Shadow Banking and Market Based Finance

September 14, 2017

Good morning and thank you for the opportunity to offer some reflections on this important issue. I would like to begin by laying out a conceptual framework for shadow banking, and its cousin, market-based finance. I will then use this framework to anchor a discussion of the following three issues:

- First, how have different forms of shadow banking evolved in the wake of the financial crisis, and what are the implications for global financial stability?

- Second, in light of the vigorous regulatory and supervisory response since the crisis, where can we derive some comfort that risks have been adequately tamed, and on the flip side, where is there still work to be done?

- Finally, I will conclude with some regional examples of policy challenges on the horizon.

Shadow Banking—A Framework

Shadow banking is a broad term that can mean different things. [1] It is often thought to comprise private credit intermediation occurring outside the formal banking system. Today I would like to be a little more prescriptive, by speaking to some specific economic characteristics and motivations that might help distinguish certain aspects of shadow banking from other forms of credit-based intermediation—like traditional banking and market-based finance. I should point out that these issues are not just attracting the attention of the Fund. The Financial Stability Board (FSB), in response to a request from the G20 leaders at the 2010 Seoul Summit, has been particularly instrumental in driving the international effort to make non-bank credit intermediation more robust and resilient.

In conceptual terms, one could argue shadow banking is like any other form of financial intermediation—a response to the unmet needs and preferences of willing borrower and lenders. By helping to complete markets—for instance, by giving issuers new outlets for capital raising when bank lending is unavailable, and providing lenders more avenues for portfolio diversification—shadow banking might yield greater efficiencies and risk sharing capacity.

So let me introduce some broad outlines of one possible framework. From the perspective of structural characteristics, the risker dimensions to certain shadow banking activities could be linked to some of the following features: [2]

- First, they can involve extensive transformation of risk characteristics through complex structuring. Key in this regard is credit enhancement associated with the pooling and tranching of risk, and/or implicit guarantees. Leverage, complexity and opaqueness can be prominent. Other features include more standard maturity and/or liquidity transformation. An example of all these features would be where a portfolio of illiquid, subprime loans on bank balance sheets is transformed, with the help of a sophisticated pricing model, into an off-balance sheet portfolio of liquid, highly-rated securities, some of which enjoy credit support features not present in the underlying loans;

- Second, these transformations are often performed along a chain of specialized and interconnected intermediaries and can thereby involve the balance sheets of many entities. [3] For instance, after a non-bank finance company originates a loan, these are pooled and warehoused by broker-dealers, whose syndicate desks structure them into asset backed and collateralized debt obligation (CDO) securities, which are assigned ratings by credit rating agencies (CRAs), and funded through the issuance of capital notes on the wholesale market, to be purchased by enhanced cash funds. A related feature of shadow banking is the reuse of collateral—we often associate shadow banking with lengthy collateral chains. While collateralized borrowing is generally safe, one drawback is that frequently reused collateral can give rise to heightened interconnectedness; [4]

- Third, shadow banking entities do not have explicit or formal access to official sector backstops (i.e. discount window access and deposit insurance) in the manner of a traditional deposit-taking bank;

- Fourth, shadow banking activity often benefits from the presumption of sponsor support, such as an implied credit guarantee or a credit line to an off-balance sheet entity provided by a bank who is concerned with incurring reputational damage if investor return expectations are not met. These exposures can become contingent liabilities for the sponsor;

- And fifth, the liabilities of shadow banking products are principally debt-financed in the wholesale market.

In practice, of course, there can be many shades of grey between the riskier elements of shadow banking and the more resilient aspects of market-based finance—the taxonomy in Table 1 is highly stylized and implies clearer distinctions than often exist. In a general sense, and as the FSB has articulated, market-based finance is just the more resilient version of shadow banking. This is not to imply that all shadow banking activity should be stopped—as the Fund and FSB have stressed, shadow banking can serve useful economic functions But, in certain circumstances, regulators need to ascertain if there are features which might be more amenable to generate financial stability risks, and if so, work through the policy implications. This discussion naturally raises the corollary—just what does ‘resiliency’ look like in the context of market-based finance? With that in mind, let me offer some considerations.

First, resilience might stem from greater simplicity, transparency, and standardization, as reflected in less pronounced, complex and/or opaque structuring and risk transformation. Additionally, enhanced resilience could stem from a lower degree of institutional interconnectedness. This could arise because collateral chains are less prominent, or because there is no presumption of third party support mechanisms (credit lines, guarantees, etc.) and other backstops that can result in the sponsor having to absorb contingent liabilities in bad states of the world. Furthermore, a more resilient funding base might be reflected in more diverse, longer-term and non-runnable forms of debt and equity, rather than a primary reliance on short-term wholesale financing. In aggregate, these forms of resilience might add up to create modes of capital intermediation that productively help to complete markets, without posing undue financial stability risks.

Table 1. A Stylized View of Structural Characteristics of Credit-based Intermediation

|

Characteristic: |

Traditional Banking |

Shadow Banking |

Market-based Finance |

|

Key Risk Transformations |

Liquidity, maturity, leverage |

Credit enhancement, liquidity, maturity, leverage |

Less emphasis on credit enhancement and less opaque vs. shadow banking |

|

Institutions Involved in Intermediation |

Single entity |

Can be many entities, interconnected through collateral chains and credit guarantees |

Single/few entities |

|

Formal Ex-ante Backstop |

Yes |

No / Indirect |

No |

|

Implied Sponsor Support |

n.a. |

Yes, can sometimes be contingent liabilities |

No (insolvency remote) |

|

Example of Entities |

Commercial bank |

Synthetic CDO, Structured Investment Vehicle (SIV), CNAV MMF, ABCP Conduit |

Bond mutual fund, Distressed debt or PE partnership, Direct lending by pension fund |

|

Main Form of Liabilities |

Debt and deposits, Wholesale & retail-financed |

Debt, Mainly wholesale financed |

Highly diverse – Short and long-term debt and equity, Retail & wholesale financed |

|

Key Resulting Financial Stability Risk |

Systemic risk (institutional spillovers) |

Systemic risk (institutional spillovers) |

Shift in price of risk (market risk premia) |

Source: IMF

Yet this discussion gets us only part of the way to understanding why regulators have become exercised over the financial stability implications arising from certain riskier features of shadow banking. We should also try to understand if there are motivations for creating these particular features that need to be taken into account by policy makers and market participants.

- Agency Frictions and Informational Asymmetries —while agency problems are omnipresent in finance in general, [5] including in market-based finance, misaligned incentive problems can be magnified in certain shadow banking contexts because of a high degree of complexity, specialization and opaqueness. These features allow agents’ considerable scope to exploit informational asymmetries in a way that is capable of generating negative externalities. [6] Take, for instance, the predatory lending practices of originators, or the adverse selection problems that allow securitization arrangers to retain high quality loans while securitizing the ‘lemons.’ [7] , [8]

- (Mispriced) Sponsor Backstops and Contingent Liabilities —some shadow banking activities can have margins that are so low they cannot absorb the full cost a backstop by themselves, and thus require subsidized external risk absorption capacity (i.e., cheap insurance). As an example, because commercial banks benefit from formal official sector backstops, their credit support lines to shadow banking affiliates can distort the cost of the latter’s liabilities by leaving investors with the presumption that these liabilities are ostensibly ‘money good.’ Another example constitutes the tail risk insurance provided by insurance companies via wraps and guarantees.

