If left unchecked, COVID-19 threatens to overwhelm weak healthcare systems (photo: Afolabi Sotunde/Reuters/Newscom)

Six Charts Show How COVID-19 Is an Unprecedented Threat to Development in Sub-Saharan Africa

April 15, 2020

Sub-Saharan Africa is facing an unprecedented health and economic crisis. One that threatens to reverse the development progress of recent years. Furthermore, by exacting a heavy human toll, upending livelihoods, and damaging business and government balance sheets, the crisis threatens to slow the region’s growth prospects for years to come.

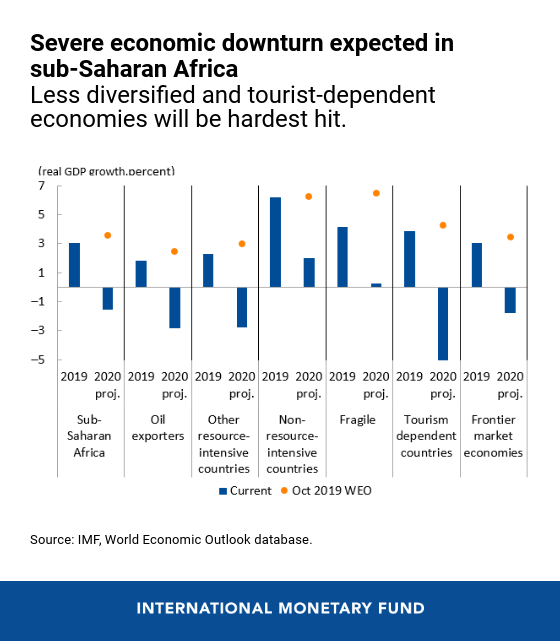

Overall, GDP is expected to contract by -1.6 percent in 2020, a downward revision of 5.2 percentage points compared to six months ago, the IMF says in its latest Regional Economic Outlook: Sub-Saharan Africa.

Comprehensive measures are needed to limit humanitarian and economic losses. Despite the limited space going into the crisis, timely fiscal support is crucial to protect vulnerable groups and ensure a quick recovery when the pandemic fades.

“The ability of sub-Saharan African countries to mount the necessary fiscal

response will require ample external financing on grant and concessional

terms from the international community,” says Abebe Aemro Selassie,

Director of the IMF’s African Department.

Here are six charts that tell the story:

-

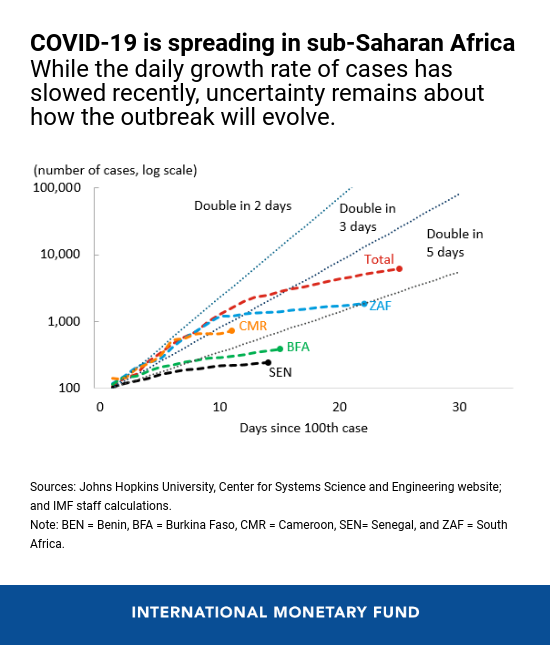

COVID-19 threatens to unleash an unprecedented health crisis in sub-Saharan Africa. As of April 13, over 7,800 cases of COVID-19 have been confirmed across 43 countries in the region. South Africa, Cameroon, and Burkina Faso are the most affected. The rapid spread of the virus, if left unchecked, threatens to overwhelm weak healthcare systems and exact a large humanitarian toll.

-

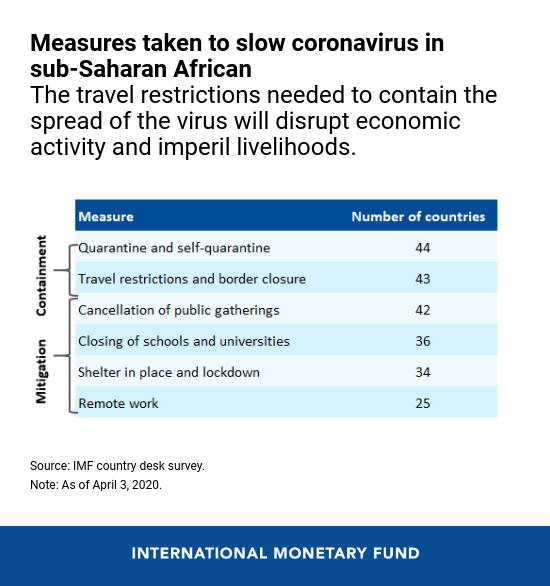

The health shock is precipitating an economic crisis and upending the livelihoods of already vulnerable groups. Containment and mitigation measures needed to slow the spread of the virus will severely impact economic activity. Furthermore, a lockdown can have devastating effects—for example, on food insecurity—on households who live hand-to-mouth and have limited access to social safety nets.

