2017 Article IV Consultation with Sweden—IMF Mission Concluding Statement

September 28, 2017

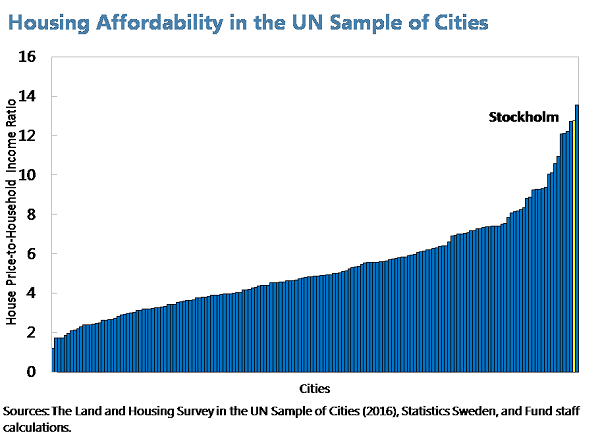

Sweden’s economy is performing well, with robust growth bringing unemployment down and lifting the fiscal balance into surplus. But wage rises remain low despite the employment rate hitting EU highs, contributing to subdued inflation. An unwinding of the accommodative stance of monetary policy must continue to await a durable rise in inflation. Making wage formation more responsive to domestic conditions—such as by using trends in labor productivity and inflation expectations as guide posts for industrial wage negotiations—would facilitate inflation returning to target while preserving high employment and industrial peace. New initiatives to help the low‑skilled and refugees gain a foothold in the labor market should be embraced. Strong construction activity is helping to moderate housing price increases, but home purchasers still face elevated prices and heavy debts, making it important to adopt the proposed stricter amortization requirement. Structural reforms are critical to gradually improve housing affordability, which poses a major obstacle to inclusive growth. The 2018 budget addresses key social goals although it also constrains fiscal flexibility in subsequent years.

1. Sweden enjoys robust growth and unemployment declining to low levels . Aided by strong investment, especially in dwellings, growth of about 3.1 percent is expected in 2017. Job creation at a pace of over 2 percent is remarkable, especially as Sweden’s employment rate hits EU highs of 81.2 percent. Rising labor supply has facilitated this strong growth, including inflows of foreign workers especially in construction. Yet unemployment has still declined to 6.7 percent on average in recent months, or 4.5 percent excluding full-time students.

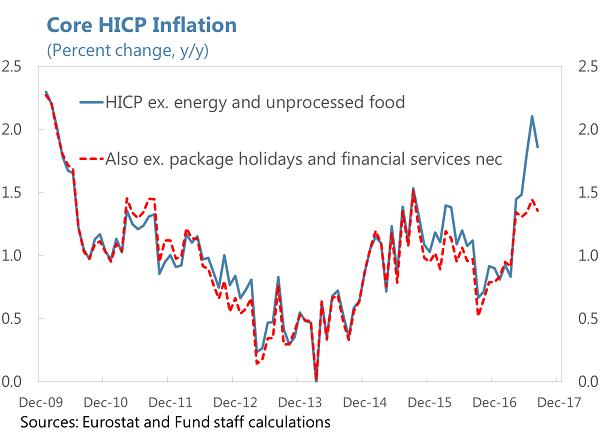

2. Inflation remains subdued nonetheless, with low wage rises playing an important role. Core HICP inflation has risen significantly from its average of just 0.5 percent in 2013‑14, with recent figures around 2 percent. However, after excluding some volatile items, core inflation is notably lower at 1.4 percent. Low inflation goes hand‑in-hand with wage rises of only 2.3 percent in 2015-16.