- Regulatory Arbitrage —this is where capital, liquidity, taxation or information requirements are circumvented to make activities profitable that might otherwise not be. A notable example prior to the crisis was seen in the provision of bank guarantees to asset-backed commercial paper (ABCP) conduits in the U.S. that were structured as liquidity-enhancing guarantees, rather than credit guarantees. In some circumstances, this had the effect of reducing regulatory capital charges nine-fold. [9]

Allow me now to make one final point about the riskier aspects of certain shadow banking activities. From the perspective of global financial stability, we are more concerned with an increase in systemic risk—the disruption of the intermediation capacity of the financial system—than an increase in the market price of risk per-se. It is in this sense that certain aspects of shadow banking could potentially pose concern. [10]

As this distinction between the market price of risk and systemic risk is sometimes conflated, allow me to elaborate. Variation in market risk premia in part reflects changes in fundamentals, and in part reflects frictions such as mutual fund investors’ procyclical response to past performance. In either case, there could be real economic consequences, felt through higher corporate borrowing costs or negative wealth effects for instance. Indeed, research by Fund staff has shown how the first mover advantage effects in fund management can amplify movements in market prices. [11] But while shifts in the price of risk can certainly be an ingredient in systemic risk, other amplification mechanisms, like leverage and institutional interconnectedness, are typically needed to generate systemic implications. [12] Viewed through a different lens, a rich literature has emerged to show that while limits-to-arbitrage can prevent dislocations in market price action from swiftly self-correcting, this tends to connect more to issues of time variation in the pricing of risk than systemic risk per-se. [13] More generally, it remains hotly contested as to whether policy makers should even try to influence the market price of risk, and even if so, how best, and under what conditions, to do it. [14]

By contrast, the desire of policy makers to defend against systemic risk is universal. And what most concerns us here is that, while not all shadow banking is potentially systemic, certain aspects of shadow banking can lend themselves to amplifying shocks and generating systemic risk, not just outsized movements in market prices. How so? Because the balance sheets of a large number of shadow banking entities can be interconnected along a lengthy intermediation chain (often involving repledged collateral); [15] because complex risk transformations can increase opacity (and thus uncertainty in a crisis) and obscure the true nature of underlying risk; because some shadow banking liabilities are principally debt-financed in short-term wholesale markets which are notoriously fickle; and because the role of implicit sponsor backstops means that stresses experienced by some shadow banking entities can quickly metastasize into contingent liabilities for their sponsors, who may not have the capital or liquidity to absorb them. The associated vulnerabilities can be magnified when agents are incentivized to exploit regulatory loopholes and asymmetric information, possibly requiring the ultimate backstop—the sovereign balance sheet—to be deployed to put out the ensuing blaze. [16] Activating this contingency might come at great cost.

The Post-Crisis Evolution in Shadow Banking

Among the key changes to have unfolded in global patterns of non-bank credit intermediation since the financial crisis, two stand out. At the activity level, there has been a material swing away from riskier aspects of shadow banking toward market-based finance. And at the geographical level, there has been a relative increase in the emerging market (EM) share of global non-bank intermediation.

Less Shadow Banking, More Market-based Finance

The first notable trend, most pronounced in Advanced Economies (AEs), has been a reduction in the types of shadow banking activities that amplified the effects of the global financial crisis. There has been a generalized ‘flight to simplicity and transparency’ in the intermediation of non-bank credit, away from the more opaque forms of shadow banking, toward more resilient forms of market-based finance.

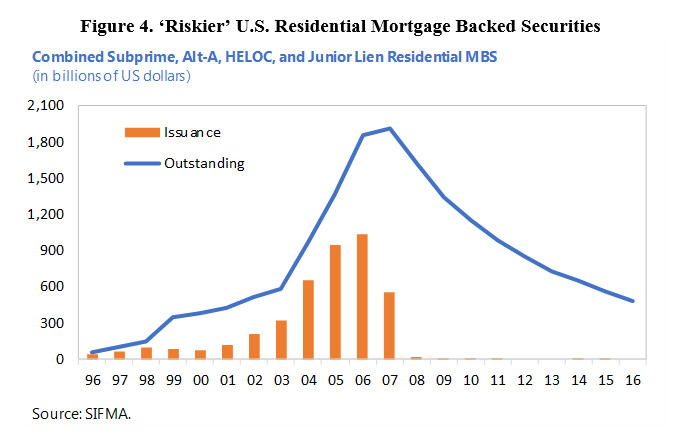

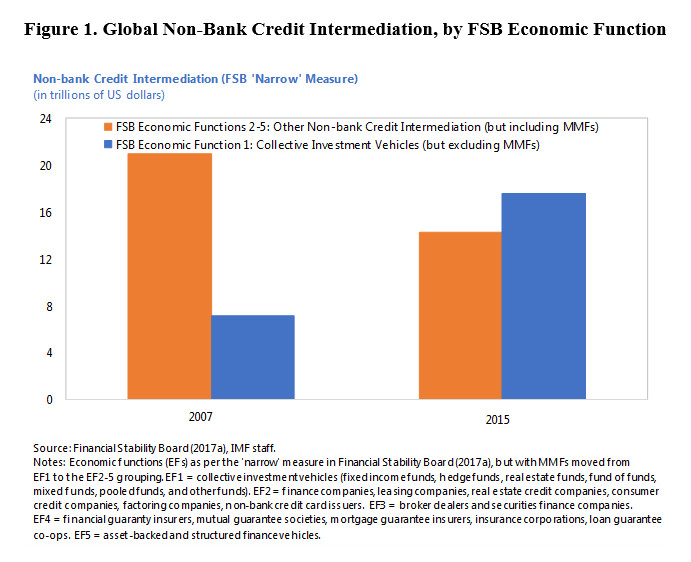

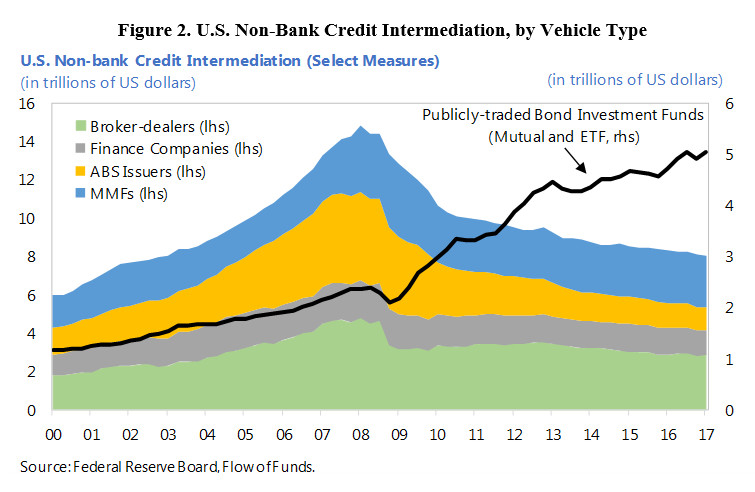

Because data inconsistencies and definitional issues at the cross-country level make attempts at precisely quantifying the size of this shift problematic, let me just draw attention to two sets of data to help make the general point (without the implication that either is perfect). On one measure—based on the FSB’s Flow of Funds data—a roughly US$10 trillion swing toward market-based finance (proxied here by standard collective investment vehicles) can be inferred between 2007 and 2015, and a $6-7 trillion swing against all other types of non-bank credit intermediation, including some forms of shadow banking which created significant problems a decade ago (Figure 1). [17] On another measure, this time focusing exclusively on the U.S. Flow of Funds, one can see a broadly similar trend—assets intermediated through simple and insolvency-remote collective investment vehicles like bond mutual and exchange-traded funds have more than doubled since 2007, while the assets of broker-dealers, finance companies, asset backed securities issuers and money market funds (MMFs) have almost halved (Figure 2). [18] Importantly, interconnectedness has also reduced. [19]

