Speaking Notes on the Global Outlook at the 8th Asian-European Finance Ministers' Meeting (ASEM) by Mr. Takatoshi Kato, Deputy Managing Director of the International Monetary Fund

June 23, 2008

At the 8th Asian-European Finance Ministers' Meeting (ASEM)

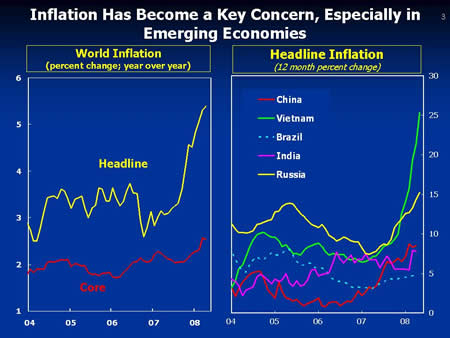

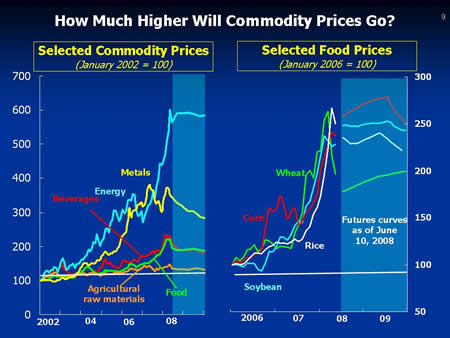

June 16, 2008, Jeju Island, Korea

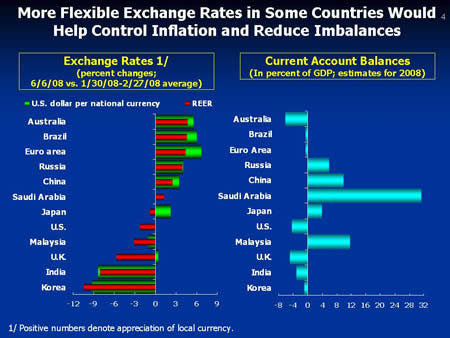

As Prepared for Delivery

| Download the presentation (220 kb PDF) |

Current Situation

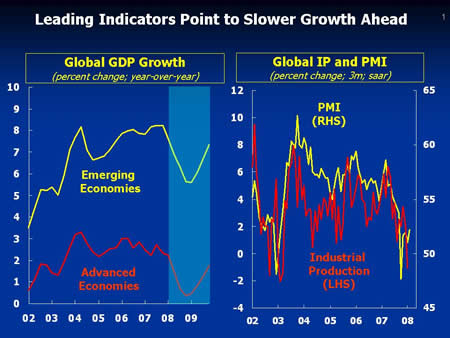

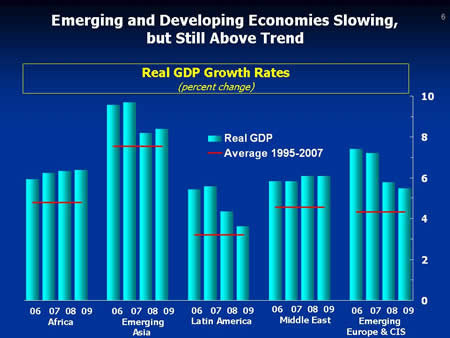

1. After five years of strong global growth, the protracted financial dislocations that began last summer are beginning to take their toll on global economic prospects.

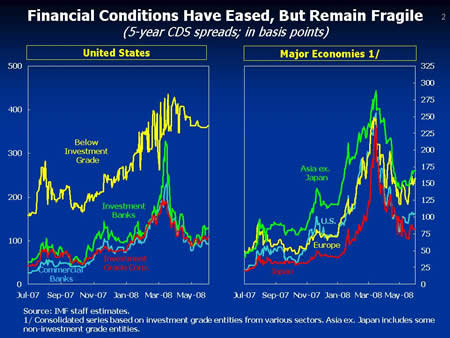

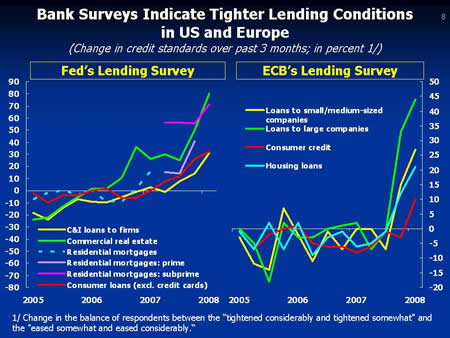

2. As activity looks set to weaken, financial markets appear to have stabilized somewhat, as concerns over systemic threats have receded. That said, the situation remains fragile. The recent improvement in financial markets have partly reversed on renewed concerns about further losses by financial institutions amid a weakening macroeconomic environment and rising inflation. Moreover, the process of balance sheet repair and adjustment in the financial system will take time.

