A funding squeeze has hit the region hard

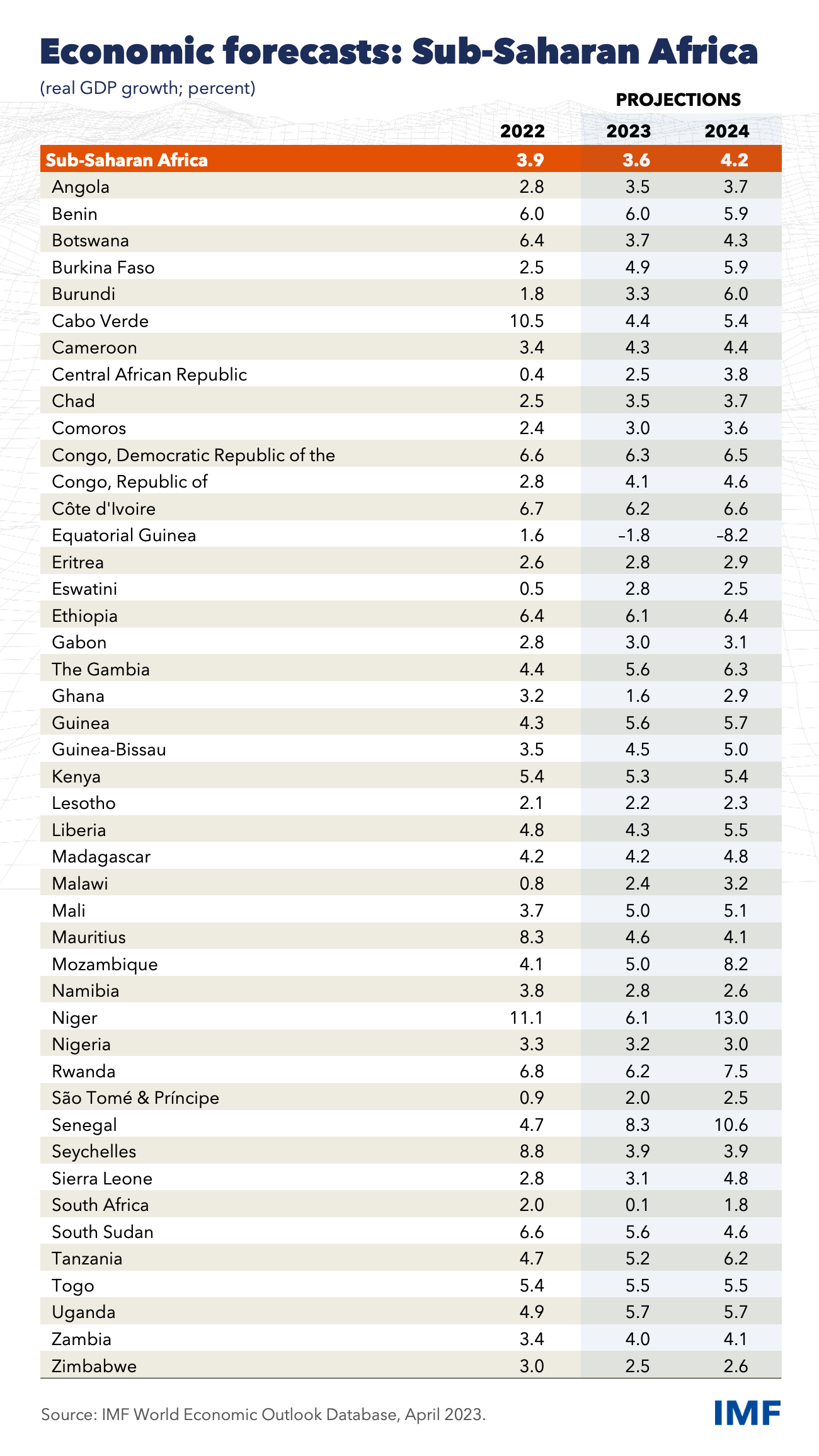

Persistent global inflation and tighter monetary policies have led to higher borrowing costs for sub-Saharan African countries and have placed greater pressure on exchange rates. Indeed, no country has been able to issue a Eurobond since spring 2022. The interest burden on public debt is rising, owing to a greater reliance on expensive market-based funding combined with a long-term decline in aid budgets. The lack of financing affects a region that is already struggling with elevated macroeconomic imbalances. Public debt and inflation are at levels not seen in decades, with double-digit inflation present in about half of the countries—eroding household purchasing power and striking at the most vulnerable. In this context, the economic recovery has been interrupted. Growth in sub-Saharan Africa will decline to 3.6 percent this year. Amid a global slowdown, activity is expected to decelerate for a second year in a row. Still, this headline figure masks significant variation across the region. The funding squeeze will also impact the region’s longer-term outlook. A shortage of funding may force countries to reduce resources for critical development sectors like health, education, and infrastructure, weakening the region’s growth potential.

Geoeconomic Fragmentation: Sub-Saharan Africa Caught between the Fault Lines

Managing Exchange Rate Pressures in Sub-Saharan Africa—Adapting to New Realities

Closing the Gap: Concessional Climate Finance and Sub-Saharan Africa

Publications

December 2025

Finance & Development

- More Data, Now What?

Annual Report 2025

- Getting to Growth in an Age of Uncertainty

Regional Economic Outlooks

- Latest Issues