As the FSB recently pointed out, these developments, spurred by regulatory changes and a reorientation in intermediary business models, mean that many of the shadow banking activities which contributed substantially to the global financial crisis pose substantially less systemic financial stability risks. [20]

Non-bank Financial Deepening in Emerging Markets

The second generalized shift in global patterns of non-bank credit intermediation has been rising activity in Emerging Market (EM) economies, consistent with the broader trend of financial deepening. Once again, data imperfections don’t allow us to be as precise as we would like. But one crude measure of this shift can be seen in comparing the growth in assets of what the FSB refers to as ‘Other Financial Intermediaries’ (OFIs), [21] where the EM share of global assets has increased from just 4 percent in 2011, to 11 percent as of 2015. The upward trend has been observed both in China and across EMs more generally, while among AEs, the U.S. and U.K. have seen the largest relative declines in their share of global OFI assets (5 percentage points in both cases). Different data sets point to broadly similar trends in the relative growth of non-bank credit intermediation in EM. [22] [23]

One implication, to which I will speak more in a moment, is that as systems of non-bank credit intermediation continue to increase in size and scope in EM economies, ensuring that regulation and supervision is globally synchronized will take on increasing importance.

Strengthening Supervision and Regulation—How Far Have We Come?

Since the crisis, a concerted policy effort has been undertaken to strengthen the regulation and oversight of non-bank credit intermediation, with the aim of promoting more resilient forms of market-based finance. The FSB has been instrumental in this regard, [24] and the Fund itself has been increasingly engaged—by intensifying its supervision under the auspices of bilateral Financial Sector Assessment Programs (FSAPs) and Article IV Consultations, in addition to its multilateral surveillance work featured in the Global Financial Stability Report [25] and other research publications. It will also commence publication of a Global Shadow Banking Monitor later this year.

A detailed synthesis of related regulatory reforms could constitute a separate speech in its own right, [26] so all I shall say here is that among the most consequential developments have been the Basel III reforms, designed in part to ensure better recognition and capitalization of banks’ explicit and contingent exposures to shadow banking entities. Largely as a result, the off-balance sheet provision of credit insurance by deposit taking institutions has declined, helping to reverse the pre-crisis trend of growing interconnectedness between the traditional and shadow banking systems. Other important shadow banking reform priorities have focused on dampening risks associated with securities financing transactions and over-the-counter (OTC) derivatives. [27]

To give a sense of how far we have come, let me speak to two examples of shadow banking activities that caused significant problems during the crisis, but by virtue of regulatory reforms have since been placed on a sturdier footing: MMFs and securitizations.

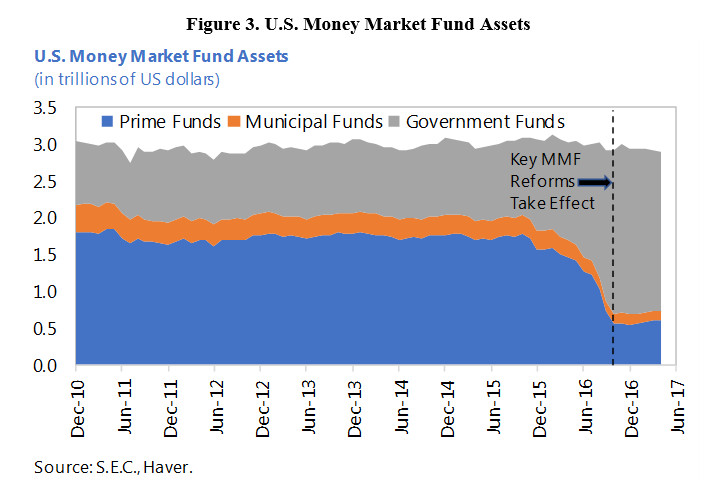

Dampening the financial stability risks associated with MMFs (and constant net asset value money market mutual funds (CNAV MMFs) in particular has been a priority. [28] In the U.S., which accounts for around 60 percent of global MMF assets, prime institutional MMFs are now required to “float their NAV” (i.e., no longer guarantee investors redeemability at par); non-government MMF boards have been equipped with new tools (liquidity fees and redemption gates) to more effectively deal with the first mover advantage problem; financial disclosure requirements have been strengthened to reduce investor uncertainty; and critically, bank sponsors are now required to capitalize their MMF support lines. These reforms have culminated in a significant shift away from prime institutional MMFs, which some investors assumed were providing something for nothing—risky asset returns, without the risk (Figure 3). And here in Europe, a similar set of regulations are set to take effect over the next 12-18 months. [29]

Securitization markets have been similarly overhauled. [30] Loan underwriting standards have been strengthened; the scope of prudential consolidation has been expanded to require banks who sponsor securitization vehicles to hold regulatory capital against these exposures; information disclosure requirements have increased; and credit retention requirements—popularly known as ‘skin in the game’—have been introduced to better align the incentives of originators and investors. [31] As a result, the issuance of riskier types of residential mortgage backed securities—known in the U.S. as subprime, Alt-A, Home Equity Lines of Credit, and Junior Liens—has all but ceased, having previously topped out at just over $1 trillion in 2006 (Figure 4). [32]

In both the U.S. and Europe, [33] regulators are now striving to create an enabling environment to support the issuance of higher quality, more standardized and more transparent securitizations as a means of contributing to a healthier overall credit mix, albeit activity has been a little less robust than hoped for. The Fund’s own research also shows that revitalized securitization markets could play a constructive role in addressing Europe’s non-performing loan overhang. [34] The broader point is that the push to transform riskier elements of shadow banking into more resilient and productive forms of credit intermediation is underway.

Nevertheless, this is not to suggest the job is done. [35] As the FSB recently acknowledged in a Peer Review, implementation of the Policy Framework for Shadow Banking Entities remains at a relatively early stage. [36] There are still lingering question marks as to whether some of the earlier discussed economic motivations for shadow banking activities have been fully addressed, and whether risk has simply shifted towards corners of the financial system where we have less visibility and fewer instruments to deploy. This should give us reason for pause if we accept that systemic risk stems, at least in part, from market failures such as moral hazard, information frictions, agency problems, and coordination failures that afflict large institutions. [37]

Take the issue of informational and agency problems. While some pre-crisis behaviors which exploited informational asymmetries and misaligned incentives in the mortgage market have been at least partially addressed, other incentive problems have proven more challenging to overcome. As a case in point, credit rating agencies (CRAs) still overwhelmingly operate under the ‘issuer pays’ model. [38]

Other incentive-related issues in structured finance have proven similarly difficult to iron out, with the result that regulatory arbitrage remains a persistent threat, including at the cross border level. For instance, many countries outside of the EU and U.S. are either yet to put into effect ‘skin in the game’ rules, or have maintained exemptions which might dilute their effectiveness. [39] Additionally, there are questions as to whether the coverage of new retention rules has been adequate. [40] Furthermore, the prospect of cross border regulatory arbitrage continues to loom large in securities financing transactions where reforms enacted in the U.S. have not been replicated elsewhere. [41]

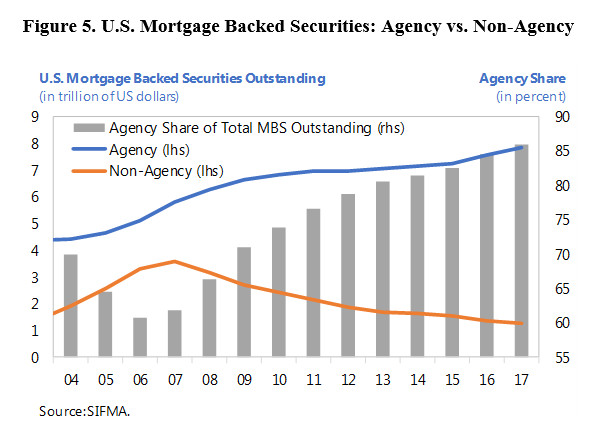

As to the issue of mispriced implicit backstops—one of the key features of riskier forms of shadow banking—progress here has also been mixed. For instance, supervisory guidelines to address banks’ ‘step-in risks’ for non-contractual and reputational exposures remain to be finalized. In the U.S., reform of the U.S. government sponsored entities appears to have stalled at a time where their share of MBS activity has expanded to 86 percent, up from 61 percent in 2006 (Figure 5). And the issue of implicit backstops has also become more pressing in some larger EMs, where shadow banking activity is growing most briskly.

