Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Cheap Oil Means a New Reality for Middle East, North Africa Region

April 25, 2016

- Intense conflicts and low oil prices continue to weigh on the region’s economic prospects

- Oil exporters should focus on fiscal reforms and diversifying away from oil

- Higher growth expected in oil importers, but unemployment remains high

Growth in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region remains subdued owing to persistently low oil prices and deepening regional conflicts, said the IMF in its latest regional assessment.

Iraqi oil worker checks pipeline valve at an oil field in Basra. Falling oil prices are weighing on growth prospects for many countries in the region (photo: Haider Al-Assadee/epa/Corbis RM)

Regional Economic Outlook

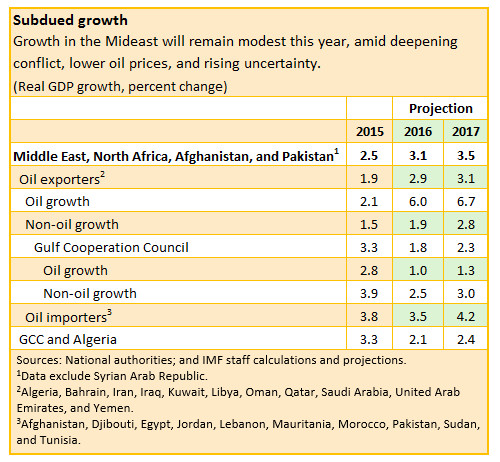

The IMF’s Regional Economic Outlook Update for the Middle East and Central Asia, released on April 25, projects that growth this year will be about 3 percent. Although slightly higher than in 2015 (see table), the modest pick-up largely reflects increased oil production in Iraq and post-sanctions Iran.

Growth in most other oil exporters, however, is projected to slow further this year as they tighten public spending in response to lower oil prices. The latest report has downgraded 2016’s growth projections in almost all MENAP oil exporters relative to the projections made last October.

Economic recovery among MENAP oil importers, meanwhile, remains fragile and uneven. Growth is projected to slow to 3.5 percent in 2016 because of adverse spillovers from slowing growth in oil-exporting neighbors and intensifying regional conflicts.

“Therefore, it is crucial that all countries step up their efforts to design and implement reforms to boost economic prospects, create jobs, and improve inclusiveness of growth, before they run out of time,” IMF Middle East and Central Asia Department Director Masood Ahmed said at the report’s launch in Dubai.

The cost of conflicts

Conflicts—particularly in Iraq, Libya, Syria, and Yemen—continue to intensify, resulting in massive numbers of displaced people and severe economic damage. Since October 2015, more than 600,000 people have fled Syria alone, bringing the total number of Syrian refugees to almost five million. The mounting costs of conflicts have put enormous pressure on government budgets and infrastructure, driving up inflation and diverting resources away from much-needed social spending, the report mentioned. The conflicts are also having repercussions in neighboring countries, who are hosting large numbers of refugees, and tackling disruptions in trade and tourism, worsening security, and decreasing levels of investor confidence.

Ahmed emphasized that the international community needs to scale up and better coordinate its support to help refugees and stabilize the affected countries. “There are large financing needs, with host countries requiring additional financing on affordable terms to fund crisis-related projects,” he said.

Lost revenues for oil exporters

The second factor shaping the region’s outlook is the continued slump in oil prices. The oil-exporting countries enjoyed large fiscal and external surpluses and rapid economic growth in recent years because of booming oil prices. Since mid-2014, however, the persistent decline in oil prices has turned surpluses into deficits, slowing growth and raising concerns about unemployment.

“The fall in oil prices has led to large export revenue losses: a staggering $390 billion last year and the expectation of a further $140 billion this year,” Ahmed told reporters. Many countries have taken significant steps to consolidate their budget positions, focusing mostly on capital expenditure cuts, but also on substantial energy price reforms.

However, for Algeria and the Gulf Cooperation Council (GCC), fiscal deficits are still expected to average 12¾ percent of GDP in 2016, and remain at 7 percent over the medium term. The deficit for other oil exporters in the region—those generally less reliant on oil revenue—is projected to be 7¾ percent of GDP in 2016 (see Chart 1).

Despite the concerted efforts to rein in deficits, “further and substantial deficit-reduction measures will be needed over a number of years to ensure that fiscal positions are sustainable and oil wealth is shared equitably with future generations,” Ahmed said. In many countries, there is room to cut public spending further, widen ongoing energy pricing reforms, and raise new revenues by designing broad-based tax systems, including value-added taxes. The GCC countries are already planning to introduce such taxes in the coming years.

The report suggests that countries need to reduce their dependence on oil and accelerate reforms to manage the new reality of low oil prices. Policymakers are encouraged to implement reforms to promote economic diversification and non-oil sector growth, such as reducing the public-private sector wage gap, and better aligning education and skills with the needs of the market.

“An equally important priority is to ensure that the private sector can create enough jobs for a young and growing population, a process that will require deep structural reforms to improve medium-term growth prospects,” Ahmed said.

Uneven and fragile growth for oil importers

The region’s oil importers saw a pickup in growth from 3 percent in 2011-14, to 3¾ percent in 2015. Growth is expected to remain around that level in 2016-17, based on the report’s assessment. Lower oil prices and improved confidence levels, owing to progress from recent reforms, have supported this recovery. However, security disruptions and adverse spillovers from regional conflicts and, more recently, lower remittances, trade, and financial assistance arising from the slowdown in the GCC, strain the outlook.

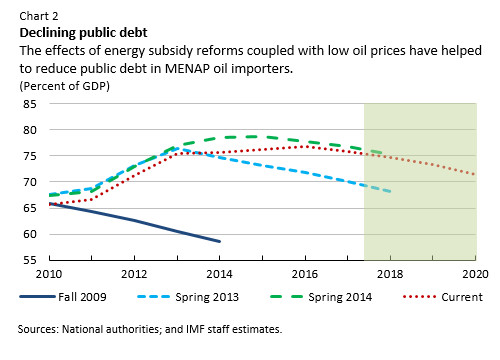

The effects of energy subsidy reforms, coupled with low oil prices, have helped to reduce government deficits to about 6½ percent of GDP in 2016 from a 2013 peak of 9½ percent. The report recommends additional fiscal consolidation measures—designed in a growth-friendly way—to put public debt on a sustainable path and preserve macroeconomic stability (see Chart 2). For some countries, greater exchange rate flexibility would support fiscal consolidation by helping them to absorb the impact of external shocks, and improve external positions by strengthening competitiveness.

Despite this mild economic recovery, “medium-term growth prospects of the oil-importing countries are still insufficient to address their long-standing problem of high unemployment,” Ahmed said. The region’s unemployment rate remains high at 10 percent, with youth unemployment reaching a staggering 25 percent.

In the report, the IMF encourages policymakers in these countries to step up structural reforms that strengthen the quality of education, improve the functioning of labor and financial markets, and increase trade openness to help boost economic growth and create jobs.