IMF Staff Completes 2021 Article IV Mission to Kosovo

November 5, 2021

- Recovered mobility, policy actions and the support from the diaspora, are the keys behind the strong economic recovery in 2021.

- We expect growth to normalize in 2022 amid still-high pandemic-related risks.

- Policy priorities include making the budget more pro-growth and ensuring the independence of the central bank.

Washington, DC: An International Monetary Fund (IMF) mission, led by Mr. Gabriel Di Bella, conducted a virtual visit during October 20-Novermber 4 in the context of the 2021 Article IV consultations. At the end of the visit, the mission issued the following statement:

Recovered mobility, policy actions and the support from the diaspora, the keys behind 2021’s strong economic recovery

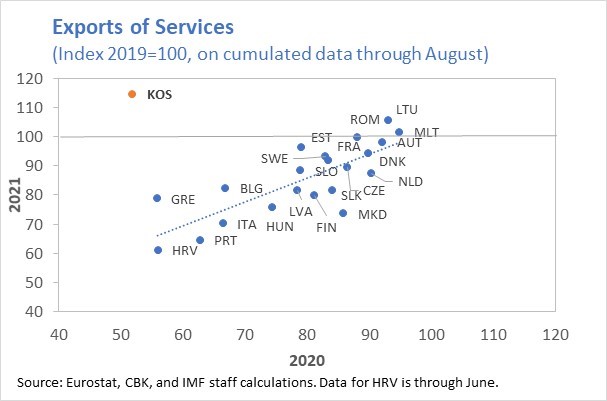

Following a contraction of 5.3 percent in 2020, Kosovo’s real GDP is projected to rebound by 7 - 8 percent in 2021 on renewed domestic mobility and extraordinary support from the diaspora . Compared to pre-pandemic levels, remittances in the first 8 months of 2021 increased by about 40 percent, while exports of services, which include tourism by the diaspora, grew by 15 percent. In turn, the successful government vaccination program contributed to mobility gains, with Kosovo featuring the highest vaccination rate of the Western Balkans at end-October (47 percent). The continuation of this program in 2022, to be financed by a budgetary allocation to secure additional vaccines for booster shots and to expand coverage, is commendable.

We expect a meaningful contribution from government policies to this year’s economic rebound:

- While fiscal policy will be less supportive than in 2020, policy actions provided lifelines to vulnerable households and firms, and supported economic formalization. A cyclical rebound in revenues, fiscal restraint, and a low implementation of the investment budget (in part due to the absence of a functioning board at the Procurement Review Body, PRB) will lead to an almost balanced fiscal position in 2021, compared to a deficit of close to 8 percent of GDP last year.

- In turn, financial policies have allowed credit to keep flowing. The extension of the window to restructure loans early in 2021 combined with improved expectations led to increased credit growth, which after some deceleration in 2020, is projected to expand by more than 10 percent (y/y) in 2021.

Inflation will increase to about 5 percent (y/y) by end-2021, on higher energy and food prices. While the rebound in oil prices explained about ½ of the increase in 2021:H1, food price acceleration contributed to inflation in the summer. While households have so far remained insulated from the steep increase in electricity prices in Europe, a few firms were affected through their exposure to the regional electricity market. While second round effects are still not strong, core inflation has begun to creep up. We expect inflation pressures to remain persistent through mid-2022 and gradually ease thereafter.

The banking sector remains resilient overall. Capital and liquidity buffers are strong and NPLs are low, though the improvement in many financial soundness indicators is partly linked with the policy response to the pandemic. Despite the absence of systemic risks, there are pockets of vulnerabilities related to the fast increase in lending to the construction sector by smaller banks.

The Outlook: Growth to normalize amid still-high pandemic-related risks

Absent negative pandemic-related surprises, we expect real GDP to grow by 3 - 4 percent in 2022, in part driven by this year’s strong economic momentum. Economic activity will also be supported by continued domestic credit expansion and fiscal policy easing, though the size of the latter will depend on the capacity to increase the absorption of externally-financed investment projects and the appointment by Parliament of directors to the PRB’s Board. The rapid surge of cases last August is a reminder that new virus mutations continue to be the main downside risk. In this regard, still-low spare capacity of hospitals may result in the need to renew mobility restrictions should cases rise again. On the upside, the implementation of an ambitious program of government measures can push growth higher, as well as the continuation of extraordinary diaspora support, which is projected to subside somewhat in our baseline .

Fiscal Policy Priorities: Making the budget more pro-growth

The fiscal revenue windfall provided by the diaspora should be used to close social and economic infrastructure gaps and diversify growth engines. Though the strength of the ongoing economic recovery suggests that fiscal policy should revert to the fiscal rule beginning in 2022, the budget needs to include an allocation for emergency expenditures should the virus strike back. Moreover, the fully replenished fiscal buffers provide an opportunity to initiate the process to obtain a rating for Kosovo’s public debt securities, which in time could expand the size and liquidity of the public debt market. In turn, making the budget more pro-growth requires improving the composition, effectiveness, and efficiency of spending. In this regard:

- The wage bill needs to remain within its legal ceiling. The new draft law regulating public wages should strengthen transparency and compensation fairness but be based on wage coefficients that do not unsustainably increase the total wage bill.

- New social transfer programs need to be well designed, targeted, and transparent. The budget for 2022 could clarify the design and target beneficiaries of envisaged programs to expand child benefits and transfers to unemployed mothers of 0.6 percent of GDP and the intended use of a blanket allocation for subsidies and transfers of 1.6 percent of GDP. The certification of war veterans should be finalized, and the budgetary envelope for war veteran benefits needs to be insulated from the expected increase in minimum wages.

- The health system’s capacity needs to be augmented, access to computers of schools and households expanded, and an allocation assigned to increase the number of commercial courts as called by the draft law currently under discussion. While security, defense, and road infrastructure comprise a large portion of the investment budget, downside risks call for devoting targeted resources to increase the share of households and schools with access to computers and the expansion of hospital infrastructure. In turn, sustaining and consolidating recent gains in formalization of economic activity requires faster and more effective commercial courts and continuing efforts to improve tax policy and administration as well as increasing electronic payments.

- Reducing pollution and emissions requires cleaner electricity generation. The installation of filters in Kosovo B, in collaboration with the EU, remains a priority in this area.

Financial policy Priorities: Ensuring Central Bank Independence

We reiterate the urgency of filling existing vacancies at the Central Bank (CBK) Board. This is essential for the CBK to adopt its budget, for the oversight of its policies, and to implement needed reforms, including ensuring that the financial stability and macroprudential policy functions are adequately represented at the CBK’s Executive Board.

Given the comfortable level of fiscal buffers, the new SDR allocation can be used to strengthen the CBK’s window for Emergency Lending Assistance (ELA). This is important as the current size of ELA is too low compared with potential financial sector liquidity risks. That said, the SDR allocation should remain available for pandemic-related support should downside risks materialize.

As pandemic-related support measures were appropriately phased out in 2021, credit risk monitoring needs to be strengthened. This will ensure that provisioning reflects the underlying increase in solvency risks, and that capital buffers are sufficient to absorb write-downs and keep the flow of credit. In this regard, the CBK should continue developing its capacity to analyze banks’ risks in the context of the transition to IFRS9.

The mission wishes to thank the authorities and other stakeholders for the frank, open and constructive dialogue.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Raphael Anspach

Phone: +1 202 623-7100Email: MEDIA@IMF.org