Transcript of IMF Press Briefing on the Release of 2017 External Sector Report

July 28, 2017

Participants:

Martin Kaufman, Assistant Director, Strategy, Policy, and Review Department

Luis Cubeddu, Division Chief, Research Department

Wiktor Krzyzanowski, Senior Communications Officer, Communications Department

Also present:

Varapat Chensavasdijai, Deputy Unit Chief, Strategy, Policy, and Review Department

Gustavo Adler, Deputy Division Chief, Research Department

Mr. Krzyzanowski: Good morning, everybody. Thank you very much for joining us this morning in the United States, and good day to all of you watching us from around the world. My name is Wiktor Krzyzanowski, and I'm with the IMF Communications Department.

We are today presenting the 2017 External Sector Report of the IMF.

Let me introduce the speakers, the key authors of the report. Martin Kaufman is Assistant Director is Strategy, Policy and Review Department of the IMF; and Luis Cubeddu is Division Chief of the Research Department of the IMF. We also have with us in the room Varapat Chensavasdijai, Deputy Unit Chief in the Strategy, Policy, and Review Department; and Gustavo Adler, Deputy Division Chief at the Research Department.

Let us first introduce the findings of the report and the reasons underlying the production of this report to you, and then we'll be happy to answer any questions you may have, both in the room, and also online. You can follow us online on the IMF Press Center, and also send questions there.

Let me start with Luis, who will introduce the findings of the report.

Mr. Cubeddu: I will briefly summarize the key findings of this year's External Sector Report, and my colleague, Mr. Kaufman, will discuss how the report fits into the broader surveillance objectives of the IMF. As you are aware the surveillance of external positions is a core mandate of the IMF. These assessments are an analytical tool to determine on a globally-consistent basis, the difficult and often contentious issue of when external surpluses or deficits are appropriate and when they are assigned economic and financial risk.

The External Sector Report brings together the individual assessments of 29 economies, representing about 85 percent of global GDP, and it also discusses the policies that should be adopted to reduce the excess imbalances. And by excess I mean the deviation of surpluses and deficits from desirable levels.

We discuss policies and their appropriateness, so that they can support global growth and stability. For more details on the methodology, as well as the process whereby we arrive at assessments, I encourage you to look at the recent blog by Maurice Obstfeld, IMF’s Economic Counselor: “ Assessing Global Imbalances: The Nuts and Bolts .”

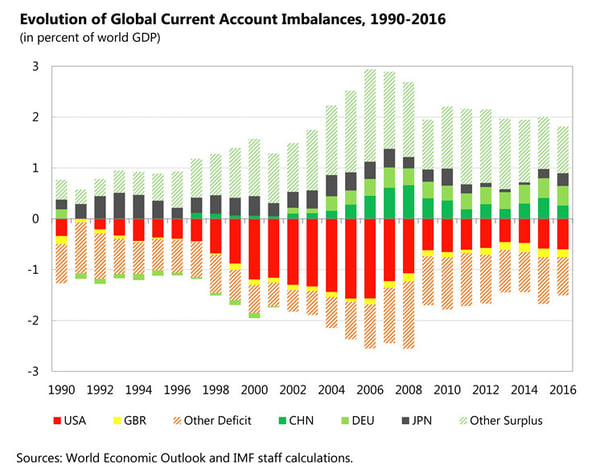

Let me now turn to and discuss the key findings of the 2017 External Sector Report. The first point worth highlighting is that global imbalances have narrowed significantly from their pre-global financial crisis peaks, and while this is positive, we also note that progress in reducing global imbalances has stalled in recent years, and they remain large from historical perspective. Both of these issues are depicted in the first chart shown.

Turning to the second point, we find that a good portion of these aggregate global imbalances are actually appropriate, and reflect well-known fundamentals such as demographics and the countries' relative investment needs. However, about one-third of total surpluses and deficits globally are deemed to be excessive, or they are undesirable.