Policy Challenges on the Horizon—Some Regional Examples

I would like to conclude the substantive portion of my remarks by briefly touching on three regional examples of the types of policy challenges that might lay ahead: managing the rise of credit intermediation in China, navigating the partial return of structured leveraged finance in the U.S, and addressing the challenges in asset management supervision in Europe.

Credit Intermediation in China

As part of an on-going Financial Sector Assessment Program, the Fund is currently engaged in close dialogue with the Chinese authorities over financial system stability issues. This analysis will likely be reported upon later in the year. As we are not in a position to speak to these issues at this juncture, let me instead offer a few very general observations here, utilizing the framework I introduced in my opening remarks, and following on from the work we have published in our regular Article IV Consultations and Global Financial Stability Reports.

The first point to acknowledge is that a high savings rate, coupled with a gradual process of financial liberalization, has enabled China’s system of credit intermediation to become more inclusive and facilitate remarkably high and stable growth rates over a long period of time. Financial deepening has been good for China, and good for the global economy.

Second, the Fund has, however, expressed some concern as to the nature of credit imbalances (both inside and outside the formal banking sector) that have accumulated in the process of generating these impressive rates of economic growth. It is now well known that China’s credit system has become very large. This aside, it has also developed some structural features that appear broadly consistent with the framework for shadow banking activities I outlined in Table 1. For instance, there are various risk transformations taking place that are sometimes difficult for regulators and investors to ‘look through;’ interconnections between banks and non-banks have expanded over the years; some of these activities seem conditioned on the presumption of sponsor or official backstops; and short-term wholesale financing is becoming more prominent.

Third, all this said, we have been encouraged by the willingness of the authorities in China to respond to these emerging trends by tackling some of the underlying motivations for these activities. Most notable in this regard have been the efforts of the authorities to close down avenues for arbitrage between the traditional and non-traditional banking sector, and to gradually unwind the presumption of sponsor support for wealth management products. Though it is early days, it appears that some of these efforts are already having the desired impact. As our recent Article IV Consultation pointed out, bank claims on non-bank financial institutions and off-balance sheet wealth management products have essentially stopped growing.

The Partial Reemergence of Structured Leveraged Finance in the U.S.

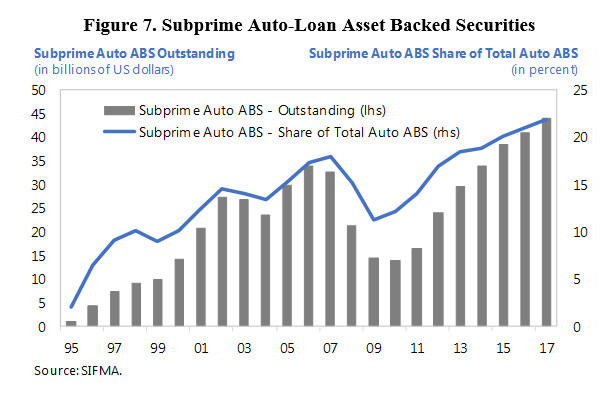

While far fewer subprime mortgage loans are now issued and securitized, and there has been a dramatic reduction in complex securitizations, U.S. structured finance markets are growing swiftly, reflected for example in a surge of relatively low-rated leveraged and subprime auto-loans.

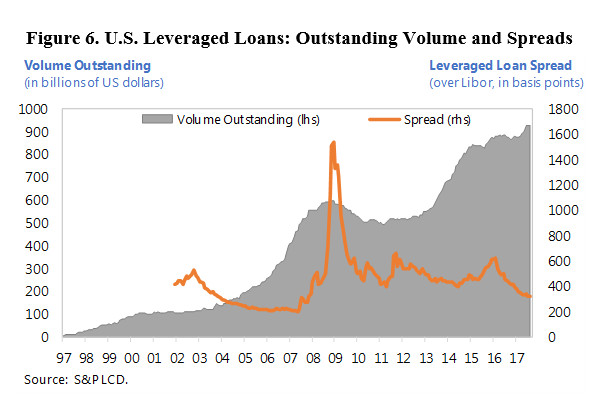

In the case of the leveraged loan market, new issuance has set a record over the past year, and outstanding volumes are now more than 50 percent above the 2008 peak (Figure 6). The share of loans at the riskier end of the rating distribution (B+ or below) has reaccelerated this year to near record levels, along with the covenant-lite share. [42] This debt has increasingly been raised for the purposes of funding leveraged buyouts and other types of procyclical merger and acquisition (M&A) transactions, and is consistent with the average debt/EBITDA multiple on leveraged loans also making new highs. In response to the decline in underwriting standards, a higher share of loans are now being downgraded, and default rates are picking up. [43] All of this at a time where spreads are at the low end of their historical range. [44]

There are two issues to disentangle here: first, whether risks are being mispriced, and second, whether any systemic implications could arise as a result. On the first issue, there is ample evidence that risk premiums are low by historical standards, particularly in light of the loosening in underwriting standards. However, as to the broader implications of any potential mispricing, it is unclear whether these are systemic, for the moment. Despite its rapid growth, the leveraged loan market is still only equivalent to around 5 percent of U.S. GDP, and in absolute terms, is half the size of the subprime mortgage market at its peak. Furthermore, the distribution of leveraged loan exposure across investor types seems better calibrated to risk absorption capacity than was the case before the financial crisis. For instance, the bank share of leveraged loans has declined from around 25 percent a decade ago to less than 10 percent now, a trend that may have been at least partly reinforced by stricter guidance issued by financial regulatory agencies in 2013. [45] Dedicated institutional investors that manage pass-through vehicles like distressed debt now play a more active role. Turning to the U.S. subprime auto-loan asset backed securities markets, rather similar dynamics (in terms of strongly rising issuance amidst an uptick in default rates) are also unfolding (Figure 7), but at less than $50 billion, this is a considerably smaller market than that for leveraged loans. [46]

We are monitoring developments in structured finance very closely. While we see these issues as sector-specific rather than systemic, they serve as a timely reminder that the credit system continues to evolve, and our monitoring efforts need to stay attuned to new risks accordingly.

Data Gaps in the Supervision of Market-based Finance—A European Perspective

Much has been said in recent years of the possible risks to financial stability posed by the largest segment of market-based finance, the asset management industry. [47] The Fund itself has been engaged in assessing these risks, including through a number of recent FSAPs in Europe: Ireland, Luxembourg and Sweden are some recent examples.

