Update: Release of the IMF’s Natural Resource Fiscal Transparency Code

May 2016

The IMF thanks the organizations and individuals who have provided comments during the online consultation on the revised draft of the Natural Resource Fiscal Transparency Code. The online consultation ended on September 9, 2016. Written comments submitted during May - September 2016, are now available. If you have any questions, please send an e-mail to IMFConsultation@imf.org.

Background

In 2014, the IMF released Pillars I to III of the new and revised Fiscal Transparency Code (FTC). As explained in the August 2014 IMF Policy Paper ‘Update on the Fiscal Transparency Initiative’, a fourth pillar on resource revenue management remains to be completed.

An initial draft of the Resource Revenue Management pillar (Pillar IV) was released for public consultation in December 2014. A number of outreach events allowed for constructive debate of the framework’s principles and practices with government, civil society and industry representatives. Extensive comments were received from a range of extractive industry stakeholders, and the written submissions are available for download. In addition, two Fiscal Transparency Evaluations conducted in Peru and Tanzania in 2015 included pilot chapters assessing the principles of Pillar IV. Reflecting both feedback from the consultation and experience of the two pilots, the IMF is now releasing a revised draft of the entire Fiscal Transparency Code for further discussion and comment.

The Natural Resource Fiscal Transparency Code

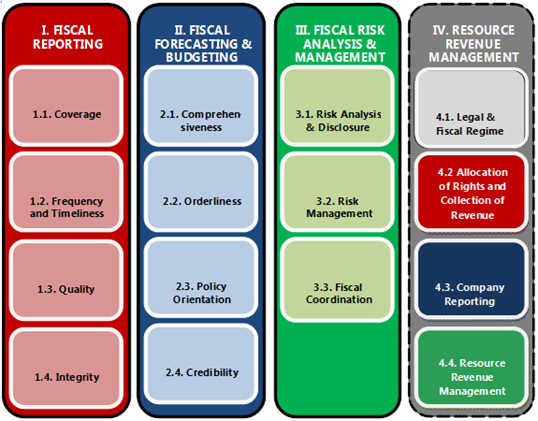

The new draft adapts the entire Fiscal Transparency Code (Pillars I-IV) to the needs of natural resource producers. The four FTC pillars are:

- Pillar I: Fiscal Reporting, in the form of fiscal statistics and accounts, which should offer relevant, comprehensive, timely, and reliable information on the government’s financial position and performance.

- Pillar II: Fiscal Forecasting and Budgeting which should provide a clear statement of the government’s budgetary objectives and policy intentions, together with comprehensive, timely, and credible projections of the evolution of the public finances.

- Pillar III: Fiscal Risk Analysis and Management which should ensure that the risks to the public finances are disclosed, analyzed and managed, and fiscal decision-making across the public sector is effectively coordinated.

- Pillar IV: Resource Revenue Management wwhich should provide a transparent framework for the ownership, allocation, taxation, and management of natural resources.

Figure 1: Natural Resource Fiscal Transparency Code Pillars

The initial draft of Pillar IV released for consultation in 2014 was intended to provide natural resource focused elements of the fiscal transparency framework not already covered by the other three pillars. Comments from the consultation and experience from the pilot evaluations demonstrated the need to adapt Pillar I-III principles to the specific needs of natural resource producers. For example, in the case of natural resource producers, the classification of fiscal reports, budgets, and long-term projections should separately identify revenues from natural resource exploitation to help assess whether these often finite resources are being utilized in a sustainable manner.

The revised draft Code now includes augmented versions of Pillars I, II and III, covering issues related to reporting, budgeting, and risk management of natural resources. By emphasizing natural resource issues in Pillars I-III, the new draft responds to calls for dedicated principles on important natural resource transparency considerations such as those associated with national resource companies, resource revenue forecasting, commodity price risk analysis, allocation of resource revenues to sub-national governments, and public participation in the resource revenue management process. A draft of the document highlighting these modifications to Pillars I-III is available here.

In turn, Pillar IV has also been modified to emphasize specific transparency issues associated with the legal and fiscal regime governing the extraction of natural resources, the allocation of resource rights holdings, reporting by companies engaged in resource extraction activity, and the governance and operation of natural resource funds.

Other modifications reflect calls for clearer definitions of concepts such as the resource project, beneficial owner of resource rights as well as clarification on what constitutes an open process and the requirements for information to be reasonably deemed as ‘published’. As with the initial Pillar IV, the draft has been calibrated to be relevant in a range of institutional and legal settings and applicable to resource-rich countries at various levels of economic development.

Application of the Natural Resource FTC

The natural resource FTC will underpin IMF Fiscal Transparency Evaluations for resource-rich countries, identify strengths and weaknesses in fiscal disclosure, and make targeted recommendations for improvements in resource revenue transparency. In addition to the Peru and Tanzania pilots conducted to date, the IMF will carry out further pilot evaluations of all four pillars of the FTC prior to finalizing the Code.

Revision to the Guide on Resource Revenue Transparency

The Code’s principles and practices will inform the accompanying Guide on Resource Revenue Transparency and Accountability. The first IMF Guide on Resource Revenue Transparency was published in 2005 and updated in 2007, and accompanied the 2007 version of the FTC. The revised Guide will be aligned to the new FTC structure, elaborating in detail on the principles of all four pillars of the FTC with respect to their application in the context of resource-rich countries. The new Guide will also provide details on prevailing international standards which are relevant to each principle of the Code. The new Guide is intended to be a core international reference on the topic, and seeks to ensure that transparency and accountability in resource revenue management continue to inform the IMF’s efforts to strengthen fiscal surveillance and capacity-building work with respect to Fund’s member countries for which resource revenues are macro-critical.

Public Consultation

While we welcome feedback on any aspect of the new draft Code, we are specifically interested in your feedback on the following issues:

- Does the revised structure of the draft Code (comprising Pillars I-IV) provide a more comprehensive picture of resource revenue transparency, adequately reflecting the most important aspects of natural resource revenue transparency ? Which principles could usefully be added, dropped, or reformulated?

- Do the descriptions of basic, good, and advanced practice under each principle provide a well-sequenced path towards state-of-the-art practice with the respective principles? Are the different levels of practice appropriately calibrated and sufficiently differentiated?

We encourage comments from all stakeholders of the extractive sector – government officials, parliamentarians, private sector entities, practitioners in the field of resource revenue management, and civil society organizations.

Procedures

The IMF’s Communications Department (COM) will receive the comments and post a summary of them. Senders can request for their comments to be private. Any interested stakeholder can submit their input through the following channels:

- E-mail: IMFCONSULTATION@imf.org

When submitting your comments via email, please include the following information so that your comments are registered: name of sender; organization you represent (if any); country; phone number; and e-mail address.

Comments should be submitted no later than September 9, 2016.

Next Steps after this Consultation

The feedback received during this consultation will inform the final version of the Fiscal Transparency Code, which the IMF plans to submit to its Executive Board for approval and publication in April 2017. As mentioned above, the IMF will also be drafting a new Guide on Resource Revenue Transparency and Accountability (Volume II of the Fiscal Transparency Manual) to align it with the new natural resource Fiscal Transparency Code, as well as to reflect recent developments in the extractive industries and new standards and practices in resource revenue transparency. This guide will also be the subject of a public consultation in Spring 2017 and finalized later in the year.