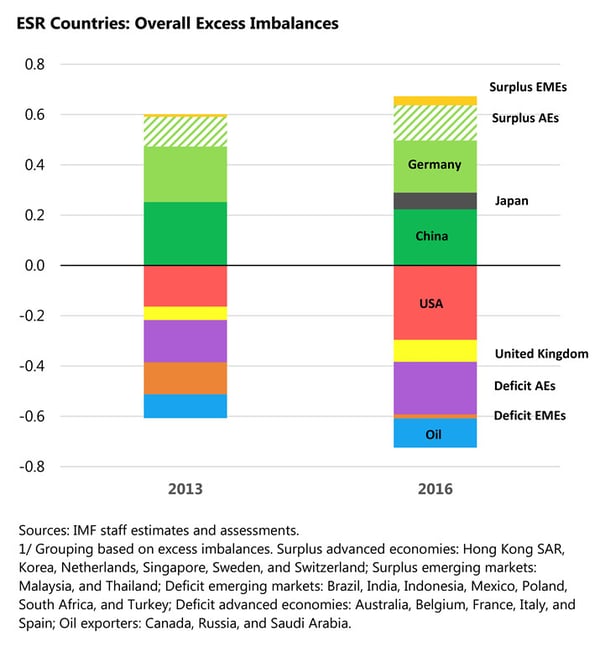

The third point is that we find that while the magnitude of these excess imbalances has remained unchanged since 2013, the composition of excess imbalances has shifted, and they are now increasingly concentrated in advanced economies. This can be seen in the second chart.

Specifically, what we have seen is that excess imbalances narrowed in key emerging economies led by smaller excess surpluses in China, smaller excess deficits in other countries like Brazil, Indonesia, South Africa and Turkey, where policies supported lower current account deficits, as external financing conditions tightened.

But this positive development on the emerging market side was accompanied by growth in excess imbalances in advanced economies; and importantly, a continuation of large and persistent excess surpluses in others. This is an issue that we explore in much greater detail in the report.

What does this rotation of imbalances mean for global risks and for policies? The current constellation of excess imbalances, especially the persistence of surpluses in a group of countries, and the resurgence of deficits in key debtor economies, indicate that the automatic adjustment mechanisms are weak. This means that prices, saving and investment decisions don't seem to be adjusting fast enough to correct imbalances. This partly reflects rigid currency arrangements, but also certain structural features, like inadequate safety nets, and barriers, which lead to undesirable levels of saving and investment.

Regarding global risks, the increased concentration of excess deficits in advanced economies, mainly the increased concentration of these deficits in the U.S., in the U.K., could be regarded as a positive development as deficit financing risks are reduced in the near term. However, we are also of the view that the current constellation of imbalances poses downside risks if these imbalances are unaddressed. And these downside risks are much more of a medium-term nature.

The concentration of deficits in a few countries could raise the likelihood of protectionists measures, and the continued reliance on demand from debtor countries, risks derailing the global of recovery, while raising the risk of a disruptive adjustment down the road as the gap between creditor and debtor positions grows.

What does this mean for policies? We are far from the level of imbalances that we were seen in the pre-crisis peak. Policy actions in our view are necessary to deal with the potential downsides that were previously mentioned. In particular, it will require efforts by both deficit and surplus economies to ensure that rebalancing is supportive of global growth and stability.

As a general rule, and we mentioned this clearly in the report, in countries whose deficits are above the desired levels, they should move forward with fiscal consolidation, while gradually normalizing monetary policy in tandem with inflation developments. Countries whose surplus are above the desired levels, and have room in their budget, should reduce the reliance on easy monetary policy and allow for greater fiscal stimulus. And in countries where monetary policy is far more constrained from playing a role, as in the case of individual euro area economies, countries should look to fiscal and structural policies to facilitate relative price adjustments.

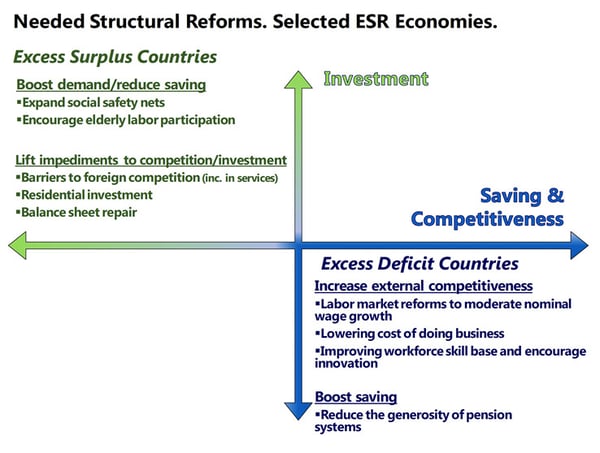

In fact, all countries should increasingly emphasize structural policies and this is another important point that we make in the report. That said, we are of the view that these policies need to be tailored to fit country-specific challenges and circumstances. This is shown in our third figure.