This area poses some interesting policy challenges. Even though market-based collective investment vehicles like mutual funds have been in existence for decades, the emphasis of regulation and supervision has traditionally been focused on consumer protection, not system-wide financial stability. Because asset managers are fundamentally different to banks, [48] one cannot superimpose the prudential policy framework developed for banks onto asset management firms or their activities.

There is a host of related topics currently under examination. Issues like the potential role of central banks as market makers of last resort [49] and the effectiveness of liquidity management tools [50] are some of the issues that have come up in this discussion. Of course, any assessment of potential stress amplification mechanisms requires policy makers to have the right type of data. On this front, much remains to be done.

As we are in Europe, let me speak briefly to some key data limitations here. In the case of the European mutual fund industry, [51] it is difficult for supervisors to know the composition of fund unit liabilities once they are distributed by intermediaries, and thus whether some funds are more vulnerable than others to synchronized runs. The manner in which leverage data are collected in the funds management industry also makes it difficult to distinguish gross from net exposure, and whether derivatives are used for hedging or speculative purposes. And more broadly, for special purpose vehicles established for activities other than securitization, information available to European supervisors has also been limited as these vehicles have typically resided outside the regulatory perimeter. [52]

Encouragingly, the authorities now have a number of initiatives underway to help address these gaps, but it is fair to say we still have some ways to go in collecting and categorizing data in a way that would be most helpful in macro-financial surveillance. And of course, I should stress that many of these points are pertinent outside of just Europe.

Concluding Remarks

Let me conclude here by circling back to a key point I raised at the outset.

At the November 2010 Seoul Summit, G20 Leaders called for shadow banking to be transformed into a system of resilient, market-based finance. Seven years on, it strikes me that the central question is: how far have we come along this journey?

To this question, I would like to leave you with two reflections.

First, we should derive some comfort that in advanced economies, many of the types of activities that amplified the impact of the global financial crisis no longer pose an existential threat to financial stability. To cite just a few areas, securitization practices have been strengthened, repo market activities have been overhauled, money market funds have been made more robust, and interconnectedness between banks and shadow banks has declined. Reform efforts have aimed at transforming the structural characteristics of riskier aspects of shadow banking, as well as the economic incentives. The business models of intermediaries have fundamentally changed as a result.

Second, we note, however, that certain areas of reform remain outstanding. Harmonizing retention rules, reforming certain rating agency practices, and winding back implicit official backstops are examples of issues to be tackled. And important data and disclosure gaps remain with respect to collective investment vehicles and cross-border interconnectedness. We must stay attentive to the emergence of new challenges such as FinTech for instance. [53]

We have made important progress in achieving the constantly moving target of a system of resilient market-based finance that supports productive risk-taking and economic growth.

On that note, I wish you the very best for the remainder of the conference.

Thank you.

References

Acharya, Viral A, Philipp Schnabl and Gustavo Suarez, 2013, “Securitization Without Risk Transfer,” Journal of Financial Economics, 107(3): 515-536.

Adrian, Tobias and Hyun Song Shin, 2009, “The Shadow Banking System: Implications for Financial Regulation,” Banque de France Financial Stability Review, 13: 1-10.

Adrian, Tobias and Hyun Song Shin, 2011, “Financial Intermediary Balance Sheet Management,” Annual Review of Financial Economics, 3: 289-307.

Adrian, Tobias, Daniel Covitz and Nellie Liang, 2013, “Financial Stability Monitoring,” Finance and Economics Discussion Series, Federal Reserve Board, Washington, D.C.

Adrian, Tobias, 2015, “Financial Stability Policies for Shadow Banking,” in Claessens, Stijn, Douglas Evanoff, George Kaufman and Luc Laeven (Eds.), 2015, ‘Shadow Banking Within and Across National Borders,’ World Scientific Studies in International Economics, 40.

Adrian, Tobias, Nina Boyarchenko and Or Shachar, 2017, “Dealer Balance Sheets and Bond Liquidity Provision,” Federal Reserve Bank of New York Staff Report No. 803., New York.

Aiyar, Shekhar, Wolfgang Bergthaler, Jose M. Garrido, Anna Ilyina, Andreas Jobst, Kenneth Kang, Dmitriy Kovtun, Yan Liu, Dermot Monaghan, and Marina Moretti, 2015, “A Strategy for Resolving Europe’s Problem Loans,” International Monetary Fund Staff Discussion Note 15/19, Washington D.C.

Allen, F., and G. Gorton, 1993, “Churning Bubbles.” Review of Economic Studies, 60(4): 813-836.

Allen, F., and D. Gale, 2000, “Bubbles and Crises,” Economic Journal, 110(460): 236-255.

Ashcraft, Adam B., and Til Schuermann, 2008, “Understanding the Securitization of Subprime Mortgage Credit,” Federal Reserve Bank of New York Staff Reports No. 318., New York.

Bank for International Settlements, 2014, “Re-thinking the Lender of Last Resort,” BIS Paper No. 79, Basel.

Bank for International Settlements, 2016, “Revisions to the Securitisation Framework,” Basel III Document, July 2016, Basel.

Bank of England and European Central Bank, 2014, “The Case for a Better Functioning Securitisation Market in the European Union,” May.

Barrett, Dominick, Brian Godfrey, and Brian Golden, 2016, “New Data Collection on Special Purpose Vehicles in Ireland: Initial Findings and Measuring Shadow Banking,” Central Bank of Ireland Quarterly Bulletin 04, October, Dublin.

Claessens, Stijn, Douglas Evanoff, George Kaufman and Luc Laeven, 2015, “Shadow Banking Within

and Across National Borders,” World Scientific Studies in International Economics, 40.

Cole, Harold L., and Thomas F. Cooley, 2014, “Rating Agencies,” NBER Working Paper No. 19972, Cambridge.

Coval, Joshua, Jakub Jurek and Erik Stafford, 2009, “The Economics of Structured Finance,” Journal of Economic Perspectives, 23(1): 3-25

Cornaggia, Jess, and Kimberly Cornaggia, 2013, “Estimating the Costs of Issuer-Paid Credit Ratings,” Review of Financial Studies, 26(9): 2229-2269.

Dobler, Marc, Simon Gray, Diarmuid Murphy and Bozena Radzewicz-Bak, 2016, “The Lender of Last Resort Function after the Global Financial Crisis,” IMF Working Paper 16/10, Washington D.C.

European Banking Authority, 2014, “Discussion Paper on Simple Standard and Transparent Securitizations,” October.

European Banking Authority, 2015, “Report on Qualifying Securitisation,” July.

Financial Stability Board, 2010, “Principles for Reducing Reliance on CRA Ratings,” October, Basel.

Financial Stability Board, 2016, “Thematic Review on the Implementation of the FSB Policy Framework for Shadow Banking Entities,” May, Basel.

Financial Stability Board, 2017a, “Global Shadow Banking Monitoring Report: 2016,” May, Basel.

Financial Stability Board, 2017b, “Assessment of Shadow Banking Activities, Risks and the Adequacy of Post-Crisis Policy Tools to Address Financial Stability Concerns,” July, Basel.

Financial Stability Board, 2017c, “Financial Stability Implications from FinTech: Supervisory and Regulatory Issues that Merit Authorities’ Attention,” June, Basel.

Financial Stability Board, 2017d, “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities,” January, Basel.

Financial Stability Board, 2017e, “Implementation and Effects of the G20 Financial Regulatory Reforms: Third Annual Report,” July, Basel.

Gennaioli, Nicola, Andrei Shleifer and Robert Vishny, 2012, “Neglected Risks, Financial Innovation, and Financial Fragility,” Journal of Financial Economics, 104(3): 452-468.

Griffin, John, and Dragon Yongjun Tang, 2012, “Did Subjectivity Play a Role in CDO Credit Ratings?” Journal of Finance, 67(4): 1293-1328.

Haldane, Andy, 2014, “The Age of Asset Management?” Bank of England, Speech at the London Business School, London.

He, Jie, Jun Qian, and Philip Strahan, 2012, “Are All Ratings Created Equal? The Impact of Issuer Size on the Pricing of Mortgage-Backed Securities,” Journal of Finance, 67(6): 2097-2137

He, Dong, Ross Leckow, Vikram Haksar, Tommaso ManciniGriffoli, Nigel Jenkinson, Mikari Kashima, Tanai Khiaonarong, Céline Rochon, and Hervé Tourpe, 2017, “Fintech and Financial Services: Initial Considerations,” IMF Staff Discussion Note, 17/05, Washington D.C.

International Monetary Fund, 2014, “Shadow Banking Around the Globe: How Large, and How Risky?,” Global Financial Stability Report, Chapter 2, October, Washington D.C.

International Monetary Fund, 2015, “The Asset Management Industry and Financial Stability,” Global Financial Stability Report, Chapter 3, April, Washington D.C.

International Organization of Securities Commissions (IOSCO), 2015, “Peer Review of Implementation of Incentive Alignment Recommendations for Securitisation: Final Report,” September.

Jiang, Xuefeng, Mary Harris Stanford, and Yuan Xie, 2012, “Does It Matter Who Pays for Bond Ratings? Historical Evidence,” Journal of Financial Economics, 105: 607-621.

Jones, Bradley, 2015, “Asset Bubbles: Rethinking Policy for the Age of Asset Management,” IMF Working Paper 15/27, Washington D.C.

Jones, Bradley, 2016, “Spotting Bubbles: A Two-Pillar Framework for Policy Makers,” Journal of Banking and Financial Economics, 2(6): 90-112.

Jurek, J.W., and E. Stafford, 2015, “The Cost of Capital for Alternative Investments,” Journal of Finance, 70(5): 2185-2226.

King, Darryl, Luis Brandao-Marques, Kelly Eckhold, Peter Lindner, and Diarmuid Murphy, 2017, “Central Bank Emergency Support to Securities Markets,” International Monetary Fund, WP/17/152, Washington D.C.

McCulley, Paul, 2007, “Teton Reflections,” PIMCO Global Central Bank Focus.

Mishkin, Frederic S., 2010, “Monetary Policy Flexibility, Risk Management, and Financial Disruptions,” Journal of Asian Economics, 21(3): 242-246.

Mishkin, Frederick S., 2011, “Monetary Policy Strategy: Lessons from the Crisis,” NBER Working Paper 16755, Cambridge.

Muley, Ameya, 2016, “Collateral Reuse in Shadow Banking and Monetary Policy,” Working Paper, Massachusetts Institute of Technology.

Pan, Kevin, and Yao Zeng, 2017, “ETF Arbitrage under Liquidity Mismatch,” Working Paper, Harvard University.

Pozsar, Zoltan, 2008, “The Rise and Fall of the Shadow Banking System,” Available at: Moody's Economy.com.

Pozsar Z, Adrian T, Ashcraft AB, Boesky H. 2013, “Shadow Banking,” Federal Reserve Bank of New York Economic Policy Review 19(2): 1-16.

Rajan, Raghuram, 2005, “Has Financial Development Made the World Riskier?” Proceedings of the Federal Reserve Bank of Kansas City Economics Symposium: 313—69.

Rivlin, Alice M., and John B. Soroushian, 2017, “Credit rating Agency Reform is Incomplete,” Brookings Institution. Available at: https://www.brookings.edu/research/credit-rating-agency-reform-is-incomplete/

Securities and Exchange Commission, 2016, “Annual Report on Nationally Recognized Statistical Rating Organizations,” December, Washington D.C.

Segoviano, Miguel, Bradley Jones, Peter Lindner and Johannes Blankenheim, 2015, “Securitization: The Road Ahead,” IMF Staff Discussion Note 15/01, Washington D.C.

Shleifer, Andrei, and Robert W. Vishny, 1997, “The Limits of Arbitrage,” Journal of Finance, 52(1): 35-55.

Singh, Manmohan, 2011, “Velocity of Pledge Collateral: Analysis and Implications,” International Monetary Fund Working Paper 11/256, Washington D.C.

Singh, Manmohan, 2013, “The Changing Collateral Space,” International Monetary Fund Working Paper 13/25, Washington D.C.

Singh, Manmohan, 2017, “Collateral Reuse and Balance Sheet Space,” International Monetary Fund Working Paper 17/113, Washington D.C.

S&P Global Ratings, 2014, “Twenty Years Strong: A Look Back at U.S. CLO Ratings Performance From 1994 Through 2013,” January.

Stein, J.C., 2013a, “Overheating in Credit Markets: Origins, Measurement, and Policy Responses,” Speech at the Research Symposium, Restoring Household Financial Stability after the Great Recession: Why Household Balance Sheets Matter, Federal Reserve Bank of St. Louis: St. Louis, MS, February 7

Stein, Jeremy C., 2013b, “Lean, Clean and In-Between,” Speech at the National Bureau of Economic Research Conference: Lessons from the Financial Crisis for Monetary Policy, Boston, Massachusetts, October 18, 2013.

Strobl, G¨unter and Han Xia, 2012, “The Issuer-pays Rating Model and Rating Inflation: Evidence from Corporate Credit Ratings,” Working Paper, University of Texas, Dallas.

Wurgler, J., 2010, “On the Economic Consequences of Index-Linked Investing,” NBER Working Paper 16376, Cambridge.

[*] Speech prepared for the 33rd SUERF colloquium held at the Bank of Finland in Helsinki, Finland, on September 14-15, 2017. The author thanks Brad Jones for help in drafting the speech. Peter Breuer, Pete Dattels, Daniel Hardy, Dong He, Nigel Jenkins, Aditya Narain, Fabio Natalucci, Ratna Sahay, Manmohan Singh, Dan Tarullo, and Christoph Rosenberg provided helpful comments.

[1] The term “shadow banking” was coined by McCulley (2007), with taxonomies provided shortly thereafter by Pozsar (2008), and Adrian and Shin (2009, 2011). A voluminous related literature has since emerged. For recent reviews, see IMF (2014), and Claessens, Evanoff, Kaufman and Laeven (2015).

[2] This synthesis is derived in part from that presented in Adrian (2015).

[3] For a general discussion, see Poszar, Adrian Ashcraft, and Boesky (2013). For a similar discussion as it pertains specifically to the intermediation chain in securitization markets, see Segoviano, Jones, Lindner and Blankenheim (2015).

[4] See for instance, Singh (2011, 2013, 2017). As Muley (2016) also points out, collateral intermediation chains can take two general forms—where the value of pledgeable collateral, and hence the amount that can be borrowed, is limited by the face value of the original debt contract (i.e., securitization); and where the collateral enables borrowing of an amount greater than the face value of the debt backed by that collateral (i.e., rehypothecation).

[5] This is in part because of asymmetric compensation structures which allows agents to effectively restrike a call option each year (in the absence of clawbacks) in which they have unlimited upside with limited downside. Convex payoff structures of this kind can generate a rational preference for aggressive forms of risk taking that are not necessarily in the best interests of principals or the broader financial system. See for instance, Allen and Gorton (1993); Allen and Gale (2000); Rajan (2005); Stein (2013a) and Jurek and Stafford (2015).

