Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Mideast Growth Outlook to Improve Overall, Bold Reforms Still Needed

May 6, 2014

- Oil exporters post solid non-oil growth, but need to strengthen budgets and diversify economies

- Oil importers see tepid growth due to weak confidence, sociopolitical frictions, and conflict in Syria

- Transition countries need bold reforms to spur growth and create well-paying jobs

Economic growth in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) is expected to strengthen this year, but weak confidence and, in some cases, large public deficits continue to pose risks to this outlook, the IMF said in its latest regional assessment.

Carpet factory, Egypt. Arab Countries in Transition see tepid growth and, hence, need bold reforms to vitalize economies and create well-paying jobs (photo: Godong/Newscom)

MIDEAST ECONOMIC OUTLOOK

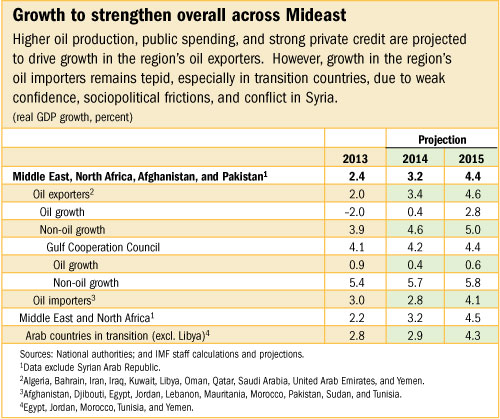

The IMF projects that growth in the region will average about 3¼ percent in 2014 as global conditions improve (see table).

“Overall growth prospects in the region remain considerably below what is needed to make a dent in the high unemployment, particularly among youth,” said IMF Middle East Department Director Masood Ahmed who unveiled the report in Dubai today. Most countries in the region need to address some of the key constraints to unleashing their growth potential and to build consensus on the needed reforms, Ahmed added.

Oil exporters post solid growth

The IMF expects growth in the region’s oil exporters—Algeria, Bahrain, Iran, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, the United Arab Emirates, and Yemen—to strengthen to 3½ percent this year from 2 percent in 2013.

Higher production in Iraq and countries of the Gulf Cooperation Council (GCC) amid strengthening global demand will offset oil disruptions in Libya. Robust non-oil growth will continue owing to high public spending and strong private credit, the report says. Lower global demand—from slower growth in emerging markets or lower inflation in advanced economies—or rising oil supply from unconventional sources (shale gas) could reduce oil prices, however.

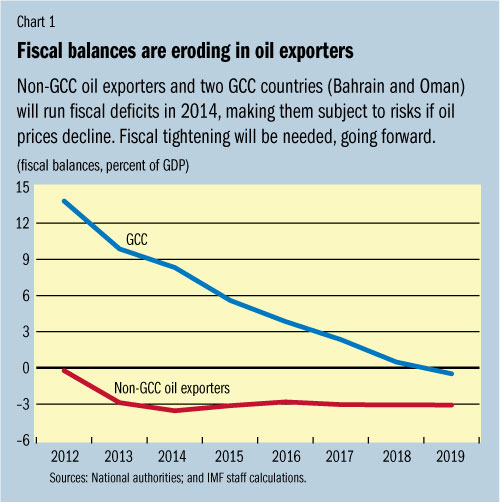

The IMF cautioned that fiscal positions in this group of countries are eroding. Non-GCC oil exporters and two GCC countries (Bahrain and Oman) will run fiscal deficits this year, which makes them increasingly vulnerable to a sustained decline in oil revenues (see chart 1). In addition, most oil exporters do not save enough of their oil windfalls for future generations, says the report.

“Governments will need to find ways to rein in hard-to-reverse current expenditures, especially wages and subsidies. At the same time, they should target high-quality capital investments and social programs,” Ahmed told reporters. “Structural reforms that bolster economic diversification and private-sector job creation for nationals are also high on the agenda,” he added.

Oil importers see tepid growth

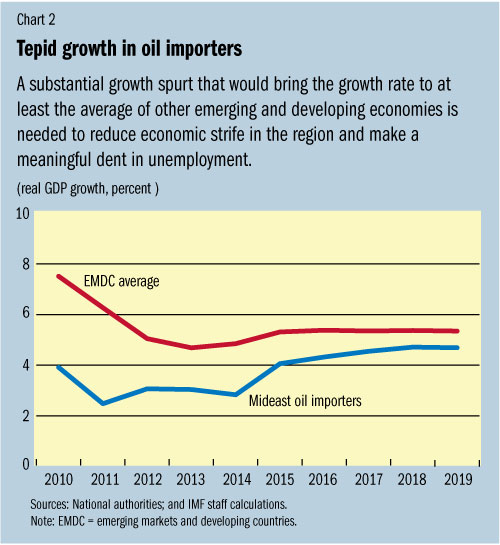

Despite some positive signs—rising public investment and strengthening exports due to improved global growth, especially in Europe—the region’s oil-importing countries—Afghanistan, Djibouti, Egypt, Jordan, Lebanon, Mauritania, Morocco, Pakistan, Sudan, and Tunisia, as a group—will see another year of tepid economic activity (see chart 2), the report says.

The main reason for this low growth is weak confidence amid ongoing complex political transitions and regional spillovers from Syria’s devastating civil war which is already having a major impact on Jordan, Lebanon, and Iraq. Resulting policy uncertainty, security tensions, and social unrest also continue to hold back private investment, says IMF.

“The economic recovery in this group of countries faces significant risks. Sociopolitical frictions could set back transitions and lead to further high unemployment and social instability,” Ahmed said. Lower growth in emerging economies, Europe, or the GCC could weaken exports, he added.

Transition countries need decisive actions

At 13 percent, the unemployment rate in the Arab Countries in Transition—Egypt, Jordan, Libya, Morocco, Tunisia, and Yemen—provides a stark contrast to the aspirations of the people that took to the streets partly in pursuit of better access to economic opportunity.

“This situation requires a response from policymakers to bring about an economic transformation toward more dynamic economies that generate more jobs and growth,” Ahmed told reporters.

To help achieve vision of high, sustainable, and inclusive growth, the IMF recommends that the region’s policymakers:

Pursue policies to maintain stability and support near-term growth. It will be important to find the fiscal space (through additional grants or low-interest loans, redirecting social protection from expensive and inefficient generalized subsidies to transfers that would better target the poor and vulnerable, and containing public wage bills) to increase public investment and spending on health and education. Plans need to be anchored in credible medium-term envelopes to ensure debt sustainability and continued financing and projects need to be carefully selected to ensure that they indeed contribute to strengthening economic growth prospects.

Embark on economic reforms to stimulate private investment and boost job creation. Lasting improvement in economic prospects and creating permanent, well-paying jobs will require structural reforms to target the most significant impediments, in particular: bureaucratic inefficiency and corruption; tax systems that do not support competitiveness; highly subsidized energy prices that distort production in favor of energy-intensive industries and do not promote job creation; difficulties and inequities in access to finance; low female labor force participation; and labor regulations that provide incentives for hiring and participation in the formal private sector labor market.

“Many of the necessary reforms are difficult to implement during political transitions. Yet some can be pursued immediately and would help improve confidence, for example, streamlining business regulations (to start a business, register property, or obtain permits and electricity), training the unemployed and unskilled, improving customs procedures, and deepening trade integration,” Ahmed said.

â– To foster debate about the policy agenda for this group of countries, the IMF is co-hosting a regional conference, in collaboration with the Jordanian government and the Arab Fund for Economic and Social Development, in Amman, Jordan titled “Building the Future: Jobs, Growth, and Fairness in the Arab World,” during May 11–12.