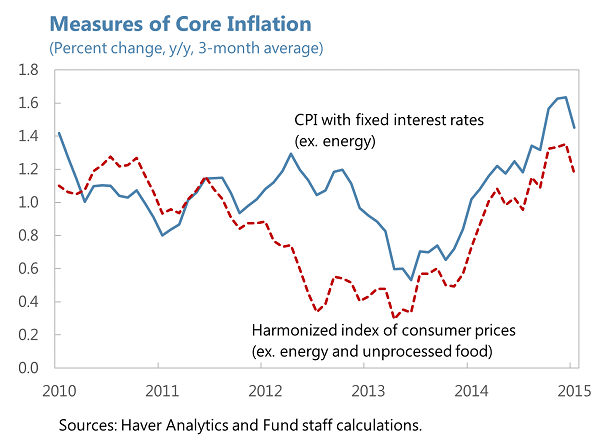

3. Solid growth is expected to continue, but uncertainty around inflation prospects remains. Growth of about 2.4 percent in 2018 will be supported by an improving international environment, accommodative monetary policy, and initiatives in the 2018 budget. Unemployment is likely to decline to around 6.3 percent next year and to remain low even as growth eases to about 2 percent in later years. Core HICP inflation of about 1.5 percent is expected in 2018, followed by a gradual increase thereafter. This medium-term outlook for increasing inflation assumes wage growth picks up to over 3 percent, as would typically occur in Sweden as labor markets tighten. But centrally-agreed wage rises averaging just 2.2 percent annually for 2017‑19, and the near absence of drift over the agreed rises in recent years, indicate downside risks to this outlook.

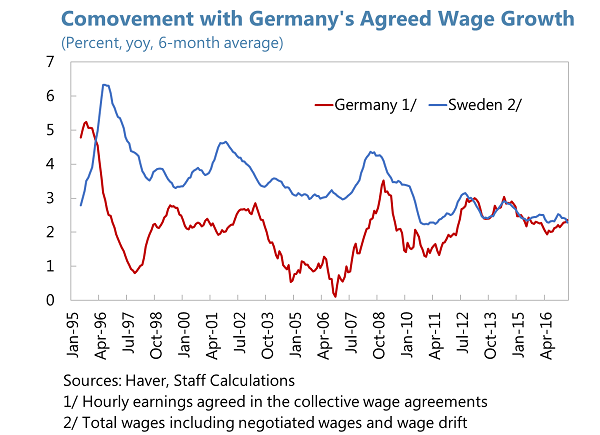

Monetary policy

4. Clearer signs that inflation is on a sustained uptrend are needed before unwinding monetary accommodation. Durable inflation around the 2 percent target would promote macroeconomic stability, including by enabling a normalization of interest rates that would rebuild room for monetary policy to help cushion shocks. At this stage an accommodative monetary stance remains appropriate with core inflation expected to fall back to about 1.5 percent in 2018. This stance can be maintained even with some further tapering of bond purchases, especially if downward pressure on bond yields in the euro area is reduced. Rate hikes should be considered once there are clearer signs that inflation is on a sustained upward trend. Stronger labor cost growth and services inflation, together with inflation expectations close to or above target, would constitute better signs of a durable increase in inflation. Foreign exchange intervention should remain a last resort limited to containing a decline in inflation in the event of a sharp krona appreciation.

5. The parliamentary review of the Riksbank Act is a welcome opportunity to analyze the inflation target, financial stability arrangements, and its financial independence. The Riksbank recently announced a significant upgrade in the inflation target by focusing on the CPI with fixed interest rates (CPIF). The review should also evaluate targeting the internationally‑comparable HICP measure, which excludes housing prices and some imputed items subject to one-off changes like depreciation. HICP inflation can provide better signals to policy makers at times, such as in 2012-13 when it declined well ahead of CPIF inflation. The 2016 Financial Sector Stability Assessment recommended that the Riksbank’s financial stability role be put on a firmer legal footing, by providing explicit mandates for the Riksbank to monitor systemic financial risks and to provide emergency liquidity to banks. It would also be important to ensure that the Riksbank’s financial autonomy is protected.

Labor reforms

6. Sweden’s wage formation system has long functioned well, but current nominal wage rises are out of sync with domestic fundamentals. For many years the wage setting process led by the industrial sector generated an enviable combination of solid real wage growth, high employment, and low labor disputes. Yet this system has increasingly anchored Swedish nominal wage rises on those in Germany. But wage growth in the 2.0‑2.5 percent range is too low relative to Swedish productivity trends and inflation targets, which would indicate rises of about 1 percentage point more. Higher nominal wage rises may not add significantly to real wage growth owing to higher inflation and a weaker trend in the krona than otherwise, but they would relieve pressure on monetary policy to prolong low interest rates.

7. Moving labor to areas with increasing needs is essential in coming years . Besides the construction and IT sectors, the areas with greatest labor shortages include education, health care, and other social services. The outlook for rises in both the young and elderly populations imply that such shortages will worsen, requiring these sectors to attract employees with the right skills that are currently working elsewhere. However, the wage setting system has great difficulty allowing relative wages to incentivize the reallocation of labor to where it is most needed.