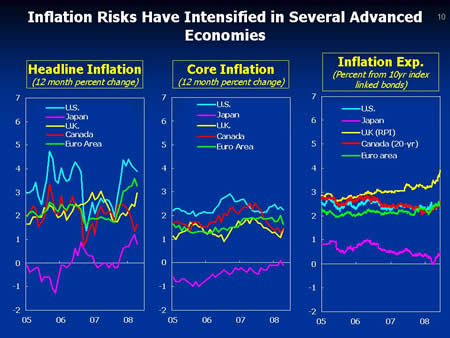

3. With financial conditions looking less precarious than before, attention has turned to surging commodity prices and their impact on inflation across the globe.

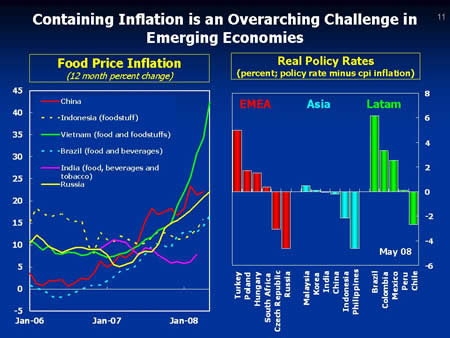

4. Exchange rate movements have also been striking, as the dollar has approached it lowest level in real effective terms since the mid-1990s. The dollar's sustained depreciation has moved it much closer to its medium-term equilibrium value than has been the case in many years. However, recent exchange rate movements have fallen disproportionately on currencies with flexible exchange rate regimes, and may, as a result, be producing new misalignments or fueling protectionist sentiment.

Outlook

5. How do these developments affect our assessment of the global outlook?

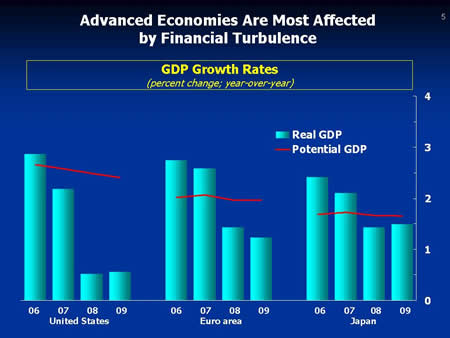

6. Advanced economies have been hardest hit by the financial crisis, and are expected to slow significantly.

• The U.S. economy continued to expand in the first quarter of 2008, but the outlook remains weak and recovery is expected to be slower than in past cycles.

• In the Euro area, growth momentum has remained solid, but is expected to moderate over the course of the year.

• In Japan, sluggish wage growth, high commodity prices, and deteriorating consumer and business confidence are expected to weaken domestic demand and growth.

7. In emerging economies, growth is projected to moderate, but remain buoyant in 2008 and 2009.

Risks to the Outlook

8. Risks to the global growth outlook are now to the upside in 2008 and are broadly balanced for 2009. Domestic demand in major advanced and emerging economies in 2008 may be a little stronger than our April projections suggested in light of strong first quarter growth outcomes. In 2009, however, overall risks are broadly balanced as financial risks have eased while inflation and oil market risks have increased.

• Risks posed by the financial crisis have moderated but remain to the downside. Market confidence remains fragile and financial conditions are expected to remain difficult for some time and could tighten further if a deteriorating macroeconomic outlook increases losses.

• As financial risks have eased, inflation and oil market risks have come to the fore. Notwithstanding slowing activity in advanced economies, oil markets have remained tight. Similar factors have also boosted food prices, as well as spillovers from energy markets through biofuel demand and rising input costs. The strength and persistence of the current commodity price boom underpins the increase in inflation risks and the threat that inflation expectations may become de-anchored. These risks present a heightened downside risk to growth, including by reducing purchasing power (particularly, in commodity importing countries), limiting central bank room for maneuver, and the increasing the possibility of more forceful policy tightening later.

• Global imbalances remain a concern, particularly as high oil prices are expected to imply sustained high current account surpluses in oil exporters.

Policy Challenges

9. How should policy respond to the outlook and the shift in the balance of risks?

• In the United States, with surging food and energy prices keeping headline inflation high, a pause in Fed policy rate cuts appears warranted as risks to price stability and financial stability are reassessed.

• For the Euro area, in the current environment of high uncertainty, we see value in keeping policy rates firmly on hold.

10. In most emerging economies, growing inflation risks are an immediate concern. In fact, real interest rates are low or have become fairly negative in several of these countries. In China, faster appreciation of the renminbi in nominal effective terms would provide more scope for monetary policy tightening to help keep domestic inflation pressures in check. Elsewhere in Asia, countries such as Vietnam, the Philippines and Indonesia appear to have fallen behind the curve in terms of their interest rate policy.

11. Rising inflation risks combined with upside risks to domestic demand have reduced the scope for fiscal easing.

12. In sum, although the broad contours of our assessment in the April World Economic Outlook are unchanged, the uncertainty regarding inflation and rising commodity prices have exacerbated the challenges facing policy makers. At the IMF, we are working closely with our membership to identify appropriate policy responses at a time when policy tradeoffs have been brought into sharper focus.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |