Global current account balances—the overall size of headline current account deficits and surpluses—widened for a third consecutive year in 2022. The main drivers were Russia’s invasion of Ukraine, the uneven recovery from the pandemic, and the rapid tightening of US monetary policy. Concurrently, the US dollar appreciated substantially, and the uphill capital flow reappeared.

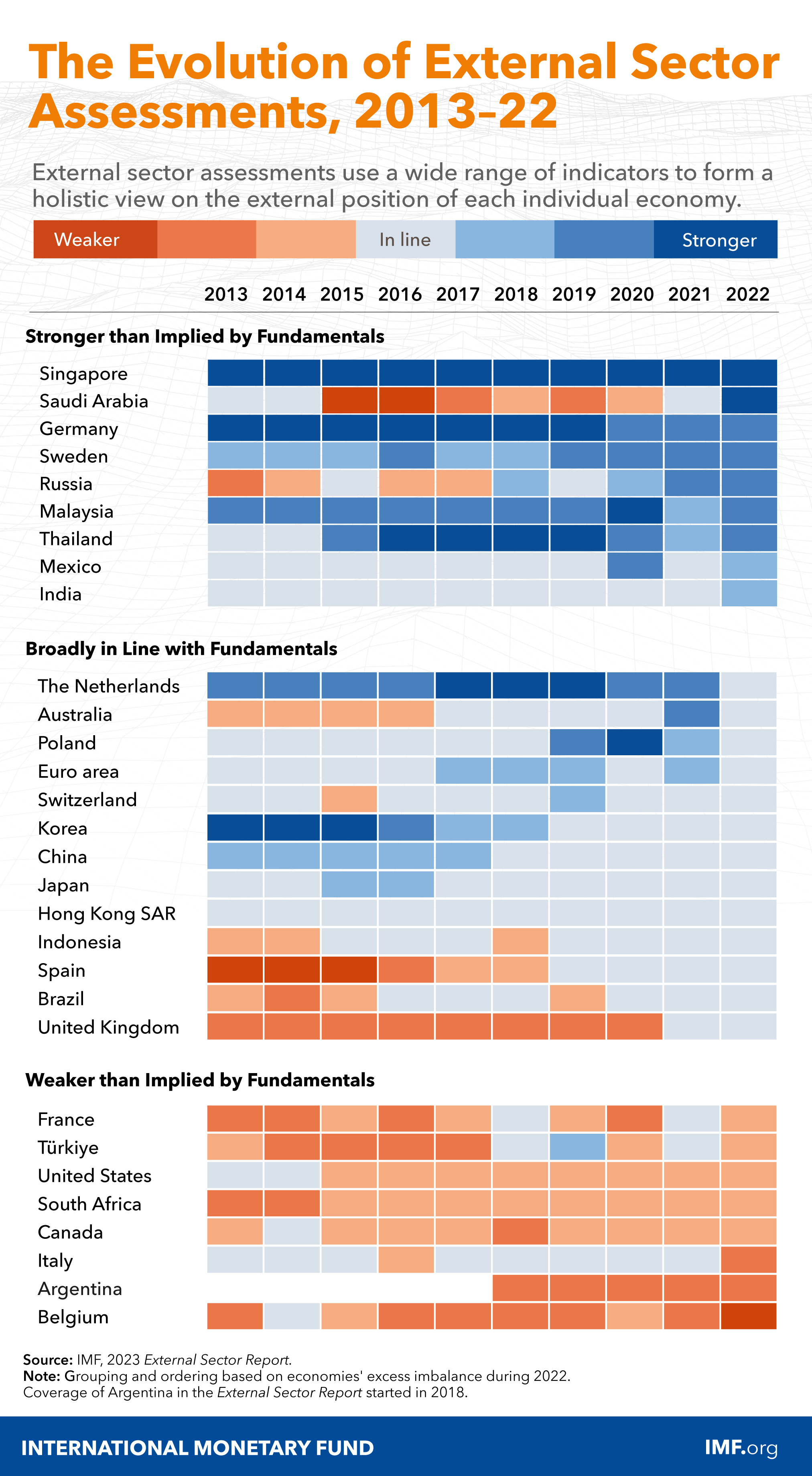

IMF’s external sector assessments suggest that the overall size of excess current account deficits and surpluses has remained unchanged since 2021, after declining for several years. This highlights the importance of efforts in both excess surplus and deficit economies to promote external rebalancing.

The US dollar appreciation under the “global dollar cycle,” which is driven primarily by global financial risks, has negative spillovers, especially for economic activity and imports, that fall hardest on emerging market economies. More flexible exchange rates and better anchored inflation expectations can mitigate these negative spillovers.

Chapter 1: External Positions and Policies

Chapter 2: External Sector Implications of the Global Dollar Cycle

Chapter 3: 2022 Individual Economy Assessments

Publications

March 2026

Finance & Development

- The Debt Reckoning

Annual Report 2025

- Getting to Growth in an Age of Uncertainty

Regional Economic Outlooks

- Latest Issues