[6] Ashcraft and Schuermann (2008) identified no less than seven informational frictions in the securitization of subprime mortgages prior to the financial crisis.

[7] Another example is the CDO structurer at an investment bank, who, with access to granular loan-level data on borrower repayment capacity, can iterate default correlation assumptions in such a way as to maximize the size of a tranche that will be of greatest appeal to target investors (unbeknown to them). Because investment mandate restrictions and provisioning charges often mean institutional investors are confined or strongly encouraged to buy highly rated securities, there are strong incentives for issuers to structure securities on the basis of benign correlation assumptions—that is, those that tend to prevail most of the time, rather than during periods of heightened systemic risk (this connects to the literature on ‘neglected risk’; see for instance Coval, Jurek, and Stafford (2009) and Gennaioli, Shleifer, and Vishny (2013)). Naturally, this leaves investors with an economic exposure that is the functional equivalent of being short catastrophe insurance.

[8] Another related example of misaligned incentives arises from the ‘issuer pays’ business model for credit ratings, which can lead to ‘ratings inflation.’ This can be a problem in many contexts, including market-based finance, but is especially pronounced in shadow banking because the complexity of shadow banking products often results in investors outsourcing aspects of their due diligence process by relying heavily on external credit rating assessments. Because issuers have the ability to ‘ratings shop’—it is they rather than the investor who employ the services of the rating agency—agencies have a strong incentive to assign ratings in a manner that maximizes the probability of winning business from issuers. This behavior has been recognized to have played a role in amplifying the effects of the crisis. For instance, the United States Financial Crisis Inquiry Report concluded that “the failures of credit rating agencies were essential cogs in the wheel of financial destruction.” Empirical studies, including Griffin and Tang (2012) and He, Qian, and Strahan (2012), have documented inflated credit ratings assigned to mortgage backed securities before the crisis. Jiang, Stanford, and Xie (2012) show that rating agencies assign higher credit ratings after switching from the “investor-pays” to the “issuer-pays” business model. Strobl and Xia (2012), Cornaggia and Cornaggia (2013) and Segoviano, Jones, Lindner and Blakenheim (2015) discuss the conflicts of interest leading to credit rating inflation.

[9] Under the Basel I and II frameworks, little capital (or zero in the case of Basel I) was required for credit exposures to, or liquidity support for, banks’ off-balance sheet asset backed commercial paper conduits (ABCP) and other securitization vehicles, compared to holding the underlying assets on their balance sheet. One result was that while the Financial Accounting Standards Board (FASB) issued guidance in 2003 to the effect that sponsoring banks should consolidate assets in ABCP conduits onto their balance sheets, U.S. banking regulators clarified that these assets would not, in fact, need to be included in the measurement of risk-based capital. Instead, a 10 percent credit conversion factor for the amount covered by a liquidity guarantee was imposed, which in effect meant that regulatory charges for conduit assets covered by liquidity guarantees were 90 percent lower than regulatory charges for on-balance sheet financing. In response, the majority of guarantees were structured as liquidity-enhancing guarantees, aimed at minimizing regulatory capital, instead of credit guarantees. Unsurprisingly, the majority of conduits were supported by commercial banks subject to the most stringent capital requirements. See Acharya, Schnabl, and Suarez (2013).

[10] Of course, size is a critical ingredient in any discussion of system risk. It is entirely possible that small shadow banking entities fail, and this not generate systemic consequences.

[11] IMF (2015). Note this work did not aim to provide a verdict on the overall systemic importance of asset management activities and firms. However, the analysis did reveal that unlike banks, larger funds and funds managed by larger asset management companies do not necessarily contribute disproportionately more to systemic risk.

[12] Leverage can both accelerate the process of fire sales, and reduce the ability of institutions to absorb losses.

[13] It would be remiss not to acknowledge that in October 1987, when the U.S. equity market shed around one-quarter of its value in a single day, no financial institution of any significance failed, and real GDP in that quarter went on to expand at an annualized rate of more than 6 percent. Nevertheless, given the rising share of institutional investment activity and the more widespread use of leverage over recent decades, it is not clear that a repeat episode would end so benignly.

[14] An extensive literature has evolved on the conditions under which authorities should consider leaning against the wind of time-varying risk premia. For recent reviews with a U.S. emphasis, see Stein (2013b) and Mishkin (2010, 2011). Jones (2015) provides a contemporary synthesis of the competing ’Jackson Hole’ and ‘Basel Consensus’ paradigms.

[15] Rehypothecation of collateral by lenders to a third party creates the lenders' bankruptcy risk in the sense that if the lender defaults on his obligation to the third party, the collateral is confiscated by the third party and the original borrower does not get it back even if he is willing and able to fulfill his obligations. See Muley (2016).

[16] One of the more notable examples was the deployment of a backstop by the U.S. Treasury in response to the market stresses occasioned by the Reserve Primary Money Market Fund ‘breaking the buck’ following the Lehman bankruptcy.

[17] It should be noted that non-Flow of Funds data do not point to a similar sized decline in certain types of intermediation activities. For a discussion of changing patterns of collateral intermediation, see also, Singh (2013).

[18] See Adrian, Boyarchencko and Shachar (2017) for a discussion of these divergent trends in the context of broker-dealer intermediation of corporate bond trading.

[19] In part, this reflects the emergence of shorter collateral chains—after all, collateral does not flow in vacuum—it needs balance sheet to move, and balance sheet space for key entities has become scarcer.

[20] Financial Stability Board (2017b).

[21] This measure includes financial system assets outside of that held by banks, central banks, public financial institutions, insurers, pension funds and financial auxiliaries.

[22] See for instance, IMF (2014), which focused on non-core liabilities.

[23] On the basis of comparable cross-country data focused exclusively on certain types of shadow banking entities, such as constant net asset value (NAV) MMFs, we observe a similar upward shift in the relative size of EM intermediation.

[24] Having designated shadow banking as one of its priority areas, the FSB has created a system-wide monitoring framework to track developments in the global shadow banking system, with a view to identifying the build-up of systemic risks and initiating corrective actions where necessary. The annual Global Shadow Banking Monitoring Report is a feature of this work. And here in Europe, the European Systemic Risk Board (ESRB) has commenced a mapping of the EU shadow banking system, which feeds into the ESRB’s Risk Dashboard, internal risk assessment processes and the formulation and implementation of related macroprudential policies.

[25] IMF (2014).

[26] Useful recent reviews can be seen in FSB (2017b) and FSB (2017e).

[27] These have included, for instance, reducing liquidity mismatches arising from non-banks’ use of securities financing transactions (SFTs); constraining excessive build-up of non-bank leverage with the imposition of haircuts on non-centrally cleared SFTs; and reducing risks in OTC derivatives and tri-party repo markets through market infrastructure reforms. With many of these efforts ongoing, it is still too early to speak to their effectiveness.

[28] Though relatively simple structures, the centrality of CNAV MMFs in the crisis stemmed from two reasons. Firstly, they issued runnable bank-like liabilities that were redeemable at par on demand, in order to fund portfolios of assets with credit risk, lower liquidity and longer maturity. In other words, mismatches of various types were hardwired into their structure. Second, by virtue of their sheer size and the structure of their asset-liability mix, MMFs were strongly connected to the commercial banking system on both sides of the balance sheet: through implicit sponsor insurance lines on the liability side aimed at preventing MMFs from breaking the buck, and on the asset side, through repo exposure and their holdings of bank paper and deposits. From a spillover perspective, these structural vulnerabilities were not just confined within domestic borders—as a case in point, the run on U.S. MMFs created significant financing problems for banks in Europe when the former were subjected to large scale redemptions.

