Aluminum production. Rising trade tensions represent an important risk for the euro area (photo: Guido Kirchner/Newscom)

Euro Area: Time to Tackle The Tough Challenges

July 19, 2018

The euro area economy is still in a good place. Growth remains strong, broad-based, and job-friendly, even if there are signs that it has peaked. At the same time, risks are rising, including escalating trade tensions and policy complacency among euro area countries. Rebuilding fiscal buffers and addressing structural issues to improve resilience, and building support for euro area reforms is now even more urgent, says the latest economic IMF health check of the euro area.

Euro area growth appears to be leveling off from the very high levels of late last year, but is projected to remain solid.

However, risks are mounting. Trade tensions have risen with the recent U.S. imposition of tariffs on steel and aluminum imports.

Time is running out on the Brexit negotiations with the lack of progress raising the risk of a disruptive exit.

Policy inaction and political shocks are important domestic risks, especially with regard to rebuilding fiscal buffers in countries with high public debt and implementing structural reforms. Against this backdrop, strong policies are needed to buttress the euro area’s resilience.

ECB should stay committed to low for long

Underlying inflation remains low, and is expected to converge only gradually to the ECB’s objective. The European Central Bank’s (ECB) commitment to keep policy rates at their current low levels, at least through next summer, is therefore vital. As quantitative easing is wound down, the importance of the ECB’s forward guidance on interest rates will grow even stronger.

Much is needed at the national level

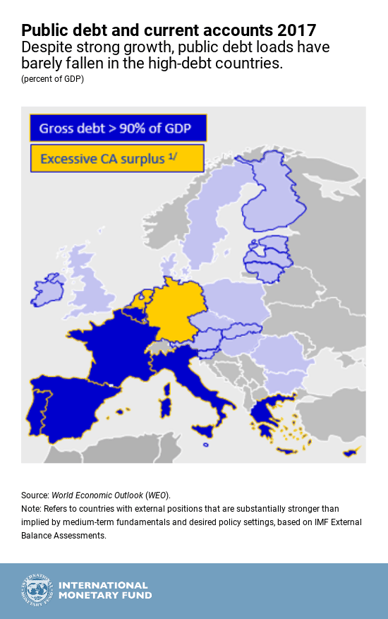

Despite strong growth, public debt loads have barely fallen in the

high-debt countries, leaving insufficient fiscal space to respond to the

next shock. High-debt countries should ramp up their fiscal efforts—

reigning in deficits and reducing debt—while conditions remain supportive.

In many countries, structural reforms must be stepped up to lift productivity and create job opportunities. Large net creditor countries with persistently excessive current account surpluses and ample fiscal space need to increase public investment in infrastructure, education, and innovation. This will lift potential growth and contribute to a necessary external rebalancing.

Reforms to the architecture of the common currency area are long overdue

Now is also a good time to fill in the missing pieces of eurozone architecture so that the region is prepared for future shocks.

Banking union

The recently completed Financial Sector Assessment Program (FSAP) for the euro area finds that euro area policymakers have made significant progress on this front. But more needs to be done.

Importantly, the lack of a common deposit insurance scheme and a shared fiscal backstop for the Single Resolution Fund could put these achievements in jeopardy. Completing the banking union will help weaken the links between banks and sovereigns that was at the heart of much of the crisis.

To make it work, all sides will need to show trust and accountability.

While substantial risk reduction has already been achieved, banks with high-levels of non-performing loans should commit to aggressively clean-up balance sheets. Banks can also use the current upswing to continue building capital and ensure they have the ability to absorb any future losses.

Capital markets union

Progress on building a capital markets union is encouraging; for example, the measures taken to help small firms raise financing across borders. But further reforms are needed to deliver a genuinely single and integrated capital market.

In the near term, it is critical to ensure that regulatory and supervisory capacities are prepared for the influx of financial firms that will move to continental Europe as a result of Brexit.

Over the medium term, there will need to be greater harmonization of national insolvency regimes and securities regulations. Implementing all or even some of these proposals would develop capital markets and stimulate growth for the entire region..

Fiscal risk-sharing

The euro area relies too much on monetary policy to stabilize the economy when hit by a shock. A recent IMF Staff Discussion Note proposes setting up a central fiscal capacity (CFC) for macroeconomic stabilization. Such a CFC would require countries to save in good times, by paying into the fund. Then, in a downturn, countries would receive transfers to help them offset budget shortfalls. The proposals cover strong safeguards, however, to ensure that countries maintain prudent fiscal policies and that there are no permanent cross-country transfers.