Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Slowdown in Emerging Markets Weighs on Caucasus, Central Asia

May 6, 2014

- Region’s growth still strong at 6 percent, but slightly lower than last year

- Weaker growth in trading partners—especially Russia—poses downside risk

- Structural reforms, closer regional cooperation would help in medium term

Economic growth in the Caucasus and Central Asia (CCA) is expected to decline to 6 percent in 2014 from 6½ percent in 2013, mainly because of sharply weaker activity in Russia and other emerging markets, the IMF says.

Chimkent oil refinery in Kazakhstan: A temporary decline in Kazakhstan’s oil output is contributing to the region’s lower growth (photo: TASS/Yevgeny Shlei)

REGIONAL ECONOMIC OUTLOOK

The IMF’s Regional Economic Outlook Update for the Caucasus and Central Asia, released on May 6 in Dubai, projects that slower growth prospects in the region’s main trading partners—Russia, China, and Turkey—will weigh on exports, foreign direct investment, and remittances. The report said that a temporary decline in oil output growth in Kazakhstan will also affect the region’s economy in the near term.

Risks from trading partners

Economic activity in the CCA continued to expand at a strong rate in 2013, thanks to robust domestic demand in the oil- and gas-exporting countries (Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan) and strong export growth in the oil- and gas-importing countries (Armenia, Georgia, the Kyrgyz Republic, and Tajikistan).

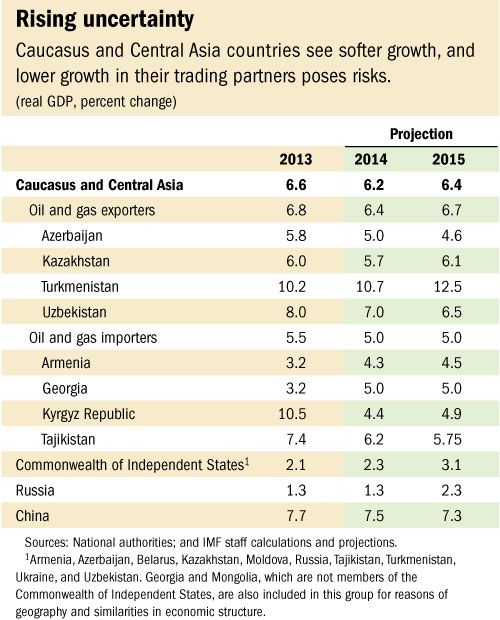

But this year growth is projected to soften, and risks to the forecast have risen, the report noted (see table).

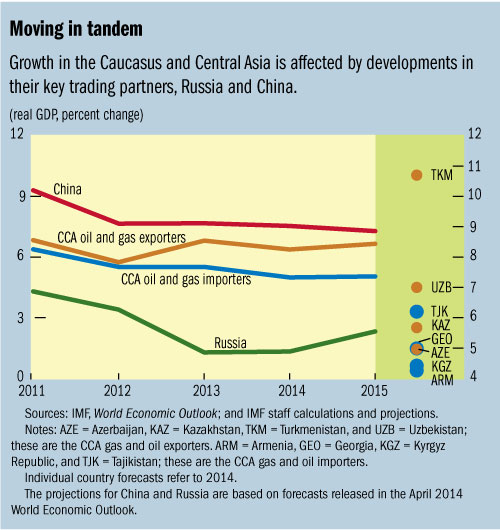

The main regional risk stems from a further deterioration of Russia’s growth prospects, which is likely to reduce growth through lower remittances, lower exports, and lower project financing. Geopolitical risks related to the Russia/Ukraine crisis may also affect the CCA through a gamut of trade, remittance, and financial channels, as well as possible disruptions in production or transportation of commodities. And a potential slowdown in China could also adversely affect the region’s economies (see chart).

The report noted that many of the gas- and oil-importing countries in the region have low fiscal and external cushions to draw on, despite the strong growth of recent years. This dearth of buffers would make it difficult for these countries to avoid an adjustment in the event of a large shock.

Inflation rising

Inflation in the CCA is expected to rise by 1½ percentage points to 7½ percent in 2014-15, mainly because of the recent currency depreciation in Kazakhstan and strengthening domestic demand in Georgia.

In countries where inflation is expected to stay within central bank target ranges, monetary policy can remain at a neutral setting, the IMF said. But the region’s central banks should stand ready to tighten policy if inflation pressures build up more quickly than expected, the report cautioned.

Policy recommendations

The report noted that most of the region’s countries could begin fiscal consolidation, a move that would improve debt sustainability, increase resilience to shocks, and preserve wealth for future generations.

CCA countries could also do more to strengthen monetary policy frameworks—such as providing greater independence to central banks, improving national statistics, and increasing transparency. These steps would help reduce inflation volatility, the IMF said, noting that some countries in the region have already made important progress toward emulating best practices of emerging markets in this area while others require more work.

The region could also strengthen financial regulatory and supervisory policies to ensure the continued soundness of its financial institutions—especially in the current environment of rapidly expanding consumer credit, the IMF recommended.

As for medium-term policy priorities, the region could concentrate on measures to raise potential growth, improve competitiveness, and build resilience to unanticipated economic shocks. Such measures include structural reforms to improve the business environment and governance, diversify the economy, and strengthen regional cooperation.

Focusing on these priorities could help CCA countries achieve their goal of becoming dynamic emerging market economies, the IMF said.

NOTE: Since the time the CCA Regional Economic Outlook Update was written, the risk related to the Russia/Ukraine crisis has materialized. Specifically, the CCA REO Update was based on the economic forecast released in the April 2014 World Economic Outlook. And, more recently, staff downgraded Russia’s economic growth forecasts from 1.3 percent to 0.2 percent in 2014.