Introduction

Asia at the Forefront: Growth Challenges for the Next Decade and Beyond

Asia has achieved remarkable economic success over the past five decades. Hundreds of millions of people have been lifted out of poverty, and successive waves of economies have made the transition to middle-income and even advanced-economy status. And whereas the region used to be almost entirely dependent on foreign know-how, several of its economies are now on the cutting edge of technological advance. Even more striking, all of this has happened within just a couple of generations, the product of a winning mix of integration with the global economy via trade and foreign direct investment (FDI), high savings rates, large investments in human and physical capital, and sound macroeconomic policies.

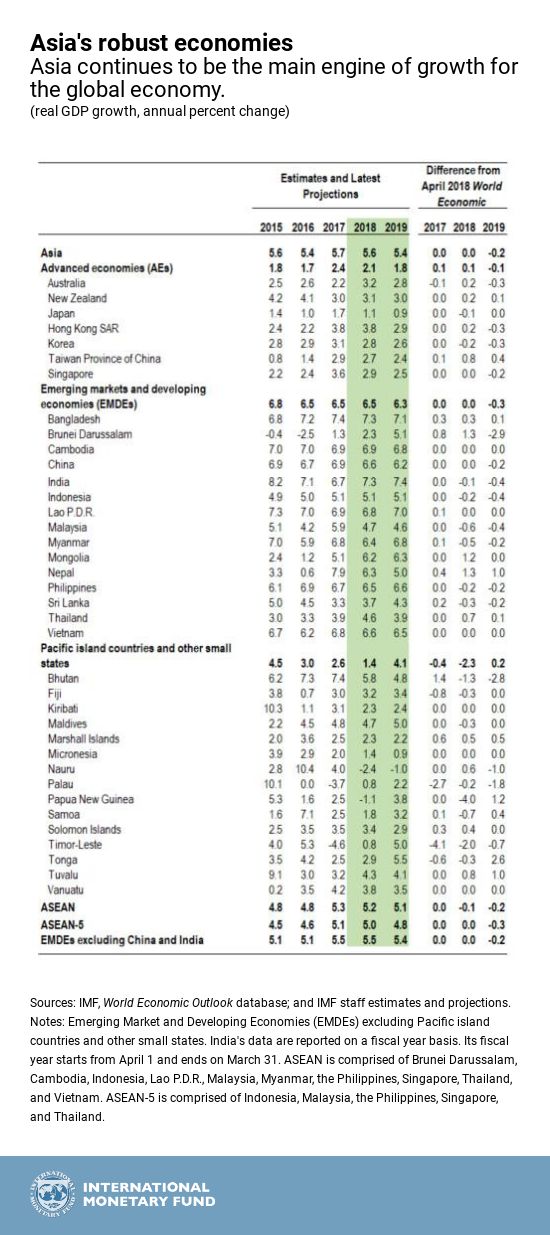

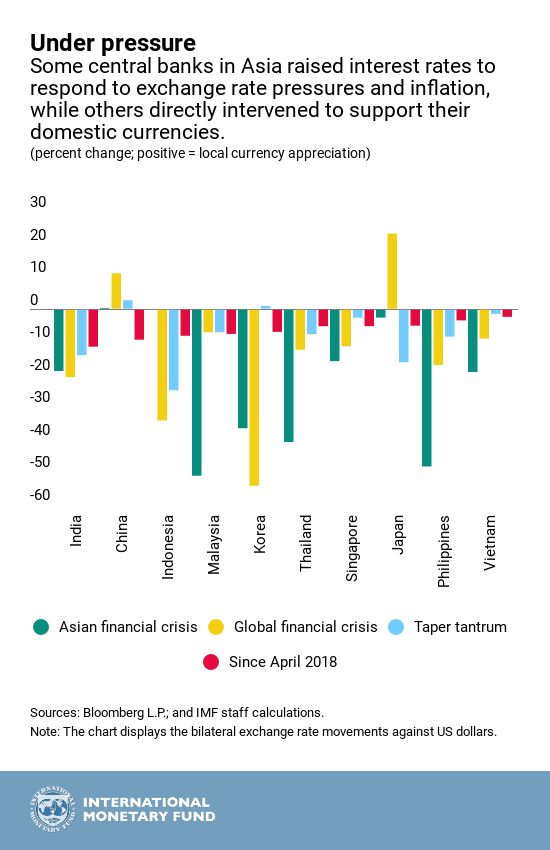

Overall per capita income in Asia still substantially lags that in the United States and Europe, but in growth terms, the region is very much at the forefront of the global economy, accounting for more than 60 percent of world growth and projected to grow at 5.6 percent in 2018 and 5.4 percent in 2019. There are signs, however, that the synchronized global recovery of the past few years is starting to fade, and risks to the Asian and global forecast are now tilted to the downside, reflecting increased financial market volatility, rising trade tensions, and slowing momentum in China.

