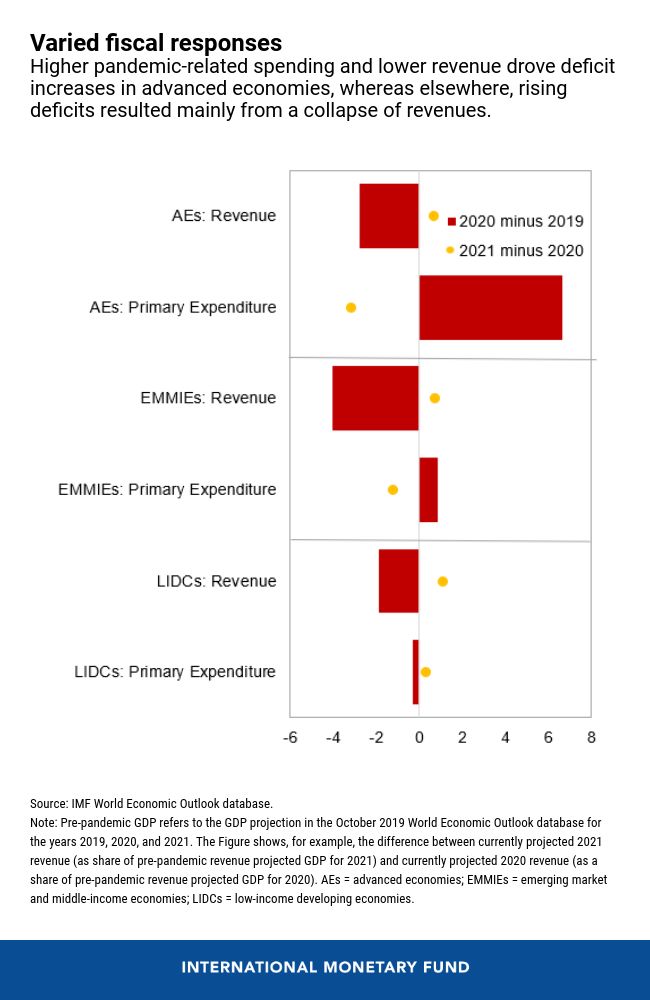

This support has varied across countries depending on the impact of the pandemic-related shocks and governments’ ability to borrow. In advanced economies, fiscal actions cover several years (exceeding 4 percent of GDP in 2021 and beyond). In contrast, support in emerging markets and developing countries was frontloaded, with a large share of measures expiring. Together with economic contraction that has resulted in lower revenues, such support has led to a rise in public debt and deficits. Average public debt worldwide approached 98 percent of GDP at end-2020, compared with 84 percent projected pre-pandemic for the same date.

Advanced economies recorded the largest increases in fiscal deficits and debt, reflecting both higher spending and declines in revenue. In emerging markets, the rise in deficits stemmed largely from depressed tax receipts due to the economic recession. In low-income countries, the fiscal policy response has been more limited, owing to financing constraints and less developed welfare programs. The pandemic thus risks leaving a lasting impact, including higher poverty and malnutrition, in these countries.

Fiscal support needs to be available until the recovery is well under way

Global cooperation on producing and widely distributing treatments and vaccines to all countries at low cost is crucial. Vaccination is a global public good that saves lives and will eventually save taxpayers’ money in all countries. The sooner the global pandemic ends, the quicker economies can return to normal and people will need less government support.

Given the unusually high uncertainty, policies should respond flexibly to the changing economic and pandemic conditions, as needed and appropriately differentiated. Most countries will need to do more with less, considering the increasingly tight budget constraints. This means focusing on the hardest-hit and most vulnerable, including the poor, women, and informal workers, and firms that are likely to remain viable after the crisis or are systemically important to the economy.

Many low-income countries will face challenges even after doing their part. They will need additional assistance, including through grants, concessional financing, the extension of the Debt Service Suspension Initiative, or, in some cases, debt restructuring. Quick operationalization of the Common Framework for Debt Treatments and expansion of the eligibility of debtor countries will be essential.

Fiscal policy should enable a green, digital, and inclusive transformation of the economy in the post-COVID19 environment. Priorities include:

- Investing in health systems (including vaccinations), education, and infrastructure. A coordinated green public investment push by economies with fiscal space can foster global growth. Projects—ideally with the participation of the private sector—should aim at mitigating climate change and facilitating digitalization;

- Helping people go back to work and move between jobs, if needed, through hiring subsidies, enhanced training and job search programs;

- Strengthening social protection systems to help counter inequality and poverty;

- Rethinking tax systems to promote greater fairness and provide incentives to protect the environment; and

- Cutting wasteful spending, strengthening the transparency of spending initiatives, and improving governance practices to reap the full benefits of fiscal support.

Policymakers will have to strike a balance between providing more short-term support to ensure a solid recovery and keeping debt at a manageable level over the longer term. Developing credible multiyear frameworks for revenue and spending (including how to strengthen fiscal positions over the medium term) will be vital, especially where debt is high and financing is tight.

In short, governments need to win the vaccination race, respond flexibility to the changing economic conditions, and set the stage for a greener, fairer, and more durable recovery.