Release of the first module of the Tax Policy Assessment Framework (TPAF)

September 2018

The IMF and the World Bank are releasing the first module of the Tax Policy Assessment Framework (TPAF) for discussion and comment. TPAF will provide framework for systematic and consistent assessments of all major taxes, aimed to provide solid analytical basis and practical guidance for the design of tax policy. It is a public good that can be used by providers of technical assistance, country officials, analysts, civil society organizations, the donor community, and academia.

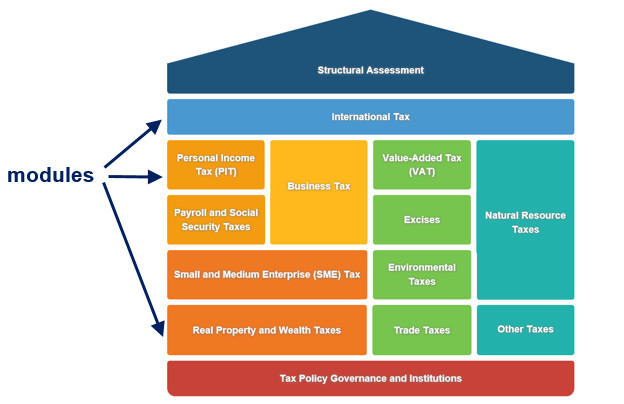

TPAF is modular, with each module representing an individual tax. This release presents the Value Added Tax (VAT) module for public consultations, seeking feedback on the content, as well as presentation style and user-friendliness of the module. Further modules will be released for comment in the following months.

The online consultation process will be open until December 5, 2018. We would welcome input by e-mail to TPAF@imf.org.

Explore TPAF

To explore TPAF, please access TPAF by clicking below.

Public Consultation

While we welcome feedback on any aspect of TPAF, we are specifically interested in feedback on the following questions:

- Do the assessment structure and questions allow for a comprehensive and consistent assessment of value-added taxation in a country? Are there additional questions that could help in a diagnostic process? Could certain diagnostic questions be removed?

- Do the pop-ups sufficiently elaborate the concepts behind the assessment questions? Are there concepts that could be elaborated, dropped, reformulated, or deleted?

- Do you find TPAF user-friendly and interactive enough? Is it fit for the modern works of web-based technology and communication? Do you have suggestions on the format and style of the presentation?

We encourage comments from all stakeholders – government officials, parliamentarians, donor community, practitioners in the field of taxation, civil society organizations, technical assistance providers, academia, as well as private sector entities.

Comments on this module are especially valuable as they will help to shape all further modules too.

Procedures

The IMF’s Fiscal Affairs Department (FAD) will receive the comments and post a summary of them. Senders can request for their comments to be private. Any interested stakeholder can submit their input through the following channels:

E-mail: TPAF@imf.org

When submitting your comments via email, please include the following information so that your comments are registered: name of sender; organization you represent (if any); country; phone number; and e-mail address.

Comments should be submitted no later than December 5, 2018.

Background

Ahead of the Financing for Development Conference in Addis Ababa, the IMF and the World Bank announced the launch of a new initiative to help member countries strengthen their tax systems. One of the pillars of the initiative includes the development of “improved diagnostic tools to help member countries evaluate and strengthen their tax policies.” [1] Building on their collective expertise, the Bretton Woods Institutions (BWIs) aim to play a fuller role in enabling their member countries to assess tax policy performance in order to identify priority tax policy reforms, and design the requisite support for their implementation.

Tax Policy Assessment Framework (TPAF)

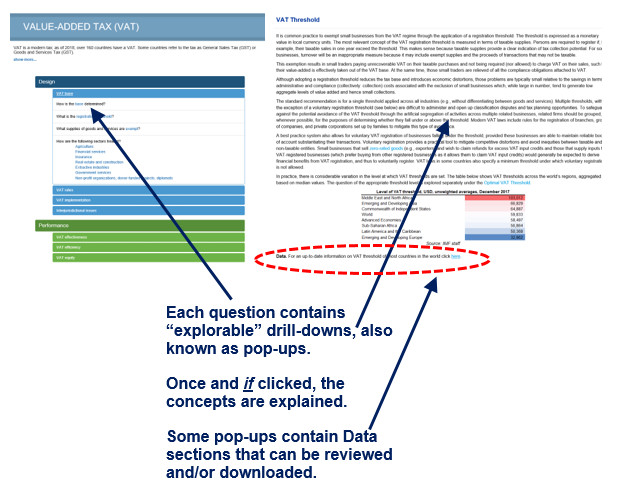

TPAF is designed to be user-friendly and interactive by employing a Wikipedia-style presentation for the most rigorous tax policy content. TPAF is scalable and intended to be flexible enough to be used for an assessment of the entire tax system, one taxation instrument, or a single tax issue of interest.

TPAF is not a scoring tool; it does not rank, grade, or score tax systems on a single scale. While designed for a wide public use, TPAF requires expert skills for sound judgement in conducting tax policy assessment based on TPAF.

Designed in the form of a house, TPAF is modular, with each module representing an individual tax (a room in “the house”). Development of TPAF is a substantial exercise, and it will be some while before all modules are available. Each TPAF module will be made public as soon as it is developed.

The Value-Added Tax Module

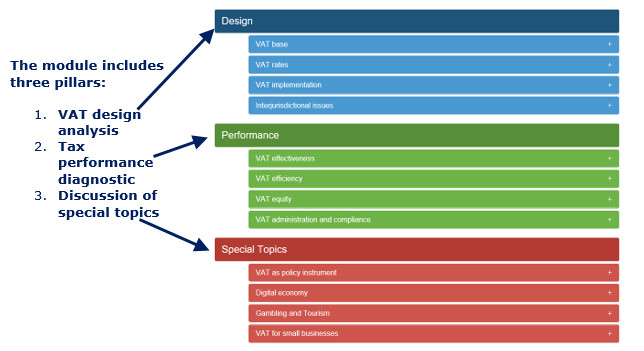

The first TPAF module presented for public consultations—VAT—can be accessed by clicking on the “Value-Added Tax (VAT)” unit of the “house". The module consists of three sets of diagnostic questions, aiming to assess (1) the Design and (2) Performance of the VAT system, and to explore several (3) Special Topics of interest.

Each assessment question contains “explorable” drill-downs. Facilitated by web-based technology, this drill-downs – also known as pop-ups – explain economic concepts and the rationale behind each question of the diagnostic assessment.

Next Steps after this Consultation

The feedback received during this consultation will inform the final version of TPAF and its VAT module. The consultation feedback will also inform the design of the remaining TPAF modules that the IMF and the World Bank are actively working on, with the Personal Income Tax and the Natural Resource Taxation modules being in their final stages of development.

[1] Press Release No. 15/330, World Bank and the IMF Launch Joint Initiative to Support Developing Countries in Strengthening Tax Systems, http://www.imf.org/external/np/sec/pr/2015/pr15330.htm