8. The social partners should work to build consensus on making wages more responsive to Swedish conditions at both the macroeconomic and sectoral level. A range of approaches could be considered while preserving collective bargaining and protecting high employment. But the bottom line should be wage rises that are anchored on trends in Sweden’s labor productivity and medium-term inflation expectations, and which are sustainable in relation to business sector profitability, as analyzed in the annual wage formation reports of the National Institute of Economic Research. A combination of greater scope for sectoral wage differences and firm‑level flexibility would help to better meet the changing labor needs ahead. Discussions with the social partners indicate that broad consensus on a new approach would be key to ensuring that it functions well in practice.

9. New initiatives to boost employment of the low-skilled and migrants are emerging; these will be most effective as a coherent package of programs that meet the needs of different groups. The foreign-born now account for over half of unemployment and unemployment rates are also high for the low-skilled, such that further unemployment reductions must come from these groups. Alongside others seeking to address this challenge, LO (the Swedish Trade Union Confederation ) has put forward a Job and Education Initiative to facilitate labor market entry by adults who lack sufficient knowledge and skills. Temporarily lower wage costs for these employees would encourage employer participation, while the government would need to provide well‑matched educational opportunities and student aid to ensure a reasonable standard of living. This initiative would be complemented by approaches that address the needs of other groups, with younger working age persons more likely to benefit from a greater emphasis on education, while older persons may need more prolonged wage subsidies and work that matches their capacities.

Housing reforms

10. High housing costs weigh heavily on Sweden’s financial stability, growth, and equality . Housing price increases have moderated, aided by the surge in new dwelling construction to almost 4 percent of GDP, although price rises are still too high at 9 percent y/y. Home costs have more than doubled relative to median incomes since the mid‑1990s, with Stockholm’s ratio nearly twice the national average and among the highest worldwide. The option to rent is severely constrained by long waiting lists owing to rent controls. These factors reduce labor mobility, especially for those from outside the main centers, hindering inclusive growth. Equity is further undermined by overcrowding among low‑income groups and the need to rely on parental savings for housing purchases. New purchasers must take on debts averaging over 400 percent of their disposable income, and over 500 percent in Stockholm, making them vulnerable to shocks especially higher interest rates.

11. Improving housing affordability should be a central priority, supported by deep structural reforms to promote the more efficient use of property:

-

Sustaining housing supply . High construction costs in Sweden need to be addressed by streamlining complex and burdensome building regulations and promoting competition in the sector, including by harmonizing fragmented planning and approval processes. Improving public transportation within regions would help relieve demand pressures in major centers. Budgetary support for construction of rental housing that meets affordability tests should be expanded.

-

Phasing out rent control . Providing incentives to better match housing to household needs will effectively increase supply in areas with high demand. All new construction of rental apartments should be fully exempt from controls. Rents on apartments under control should be progressively aligned with market rates, with low‑income households protected by the housing allowance.

-

Removing tax incentives for home ownership and debt . To promote more efficient use of space, the composition of property taxation should be shifted by cutting capital gains taxes that deter sales while raising the recurrent property tax, which in 2008 was capped at a level among the lowest in OECD. If the property tax cannot be raised, it becomes more critical to reduce mortgage interest deductibility to ease demand and discourage high leverage. The macroeconomic impact would be modest while interest rates are low and such reforms could be part of a broader package that also benefits households.

Financial stability

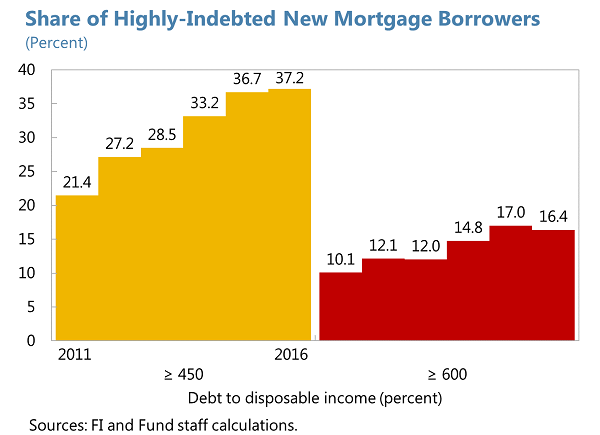

12.The stricter amortization requirement proposed by Finansinspektionen (FI) should be adopted soon. The amortization requirement effective from mid-2016 has encouraged purchases of less expensive housing and has modestly reduced the share of new mortgages with high debt-to-income (DTI) ratios. The proposed additional 1 percentage point of annual amortization for new mortgages with a high DTI ratio would further slow the increase in the share of high DTI loans. The effectiveness of macroprudential measures should continue to be reviewed regularly, making it essential that the authorities collect information on households’ balance sheets. Further steps, including a possible DTI limit, should be available to use if needed.

