Portugal: Staff Concluding Statement of the 2019 Article IV Mission

May 17, 2019

Portugal’s expansion is in its sixth year, with unemployment now below pre-crisis levels and improved private and public leverage ratios. Growth is expected to ease to 1.7 percent in 2019, still above its medium-term potential. Although the main sources of risk are external, strong policies at home are needed to make Portugal more resilient. Banks’ overall health has improved significantly, but still high nonperforming loans and low-profitability continue to demand attention. The government’s target for the nominal fiscal balance appears within reach, but the high ratio of public debt warrants additional fiscal effort. Public policies should foster higher productivity, investment, and saving to boost balanced long-run growth.

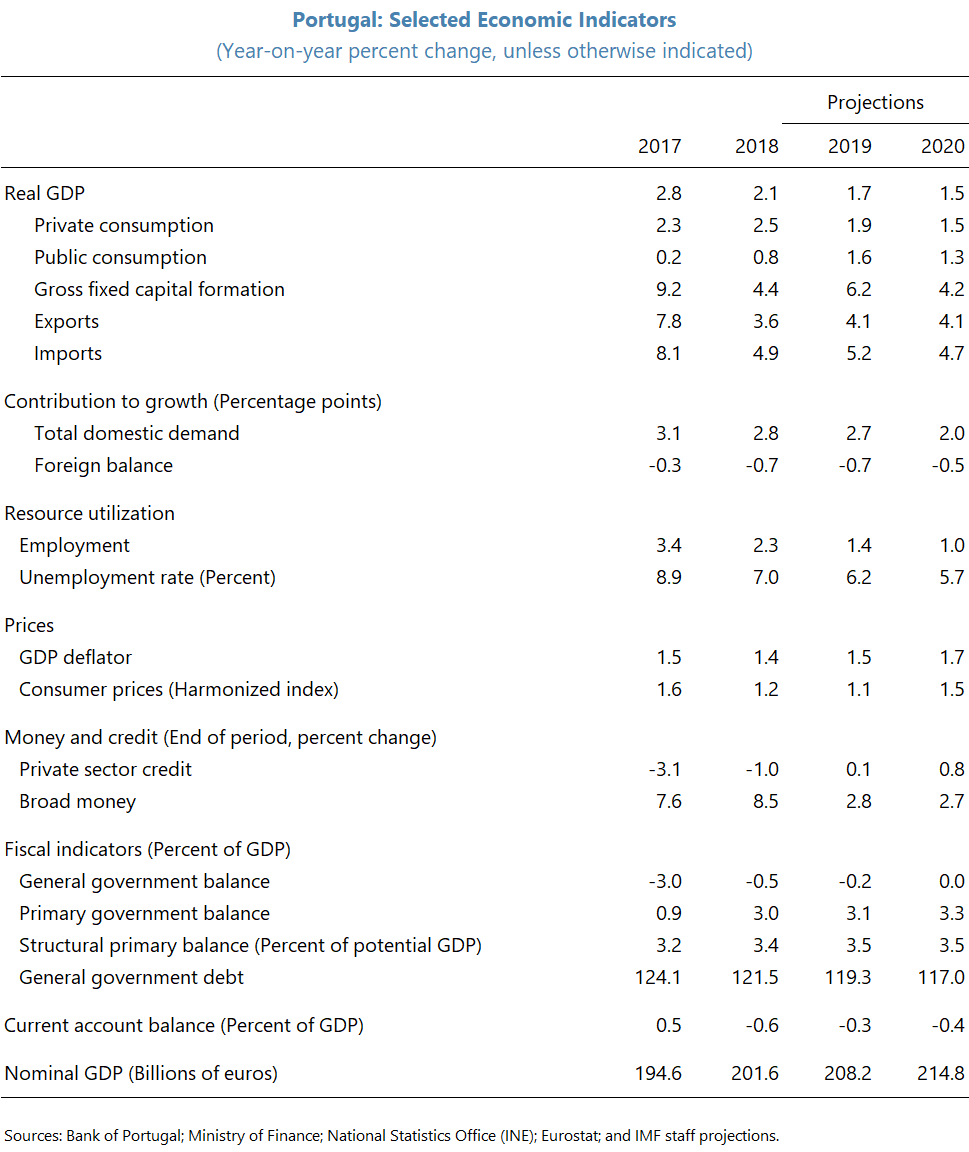

Economic activity is expected to moderate further in 2019. The economy grew 2.1 percent in 2018, down from 2.7 percent in 2017. The second half of 2018 was marked by a deceleration, coinciding with weaker economic activity in Europe. In 2019, the mission team forecasts real GDP growth to ease to 1.7 percent, and subsequently to move towards its estimated medium-term potential of 1.4 percent – implying very slow convergence to average euro area livings standards. Consumer prices also decelerated in 2018, and inflation is expected to remain low. Falling steadily over the past five years, the unemployment rate was 6.5 percent (seasonally adjusted) in the first quarter of 2019. Employment growth is expected to moderate in 2019. The external current account shifted into deficit in 2018, and is projected to continue posting moderate deficits in coming years.