For example, countries with excess surpluses or surpluses above desired levels should focus on lifting distortions that constrain domestic demand and investment, and limit trade competition. Meanwhile, countries with deficits above desired levels, should focus more on policies to improve competitiveness and boost savings.

Finally, protectionist policies should be avoided at all cost. And this is highlighted in both box 6 and box 8 of the report. The reason is that they are unlikely to meaningfully address external imbalances, while they would be extremely harmful for both domestic and global growth.

Let me summarize again: Excess imbalances have rotated towards advanced economies. This poses challenges and risks. Perhaps less near-term risks, and more medium-term risk, if these are unaddressed. We are of the view that policies should be implemented by both surplus and deficit countries, and calibrated in a way such that they are supportive of global growth.

With this I pass the word to Mr. Kaufman.

Mr. Kaufman: Let me say a few words about why the IMF produces the External Sector Report. The oversight of the international monetary system is one of the key responsibilities of the IMF. Assessing the external position of member countries is therefore a core mandate of the IMF. In 2012, as part of broader efforts to enhance surveillance, the IMF launched the external sector report to strengthen its multilateral assessment of global imbalances. This comprised both significant methodological upgrades with a development of the external balance approach, the EBA, replacing what was called before the CGER. But also, better distilling an integrated global view from the constellation of individual assessments and presenting it in a dedicated report, the External Sector Report.

These methodological upgrades allowed to better disentangle the contribution of policies, for instance fiscal policy or FX intervention, to external imbalances, and in particular, the role of policy gaps, which are deviations of actual policies from desirable polices. Moreover, the role of economic fundamentals, such as demographics, in explaining external positions was further improved. Of course, there is room for routinely reassessing and refining the methodologies.

In turn, the introduction of the external sector report allowed us to better understand the extent of excess global imbalances, their key drivers, what they mean for global risks, as well as the vital importance of collective action, as Mr. Cubeddu emphasized, by both surplus and deficit countries, to ensure that the reduction of global imbalances is done in a growth friendly manner. In this way, it allows us to focus discussion on the key policies and distortions underlying imbalances.

Let me make a parenthesis here and elaborate on the last point. As the report notes, excess global imbalances are primarily driven by macro policies and structural distortions. Trade barriers can play a role in some instances to the extent that they have macroeconomic effects on savings and investments. And the External Sector Report highlights a few instances where increasing competition, for instance, is desirable -- for instance, in box 8 page 25, and in table 5 page 46.

Addressing excess global imbalances requires addressing primarily those macro and policy gaps and structural distortions, which are certainly specific to each county. Nevertheless, there are still significant trade barriers, particularly non-tariff barriers and barriers affecting services, and reducing those barriers would boost further trade integration, bolster productivity and support growth.

Let me conclude by saying that the External Sector Report is a key global public good, particularly in today's highly interdependent world. The IMF is uniquely placed to do this job because of its near universal membership and macroeconomic expertise. The External Sector Report provides a multilateral assessment that is a blueprint for collective action to reduce global risks and support strong and sustainable growth.

Mr. Krzyzanowski: Thank you very much. We are now ready to answer any questions you may have both in the room and online.

Questioner: The Federal Reserve has raised the interest rate several times but the U.S. dollar has not appreciated as much as expected. So, how do you assess this kind of phenomenon? About the assessment of the United States’ external position, you mentioned that the U.S. dollar is a little bit weaker than the fundamentals. Please elaborate on this assessment.

Mr. Cubeddu: I think one key point to make is to look a little bit at the longer term. So, what we've seen is an important appreciation of the U.S. dollar since 2013 through 2016. We have seen quite a bit of volatility following the U.S. election, where we saw a period of appreciation followed by some weakness in the U.S. dollar. This simply reflected the views of policies in the United States in the extent to which those policies were going to be stimulative. I think that the view is that there has been some scaling back about the policies that the new administration would undertake and the extent to which they would stimulate growth and demand. There has been some scaling back of that. For this reason, we haven't seen the strength in the U.S. dollar. In addition, I think it is important to point out that the U.S. policy interest rates have only risen quite gradually and that continues to be the expectation going forward.

Mr. Krzyzanowski: We also have one question on U.S. online, from Shawn Donnon at the Financial Times. What is the message that authorities in the United States should be taking from this report and could you elaborate on your findings in box 6 on trade protectionism. You seem to be saying that protectionism can work and yet it has a cost.

