News

Press Briefing | February 19

Watch the latest developments related to key economic issues, and answers questions about Ukraine, Argentina and Venezuela, Sri Lanka, India, the United States, Japan, and more.

Remarks by Kristalina Georgieva, IMF Managing Director

Policies Amid a Reset of the International Trade and Financial Systems

Latest News

- March 9, 2026Principality of Andorra: Staff Concluding Statement of the 2026 Article IV Mission

- March 9, 2026Coping and Thriving in a Fluid World

- March 6, 2026IMF Staff Concludes Visit to Gabon

- March 5, 2026IMF Staff Concludes Visit to Zambia

- March 5, 2026IMF to Close Resident Representative Office in Suriname

- March 5, 2026IMF Staff Concludes Visit to Kenya

- March 5, 2026Shaping Asia’s Future

- March 4, 2026IMF Staff Completes 2026 Article IV Consultation to Kiribati

Email Notifications

Sign up to receive free e-mail notices when new series and/or country items are posted on the IMF website.

Podcasts

Johan Norberg on What Makes and Breaks Golden Eras

The most prosperous of civilizations were the most open. The Romans, for example, expanded their empire by integrating the populations they conquered, creating a melting pot of new ideas. Johan Norberg’s latest book, Peak Human, examines the rise and fall of seven golden age civilizations. In this podcast, he says that if openness to learning and trade are what great societies make, building walls to protect their dominance often sparks their demise.

Enrico Letta: Harnessing Europe's Single Market

The idea of European integration through a single market was to capitalize on the EU as a whole. However, EU member states now appear reticent to pool sovereignty to the degree required to counter the geopolitical challenges of today’s world. Enrico Letta is President of the Jacques Delors Institute and a champion of Delors’ vision of creating a fully integrated European economic space. Letta says the adaptation of the single market should include all sectors rather than a select few and that fragmentation is holding Europe back.

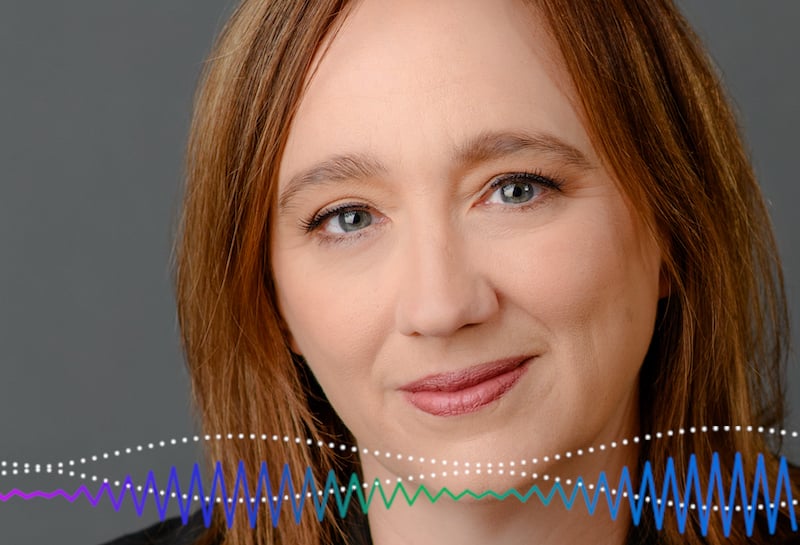

Claudia Sahm on how Private Data can Augment Official Statistics

While official statistics compiled by government agencies are still considered the most reliable, policymakers are increasingly using private data to get around their limitations. Former Federal Reserve economist Claudia Sahm says the immediacy and granularity of private company data should serve as a complement to traditional data, not as a substitute.

Country Focus

Business Growth and Innovation Can Boost India’s Productivity

Strengthening innovation could help boost productivity growth by 40 percent, equal to adding the output of the country’s fourth-largest state economy

Canada Can Grow Faster by Unlocking Its Own Market

Knocking down internal trade barriers could boost output in Canada by 7 perc

Saudi Arabia’s Path Forward Amid Lower Oil Prices

Prudent fiscal policy, vigilant financial oversight, and deeper labor and investment reforms can keep Saudi Arabia’s transformation on track