The risks to the growth outlook have increased since last year. As illustrated by the recent volatility in euro area activity indicators and the downward revision of real growth forecasts for Europe in 2019 by the IMF, the European Commission, and the European Central Bank, external risks are significant, and include a further deceleration in Europe and a range of other external risks. As a small open economy integrated in the European and global economies, Portugal would directly feel the negative consequences of weaker external growth and rising protectionism. A disorderly Brexit might be especially felt through tourism. Domestically, vocal groups are pressing for more spending. Maintaining strong domestic policies is essential to mitigate external risks and ensure the continued reduction of vulnerabilities associated with still high public and private debt.

The target for the nominal fiscal balance in 2019 appears feasible. The headline fiscal balance improved by 2.5 percent of GDP in 2018, reaching -0.5 percent of GDP. This improvement was driven by a large drop in bank recapitalization costs, a declining interest bill, stronger-than-potential economic growth, and tight budget execution—resulting in a small increase in the structural primary balance relative to 2017. Despite the higher-than-budgeted transfer to Novo Banco under the contingent capitalization mechanism, the 2019 nominal fiscal deficit target of -0.2 percent of GDP looks feasible, with buoyant revenue and capital spending now projected somewhat lower than budgeted. Moreover, the deficit is projected to be eliminated in 2020 under unchanged policies. The public debt ratio should decline again in 2019, and in the absence of adverse developments, is expected to fall to about 100 percent of GDP in 2024—a clearly positive prospect.

Greater fiscal effort would help build more resilience. The authorities should aim to consider additional fiscal efforts now and in the coming year to build policy space by reducing still-high public debt more rapidly and better differentiate Portugal from other high-debt countries. Such space would also help to prepare for upcoming pressures on spending from an aging population and to guard against unanticipated adverse events. Accordingly, the mission recommends an additional 1 percent of GDP tightening of the structural primary balance over the next two years, taking advantage of a still favorable environment, including supporting monetary conditions. In the event of a material downturn in economic activity, a neutral fiscal stance would be appropriate as long as the public debt ratio remains on a downward trajectory (which supports moderate sovereign interest rate spreads), allowing the nominal deficit temporarily to widen as a result of slower growth.

The composition of public spending needs rebalancing. Ongoing efforts to prioritize public investment in areas such as healthcare are welcome, as is the rise in investment projected in the Stability Program; but needs are pressing. As noted by the Fiscal Council, the latest official projections of the government wage bill for coming years are significantly higher than projected last year, implying additional pressure on the public finances—even within the solution given to the difficult question of career progressions. The stop-and-go cycle of career progressions since 2005 (years before the program period) has been disruptive for both the government and public servants, and raises questions about the sustainability of these frameworks in the face of economic fluctuations. A comprehensive review of the level, composition, and rules of public employment would lay the basis for better controlling the trajectory of current spending, without sacrificing service delivery. In addition, the pension system could benefit from targeted adjustments with the aim of curbing projected aging-related expenditure increases over coming years and reducing inequality among pensioners, which is high by European standards.

Supervisors should maintain the focus on furthering the ongoing bank balance sheet repair. Bank capital ratios have been boosted by the 2017-18 capital augmentations, profitability has improved, and non-performing loans have markedly decreased, but banks continue to face challenges. Although it remains below Euro Area standards, asset quality has steadily improved, with the nonperforming loan (NPL) ratio declining to 9.4 percent at end-2018, with a provisioning ratio above 50 percent. The banking system has reported positive profits since the beginning of 2017, but these remain low relative to pre-crisis levels and below the cost of equity. The mission recommends that supervisors ensure that banks continue to follow through on their NPL reduction targets and strengthen their corporate governance, internal controls, and risk management, and encourage banks to step up efforts to improve operational efficiency and profitability. An effective financial supervision model must ensure the independence of supervisors, support timely and informed decision making, be cost efficient, and provide a leading role for the central bank in macroprudential matters. One of the main goals of the financial supervision reform bill before Parliament is to enhance coordination among the three sectoral supervisors. The bill has features that could improve the current system. Nevertheless, the three national sectoral supervisors (Banco de Portugal, Comissão do Mercado de Valores Mobiliários, and Autoridade de Supervisão de Seguros e Fundos de Pensões) have raised legitimate concerns regarding the bill that merit careful consideration in Parliament before this bill is passed into law.

Strengthening medium-term growth requires higher investment and productivity. A more streamlined regulatory environment, stronger product market competition, improved skills, and more efficient use of labor are key to raising productivity and investment, which are needed to raise potential growth. Further progress in promoting competition in the network industries – notably energy and transport - is important for supporting competitiveness. Enhancing labor market flexibility by making permanent contracts less rigid is important for Portuguese firms’ ability to process adverse shocks.

Fostering higher private saving is required for balanced growth. Corporate and (especially) household saving are below the corresponding Euro Area averages. Sustaining higher investment rates without creating new external imbalances requires stronger domestic saving rates. The authorities should issue the regulations needed for the complementary second-tier occupational pension schemes, as called for in existing legislation. They should also explore options, including tax incentives, to encourage the use of well-regulated complementary occupational and individual retirement saving schemes.

The mission would like to express its gratitude to the Portuguese and European authorities and other interlocutors.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Andreas Adriano

Phone: +1 202 623-7100Email: MEDIA@IMF.org