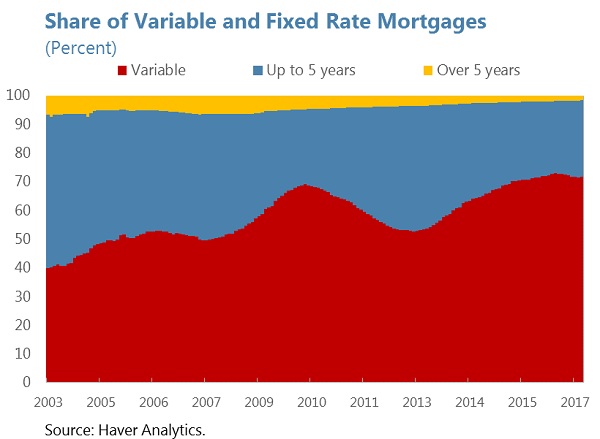

13. Removing deterrents to fixed rate mortgages would help households manage their risks. Some 72 percent of mortgages have variable rates, with interest fixing for over 5 years being rare, partly because fixed rate loans can be subject to a prepayment fee. Eliminating this fee would make fixed rate loans more attractive, enabling households to better manage their interest risk exposure and potentially easing macroeconomic vulnerabilities. This step would also make it feasible to consider limits on variable rate mortgages if warranted for macroeconomic or financial stability purposes.

14. The strengthening of FI’s capacity to safeguard Sweden’s financial stability must be completed. The augmentation of FI’s budget in 2018 is welcome to build its capacity for robust supervision of Sweden’s large and interconnected financial system. Implementing the expansion of FI’s macroprudential authority as scheduled in early 2018 would address a key recommendation of the IMF’s 2016 FSSA. To ensure that macroprudential measures are timely and effective, the government’s approval responsibility should only be used as an “emergency brake”. Nordea’s proposal to move its HQ to Finland will require sound supervisory and resolution arrangements to be established among the relevant authorities, guided by the MoUs signed in December 2016, and it should not reduce Nordea’s capital.

15. Swedish banks rely heavily on wholesale funding, requiring close liquidity monitoring and adequate foreign reserves. Alongside the adoption of EU liquidity regulations, Sweden should retain its own requirements on euro and U.S. dollar exposures. Monitoring an extended (three‑month) Liquidity Coverage Ratio in U.S. dollars and euros will remain useful in ensuring the adequacy of liquidity buffers. To safeguard the stability of the Swedish and regional financial systems, the Riksbank must also hold sufficient foreign reserves.

Fiscal policy

16. Sweden’s strong economy has boosted revenues, bringing the fiscal position into surplus in 2016-17. A surplus of about 0.9 percent of GDP is projected in 2017, benefiting from an unexpectedly strong revenue base in 2016. The fiscal stance is estimated to be broadly neutral in 2017, with the structural balance stable at around 0.6 percent of GDP, well above the structural deficit of 2014 and approaching the current medium-term surplus target of 1 percent of GDP.

17. The 2018 budget tackles key social goals and it is mildly expansionary. Initiatives of 0.9 percent of GDP include expanded resources for core public services, security, welfare, and climate and the environment. These measures to strengthen the Swedish model will reduce inequality and the streamlining of active labor market policies should expand the number of firms and workers that benefit. Estimates of the structural balance decline only slightly to about 0.5 percent of GDP in 2018, with the macroeconomic stimulus reinforced by the composition of measures, yet concerns around overheating are limited by persistently low inflation.

18. Even with a reduced surplus target, budgetary flexibility in 2019 is more limited. The structural surplus expected for 2018 is close to the new medium‑term surplus target of 0.33 percent of GDP effective from 2019. Moreover, the budget includes significant commitments for 2019-20 that reduce scope for other initiatives. Nonetheless, Sweden’s fiscal position remains healthy and continues to allow full operation of the automatic stabilizers over the cycle. It is welcome that the surplus target and debt benchmark will be reviewed every 8 years. If debt falls below the 35 percent of GDP benchmark, a further reduction in the surplus target may be appropriate in due course.

The mission team thanks the Swedish authorities and other counterparts for the candid and insightful discussions and much appreciates their warm hospitality.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org