[29] These measures entail variable NAV pricing for some (non-sovereign) MMFs; new redemption fee and gating provisions; increased liquidity and diversification requirements; and a prohibition on MMF sponsor support.

[30] The key role of particular forms of securitization activity in amplifying the crisis has been well documented. In short, where credit risk transformation was motivated by regulatory arbitrage and misaligned incentives, amplified by neglected tail risk, and abetted by mispriced backstops which had significant spillover implications for the insurance providers, the effects were devastating. It is worth recalling it was not just in the United States where securitization markets took on a very different complexion in the pre-crisis period. In Europe, annual securitization issuance soared from less than $US100 billion in 1999, to $US1.2 trillion at the 2008 peak, most of which comprised RMBS (Segoviano, Jones, Lindner and Blankenheim, 2015).

[31] In the EU, retention rules were put in place in January 2011 (and subsequently revised in 2014) which allowed investor financial institutions to assume exposure to a securitization only if the originator, sponsor, or original lender has explicitly disclosed to the institution that it will retain, on an ongoing basis, a material net economic interest of at least 5 percent. In the U.S., risk retention rules now require securitization issuers or sponsors to retain an economic interest of at least 5 percent of the aggregate credit risk of the collateralizing assets (since December 2015 for securitization transactions backed by residential mortgage loans, and since December 2016 for all other ABS).

[32] Reforms have also been directed to increasing the transparency and standardization of securitization products, a direct response to the opaqueness and complexity that came to characterize securitization innovations (i.e., synthetic CDOs) in the pre-crisis period. This requires both intermediating banks and credit rating agencies to disclose far more information about underlying loan pools, and the assumptions used to arrive at credit rating assessments.

[33] See for instance, Bank of England and European Central Bank (2014), and European Banking Authority (2014, 2015).

[34] Aiyar, Bergthaler, Garrido, Ilyina, Jobst, Kang, Kovtun, Liu, Monaghan, and Moretti (2015).

[35] See also, FSB (2017b).

[36] FSB (2016).

[37] See for instance, Adrian, Covitz and Liang (2013).

[38] Some researchers have suggested excessive regulatory reliance on ratings and the increasing importance of risk-weighted capital in prudential regulation have more likely contributed to distorted ratings than the matter of who pays for them, particularly in light of the fact that for a century prior to the global financial crisis, CRAs were viewed by regulators and investors as valuable independent agents in the financial system (see Cole and Cooley, 2014). However, many countries have since taken steps to reduce the mechanistic reliance on CRAs in their laws and regulations.

[39] IOSCO (2015).

[40] In the EU, products that are guaranteed by governments and public institutions are generally exempt from retention requirements, as are some products guaranteed by certain regulated financial institutions. In the U.S. meanwhile, securitizations related to some government programs are also exempt from incentive alignment requirements, along with securitizations considered to have met high quality underwriting standards or are otherwise considered in the public interest (IOSCO, 2015).

[41] These reforms have culminated in the supervision of the two key triparty service providers and a substantial reduction in potential financial stability risks associated with repo market infrastructure. For example, the share of tri-party repo volume that is financed with intraday credit from a clearing bank has declined from 100 percent as recently as 2012, to around 5 percent more recently (FSB, 2017b).

[42] Apart from a deterioration in lending standards, a high ‘Cove-lite’ issuance share could reflect other developments, such as an increase in the quality of the borrower pool, and/or the rising share of institutional investors (who are less likely to make use of covenants) in the leveraged loan market. For a review of financial stability-relevant information that can be reflected in both price and non-price terms in credit markets, see Stein (2013a) and Jones (2016).

[43] Historically, defaults on leveraged loans have closely tracked macroeconomic and financial conditions, with default rates a little lower than high yield bonds (in the range of one and twelve percent annually) and recovery rates much higher (around 70 percent, reflecting that leveraged loans are typically collateralized and senior to other debt instruments).

[44] Similar dynamics can also be observed in other areas of leveraged finance, such as the high yield bond market.

[45] The agencies involved included the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corporation. The guidance outlined the agencies’ minimum expectations on a wide range of topics related to leveraged lending, including underwriting standards, valuation standards, pipeline management, the risk rating of leveraged loans, and problem credit management. For a review of its effectiveness, see: http://libertystreeteconomics.newyorkfed.org/2016/05/did-the-supervisory-guidance-on-leveraged-lending-work.html

[46] The subprime loan share of the total auto-loan market is rising strongly, with $110bn of subprime auto-loans issued last year alone. Growth in auto-loan ABS issuance has followed suit, with the subprime share of auto-loan ABS also surging to a new high. Accompanying the rise in lower credit quality auto-loans and subprime auto-loan ABS, delinquency and loan loss rates are on the rise. However, the stock of subprime auto-loan ABS is still under $50 billion, and there is less scope for sizable forecast errors on auto-loan collateral values compared to the housing market given the boom/bust nature of home price cycles has no equivalent in the auto sector.

[47] For instance, after a lengthy consultation process, the FSB earlier this year issued a set of policy recommendations to address structural vulnerabilities arising from asset management activities. These related to liquidity transformation by investment funds; leverage within funds; operational risk and challenges in transferring investment mandates in stressed conditions; and securities lending activities of asset managers and funds (FSB, 2017d).

[48] For instance, they typically act in an agency capacity rather than as principals, their vehicles are generally insolvency remote, and they do not have an official backstop. Additionally, the asset management community is highly heterogenous, which makes one-size-fits-all policy prescriptions problematic.

[49] On central bank reaction functions in this respect, see, for instance, King, Brandao-Marques, Eckhold, Lindner and Murphy (2017), Dobler, Gray, Murphy and Radzewicz-Bak (2016), and Bank for International Settlements (2014).

[50] Liquidity management tools include redemption gates, fees, swing pricing and other measures designed to ameliorate first mover advantage. The topic of liquidity stress testing for investment funds has also been addressed in recent FSAPs.

[51] Undertakings for Collective Investment in Transferable Securities.

[52] While these entities sit outside the regulatory perimeter, the Central Bank of Ireland has been notably active in attempting to better understand the nature of activities performed by them, and the risks they might pose, if at all, to financial stability. See for instance, Barrett, Godfrey and Golden (2016).

[53] Any assessment of the financial stability implications arising from FinTech is inherently challenging by virtue of the limited availability of official and privately disclosed data. The information we do have suggests credit intermediation by the industry is still very modest, less than 1 percent of bank loans. A recent assessment in FSB (2017c) concluded there was no evidence to suggest that FinTech poses a compelling financial stability risk in its present form. However, though it is small, it is rapidly growing, and there are particular elements that will need to be monitored going forward as the scale and scope of FinTech increases. These include, for instance: where payments service companies invest the float of customer debit accounts in credit products without the proper expertise, disclosure or safeguards; where peer-to-peer lending begins to take the form of an originate-to-distribute model without being subject to skin-in-the-game requirements; and at the operational risk level, where poor governance or process control could potentially lead to risk of disruption in the provision of financial services or infrastructure. A growing FinTech industry will also give rise to important consumer protection and financial integrity concerns (i.e., AML/CTF) that authorities will need to address. And like any financial innovation, it will be incumbent on the relevant agencies to ensure FinTech serves a broader public good, like making the financial system more inclusive, without imperiling its health in the process. For a broader recent discussion, see He, Leckow, Haksar, ManciniGriffoli, Jenkinson, Kashima, Khiaonarong, Rochon, and Tourpe (2017).

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org