Mr. Cubeddu: I think the important takeaway from the box is not that trade protectionism can work. In fact, our view is that trade protectionism has a negative impact both on the country that is imposing the trade protection, the tariff be it or non-tariff barrier. We see this as a negative for the country that is imposing it as well as negative globally as well. So, the key takeaway of the box is the following in that it that it would be negative for the country that is imposing it. It may have a transitory positive impact on its trade balance, but it would have a negative implication for growth both domestically as well as globally.

In terms of what the key takeaway of the report for the United States would be is, I think that addressing global imbalances it’s imperative, that actions are not only required by countries that have excess surpluses but also countries that have excess deficits. In the case of the United States, as was mentioned in the recent Article IV consultation, the view of the team is that the U.S. should gradually consolidate its fiscal position. This is going to also help in terms of dealing with this excess deficit or too weak current account. And also proceed with structural reforms that boost competitiveness and also increase overall savings. So, again in terms of the key takeaways of the report, we're looking for actions from both sides, it is not only about surplus economies taking actions to deal with those excess surpluses, but also deficit economies.

Questioner: Recently the IMF revised down the United States economic outlook. Considering the U.S. fiscal policies remain still uncertainty, how do you expect the United States economic growth to develop in the future?

Mr. Cubeddu: I would suggest that you refer to the U.S. Article IV that was recently released. My understanding is that the team is of the view that the revisions reflect changes in policy expectations. For that for that reason, U.S. growth has been scaled down a bit. However, I think growth over the medium-term is broadly unchanged relative to where it was before. It was a revision much more to the near-term growth related to reduced prospects of policy stimulus.

Questioner: Considering U.S. fiscal policies, there is still uncertainty. How can U.S. economy keep a sustainable growth in the future?

Mr. Cubeddu: On the policy and the risks related to policy implementation, our view is that these are far more balanced than before. We have a situation where yes, there is a risk that U.S. policies could out to be more stimulative, but there is also a risk that could be tighter than under the baseline. So, we basically have a baseline where on the policy front the risks are more of a balanced.

One of the points that we do make in the report, however, is that there is a downside risk of policy actions in the U.S and other excess deficit countries that could go against closing their excess deficit positions. Should the U.S. embark on a large fiscal stimulus, this would carry some risk, not only for the U.S. but also globally in the sense that you would have a stronger U.S. dollar, you would have a tightening of monetary conditions, and this could have implications for many emerging economies. So, this is a risk that we highlight in the report.

Mr. Krzyzanowski: Let me turn online again, we have a couple of questions from Ian Talley with The Wall Street Journal. If the savings glut contributed to the global financial crises, what main trends risk the next crises? Another question: Why should we be concerned about the net international investment position surge seen in Figure 13? And then, last question if I may, please explain better this sentence: A greater concentration of excess deficits in advanced debtor economies may engender protectionist sentiment and raise the risk of disruptive corrections down the road, including due to widening external stock imbalances.

Mr. Cubeddu: With regards to the first point, and why we should be concerned about the NIIP position, and this refers to Figure 13, I think the view is the following: stock imbalances could widen over time, and this widening could spell trouble down the road, especially if policies are not put in place to correct some of the external gaps that currently exist. So the idea is the following, the U.S. NIIP position is projected to deteriorate further as it will continue to have a current account deficit. The same thing can be said about Germany, Japan, and other advanced economies that have surpluses. Their NIIP position is projected to improve further as they continue to register current account surpluses.

We don't see, necessarily, this as a huge near-term concern. The big concern is that if the U.S. and also surplus economies don't address their excess imbalances, their excess surpluses or excess deficits, what we would see a much larger deterioration than their IIP positions, a much bigger gap between creditor and debtor positions, that could haunt them down the road. And so, again, what we're basically making as a call for action to address this growing divergence between creditor and debtor positions. With regards to risks, we see this much more of a medium-term risk and that action should be taken to prevent an important widening of these positions.

As to the question about the greater concentration of excess deficits in advanced debtor economies and what does it mean for protectionism, I think the view here is more that when you have the concentration of excess deficits in a few countries, there could be pressures to address them through protectionist policies. Since it can engender protectionist sentiments. The idea of the report is that it is important to address imbalances, because if they're not dealt with appropriately and through the right policies, we could have a backlash in the form of protectionism. Mr. Kaufman may wish to add in this regard.