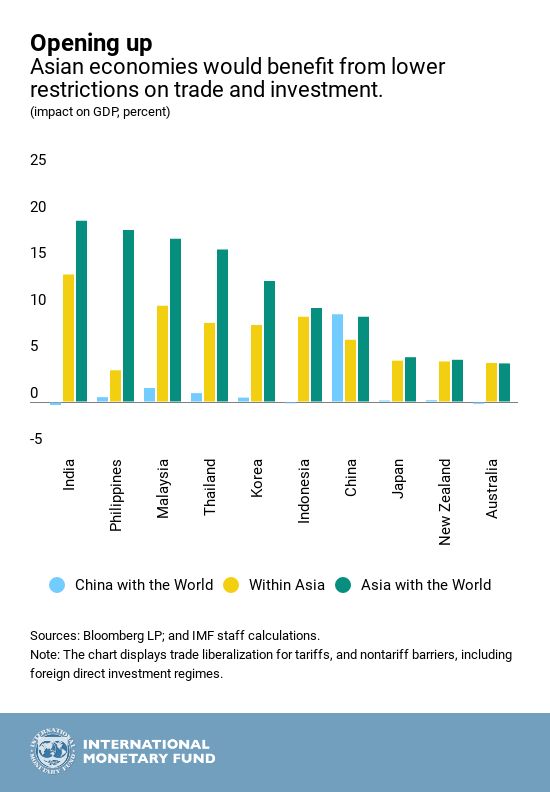

In addition to these short- and medium-term risks, Asia faces important challenges to its long-term growth prospects. One of these relates to trade. While it is difficult to predict how the current situation will unfold, policymakers now confront the possibility of a pronounced and protracted slowdown in trade. If tariffs spiral upward and economies slip toward autarky, global growth would take a substantial hit, and Asia—which already needs to rebalance its trade-driven growth model given weaker medium-term prospects in advanced economies—would be vulnerable.

Population aging is another important long-term challenge. Some countries, such as India, Indonesia, and the Philippines, still enjoy a young population and a growing labor force, but Japan, Korea, Thailand, and several other economies are well past their demographic dividend. As the April 2017 Regional Economic Outlook: Asia and Pacific showed, many Asian economies face the risk of “growing old before they grow rich,” in that they will not yet have converged to the income frontier by the time the demographic tide begins to turn against them.

Slowing productivity growth is another key challenge for Asia, as it is for other regions. The April 2017 Regional Economic Outlook: Asia and Pacific documented the slowdown in Asia since the global financial crisis and identified its main drivers, including declining research and development (R&D) investment, trade openness, and FDI. But firm-level dynamics—the misallocation of resources across firms of differing productivity—can also be an important factor.

Finally, Asia is at the forefront of digitalization, which promises a radical transformation of the global economy, and indeed of society itself, while at the same time threatening substantial disruptions and dislocation. For instance, workers worry that robots will make them obsolete, while financial supervisors are concerned about the risks to financial stability posed by the latest fintech innovations. Handling the possibly bumpy transition to an increasingly digital future will be yet another major challenge for policymakers during the coming decades. At the same time, digitalization may well be a key driver of productivity growth and improved welfare over the long run.

Thus, while Asia is at the forefront of the global economy today, it confronts some fundamental challenges that may require a shift in the region’s growth model. This report and its four background papers take up these issues, suggesting that, with the appropriate policy responses, Asia will be able to meet its challenges and secure its growth prospects. The next section offers a brief description of the current conjuncture, and the following sections analyze trade, productivity, and the digital economy, respectively, presenting highlights of the fuller analyses offered in the background papers. The main policy recommendations are as follows:

In sum, Asia’s growth faces some fundamental challenges, but with continued proactive and sound policymaking, the region should have good prospects for staying at the forefront over the coming decade and beyond.