-

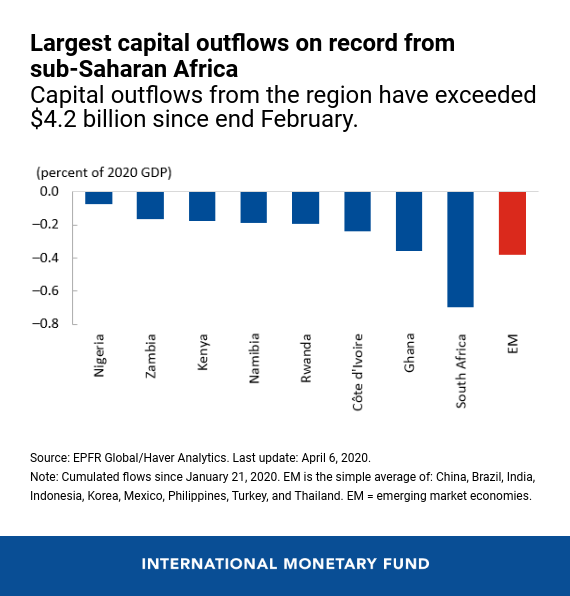

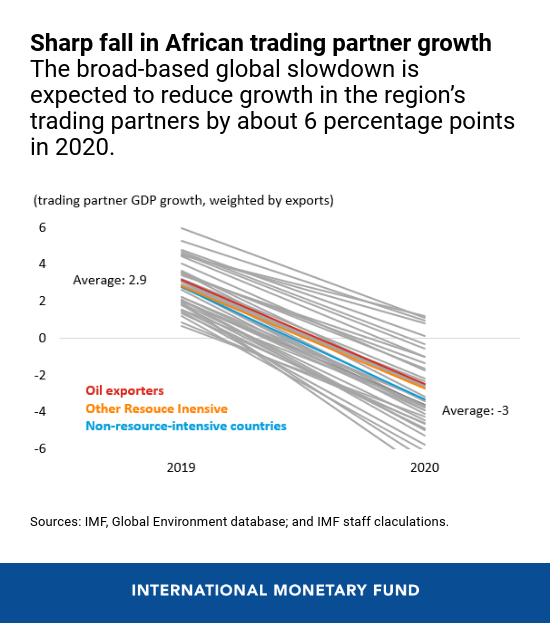

Spillovers from a rapidly deteriorating external environment are compounding the economic challenges facing sub-Saharan Africa. A sharp growth slowdown among key trading partners is reducing external demand. In addition, tightening global financial conditions are reducing investment flows and adding to external pressures. Finally, a sharp decline in commodity prices, especially oil, is exacerbating challenges in some of the region’s largest, resource-intensive economies.

-

GDP in sub-Saharan Africa is projected to contract by –1.6 percent this year—the worst reading on record. While the effect across countries is expected to differ depending on factors like extent of diversification and dependence on tourism, no country will be spared. Compared to projections made six months ago, growth for 2020 has been revised down for all countries in the region.

-

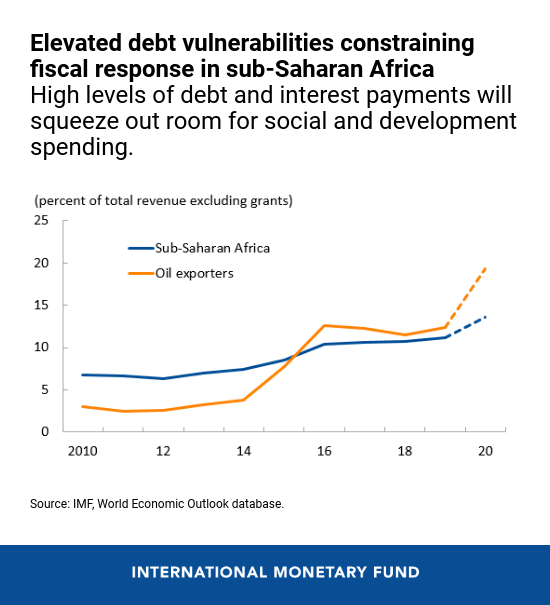

Timely fiscal support is crucial to limit humanitarian and economic losses. Stepping up health spending is essential, irrespective of fiscal space and debt levels. Given the large but temporary nature of the shock, some discretionary fiscal support is warranted, even in countries with limited space. The focus should be on targeted measures that alleviate liquidity constraints on vulnerable firms and households.

For countries facing financing constraints, especially oil exporters where the shock is likely to be more long-lasting, the aim should be to undertake well-paced, growth-friendly spending adjustments that seek to generate resources for social spending, while mobilizing additional financing from the donor community.

-

A comprehensive and coordinated effort by all development partners is essential to respond effectively to this crisis. The ability of countries to mount the required fiscal response is highly contingent on ample external financing and grant on concessional terms being made available by the international financial community. Without adequate financing, temporary liquidity issues could turn into solvency problems, resulting in the COVID-19 crisis having long-term effects on economic activity.