Mr. Kaufman: Just to say that this type of trade protectionist measures can be first and foremost self-detrimental and obviously can hinder and affect global growth, particularly, in the current age of global supply chains where they can have significant ramifications. But the report also takes a more positive view and says, look, there are still some trade barriers, particularly, as I mention, in services. And reducing those trade barriers, including non-tariff barriers, can be very important to bolster productivity and growth, and that’s an element that we want to highlight. There is still room to improve and further promote trade integration through reducing existing trade barriers.

Mr. Krzyzanowski: Let me on this occasion also recall what the speakers already mentioned that there is a very useful explainer on the economics of global imbalances in a recent blog by the Economic Counsellor of the International Monetary Fund.

Questioner: China's renminbi has appreciated this year and the foreign reserves has also stopped declining due to some measures taken by the government to control the capital flows. So how do you assess China's efforts to stabilize the foreign reserves and do you support China's stance in this regard?

Mr. Cubeddu: I think the first point is that the recent depreciation of the renminbi does not change our external assessment in the case of China. We still view China's real exchange rate to be broadly in line with fundamentals. I think it's important to mention that we have seen less capital outflows, less need to sell reserves, or less reserve loss. This likely reflects policies that have been put in place to stabilize growth. I do think that China will have important challenges going forward, including how it goes about rebalancing its domestic economy away from credit, away from investment, and towards consumption, and this will be a key area that the authorities we understand are working on, with a keen eye of maintaining financial stability and containing financial risks.

Mr. Krzyzanowski: Since we're in China, there is one question online from David Lawler at Reuters: Can you explain a bit more about how you arrived at the China REER assessment? There is an unusually wide gap with fundamentals of plus/minus 10 percent and the current account surplus is still too large. How does this not translate to an undervaluation?

Mr. Cubeddu: I will point to paragraph 14 of the report. While in general we real exchange rate assessments and current account assessments match, there are a few cases where that is not the case. China being one where the discrepancy between the current account and real exchange rate assessments arise. especially in situations when there's a sharp real exchange rate movement, in this case, appreciation, that is not yet been fully reflected in the current account. Our view is that the real exchange rate for China remains broadly in line despite a moderately stronger current account. And that we are bound to see a further narrowing of the current account surplus going forward as reforms are put in place. So again, we have some discrepancy. These discrepancies are deemed to be transitory and the view is that the current account surplus for China will come down as reforms are put in place.

Mr. Krzyzanowski: I think it's also useful to remind that the China Article IV will be shortly discussed by the IMF Executive Board and released a few days after. The same is true for Japan.

The next question comes from Yomiuri Shimbun. Francesca Regalado is asking what should the Bank of Japan take from this report regarding their interest rates? So again, Francesca, Japan Article IV will be shortly discussed by the IMF Executive Board and we will be of course releasing that. But as regards the External Sector Report, I ask Luis to address this question.

Mr. Cubeddu: In the case of Japan we're of the view that the monetary conditions should remain accommodative as Japan looks to strengthen its growth prospects. It still has a fairly negative output gap. Our view is that on the macro policy side, monetary policy should remain easy as Japan embarks on a gradual fiscal consolidation. Given the presence of slack, monetary policy should normalize only gradually.

Mr. Krzyzanowski: And then we have also country-specific question from Ian Talley at Wall Street Journal. How is Germany's surplus a threat to the global economy?

Mr. Cubeddu: I think this is a loaded question. We don't necessarily see Germany's surplus as a threat to the global economy. We are of the view that part of the surplus of Germany is excessive and higher than desirable and that there are policies that Germany should put in place for its own domestic interest to reduce that surplus. And by reducing that excessive surplus, it would have positive spill-overs on the global economy. So again, the policies that we're recommending for Germany to reduce its excessive surplus are actually in its domestic interest. Many of those policies have been highlighted in the recently completed Germany Article IV consultation. They involve policies that boost productivity, that encourage investment in particular sectors, with the view of enhancing its own growth potential, its own demand, and in the process, improving growth prospects for the world.

Mr. Kaufman: The report also highlights the importance of structural reforms, including competition policies, which are in the own interest of Germany, and supporting what Luis was saying in terms of bolstering investment and productivity.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Wiktor Krzyzanowski

Phone: +1 202 623-7100Email: MEDIA@IMF.org